5 overseas cash flow management strategies

This article covers:

Managing an international business may have its glamour, but let’s be real, it’s tough work. