Exploring the expenses: How much does it cost to live in Australia?

This article covers:

- Exploring the cost spectrum in Australia

- Diving into the Heartlands: A Look at Regional Living Costs

- Homing in on Housing Costs

- Food and Grocery Expenses

- Transportation Costs

- Healthcare and Education Expenses

- Education Expenses: An Overview

- Utilities and Communication Costs

- Entertainment and Leisure Expenses

- Savings and Financial Management

- Understanding the Essentials of Australian Living Costs

- Before you go…

Australia is a vast and diverse country, well-known for its stunning landscapes, vibrant cities, and unique wildlife. But how much does it cost to live in Australia? From the bustling streets of major cities like Sydney and Melbourne to the more relaxed and serene regional areas, living expenses can vary quite a bit.

In the bigger cities, where there’s a lot going on from businesses to cultural events, the cost of living tends to be higher. Everything from housing to a cup of coffee can be quite expensive. However, these cities offer more job opportunities and activities, balancing out the higher expenses to some extent.

On the other hand, smaller towns and regions offer a more laid-back lifestyle at a lower cost. Life here is more relaxed and easy-going, but there are fewer urban luxuries and conveniences.

So, let’s take a closer look and unravel the various costs of living in Australia. From this guide, you’ll get a clearer picture of what you can expect to spend, whether you choose the energetic life in the city or a quieter existence in a regional town.

Exploring the cost spectrum in Australia

Australia presents a dynamic range of living costs, with its major cities and regional areas offering varying economic landscapes. Let’s explore the expenses across the continent.

Sydney

As Australia’s bustling metropolitan giant, Sydney stands tall both in its skyline and living expenses. With a housing market that’s often the talk of the town due to its soaring prices, Sydney still lures many, thanks to a thriving job market that might just balance the scales for the higher costs of urban living. And while savouring the city’s culinary scene might require a deeper dive into the wallet, the experiences often justify the expense.

Melbourne

Often hailed as the heartbeat of Australia’s cultural and artistic life, Melbourne exudes charm and vibrancy. The city strikes a moderate chord between living costs and the quality of life. Although expenses here might not be as high as Sydney’s, they command attention. Yet, Melbourne doesn’t disappoint, offering plenty of wallet-friendly dining and entertainment treasures waiting to be discovered.

Brisbane

Embracing its residents with a balmy climate, Brisbane is an oasis of affordability in comparison to its southern siblings, Sydney and Melbourne. The city ensures its dwellers get the best of both worlds—a cosmopolitan lifestyle without the intimidating costs, especially when it comes to housing.

Perth

Perth’s unique geographical stance on Australia’s western fringe brings with it a distinct economic narrative. While the housing sector might seem a tad ambitious with its pricing, daily expenses, especially the culinary delights, are more down-to-earth, offering residents a balanced lifestyle.

Diving into the Heartlands: A Look at Regional Living Costs

Adelaide

Adelaide, the jewel of South Australia, crafts an appealing financial landscape. The city successfully marries affordability with urban amenities. With housing and transit costs that invite smiles rather than frowns, Adelaide emerges as a top contender for those wanting urban flair without the accompanying price tag.

Hobart

Nestled in the lap of Tasmania, Hobart is a haven for those seeking tranquillity, quality of life, and affordability. Housing costs here are a refreshing change from the mainland’s hustle and bustle, making Hobart an increasingly popular choice for many.

Regional Queensland

Venturing into Queensland’s heart reveals regions like Toowoomba and the Sunshine Coast, where affordability dances gracefully with Queensland’s famed sun-kissed climate and scenic beauty.

Regional New South Wales

Offering a sweet spot between affordability and proximity to Sydney are cities like Newcastle and Wollongong. These regions harmoniously blend the perks of urban life with a cost structure that doesn’t raise eyebrows.

Australia’s living cost narrative is as vast and varied as its landscapes. Whether one desires the rhythmic pulse of a major city or the serene embrace of regional life, there’s a chapter in this Australian story for everyone.

Homing in on Housing Costs

Navigating through the diverse landscape of Australia’s rental and property market reveals an array of choices influenced by various pivotal factors.

The exploration uncovers details from the glittering hubs of Sydney, Melbourne, and Brisbane, to the serene allure of Perth.

Sydney: The Metropolitan Beacon

- Apartments: Renting an apartment in Sydney’s central districts can be quite an investment, often surpassing AUD 500 per week for a one-bedroom unit. As we tread into more luxurious or centrally located two-bedroom spaces, the weekly rent can escalate beyond AUD 800.

- Houses: Sydney’s house rental market holds its place on the pricier end of the spectrum, with median rents for houses navigating around the AUD 600-800 per week mark, depending on location and amenities.

Melbourne: The Cultural Epicenter

- Apartments: In Melbourne, a one-bedroom apartment typically ranges between AUD 350-600 per week, fluctuating based on proximity to the city centre and available amenities.

- Houses: The rental rate for houses in Melbourne swirls around AUD 450-700 per week, varying significantly based on location, size, and the overall property condition.

Brisbane: The Tropical Metropolis

- Apartments: Brisbane’s apartment market is more lenient, with a one-bedroom unit in Brisbane averaging around AUD 300-450 per week.

- Houses: For those eyeing a house in Brisbane, anticipate rental costs somewhere between AUD 500-700 per week, influenced by the property’s location and characteristics.

Perth: The Western Oasis

- Apartments: Perth offers one-bedroom apartments at an approximate range of AUD 400-500 per week, reflecting its geographical uniqueness.

- Houses: A house in Perth is likely to set the renter back by about AUD 600-800 per week, the cost fluctuating based on various influencing elements.

Factors Affecting Housing Costs

- Location: The geographical heart of your dwelling plays a central role, with metropolitan hubs like Sydney and Melbourne often demanding a heftier financial commitment.

- Size and Accommodation Type: Choices between apartments and houses, along with the decision between furnished and unfurnished spaces, paint varied cost scenarios.

- Demand Dynamics: Areas bathed in higher demand due to robust amenities, schools, and transport networks, naturally garner higher rental and property valuations.

- Property’s Pulse: A property’s age, maintenance level, and renovation status breathe life into its pricing structure.

- Employment Echoes: Proximity to vibrant employment arenas also sings a significant tune in the rental and property cost opera.

Practical Tips for Finding Affordable Housing

Finding affordable housing in Australia, especially in major cities, can be a competitive endeavour. Here are some practical tips to help you secure more budget-friendly accommodation while also considering the cost of living in Australia:

1. Research and Compare

Utilise real estate websites and apps to research different areas and compare rental and property prices. Look for areas that offer a balance between affordability and convenience.

2. Consider Suburbs

Expanding your search to suburbs located a bit further from the city centre can lead to more affordable options. Research the suburbs’ accessibility to public transport to ensure convenient commuting while keeping the overall cost of living in Australia in mind.

3. Share Accommodation

Consider sharing accommodation with roommates or housemates to split the cost of rent and utilities. This can significantly reduce your monthly housing expenses.

4. Negotiate Rent

Don’t hesitate to negotiate rent with the landlord or property manager. In some cases, landlords may be open to lowering the rent, especially if the property has been vacant for a while.

5. Look for Off-Peak Times

Timing matters. Try to lease properties during off-peak seasons when there might be less competition, and landlords may offer better deals.

The rental and property symphony in Australia plays a diverse melody, each city composing its unique economic rhythm and rhyme. Understanding these varying tempos is essential for finding a home that resonates with one’s lifestyle and financial harmonies.

Food and Grocery Expenses

Living and eating in Australia can be as affordable or as expensive as you make it. Here’s a guide to managing your food expenses, from grocery shopping to dining out.

Groceries

- Supermarkets: Chains like Coles and Woolworths are where you’ll find a range of options to suit different budgets. A weekly shop could cost a single person about AUD 80-150.

- Local Markets: Fresh produce and unique finds are plentiful at local markets. Prices can be a bit higher, but the quality is usually better.

Eating Out

- Casual Dining: A meal at a cafe or a casual restaurant usually costs between AUD 10-20, but prices can be higher in big cities like Sydney.

- Fine Dining: If you’re into high-end restaurants, be prepared to pay AUD 40 or more per person.

Takeaway

- Fast Food: Fast-food chains offer quick and cheap meals, costing around AUD 5-15.

- Ethnic Takeaways: Options like Indian or Vietnamese takeaways offer meals for about AUD 10-20.

Coffee and Snacks

- Coffee: A cup of coffee generally costs AUD 4-6.

- Pastries: For a quick snack, pastries and sandwiches at bakeries are priced around AUD 4-10.

Saving Tips

- Discounts: Keep an eye out for sales, coupons, or loyalty programs to save some money.

- Seasonal Produce: Buying fruits and veggies that are in season can also help keep costs down.

By understanding and exploring these options, you can make informed decisions that suit your budget and lifestyle, ensuring that each meal is not just consumed but enjoyed.

Transportation Costs

Getting around in Australia comes with its own set of expenses, and the mode of transportation you choose can significantly impact your overall cost of living in Australia. Here’s a breakdown of what you can expect to pay when navigating the cities Down Under.

Public Transport

Public transport networks in Australia are extensive and well-maintained, offering a practical choice for daily commuting. Most cities have a multi-modal system, encompassing buses, trains, and trams, allowing for convenient transfers and flexible routes.

- Buses: Buses are a widespread option, generally cost-effective, and a single ticket can range from AUD 2-5.

- Trains: Train networks are extensive, especially in larger cities, providing a quick and reliable mode of transportation. A single fare typically ranges from AUD 4-8.

- Trams: Available in cities like Melbourne, trams are a convenient way to navigate the city centre. Costs are similar to those of buses and trains.

Many cities offer contactless payment systems and travel cards, like Sydney’s Opal card and Melbourne’s Myki, allowing for capped fares and discounted rates, making daily commuting more affordable.

Fuel and Vehicle Ownership

Owning a vehicle comes with its own set of considerations, including the cost of the vehicle itself, fuel, maintenance, insurance, and registration.

- Fuel: Fuel prices can be volatile, but on average, you might pay around AUD 1.60 to 2.70 per litre.

- Maintenance and Repairs: Regular maintenance is essential and can vary based on the vehicle’s age and type, but anticipate setting aside AUD 300-600 annually.

- Insurance: Insurance costs can vary based on various factors, including the vehicle and driver’s age and experience. Annual premiums can range from AUD 800-1,800.

- Registration: Vehicle registration costs depend on the car’s size and type, ranging from AUD 300-900 annually.

Commuting Convenience and Costs

Considering convenience, public transport often emerges as a winner, especially during rush hours, as it helps avoid traffic and parking hassles. However, having a personal vehicle can provide flexibility and might be a more viable option in areas with limited public transport accessibility.

When choosing your mode of transport in Australia, consider not only the direct costs but also the value of time and convenience to make a choice that aligns with your lifestyle and budget, ultimately impacting your cost of living in Australia.

Healthcare and Education Expenses

Navigating healthcare and education costs in Australia requires a clear understanding of the associated expenses for effective planning and decision-making. Here’s a straightforward look at the costs and considerations in these key areas:

Healthcare Expenses

Australia’s healthcare framework includes public and private practices, each contributing to a robust and comprehensive system. Medicare, at the heart of this system, furnishes residents and most visitors with access to a spectrum of subsidised medical services. Yet, financial considerations extend beyond the immediate purview of Medicare.

- Medicare Levy: Integral to the funding of the public healthcare system, the Medicare Levy is a standard expenditure, calibrated at 2% of one’s taxable income, subject to variations based on income thresholds.

- Out-of-Pocket Costs: Medicare, despite its broad coverage, leaves certain expenses unattended. Costs related to dental care, optical services, and ambulance services, among others, usually emerge as out-of-pocket expenses.

Health Insurance Insights

Private health insurance surfaces as a pivotal player, bridging the gaps left by Medicare. It heralds benefits such as expedited access to medical services, broader service ranges, and enhanced choice and comfort in hospital selections.

- Premiums: The financial architecture of private health insurance is underpinned by premiums, whose values oscillate based on the depth and breadth of the coverage. Premiums span a spectrum, from around AUD 1,000 annually for basic covers to a more elevated scale for comprehensive plans.

- Extras and Ancillary Cover: Augmenting the basic covers, extras, and ancillary covers extends the insurance canopy, embracing services such as dental and optical care, with distinctive premium structures.

Education Expenses: An Overview

Australia has a world-renowned education system, making it a popular destination for international students. While public schools are generally free for residents, there are still education-related costs to consider:

- Tertiary Education: For the seekers of higher education, especially international students, tuition fees emerge as a primary expense. Variability is profound, with undergraduate programs generally ranging from AUD 20,000 to AUD 45,000 annually, contingent on the specific course and institution.

- Private Schools: Venturing into the private education domain unveils a significant investment, with tuition fees that can eclipse AUD 30,000 annually in certain elite institutions.

- Student Visa Considerations: An essential conduit for international students, the student visa carries its intrinsic costs, accentuating the financial landscape of education in Australia.

Utilities and Communication Costs

Understanding the costs of utilities and communication services in Australia is essential for budgeting and choosing the best services to meet your needs. Here’s a breakdown of these costs:

Electricity and Gas

- Variable Costs: The costs of electricity and gas can vary based on location, usage, and whether the utilities are bundled.

- Energy Efficiency: Utilising energy-efficient appliances and practices can help reduce the electricity bills.

Water

- Consumption Charges: The water bill comprises consumption charges, which are variable costs based on usage.

- Service Charges: Fixed charges for water services are also part of the bill, covering the cost of maintaining water and sewerage systems.

Internet Services

- Plan Variety: Internet costs vary widely based on the type of connection (NBN, ADSL, mobile broadband) and the plan’s speed and data allowance.

- Bundles: Consider bundling the internet with other services like mobile or landline phones to potentially save money.

Mobile Plans

- Prepaid vs. Postpaid: Prepaid plans offer flexibility without contracts, while postpaid plans might include added benefits like more data or international call allowances.

- Data Allowance: Choose a plan that matches your data usage to avoid extra charges.

Landline Phones

- Decline in Use: The use of landline phones has decreased, but they might still be useful for international calls.

- Bundling Options: Bundling a landline with an internet package can sometimes offer cost savings.

Streaming Services

- Subscriptions: Factor in the costs of subscriptions to streaming services like Netflix or Spotify, as they are now common communication and entertainment expenses.

By evaluating and understanding these costs, you can make informed decisions and select the most cost-effective utility and communication services to meet your needs and preferences.

Entertainment and Leisure Expenses

Navigating through Australia’s diverse entertainment and leisure landscape offers a multitude of options, that fit various preferences and budgets. Here’s an insightful guide on how to balance fun and finances effectively.

Movies and Theatres

- Ticket Prices: Expect to pay around AUD 18-22 for a standard adult movie ticket. Premium experiences like IMAX or VIP seating will cost more.

- Discount Days: Some cinemas offer discounts on specific days or for members, which can be a smart way to save money.

Gym and Fitness

- Memberships: Gym memberships vary, with costs ranging from AUD 10-40 weekly, influenced by the range of facilities and classes offered.

- Community Centers: Consider community centres or outdoor fitness stations for budget-friendly exercise options.

Sports and Recreational Activities

- Participation Costs: Engaging in sports often comes with associated costs like equipment, venue hire, or membership fees.

- Local Council Activities: Check local councils for free or low-cost community sports and recreational activities.

Music and Concerts

- Ticket Range: Concert ticket prices can widely vary, from AUD 50 for smaller acts to several hundred dollars for international stars.

- Music Festivals: Festivals offer a range of experiences but can be quite costly, considering ticket prices, food, and possible accommodation.

Eating Out and Socialising

- Varied Options: From high-end restaurants to cosy cafes, dining out ranges from AUD 10 to above AUD 50 per person.

- Happy Hours and Specials: Look out for happy hours or daily specials to make dining out more affordable.

Parks and Outdoor Activities

- Free Access: Many parks and natural reserves offer free access, making for a budget-friendly leisure activity.

- National Parks: Some national parks may charge entry fees, usually around AUD 10-15.

Museums and Cultural Activities

- Entry Fees: Museums and galleries often charge entry fees, but these are usually reasonable, and concession rates are available.

- Free Days: Look out for free entry days or times, as many institutions offer them.

Budget-Friendly Tips

- Membership and Loyalty Programs: Look into memberships or loyalty programs which offer discounts or accumulate points for future savings.

- Community Events: Explore community events or local festivals which often offer free or inexpensive entertainment options.

- Online Platforms and Apps: Consider using online platforms or apps that specialise in showcasing discounts, offers, or last-minute deals for various entertainment and leisure activities, such as dining, concerts, theatre, and sports events. These platforms often provide a convenient way to discover new experiences while benefiting from reduced prices or special promotions.

By exploring various options and planning ahead, you can indulge in a fulfilling range of leisure and entertainment activities that align with your budget.

Savings and Financial Management

Living in Australia can be financially rewarding, but it’s essential to manage your finances wisely to make the most of your experience. Here are some practical tips on managing expenses, creating a budget, and saving money:

Managing Expenses

Budgeting: Start by creating a monthly budget that outlines your income and expenses. This will help you understand where your money is going and identify areas where you can cut back.

- Track Your Spending: Keep a record of your daily expenses, whether it’s through a mobile app or a traditional journal. This will give you a clear picture of your spending habits.

- Prioritise Needs Over Wants: Differentiate between essential expenses (needs) and discretionary spending (wants). Focus on covering your needs first and allocate any surplus to wants.

- Cook at Home: Eating out can be expensive. Cooking at home not only saves money but also allows you to explore local markets and cook with fresh Australian ingredients.

- Use Public Transportation: Australian cities have efficient public transportation systems. Utilise buses, trams, and trains to save on fuel and parking costs.

Creating a Budget

- Emergency Fund: Set up an emergency fund with at least three to six months’ worth of living expenses. This safety net can help you navigate unexpected financial challenges.

- Savings Goals: Define specific savings goals, whether it’s for travel, education, or retirement. Having concrete objectives makes it easier to stay motivated.

- Automate Savings: Consider setting up automatic transfers from your checking account to a savings account. This “pay yourself first” approach ensures that you save regularly.

- Review and Adjust: Periodically review your budget to assess your progress. Adjust it as needed to accommodate changes in your financial situation.

Understanding the Essentials of Australian Living Costs

This exploration equips you with essential knowledge, from housing to leisure activities, allowing for a balanced and sustainable living experience in the diverse environments of Australia. Armed with these practical tips and information, you can better plan, budget, and manage your expenses, ensuring that life in Australia, whether in a bustling city or a tranquil regional area, aligns with your financial expectations and goals.

Before you go…

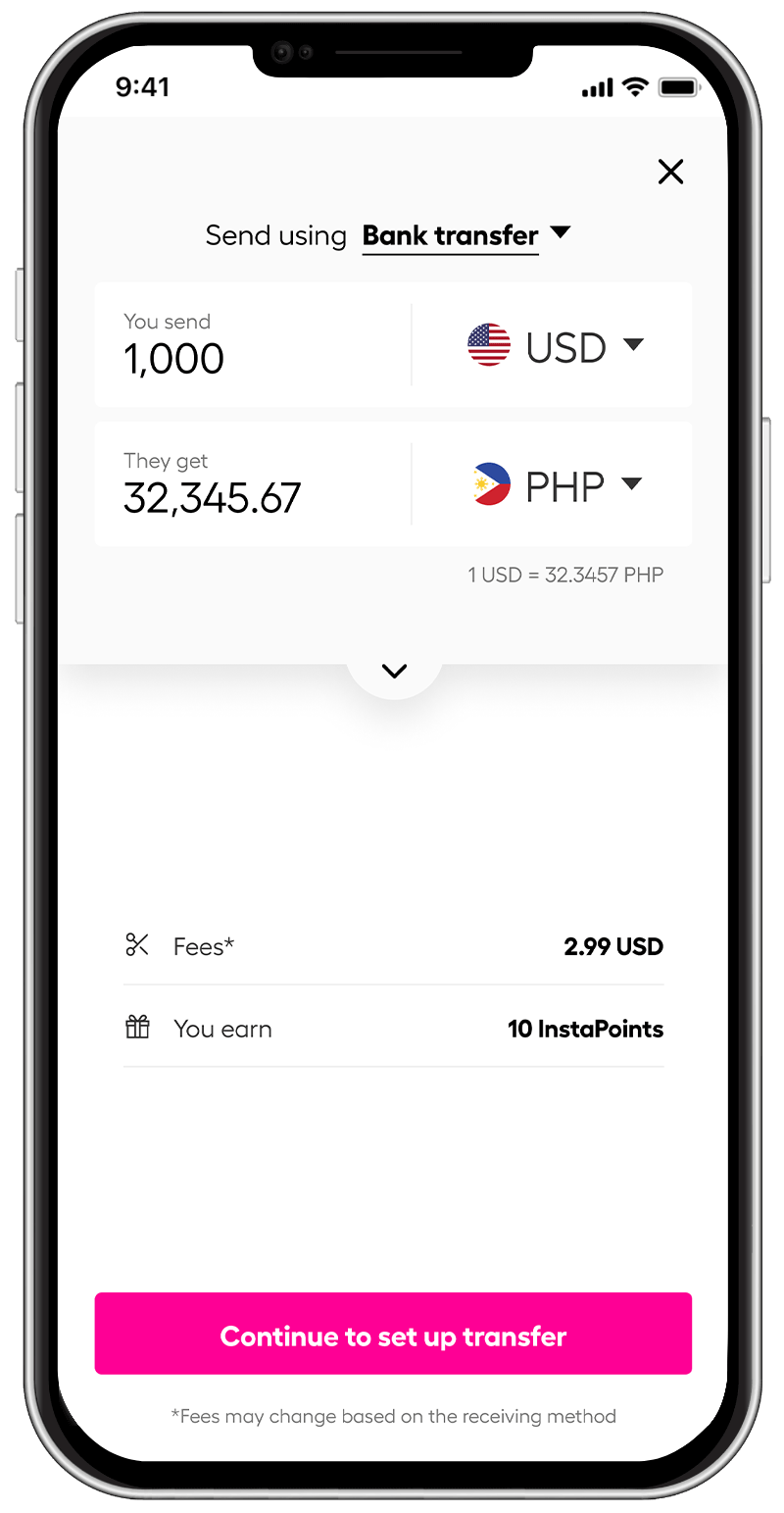

Living in Australia, you might need to send money internationally or receive funds from overseas. Online money transfer services like Instarem can be instrumental in facilitating these transactions:

- Cost-Effective Transfers: Instarem offers competitive exchange rates and low fees, ensuring that you get more value when transferring money across borders.

- Speed and Convenience: The platform allows for quick and hassle-free transfers, making it ideal for expatriates who need to send money to family or manage international investments.

- Transparency: Instarem provides transparent fee structures and real-time exchange rate quotes, so you know exactly how much you’re sending and how much will be received.

- Safety and Security: With Instarem, your financial information and transactions are secured using advanced encryption and anti-fraud measures.

*rates are for display purposes only.

Try Instarem for your next transfer.

Download the app or sign up here.

**Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app