Cost of living in Melbourne – single, family & student

This article covers:

- Overview of Cost of living in Melbourne

- Do you know?

- A glance at the average cost of living in Melbourne

- Average cost of living in Melbourne: Single vs Student vs Family

- Tax scenario in Melbourne

- What salary do you need to live in Melbourne?

- Do’s and don’ts to manage the cost of living in Melbourne

- Can’t afford Melbourne? Here are the top 5 cost-effective Australian cities

- Before you go…

- FAQs

Melbourne is rated among the top cities in Australia and worldwide. Located on the banks of the majestic Yarra River, this lively city boasts a rich history, culture, and a stunning location.

When moving to a country like Australia, its cost of living is a critical factor to consider. It directly impacts your living standard and financial management; moving to Melbourne is no exception! So, whether you are planning to relocate to Melbourne with your family, as an international student or job seeker, this guide on the average cost of living in Melbourne will help you plan your budget accordingly.

Overview of Cost of living in Melbourne

- The cost of living in Melbourne for a single person = ~AUD 3434 monthly & ~AUD 41,208 yearly.

- The Melbourne living expenses for a family of 4 = ~AUD 8061 monthly & ~AUD 86,732 annually.

- The cost of living in Melbourne for students = ~AUD 1500 monthly & ~AUD 18,000 annually

Do you know?

- According to Mercer in 2024, Melbourne ranked 73 in the cities with the highest cost of living in the world for international employees. Meanwhile, Sydney remains the most expensive Australian city with a ranking of 58. [1]

- With an average salary of AUD 78,000 per year, Melbourne is among the top five highest-paying cities in Australia.[2]

- Melbourne has secured 5th position in the list of the world’s best cities for students, according to 2025 QS rankings.[3]

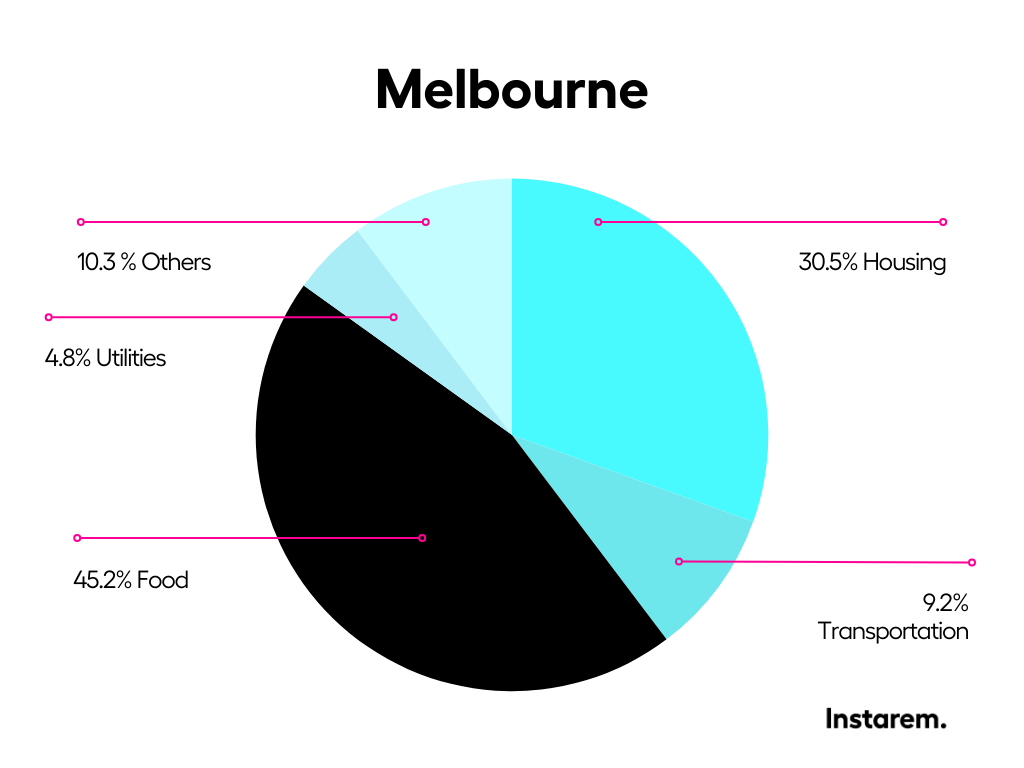

A glance at the average cost of living in Melbourne

Source: Numbeo

Average cost of living in Melbourne: Single vs Student vs Family

Type of expense | Avg. cost per month for student (AUD) | Avg. cost per month for single (AUD) | Avg. cost per month for family (AUD) |

Housing & rent | $800 – $1200 | $2015 | $4086 |

Food | $500- $600 | $847 | $2148 |

Transportation | $160 | $463 | $1178 |

Utility (electricity, water, heating, etc.) | $220 | $154 | $235 |

Entertainment | $80-140 | $80 – $140 | $120 – $480 |

Source: Cost of living for single and family: Livingcost.org

Cost of living for students: UpGrad

Also Read: How much does it cost to live in Australia?

An overview of monthly rents in Melbourne

Expense Category | Item | Avg. cost per month (AUD) |

Rent | 1-bedroom apartment (in city centre) | $2015 |

1-bedroom apartment (outside city centre) | $1586 | |

3-bedroom apartment (in city centre) | $4086 | |

3-bedroom apartment (outside city centre) | $2444 |

Source: Livingcost.org

Cost of living in Melbourne as compared to other cities

Type of expense | Melbourne | Sydney | Brisbane | Perth | Adelaide |

Monthly Salary (after taxes) | $6108 | $6754 | $5865 | $5721 | $5303 |

Cost of living (single) | $3434 | $3974 | $3155 | $3247 | $3096 |

Cost of living (family) | $8061 | $9641 | $7227 | $7583 | $6700 |

Rent (single) | $1904 | $2342 | $1921 | $1874 | $1801 |

Rent (family) | $3084 | $4271 | $3194 | $3012 | $2776 |

Food (single) | $847 | $817 | $788 | $832 | $830 |

Food (family) | $2148 | $2080 | $2014 | $2126 | $2135 |

Transport (single) | $463 | $585 | $233 | $323 | $268 |

Transport (family) | $1178 | $1520 | $637 | $865 | $711 |

Overall quality of life | 100 | 100 | 97 | 98 | 94 |

Source: Livingcost.org

Note: The above expenses are average costs in AUD

Tax scenario in Melbourne

Not just the Australian citizens but all the temporary as well as permanent residents in the country who are earning are subject to income tax. Typically, your employer is responsible for calculating taxes and deducting them from your salary based on certain criteria.

Below tables shows the income slabs and applicable tax on them:

Income levels in Sydney | Tax applicable |

0 – $18,200 | Nil |

$18,201 – $45,000 | 16c for every 1 AUD over 18,200 AUD |

$45,001 – $120,000 | 4,288 AUD + 30c for every 1 AUD over 45,000 AUD |

$120,001 – $180,000 | 31,288 AUD + 37c for every 1 AUD over 135,000 AUD |

$180,001 and above | 51,638 AUD + 45c for every 1 AUD over 190,000 AUD |

Source: Australian Taxation Office

Also Read: A comprehensive guide to Australia’s visa options

What salary do you need to live in Melbourne?

Salary requirements to live in Melbourne can vary based on factors such as lifestyle, number of dependents, individual expenses, etc. According to Payscale, the annual average salary in Melbourne is AUD 79,000. Most individuals earning between AUD 60,000 to AUD 79,000 can live comfortably in the city. They can afford necessities such as rent, utilities, groceries, and transportation but have limited entertainment options.

The mid-range earners who earn over AUD 79,000 can live a fulfilling life with plenty of entertainment options. They can easily spend around AUD 500 per week. Those who prefer a luxurious lifestyle need over AUD 100,000 per year. They can manage to spend around AUD 1000 – AUD 2000 per week.

What should be your monthly budget to live in Melbourne?

The monthly budget of an individual to live in Melbourne depends on several parameters such as monthly income, area of residence, way of living, and other specific expenses. Thus, it can vary from one individual to another. Based on these factors, we have roughly outlined the basic budget for a student, a single person, and a family (a couple and two small children).

Category | Student | Single | Family |

Housing/Rent | $800 -$1200 (in shared apartment) | $1200 – $1500 | $2000 – $2500 |

Utilities | $50-$100 | $100-$120 | $200 – $300 |

Groceries | $150 – $200 | $400 – $600 | $800 – $1500 |

Transportation | $100 – $120 | $150 – $350 | $500 – $800 |

Health insurance | $50 – $80 | $50 – $80 | $200 – $300 |

Other (entertainment, shopping, personal care) | $100 – $200 | $200 -$250 | $300 – $500 |

Total##(approximately) | $1400 – $2000 | $2000 – $2500 | $5000 – $7000 |

##It is an approximate value based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Note: The above expenses are average costs in AUD

Do’s and don’ts to manage the cost of living in Melbourne

Do’s

- Plan a budget: Plan a monthly budget and follow it stringently.

- Use public transport: Public transportation is a lot cheaper than having a private vehicle in Melbourne. So, make sure to use public transport whenever possible.

- Explore multiple accommodation options: If you are on a budget, then consider exploring the cost of living in Melbourne. In simple words, compare multiple areas before renting your accommodation.

- Utilise student discounts: Students get great deals and discounts on transportation, entertainment, and other facilities. Using them can help to maximize your savings.

- Shop around for groceries: Grocery stores in remote locations are often expensive. For affordable grocery shopping, consider exploring affordable options like Costco, NQR, and the local farmer’s markets.

- Use trusted fund transfer service: Transferring funds across borders can impose additional financial burdens due to higher exchange rates. If you want to save money and ensure a secure overseas transaction, then use services like Instarem to send money from Australia to India or vice-versa.

