How The Rallying US Dollar Impacts Remittances From Australia To Emerging Countries

This article covers:

The Rise & Rise Of The US Dollar

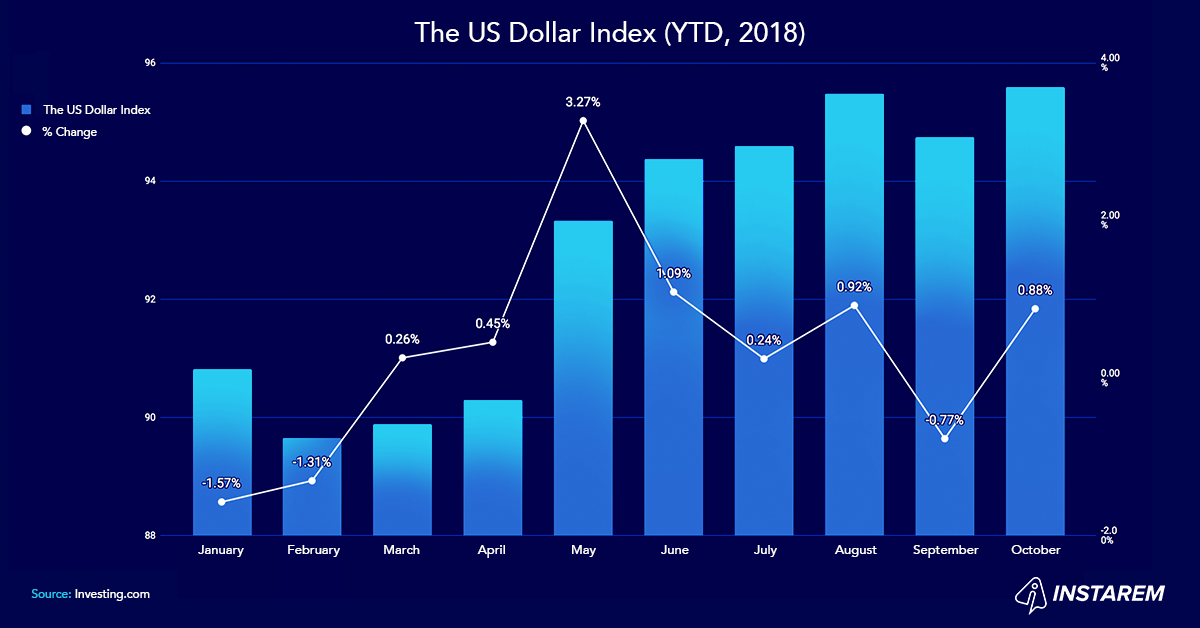

The soaring US dollar has had a domino effect on currencies across the world this year. Since the beginning of 2018, the US dollar has appreciated over 7-9% against the Australian dollar and the New Zealand dollar, and more than 4% against the Euro and the GBP.

Despite the threat of a trade war with China looming large and experts fearing a downward spiral in the American economy, the US dollar continues to rise and dictate the fate of global financial markets and currencies.

However, the currencies of the emerging economies are the worst-hit by the rallying US dollar. While major currencies are down only a few percent, the Indian rupee has lost close to 13% of its value against the US dollar so far this year, the South African Rand is down 14%, the Turkish Lira has fallen by 33% and the Argentinian peso has lost 48% against the US dollar since the beginning of the year.

How A Strong US Dollar Has Impacted The Australian Economy?

A strong US dollar is a double-edged sword. While it makes foreign goods cheaper for Americans, American goods become expensive in other countries – developing as well as developed – and even some American exporters may lose their competitive edge in the international market. A strong dollar does affect the American companies that earn a significant portion of their revenues coming from overseas.

Why should Australian dollar get affected? Well, the Australian dollar has a strong correlation with global commodity prices. Australia is a major exporter of commodities like iron ore and coal, whose prices have declined due to a strong US dollar. Weak commodity prices mean lower demand for the Australian dollar, which has lost around 7.60% of its value against the US dollar this year. Australian companies, especially the commodity exporters, will be adversely affected due to a strong US dollar.

Australia’s close trade relationship with China also makes the Australian dollar vulnerable against the US dollar amid the ongoing tensions between China and the US. Australia’s dependence on the export of commodities like coal and iron ore for the global steel industry may further affect the prospect of the Australian dollar as President Donald Trump announced tariffs on imported steel and aluminium. Another fallout of the strengthening US dollar against the Australian dollar is the high cost of petrol. Reflecting the recent strength in global crude oil prices as well as the weakness in the Australian dollar, the average petrol price shot to 159.3 cents a litre, its highest level in more than a decade.

Although the rising US dollar has had a negative impact on the Australian economy, the Australian dollar is still a forerunner among the developed economies. Therefore, the emerging economies stand to gain in the form of remittances from the comparatively stronger Australian dollar.

Remittances To Emerging Economies

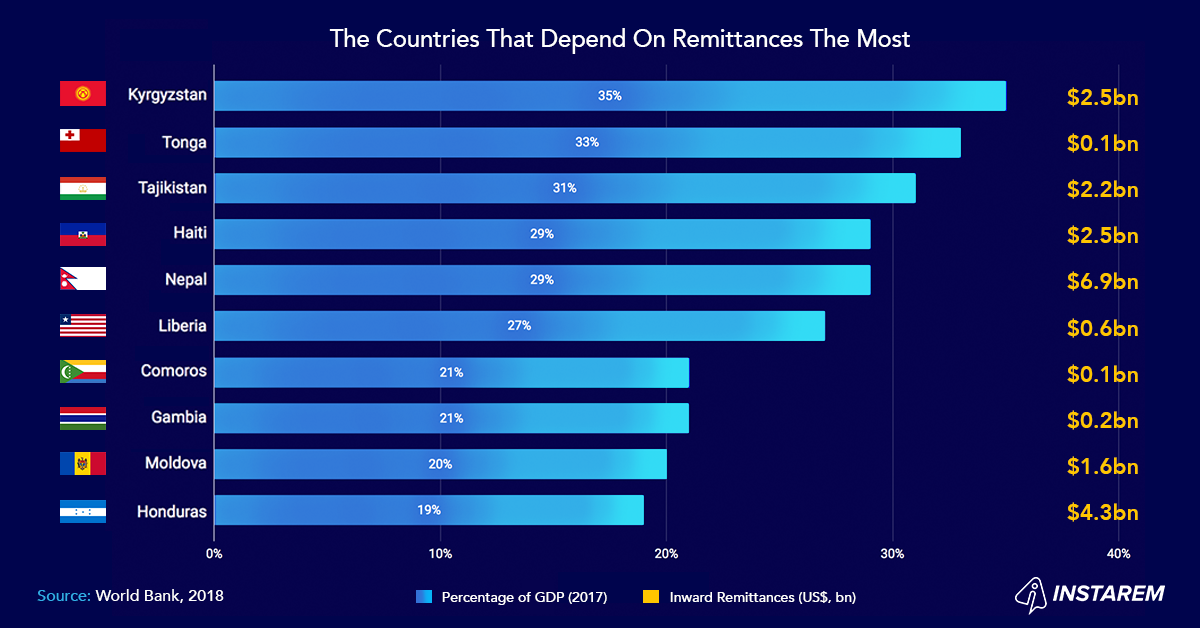

According to the World Bank, remittances are the second largest source of external finance for developing countries after foreign direct investment (FDI). For some emerging economies, remittances are a greater source of foreign exchange than foreign direct investment and portfolio investment flows. And for countries like Tajikistan, the Kyrgyzstan, Nepal, Tonga, and Moldova, remittances represent more than a quarter of their GDPs.

Remittances To Emerging Economies From Australia

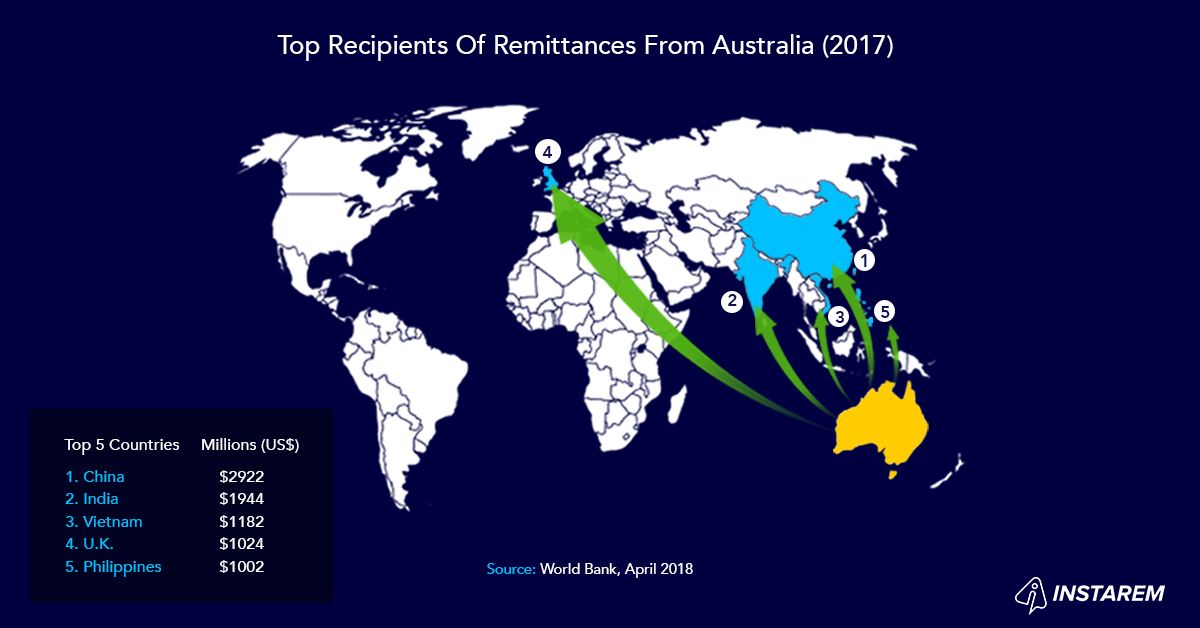

As per the World Bank data, Australia is the 11th largest sender of remittances in the world and ranks 60th on the list of remittance receiving countries.

According to the World Bank estimates, remittances from Australia in 2017 were worth US$ 16.89 billion – including US$ 1.944 bn sent to India, US$ 1.182 bn to Vietnam, US$ 1.002 bn to the Philippines, US$ 1.084 bn to the UK and US$ 2.922 bn to China.

The falling currency values of the emerging economies have made the environment more conducive to remittance inflows as now expats in Australia get more bang for the buck when they transfer money back home.

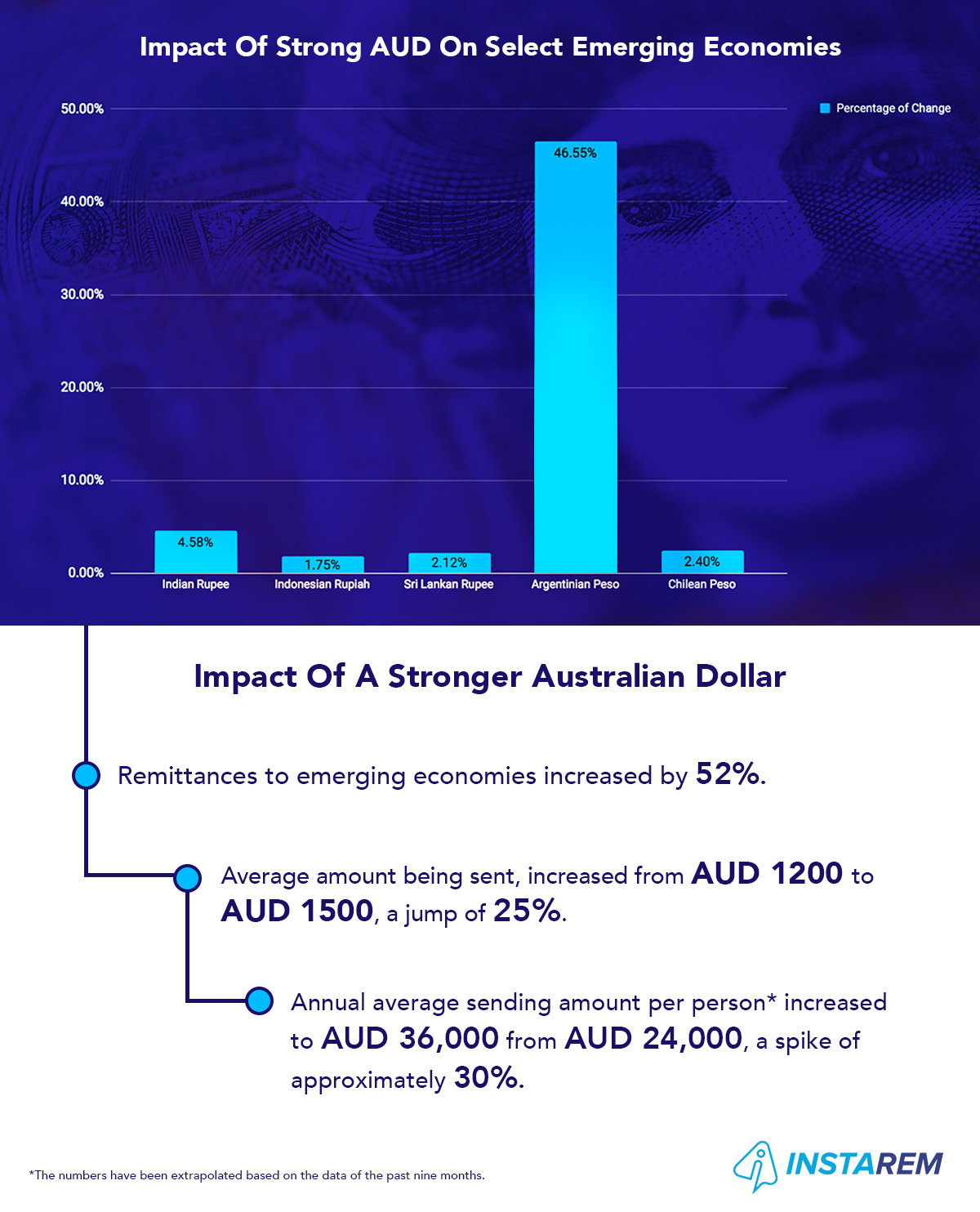

For example:

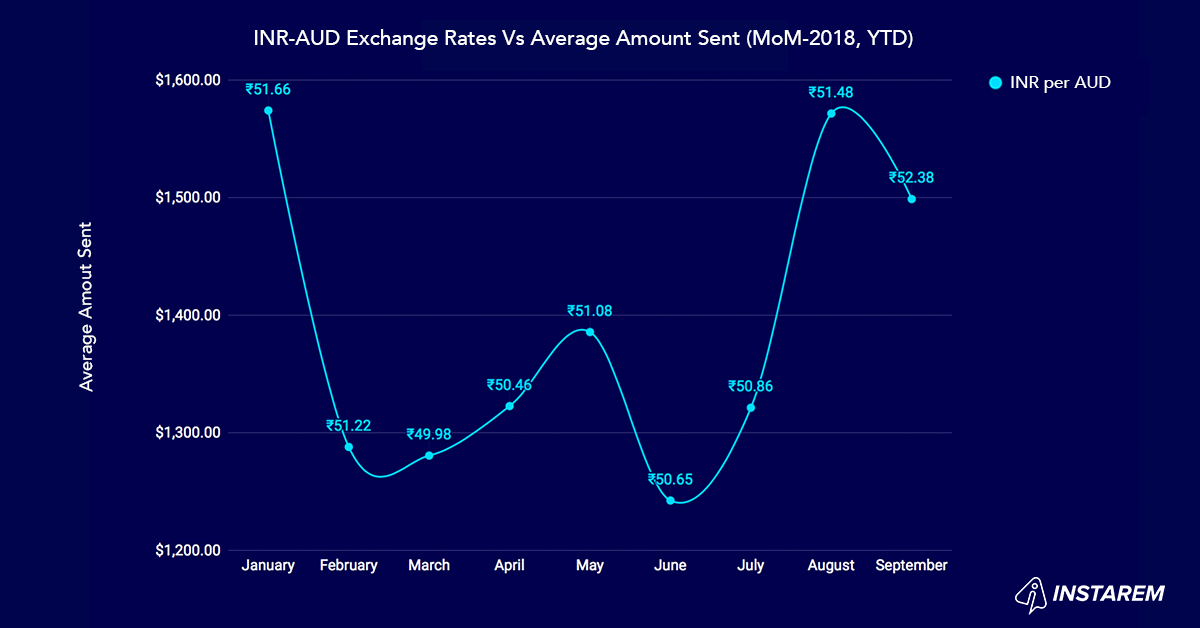

On March 30, 2018, AUD 1,000 remitted to India was equivalent to INR 49, 980.

While on September 30, 2018, it was equivalent to INR 52,380.

Between March 30 and September 30, the Indian rupee lost 4.58% of its value against the Australian dollar.

InstaReM analysed approximately 100,000 transactions between January and September 2018 and found that money transfers from Australia to emerging economies increased by 52% when the Australian dollar was stronger in comparison to currencies of emerging economies.

Between January and September 2018, InstaReM witnessed a jump in the average amount sent as well as the volumes of remittances from Australia. Our analysis of the remittance data showed that the average amount sent per transaction increased from AUD 1200 to AUD 1500, an increase of 25% in remittances from Australia to developing economies.

As the Australian dollar trended higher in comparison to the currencies of emerging economies, annual* average sending amount per person (from Australia to emerging economies) increased to AUD 36,000 as against AUD 24,000 when the dollar was weaker.

*The numbers have been extrapolated based on the data of the past nine months.

Conclusion

While a relatively stronger Australian dollar has had a positive impact on remittances to emerging economies, the Australian economy is struggling against the surging US dollar. However, every cloud has a silver lining! On the brighter side, a strong US dollar may prove to be beneficial for tourism in Australia as Americans, who now have a higher purchasing power, may want to take a holiday down under.