10 offbeat things people do to save money

This article covers:

- Exploring the value of store brands vs. premium picks

- Ditching loyalty for savings

- Avoid hitting the stores on an empty stomach

- Make your own food

- Make your credit card work for you

- Dental care is an investment, not an expense

- Hit that unsubscribe button

- Learn how to fix your own stuff

- Water is life elixir

- Check out all the freebies out there

- Before you go…

Hey, ever notice how everything’s getting pricier, but your pay check is stuck in the slow lane? So, what’s your move? Probably beefing up those savings, right?

But here’s the scoop – stashing your cash in the bank might not cut it. In this blog, we’re spilling the beans on kicking your thriftiness up a notch. We’ve scoured various Reddit groups to hook you up with some seriously offbeat money-saving hacks.

Exploring the value of store brands vs. premium picks

Alright, here’s the deal – most of the time, those store brands are holding their own against the big names. Take something as simple as toilet paper, for instance. Do you really need the Rolls Royce of TP, or could a more budget-friendly house brand do the job just as well?

Sure, the type of item might sway your decision a bit, but why not take a chance and give those house brands a go? Compare them in your head – you might just be pleasantly surprised!

Ditching loyalty for savings

Gone are the days of loyalty perks – no more discounts or upgrades for sticking around. It’s time to keep your options open when it comes to things like home insurance, auto insurance, mobile plans, internet deals, and more.

Switching might mean dealing with a bit of paperwork, but that small hassle could end up saving you a bundle in the grand scheme of things.

Avoid hitting the stores on an empty stomach

Trust us, it’s not just an old wives’ tale. Researchers dug into this and found that folks who hadn’t eaten for hours ended up loading their carts with more high-calorie goodies in a pretend supermarket experiment compared to those who had a snack before diving into online food shopping.

Ever wonder why supermarkets flaunt their bakeries and food sections right at the entrance? It’s a sly tactic – you start drooling, and before you know it, you’ve shopped your hunger away.

Now, some folks swear by rules to outsmart the urge. You might’ve heard about the 48-hour waiting game. The idea is, after two days, you’ve had time to chill out and figure out if what you want to buy is a legit need or just a spur-of-the-moment want.

But let’s be real – shopping on an empty stomach turns you into a stomach-driven decision-maker. Hunger has a way of making us a bit irrational, don’t you think?

Make your own food

Okay, you’ve probably heard this a gazillion times, but seriously, whip up your own grub. We get it – hitting up the convenience store for ready-made eats and drinks is easy peasy, but guess what? That convenience comes with a price tag, and it’s often a premium one.

Some folks even swear by the “three-ingredient rule.” If it takes more than three items to make, they say, why not DIY it? Yep, that goes for your fancy café avocado toast or your go-to Starbucks iced coffee.

Now, don’t get us wrong, we are not saying you should turn into a hermit and only eat at home. Life’s too short for that! Explore, have fun, but just keep an eye on those expenses. Give yourself a bit of wiggle room so you can strike a balance between enjoying life and actually saving some cash at the same time.

Make your credit card work for you

Everyone’s heard the horror stories of credit card debts spiralling out of control, and the importance of paying those bills on time is like credit card gospel.

But here’s the twist – your credit card is more than just a bill collector. Nowadays, they’re handing out goodies like cashback, rewards, or even air miles when you flash that plastic. It’s like getting a bonus for your everyday spending – free money, my friend!

And that’s not all – using a credit card can be your secret weapon for keeping tabs on where your money’s going. It’s like having a personal spending tracker in your pocket. And hey, if your credit card isn’t showering you with rewards, maybe it’s time to make a switch.

Dental care is an investment, not an expense

Alright, let’s talk about those pearly whites. The dentist’s chair might give you a twinge of anxiety. It’s not just about enduring the physical discomfort; it’s also about waving a tearful goodbye to your hard-earned cash.

Sure, dental care can feel like a bit of a dent in the budget, but here’s the real deal – skipping those routine check-ups isn’t a money-saving strategy. Investing in preventive care today could save you a boatload later if you end up needing major dental work. Trust me, it’s a game-changer!

And because a dazzling smile plays a big role in your quality of life, make a habit of brushing and flossing daily. Don’t forget those regular dentist visits every six months – it’s not just about saving your teeth; it’s about preserving your overall well-being. Cheers to keeping that smile shining bright!

Hit that unsubscribe button

Ever find yourself drowning in a sea of tempting online deals and discounts? We get it – those inbox goodies can be hard to resist. But here’s a little money-saving secret: hitting that unsubscribe button can be a game-changer.

Picture this: you make a purchase online, all good so far. However, the aftermath involves a flood of junk emails bombarding your inbox with too-good-to-miss offers and discounts. Sure, they might seem enticing, but think about it – every message insisting it’s a fantastic deal is probably just trying to lighten your wallet.

Sure, some deals might be legit, but when every email is singing the same tune, it’s time to question the song. Spending doesn’t equal saving, and we all know resisting those tempting coupons and discount percentages is easier said than done.

So, if you’re on a mission to keep those hard-earned dollars where they belong, consider unsubscribing from those tricky emails and newsletters. And if they’re persistent, don’t hesitate to mark them as spam – your wallet will thank you later!

Learn how to fix your own stuff

Back in the day, folks would suggest Googling solutions to problems, but now it’s all about finding a step-by-step guide on YouTube.

Thanks to the wonders of the internet, especially YouTube, tackling maintenance and repairs is totally doable for most people. And guess what? Yard sales are a goldmine for snagging basic starter tools – you can always upgrade as you figure out what you need most. A lot of things may seem tough to fix, but trust us, it’s often way easier than it looks.

All you need are some basic tools like a good pair of pliers, diagonal cutters, and both Phillips and flathead screwdrivers – they’ll cover a whopping 80% of simple home repairs.

Water is life elixir

It might sound a bit goofy, but plenty of online hacks swear by it. Ever considered how a $5 coffee or a restaurant drink can add up? Even when you’re just feeling a bit parched, you might find yourself forking out for an overpriced bottle of water at the convenience store. But hey, here’s a simple solution: Carry a reusable water bottle everywhere you go. Fill it up at water cooler stations or bring a bottle from home.

Sure, it depends on factors like water hygiene, but if that’s not a major concern for you, stick to the trusty old water bottle. Your wallet and your body will both thank you for it. Stay hydrated and save some cash!

Check out all the freebies out there

It might sound a bit odd, but there’s a ton of free entertainment waiting for you.

Take your local library, for instance! These days, many libraries have phone apps that let you borrow ebooks, comics, audiobooks, and even some TV shows and movies. But wait, there’s more – some libraries offer tool rentals, free museum passes, seed banks, affordable 3D printing, and super cheap regular printing.

Why shell out for a printer and cartridges when you can just swing by the library and pay a few cents for a page? Save your money for the good stuff!

Before you go…

Alright, let’s take a breather from the whole cost-of-living stress and shift gears to something that can actually bring you value in today’s global economy – sending money overseas.

Just like there are hacks to save you some bucks, there are also tricks to cut costs when sending money across borders.

We’ve all felt the headache of sending money abroad, right? The extra fees and sneaky charges always seem to pop up when you least expect them.

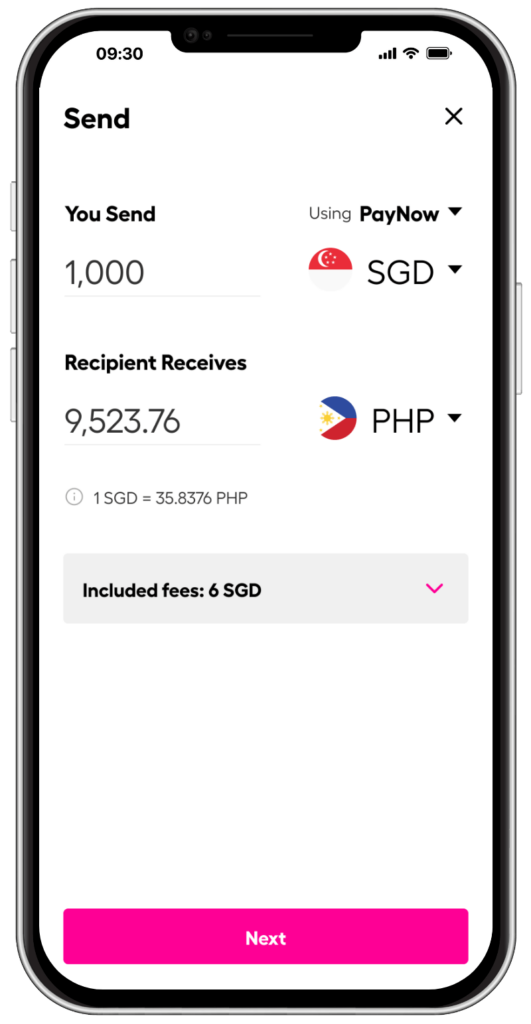

But here’s the good news – enter Instarem. With Instarem, you can now send money to over 60 countries at awesome rates and with transparent fees that won’t leave your wallet crying. No more unpleasant surprises, just a more secure and hassle-free way to send money overseas. Say goodbye to the money-sending blues!

*rates are for display purposes only.

Download the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.