4.4/5 – Excellent. From 8,000+ reviews

International money transfers

Our rates

Our rates

Payment by

Fees Fees and exchange rates vary by sending amount, currency, payment method, and receiving country. Please change these parameters to view the applicable fees.

Transfer time Estimated transfer time may vary based on the currency selected, payment method, and bank timings.

Making your first transfer?

Get a special FX rate on your transfer! Send between USD 1 and USD 3,000 today.

Plus, enjoy USD 5 off your first transfer of USD 1,000 or more. Use code WELCOME.

Need to send over 25,000 USD? Enjoy special discounts. Learn more

Why Instarem?

Fast

Usually within 1-2 business days*

Low-cost

Competitive exchange rates and low fees

Safe

Licensed and regulated in 11 countries

Transparent

All costs are upfront, no hidden charges

Rewarding

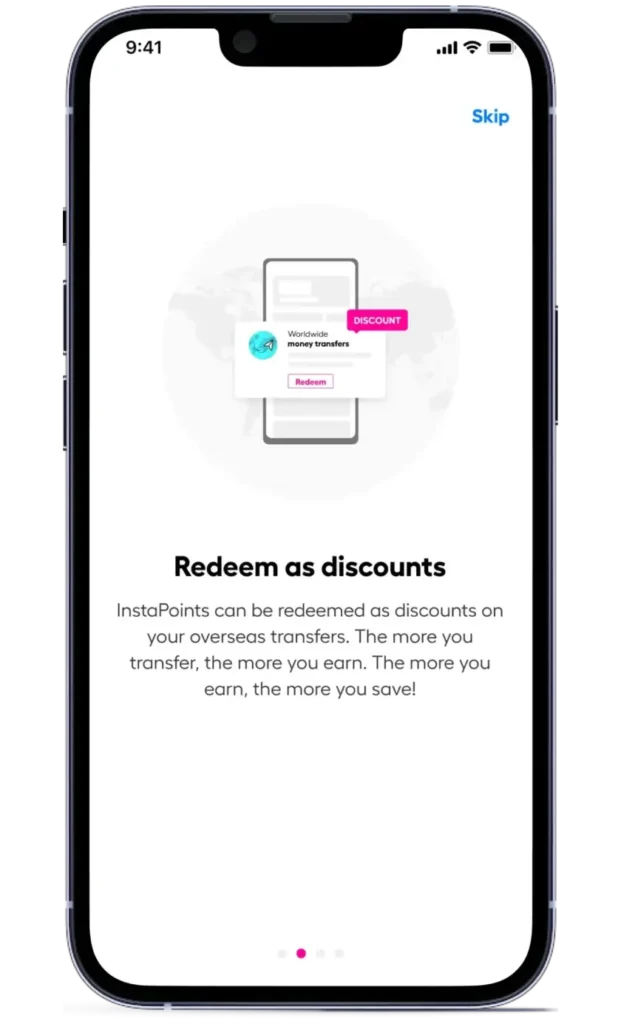

Earn rewards on every transaction

Fast and secure international transfers

Earn rewards with every transfer

Find the best rate for your money transfer

Compare Instarem’s rate for with other providers and see the difference yourself.

What our customers say

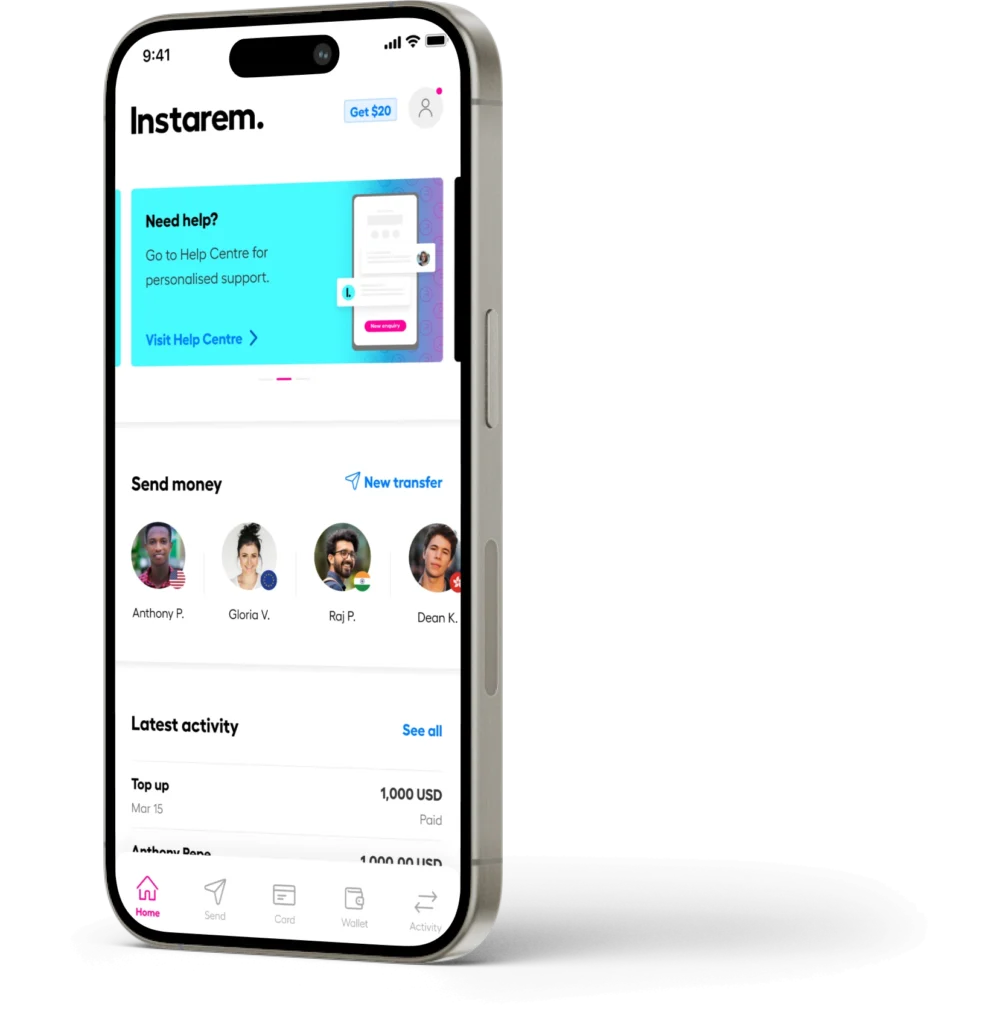

Money transfers at your fingertips

Send money to over 60 countries hassle-free and stay in the know with real-time tracking.

Rack up loyalty points with every transfer and level up your next one for an even sweeter deal.

Never miss a great rate! Set up rate alerts to seize favourable opportunities and get more value for your money.

Ready to get started?

Looking for an easy global payment solution for your business?

We provide fast and cost-effective international payments for all your business needs. With us, you can focus on what truly matters.

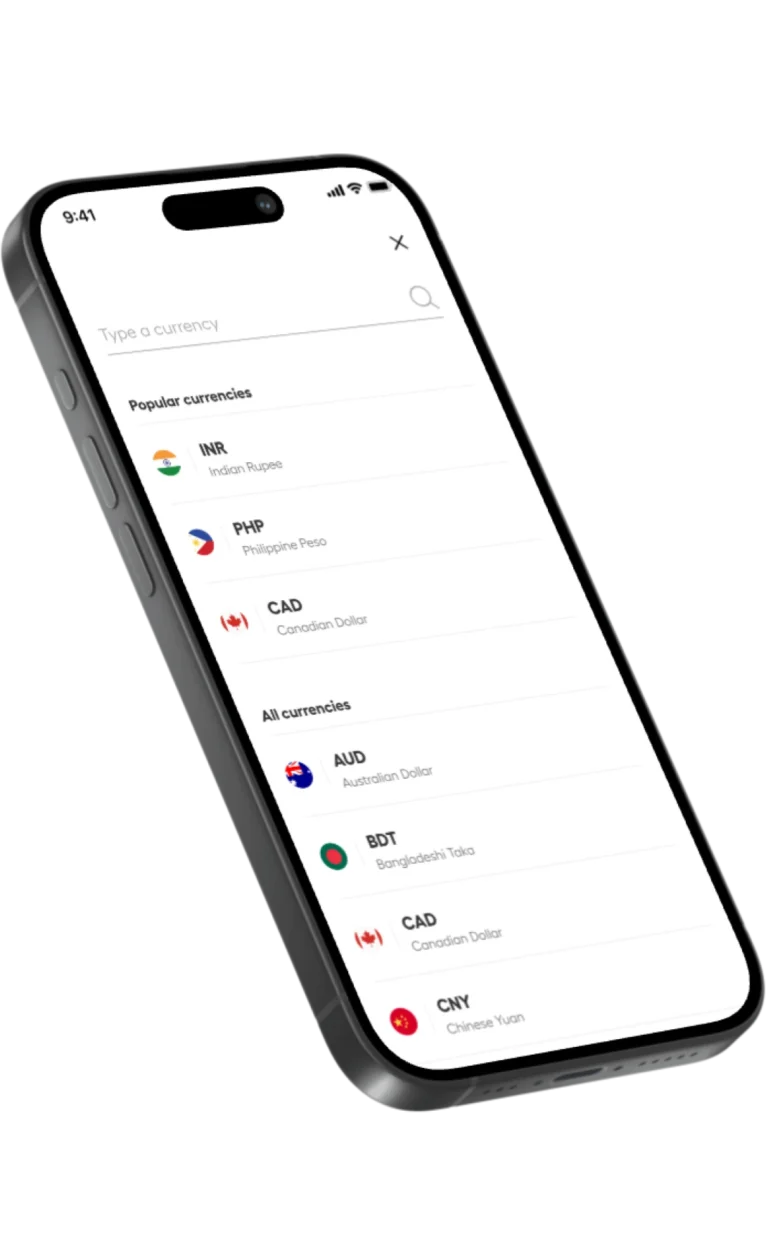

Send money from USA to 60+ countries

If you cannot find the location you would like to send to, it means we currently do not support transfers to that destination, but we are working on it! Do come back and check again as we are continuously updating our services.

More currency pairings for USD

If you cannot find your desired currency pair, it means that transfers to that specified currency are not supported by our services, but we are working on it! Do come back and check again as we are continuously updating our services.

Our latest articles

Complete list of startup schemes and grants in Singapore

This article covers: Quick overview of startup grants Singapore Startup SG equity funding Startup SG…

Complete guide to transferring money from Singapore to Malaysia

Thinking of sending money from Singapore to Malaysia? We’ve got you covered with the…

UOB Singapore overseas money transfer: Everything you need to know

How to conduct an overseas fund transfer with UOB Singapore? Here’s everything you need…

Singapore to Batam ferry guide: Ticket price, schedule and more (2026)

This article covers: Where to take the ferry from Singapore to Batam? How to get…

Securing housing loans for foreigners in Singapore: 2026 Guide

This article covers: Key takeaways Who is considered a foreigner in Singapore? What types of…

What is (FIRC) foreign inward remittance certificate?

This article covers: What is a FIRC certificate? Types of foreign inward remittance certificates Importance…

Property tax payment in Singapore: A complete guide

This article covers: Key takeaways What is property tax? The difference between property tax and…

DBS international money transfers Singapore – Everything you need to know

Thinking of sending money overseas using DBS? Get an understanding of the fees, rates, transfer…

Ferry to Desaru: Guide to ferry prices and where to buy tickets

This article covers: Okay, so how to get to Desaru from Singapore by ferry in…

10 college degrees that will help you become an expat

If globetrotting is your ultimate goal, you’ll want to hit the books and get…

FAQs

There are many ways to send money abroad including banks, retail money transfer operators and online money transfer services. The best international money transfer option depends on key factors such as exchange rates, transfer fees and speed.

While some banks and financial organisations may have unfavourable rates and hidden fees, Instarem offers competitive foreign exchange rates close to mid-market rates, with low fees. New users get a special offer on their first transfer, plus, every transaction earns you InstaPoints that can be redeemed for even more savings.

With fast, secure, and low-cost transfers, Instarem is a smart choice to send money internationally.

Instarem allows you to make global money transfers effortlessly. You can send money online to your loved ones, pay for education fees, or transfer funds to your own account in over 60 countries.

To get started, just create an account on instarem.com or download the Instarem app. Enter your sending amount and recipient’s details and fund your transfer. Your recipient doesn't need an Instarem account to receive money.

Once we get your funds, we send them directly to your recipient’s bank account in their local currency. It’s quick and easy, and with our favourable rates and fees, you can enjoy great value on every foreign currency transfer.

Sending money abroad with Instarem is simple and affordable, with no hidden fees or unfair FX margins. We make international money transfers seamless with a quick, hassle-free process— no lengthy forms, no unnecessary delays.

Here’s how you can benefit from sending money with us:

- Fast: Most transfers are instant or same-day.

- Low-cost: Get competitive exchange rates and low fees.

- Safe: Instarem is licensed and regulated in 11 jurisdictions.

- Transparent: All costs are upfront, no hidden charges.

- Convenient: Track your transfer in real time on our app.

- Rewarding: Earn InstaPoints on every transaction.

You can send money abroad with Instarem in just a few simple steps:

- Sign up: Download the Instarem app, create an account for free and verify your identity.

- Add a recipient: Add a new recipient or choose from your phone contacts. You can send money to yourself, family and friends.

- Add your transfer details: Use the currency calculator to select the sending amount and receiving country. You’ll see exchange rates and fees upfront, with no hidden charges.

- Authorise and pay: Fund your money transfer via your preferred payment method.

Once we receive the funds, we’ll process your transfer and notify you when it’s sent. You can also track your transfer in real time on the app.

The maximum amount you can send with Instarem depends on the country you're sending money to and from, as well as the payment method you use. You can check international money transfer limits here.

As a licensed and regulated service, Instarem requires certain details to verify your identity and safeguard your transactions. To send money abroad with Instarem, you’ll need to provide:

- Your personal details: Name, email, phone number, identity proof (like a National ID or passport), and address documents.

- Your recipient’s details: Full name and bank account information.

- Your money transfer details and reason for transfer.

Depending on your reason for transfer, we may ask for supporting documents like a university letter, education visa, or emigration payment invoice.

You can set up an overseas money transfer on our website or app within minutes. Once we receive your funds, your transfer may be sent to your recipient instantly or may take up to 1-2 business days. The time it takes to send money depends on several factors including your payment method, destination country, and the receiving bank’s processing time.

You can easily track your money transfers in real time by following these simple steps:

- Log into your app.

- Tap the Activity icon at the bottom.

- Select your transfer and check its status.

Also remember to keep your notifications on, so that we can let you know when your money transfer has been completed.

Yes, in addition to our great exchange rates, we have special offers to help you save even more on your transfers.

- New user benefits: Get a special offer like zero fees or special exchange rates on your first global money transfer. You can check the available offer when setting up your transfer on our website or app.

- Large transfer offer: If you’re planning a large money transfer, you can connect with us and get an exclusive offer.

- InstaPoints: You can earn InstaPoints on every successful transfer and redeem them for discounts on future money transfers.

- Referral bonus: You can earn a 50 USD-equivalent bonus plus 200 InstaPoints for every friend you refer who completes their first transfer with us.

- Limited-time promotions: We run exclusive offers through the year – keep your notifications on so that you don’t miss out.

Please note that minimum transfer amounts and other terms may apply.

In addition to international money transfer for individuals, Instarem offers cross border payment solutions for businesses. Small and medium enterprises can easily pay their overseas suppliers and employees in 160+ countries while enjoying competitive exchange rates, low fees, and dedicated support. Learn more here.