Cost of living in Ireland – single, family & student (2025)

This article covers:

- Overview of Cost of living in Ireland

- A glance at the average cost of living in Ireland

- Average Ireland living expenses: Comprehensive view

- Average cost of living in Ireland: Single vs Student vs Family

- Average cost of living in Ireland citywise

- Ireland cost of living – Tax scenario

- What salary do you need to live in Ireland?

- What should be your monthly budget to live in Ireland?

- Do’s and don’ts to manage the cost of living in Ireland

- Looking for the best places to live in Ireland? Here are the top cities for students and job seekers

- Ireland cost of living – Before you go…

- Frequently asked questions

Over the past few decades, Ireland has earned a reputation for being a highly sought-after destination among expats. Not only is it one of the wealthiest countries in Europe, but also rich in culture and lush landscapes. It is also renowned for its warm and welcoming people, offering world-class hospitality.

While the cost of living in Ireland is high as compared to other countries, it offers an excellent quality of life, numerous employment opportunities, and a high-quality education system.

Whether you are planning to move to Ireland for study or work, our guide on the “average cost of living in Ireland” will help you make an informed decision.

Overview of Cost of living in Ireland

- Cost of living in Ireland for a single person = ~ €2328 monthly & ~ €27,936 annually.

- Average cost of living in Ireland for a student = ~ €1,666 monthly & ~ €20,000 annually.

- Cost of living in Ireland for a family = ~ €5272 monthly & ~ €63,264 annually

Do you know?

- As per Expatistan rankings, Ireland is the 8th most expensive country to live in the world in 2025. Nevertheless, it is one of the top choices among expats.

- According to the World Population Review, Ireland ranks in 24th position in the list of best countries to live in 2024.

- 8 out of 1500 best universities in the world are in Ireland, according to the QS World University Rankings 2024.

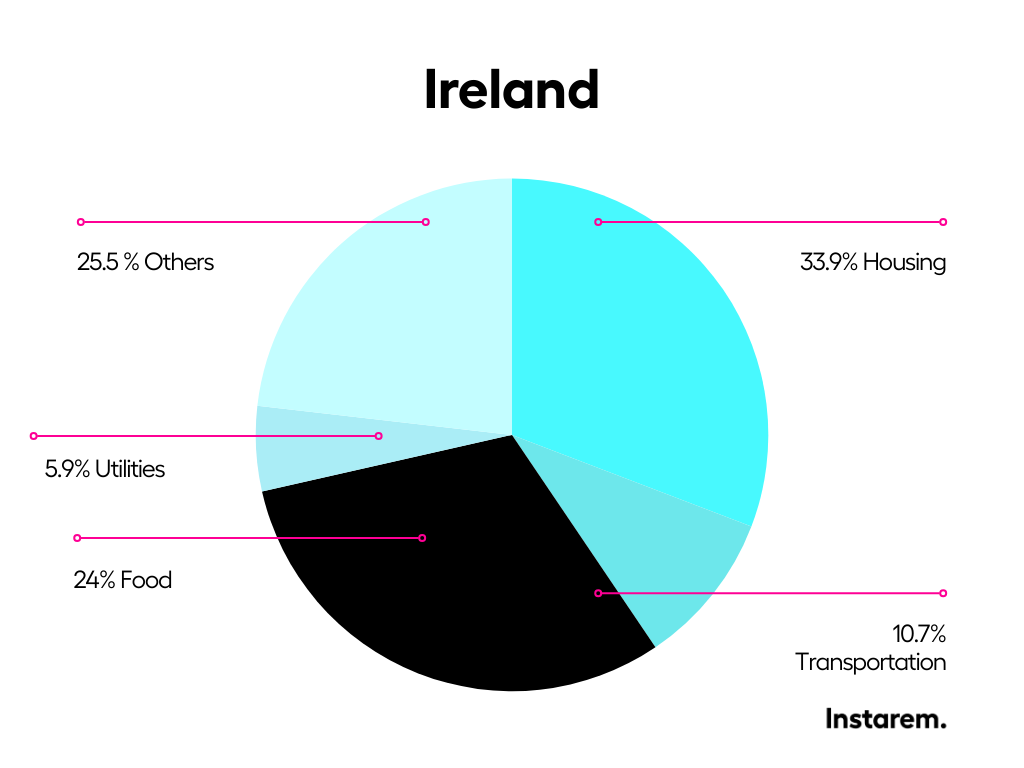

A glance at the average cost of living in Ireland

Source: Numbeo

Average Ireland living expenses: Comprehensive view

Cost of living | Single person | Family of 4 |

Total expenses (including rent) | €2328 | €5272 |

Total expenses (without rent) | €817 | €2551 |

Rent + utilities | €1570 | €2720 |

Transport | €125 | €328 |

Food | €551 | €1426 |

Source: Livingcost.org

Expense Category | Item | Avg. cost per month |

Housing | 1-bedroom apartment (in the city centre) | €1635 |

1-bedroom apartment (outside the city centre) | €1324 | |

3-bedroom apartment (in the city centre) | €2901 | |

3-bedroom apartment (outside the city centre) | €2351 |

Source: Livingcost.org

Average cost of living in Ireland: Single vs Student vs Family

Type of expense | Avg. cost per month for student | Avg. cost per month for single | Avg. cost per month for family |

Housing & rent | €400 – €1000 | €1570 | €2720 |

Food/groceries | €140 – €220 | €551 | €1426 |

Transportation | €80 – €110 | €125 | €328 |

Utility (electricity, water, heating, etc. ) | €40 – €80 | €139 | €214 |

Entertainment | €120 – €180 | €120 – €180 | €180-€250 |

Source: Livingcost.org, gostudy

Average cost of living in Ireland citywise

Type of expense | Dublin | Galway | Cork | Limerick |

Monthly Salary (after taxes) | €3727 | €3013 | €3247 | €2962 |

Cost of living (single) | €2627 | €2297 | €2275 | €1969 |

Cost of living (family) | €5796 | €4884 | €5194 | €4141 |

Rent & utilities (single) | €1748 | €1594 | €1450 | €1279 |

Rent & utilities (family) | €3037 | €2680 | €2634 | €2063 |

Food (single) | €536 | €517 | €576 | €511 |

Food (family) | €1456 | €1332 | €1488 | €1314 |

Transport (single) | €168 | €57.9 | €114 | €59.5 |

Transport (family) | €438 | €155 | €305 | €161 |

Overall quality of life | 96 | 86 | 86 | 88 |

Source: Livingcost.org

Ireland cost of living – Tax scenario

All the residents of Ireland are subject to taxation based on their residency status. While permanent residents have to pay taxes on their overall income, foreign nationals/temporary residents have to pay taxes only on the income they have earned in Ireland.

The below table shows the tax rates and tax bands applicable for the tax year 2025.

Personal circumstances | Tax rates |

Single/widowed/surviving partner with no qualifying children | €44,000 @ 20%, balance @40% |

Single/widowed/surviving partner, eligible for Single Person Child Carer Credit | €48,000 @ 20%, balance @40% |

Married/in a civil relationship (one civil partner or spouse with income) | €533,000 @ 20%, balance @40% |

Married/in a civil relationship (both civil partners or spouses with income) | €53,000 @20% (with a maximum increase of 33,000) balance @40% |

Source: Revenue (Irish Tax and Customs)

What salary do you need to live in Ireland?

As compared to the other European nations, the average cost of living in Ireland is a bit high.

Similar to the popular cities in other countries, the cost of living in Dublin, the capital city of Ireland, is higher than other cities and towns in the country. It is even compared to London in terms of living costs.

Over the past few years, the rents in Ireland have increased to a great extent. Moreover, the prices of certain goods that are imported from other countries have also increased considerably.

However, the good news is the average wages in Ireland are also comparatively high. This means individuals planning to work in Ireland can expect a relatively higher-paying job to manage a comfortable lifestyle.

A salary of around €6,000 per month is estimated to be sufficient for a family to live comfortably in Ireland. This amount will cover the basic expenses such as rent, food, transportation, healthcare, and utilities.

Further, any individual can live comfortably with a salary of around €750 per week or €3000 per month, which is roughly around €5 than the average minimum income levels in Ireland.

What should be your monthly budget to live in Ireland?

Category | Student | Single | Family |

Housing/Rent | €400 – €1000 | €1969 – €2700 | €2,000 – €3,000 |

Utilities | €40 – €80 | €80 – €150 | €100 – €200 |

Groceries | €140 – €220 | €250 – €350 | €400- €600 |

Transportation | €80 – €100 | €100 – €200 | €150 – €300 |

Health insurance | €50 – €100 | €50 – €100 | €100 – €200 |

Other (entertainment, shopping, personal care) | €90 – €120 | €200 – €300 | €300 – €400 |

Total##(approximately) | €800 – €1,620 | €1,600 – €3,500 | €3,400 – €5,000 |

##It is an approximate value based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Do’s and don’ts to manage the cost of living in Ireland

Do’s

- Create a monthly budget: Perhaps the biggest challenge when moving to a new country is dealing with the new currency. This is especially true for those moving to a country with a stronger currency than their home country.

- At this point, creating a budget becomes indispensable to prevent unnecessary expenses. So, start planning a realistic monthly budget from the first day of moving to Ireland.

- Make sure to include all the fixed (rent, food, utilities, etc.) as well as variable (entertainment, leisure, healthcare, etc.) expenses in this budget. Also, check out our guide on several unexpected expenses to consider when moving overseas.

- Shop locally: Be it for groceries or personal items, shopping online becomes very irresistible in the presence of multiple discounts and deals.Falling for marketing gimmicks is very obvious, and it often leads you to buy the stuff you don’t even need.

- To prevent this, shop at the local stores. And make sure to compare prices from different outlets before making a purchase.

- To prevent this, shop at the local stores. And make sure to compare prices from different outlets before making a purchase.

- Use public transport: Having a car can be very convenient. But we can not ignore the fact that it is expensive.

- From higher fuel prices to insurance and maintenance costs, owning a personal vehicle can drain a significant portion of your earnings. Public transport, on the other hand, is way cheaper.

- If you are a student, then you can get amazing discounts and deals on monthly transport passes in Ireland.

- Research well for accommodation: Do your homework before renting out a flat or apartment in Ireland. It can help you in finding budget-friendly and comfortable accommodation.

- If you have a limited budget, then consider finding a place away from the main city as it will be much cheaper.

- Further, if you are a student, then having a shared accommodation will be the best option for you. Also, refer to our guide on things to consider before signing a rental agreement abroad.

- Explore cost-free recreational options: Ireland offers plenty of free activities such as community events, local festivals, outdoor activities at parks, etc. This can save you a lot of money.

Don’ts

- Rely on eating out: Eating out every day can drain your income very fast. Instead, consider cooking at your home. It takes a bit of time but is worth the amount of money it saves. What’s more? It is much healthier as compared to the food you get at the restaurants.

- Overuse utilities: Avoid overusing utilities if you don’t want to exceed the average cost. Limit the use of heavy appliances such as a dishwasher and washing machine to save energy and utility bills.

- Ignore currency exchange rates: Higher currency exchange rates can significantly add to your regular expenses. For example, to send money from Ireland to India or any other country, make sure to utilise authentic money transfer services like Instarem, which offers zero margin FX rates for EU union countries and higher fund transfer guarantees.

- Neglect emergency savings: Emergencies can strike at any time. So, don’t neglect an emergency fund. It can save you from potential debts and financial challenges.

Looking for the best places to live in Ireland? Here are the top cities for students and job seekers

Dublin

The very first and best place to live in Ireland is its capital, Dublin. It is the largest city in the country, rich in tradition and history. The city is well known for its vibrant culture that offers plenty of opportunities for students as well as retirees.

Dublin also has a vibrant nightlife, which is quite popular among students and young individuals. Also, because the city is located near the coast, it has beautiful scenery and beaches.

Most importantly, there are plenty of job opportunities in Dublin with many pharmaceutical, science, health, and engineering companies.

So, if you are planning to stay in Ireland, then Dublin can be the perfect place for you. If you wish to find cheaper accommodation, then consider living in the suburbs.

Average living cost per person: EUR 2627 per month

Galway

Moving towards another best place to live in Ireland, that is Galway. It is situated on the west side of the country near the river Corrib. Also, Galway is the most populous city in Ireland.

Most importantly, Galway is the safest city in Ireland and has many job opportunities. Various multinational companies such as Medtronic, Wayfair, and Boston Scientific are located in this city.

Average living cost per person: EUR 2297 per month

Cork

Cork is located on the southwest side of Ireland. It is a lively city perfect for the virtual nomads looking to build a social life.

It is the second largest city in Ireland and that is why job opportunities are plenty here. To be more specific, the pharmaceutical and tech Industries are the most popular.

The city is also known as the food capital of the country, the reason being the high-quality produce of food items. Other than food, Cork also serves entertainment, outdoor activities as well as cultural experiences to the people.

All in all, Cork is a diverse city filled with opportunities, entertainment, and experiences.

Average living cost per person: EUR 2275 per month

Limerick

The next great city to live in Ireland is Limerick. People prefer living here for various reasons. It is one of the oldest and the third largest city in Ireland.

Moreover, the most famous institute in Limerick is the Limerick Institute of Technology. Limerick is most preferred because of its affordability, diversity, and cultural heritage. The city is also surrounded by natural beauty, adding to its existing charm.

Moreover, the city is vibrant and full of energy. It has many theatres, galleries, and music venues for your entertainment.

Average living cost per person: EUR 1975 per month

Ireland cost of living – Before you go…

Ireland is a wonderful country to live in. It has something for everyone, be it a robust job market, prestigious educational institutions, or an amazing living atmosphere. So, if you are looking forward to moving here, comhghairdeas! (congratulations!)

But moving to a new country is not a cakewalk. One of the common challenges faced by expats is managing their funds, especially during the initial days of moving.

There can be several occasions when you might need to send money from India to Ireland or vice-versa. If you want to ensure convenient fund transfer and avoid hefty EUR to INR conversion rates, then use a money transfer service like Instarem.

Instarem is an all-around overseas fund transfer service that offers affordable# exchange rates and fast** fund transfers. On top of it, it also offers a highly secure transaction channel, making money transfer less worrisome.

Download the app or sign up here.

Frequently asked questions

- Is it expensive to live in Ireland?

Yes. Ireland is named among the top 10 countries in the world with the highest cost of living. The average cost of housing, transportation, and other daily necessities is relatively high. Nevertheless, those earning slightly above the average can comfortably afford the Ireland standard of living. - How much is the cost of living in Ireland for International students?

International students need around €1,000 to €1,500 per month to pay for daily expenses such as accommodation, utilities, food, and transportation. This amount can vary based on the city they are living in. Moreover, students can also avail of special discounts to save on their monthly expenses. - What is the average room rent in Ireland?

The average room rent in Ireland varies from one city to another. It is around €1479 (with a single bed) in Dublin, which is regarded as the most expensive city in Ireland. - How much is the cost of living in Ireland for a couple?

The cost of living in Ireland for a couple is influenced by several factors, such as the location, type of housing, preferred mode of transportation, personal spending habits, and so on. Depending on these factors, living in a city like Dublin can cost around €2,600 to €4,500 for a couple. Those who prefer a luxurious lifestyle can expect it to be even more expensive. - What is the cost of living in Ireland for a single person?

The cost of living in Ireland for a single person is nearly €2387 per month. However, this amount can vary based on the individual lifestyle, personal expenses, and spending habits. - What is the cost of living in Ireland for a family?

The average cost of living in Ireland for a family of four (a couple and 2 small children) is around €6,000. This amount is inclusive of basic expenses such as housing, food, utilities and transportation.

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- Prices mentioned in this blog are subject to change.

- ** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- # When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.