Don’ts

- Overlook health insurance: Healthcare costs are on the rise worldwide. Dealing with a medical emergency in the absence of health insurance can impose a significant financial burden. So, make sure to have a suitable health insurance plan.

- Shop mindlessly: Avoid unnecessary shopping and stick to your budget if you want to minimize your expenses and increase your earnings.

- Ignore savings: Your main objective in settling abroad should be building a financial safety net and creating wealth for your future. So, direct a fixed portion of your earnings into savings (or investments, if possible) regardless of your income.

Also Read: An expat’s guide to rent in Australia

Can’t afford Melbourne? Here are the top 5 cost-effective Australian cities

Adelaide

Adelaide is one of the cheapest cities in Australia. It has a relatively lower cost of living, because of which it attracts a lot of international students and those with limited earnings. It is a wonderful city with plenty of opportunities and great connectivity with other parts of the state.

Average cost of living (without rent): AUD 1295 per month.

Perth

Perth is regarded as the education hub of the country due to its high population of international students. It not only boasts a low cost of living but also has a high-quality education system and excellent public transportation.

Average cost of living (without rent): AUD 1373 per month.

Canberra

Interestingly, the cost of living in Canberra is a whopping 23% less than in Sydney and a substantial percentage less than in Melbourne. There are plenty of work opportunities, quality healthcare and education. Above all, the city has the lowest crime rate as compared to other Australian cities.

Average cost of living (without rent): AUD 1214 per month.

Brisbane

According to QS Best Student Cities 2025, Brisbane holds 25th position globally. It offers excellent living conditions along with higher education standards and ample work opportunities. Moreover, the city has a welcoming and warm community, making it easier for migrants to get along.

Average cost of living (without rent): AUD 1234 per month.

Hobart

If you are looking for a city with a lower cost of living but exceptional quality of life, high air quality, and great cultural significance, then consider moving to Hobart. Believe it or not, the rents here are around 25% cheaper than the average rent in Australia. Besides, if you are planning to buy a house, you can get it for 60% less compared to other cities.

Average cost of living (without rent): AUD 1238 per month.

Also Read: Average salary in Australia

Before you go…

Australia is undoubtedly one of the most popular study and work destinations among foreign nationals. When it comes to moving to Australia, most people choose Melbourne as their preferred location.

Be it a high-quality education, excellent career opportunities, or higher salaries, there are plenty of reasons why the number of migrants is increasing gradually in this Australian city. If you are among them, then our detailed guide on the cost of living in Melbourne will help you in making the right decision.

Moving to a new city or country can be very rewarding, but it comes with its own challenges. Managing your finances is one of the most challenging tasks. During your moving abroad journey, you might need to send money from India to Australia (or visa-versa) on several occasions, like paying rent, tuition fees, etc.

In scenarios like these, it becomes indispensable to have a reliable fund transfer partner like Instarem. As one of the most trusted money transfer services in the world, Instarem takes pride in providing fast** money transfer services across borders. Not only that, you also get affordable AUD to INR exchange rates#, a higher fund transfer, and a secure transaction every time.

Try Instarem for your next transfer. You can download the app or sign up here to send your warm wishes for a happy festive season!

FAQs

Is it expensive to live in Melbourne?

Yes. Melbourne is the second most expensive city to live in Australia. The total cost of living for a single person can be as high as AUD 3155, whereas a family of four requires around AUD 5150 per month.

How much money do you need to live in Melbourne?

Although the answer depends on the spending habits, a monthly budget between AUD 1400 to AUD 8000 is required to live comfortably in Melbourne for a student, single, and family respectively.

How much does it cost to live in Melbourne for international students?

The average cost of living in Melbourne for international students is around AUD 1500 – AUD 2000. As compared to working professionals and those living with their families, the monthly budget for international students living in Melbourne is slightly lower.

Is it cheaper to live in Sydney or Melbourne?

Melbourne is way cheaper than Sydney to live in. Notably, the rent prices and groceries in Melbourne are 19% and 6% cheaper than in Sydney.

What is the average room rent in Melbourne?

The average room rent in Melbourne varies depending on factors such as the location, type of property, furnished/unfurnished, and other amenities. Generally, the shared apartments in the city range from AUD 1589 to AUD 2259 per month.

How much is the cost of living in Melbourne for a couple?

The cost of living in Melbourne for a couple can range anywhere from AUD 2000 to AUD 3000 per month.

What is the cost of living in Melbourne for a single person?

The cost of living in Melbourne for a single person is around AUD 3000 to AUD 4000 per month. It can be more or less depending on spending habits and the living standard of the person.

What is the cost of living in Melbourne for a family?

The cost of living for a family of four in Melbourne can range from AUD 7000 to AUD 9000.

.

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- The costs mentioned in this blog are taken from various websites on 06th February 2024 and are subject to change.

- **Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- #When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Citations: