This article covers:

- 1. Make a budget and stick to it

- 2. Make a list

- 3. Milk those student discounts

- 4. Snoop for second-hand items

- 5. Get council tax exemption

- 6. Cook your own meals

- 7. Dumpster dive for groceries

- 8. Plan your travels

- 9. Take up a part time job

- 10. Surviving the cold without breaking the bank

- 11. Open a UK bank account

- Before you go…

Ah, money tips. What springs to your mind the moment you hear those words? Cancelling all your plans and living like a hermit? Sitting in the dark, munching on stale bread, saving every penny for that elusive investment opportunity? Yeah, right. This isn’t one of those blogs.

We’re not here to tell you to live like a monk and count your pennies until your fingers bleed.

Life is all about balance, folks. Is that limited-edition video game really worth a week’s groceries? Maybe, if you’re planning to survive on air and good vibes.

But hey, we’re also throwing in some handy shortcuts to help you squeeze every bit of value from your pounds. But hold on this exclusive club is strictly for students only. You know, those of us who spend more than we earn and still somehow survive in the UK without selling a kidney. So, without further ado, here are some cheeky shortcuts…

1. Make a budget and stick to it

So, you’ve finally flown the cosy coop of your parent’s house and you’re a student now, living it up in the UK. What’s the first thing you do? Spend money like it’s going out of fashion, of course! But who can blame you? You’re in a new country, everything costs money, and you’re doing mental gymnastics trying to convert currencies faster than a Forex trader on a caffeine high.

But after the dust has settled, and you’ve had a few heated debates with yourself about whether that fifth pint was really a “necessity”, it’s time to get serious about your spending. You might want to start tracking your expenses for a week or two and hey, the sheer terror of seeing where your money is going might just make you cut back without even trying. Then, go through that list with a fine-tooth comb and decide what’s worth the splurge and what’s not.

Now, this is the part where I sound like your mom – make a budget and stick to it. This is crucial, folks. It’s easier than ever with all these fancy budget planners floating around. And hey, some banks even let you create little pots for specific savings goals (take Monzo, for example). Want to keep things simple and avoid wrestling with Excel spreadsheets? There’s an app for that. Budgeting apps are here to save your sanity (and your bank balance).

You might be interested in: Guide to cost of living in London (2023 – 2024)

2. Make a list

Groundbreaking, right? But bear with me here. Ever wandered into a supermarket and suddenly every snack on the shelves is whispering sweet nothings to you? Okay, maybe not literally, but you get my drift.

Without a shopping list of essentials, your basket could quickly turn into a party for all your unnecessary cravings. And what’s the fun in making a budget if you’re just going to throw it out of the window at the first sight of a chocolate bar?

So, grab a pen and paper (or a stone tablet and chisel, if you’re feeling extra), and make that list. Or, if you’re too cool for the old-school methods, there’s an app for that too. HNGRY, for instance, helps you categorise your shopping list by what’s critical and what can wait until you’ve won the lottery.

3. Milk those student discounts

Student discounts are truly the sweet nectar of student life. With your shiny student visa status, you’re now part of an exclusive club where you can ask for discounts just about anywhere. So, don’t be shy, flash that student ID like it’s a VIP pass to the world of savings. Buying a meal? Show them the ID. Eyeing a new laptop? Whip out the ID. Need new software? Channel your inner detective and sleuth out that discount.

And let’s not forget the wonders of apps and websites like UniDays. It’s like a treasure trove of discounts on everything from tech gadgets to beauty products, trendy clothes, and more.

Plus, being a student in the UK, you get to ride the trains and buses for less with the magical ’18+ Student Oyster photocard’. It’s like having your own personal magic carpet, but cheaper.

And before you leave any store, don’t forget to grab those loyalty cards. Boots, Tesco, Co-op, they all have them. It’s like a game – the more points you collect, the more discounts you unlock. Who knew shopping could be so rewarding?

You might be interested in: 12 must have apps for newbies in United Kingdom

4. Snoop for second-hand items

Here’s a wild idea for cutting costs – have you ever thought about hitting up those online marketplaces or local thrift stores? Clever, right? These hidden gems are bursting at the seams with items that have been gently loved, and they’re practically giving them away. Plus, you’ll do your bit for the environment and support your community. It’s a win-win-win.

Need something? Before you whip out your wallet, why not ask if you can borrow it first? You’d be surprised what people have lying around that they’re not using.

Now, let’s talk textbooks. Those hefty, overpriced bricks that you use for one semester and then they become glorified dust collectors. Here’s a revolutionary concept – don’t buy them. Borrow them from the library or, even better, tap into your university’s e-library. Sure, it’s not as satisfying as slapping post-it notes all over the pages, but the money you’ll save is pretty satisfying too. If your university had a knack for timely updates, you’d be in the loop already. But just in case they missed it, consider this your much-needed info alert!

And when it comes to furnishing your place, why not try buying large items from the Facebook marketplace or Amazon, instead of sprinting straight to IKEA? Think of the pounds you’ll save! Just remember, while pre-loved items can be great, there are some things you should never buy used. Unless you fancy sharing your bed with bed bugs or termites, that is. So, buyers, beware!

5. Get council tax exemption

Along with the thrill of late-night study sessions and figuring out how to do your laundry, you also get to learn about fun things like taxes. Specifically, in the UK, they have a little thing called council tax. If you’re 18 or over, congratulations, it’s usually your responsibility.

A full Council Tax bill is based on the assumption that at least 2 adults are living in a home. And, in case you didn’t know, spouses and partners who live together are jointly responsible for paying the bill. It’s like a romantic bonding experience, only with less candlelight and more bureaucracy.

But here’s the kicker – if everyone in the household is a full-time student, you don’t have to pay Council Tax. That’s right, no tax! So, if you do get a bill, apply for an exemption faster than you would swipe right on a hot Tinder profile.

And here’s a little nugget of wisdom for you: Students can get a Council Tax exemption of up to 25% when sharing a property. So, when you’re renting, make sure to tick that box. And if the property is rented solely by students, there’s a whopping 100% council tax exemption. It’s like hitting the jackpot, only without the flashing lights and the oversized cheque.

6. Cook your own meals

Eating out is a surefire way to burn through your cash faster than you can say “Extra guac, please”. The savings you’ll make by cooking at home are astronomical. And, while we’re on the subject, let’s not forget food delivery services like Deliveroo – they’re a big no-no if you’re trying to save pennies.

Well, here’s a novel idea. Why not try impersonating your “mom” for a change and cook your own meals? Shocking, I know. But brace yourself – it turns out you can whip up a culinary masterpiece (or at least something edible) for a mere £2-4. Who would’ve thought?

Make your local Lidl your new best friend and buy only what you need.

Learn to love cheap, nutritious ingredients like lentils, dried beans, rice, noodles, and canned or frozen veggies. Pick up some basic spices, sauces, and chutneys, and you’ll be able to rustle up a delicious meal for next to nothing. And, if you’re really in a pinch, they have ready meals for around £2. They might be a bit pricier than cooking from scratch, but they’re still a lot cheaper than eating out.

And don’t worry, you don’t need a fancy air fryer or any other expensive gadgets. A good pot will do just fine, but keep an eye out in charity shops for great deals on appliances like slow cookers.

One last tip – make sure you have enough freezer space to batch cook. I get it, cooking for one is a pain, so why not make four portions at once? It’ll save you time and money. Now there’s a recipe for success.

7. Dumpster dive for groceries

Alright folks, buckle up because we’re going dumpster diving. Relax, we’re not literally rummaging through trash. We’re talking about perfectly good food and groceries here.

There’s an app called ‘Too Good To Go’ that’s a bit like Willy Wonka’s Factory. Instead of golden tickets, they deal in ‘Surprise Bags’ of surplus food. It’s a lottery where nobody loses, and the jackpot is a meal at a price so low it feels like daylight robbery.

Oh, and you know those ‘Best Before’ dates on food items? They’re more like guidelines than actual rules. Food doesn’t magically turn into a science experiment after that date. It just loses a bit of its nutritional value and maybe its youthful glow, but it’s still perfectly edible. And get this – it’s even cheaper! There are apps like Olio where people are basically throwing food at you for free. I mean, who needs money when you have generous strangers, right?

Still hungry for options? Try budget supermarkets like Lidl, One Below, Savers, and Poundland… They’re the thrift shops of the food world, only with less vintage clothing and more canned goods. Or try the supermarket version of happy hour. Swing by around 6 pm and you’ll find reduced items like meat, bread, etc. It’s like happy hour, but instead of half-priced cocktails, you get discounted groceries. Cheers to that!

8. Plan your travels

Here’s a secret: buses and unsociable hours are cheaper than a celebrity’s thrift store find. The catch? You can’t be in a hurry. But hey, who needs speed when you’re on a student budget?

Enter Citymapper, the magical tool that times your travel so well, that you’ll feel like you’ve got Hermione’s Time-Turner. With this nifty app, you can hop on and off multiple buses and trains for the cost of one journey, as long as it’s within an hour. It’s like a buffet but with public transport!

Now, if you’re planning to use National Rail for those city-hopping adventures, book your tickets online and in advance. It’s cheaper than buying on the day, which is like trading your soul for a student coupon. And speaking of discounts, don’t forget to carry the ’18+ Student Oyster photocard’. It’s your golden ticket to cheaper train and bus rides.

For your daily university commute, consider the Bus and Tram pass — it’s like having your own chauffeur, only way cheaper. If you’re feeling adventurous (or just really want to avoid Zone 1), you could always walk, scoot, or cycle. It’s eco-friendly, it’s cheap, and hey, who knows? You might even get fit in the process!

9. Take up a part time job

With a bit of extra dough in your pocket, you might even be able to afford the luxury of going out now and then.

So how about snagging a part-time job? Like a 12-hour gig at Nando’s or any food joint – you get to bring home the bacon (literally).

If playing waiter/waitress isn’t your style, try custome service, retail or even tutoring. There are apps like Indeed Flex, Hap, and Stint where you can find shift work. Want to slash your grocery bills? Land a part-time job at a supermarket. You’ll be stacking shelves one minute and stacking discounts the next! You’re welcome.

10. Surviving the cold without breaking the bank

So, you’re from the tropics and you’ve landed yourself in the UK? Well, aren’t you a lucky duck? And by ‘lucky’, I mean ‘perpetually chilly’. But hey, don’t worry about those pesky heating bills. There are ways to keep warm that don’t involve selling a kidney.

Ever thought about studying at the library? It’s warm, it’s quiet, and there’s a distinct lack of distracting shiny objects like TVs and PlayStations. Plus, you’ll save on heating and might actually get some work done. Win-win!

But maybe you’re more of a homebody. In that case, invest in an electric blanket. It’s like a warm hug that doesn’t let go… and doesn’t give you weird looks when you refuse to let go. Best part? It’s 1/10th the cost of heating your room.

And for the love of all things holy, stop buying coffee out. It’s like burning money and then drinking it. Invest in a cheap espresso maker instead. It’ll pay for itself in no time, and you’ll feel like a fancy barista every morning. Now, isn’t that a steaming cup of awesome?

11. Open a UK bank account

Student bank accounts are like the VIP lounges of the banking world. They’re designed with all the quirks and imperfections of university life in mind. Some banks even have a special account just for international students!

These accounts don’t include an overdraft though, which is essentially a free pass to borrow money (within limits, of course). But hey, who needs more debt, right?

If a student account doesn’t tickle your fancy, there are other fish in the sea. You could go for a current account or a basic bank account. Just make sure to compare things like in-credit interest (aka free money), account fees, cash card and/or debit card options, and whether you can set up direct debits or standing orders.

Also, check if they offer online or app banking – it’s like having a personal accountant in your pocket, minus the judgemental looks when you splurge on that third coffee for the day.

Now, before you rush off to open your account, remember you’ll need some paperwork. This usually includes your ID, address documents, and your course confirmation letter. So get your ducks in a row before you head to the bank!

Before you go…

Alright folks, prepare yourselves for a hard truth: that paycheck from your part-time gig at any Burger Joint doesn’t cover all your student needs. Tragic, I know. And so, like a broke superhero with no powers, you’ll have to rely on the ‘Bank of Mom and Dad’ for a while.

But here’s the kicker: transferring money from one bank to another can be about as enjoyable as a root canal. Thanks to bank fees and exchange rates, you’ll end up with less money than you started with. It’s like throwing a party and finding out someone ate all the pizza before you got a slice.

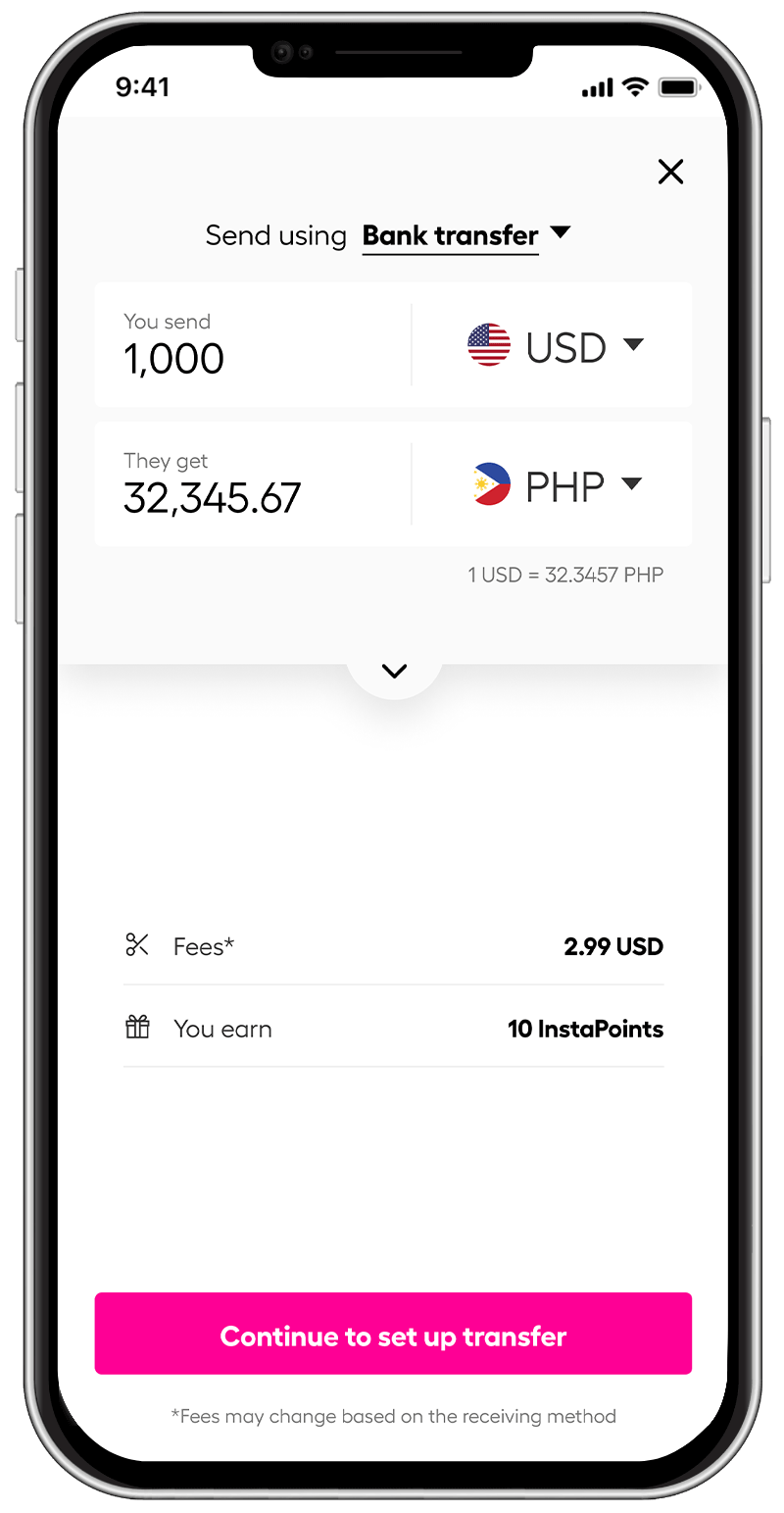

Enter Instarem. With no hidden fees, competitive exchange rates, and a user interface so simple, even your grandma could breeze through it.

*rates are for display purposes only.

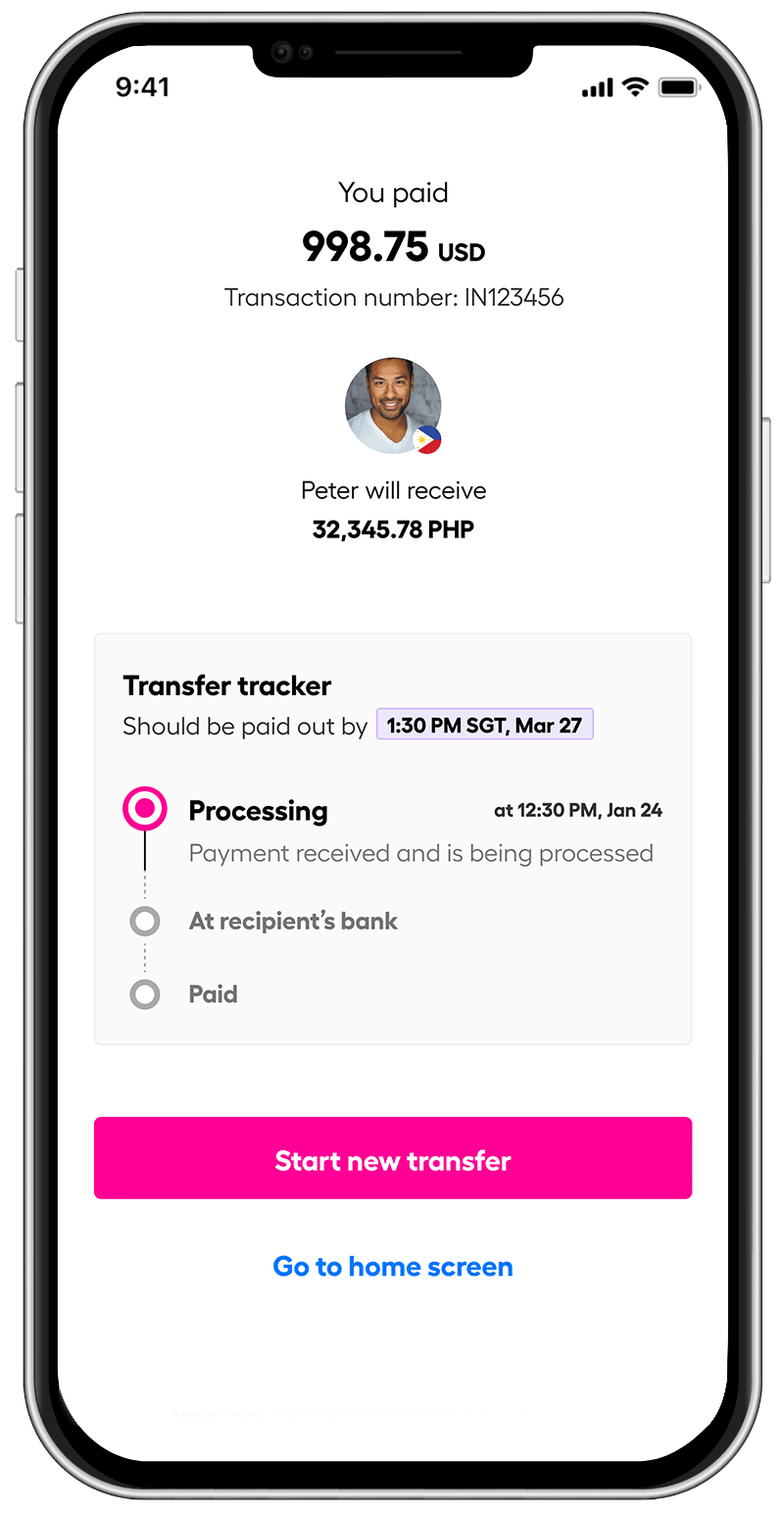

And if you’re the type to stay up at night worrying about where your money is off gallivanting, fear not! Instarem features a nifty transaction timeline.

Think of it as a GPS but for your cash. So now you can rest easy knowing your money isn’t out there having a better time without you.

Send money overseas with Instarem now. Simply download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.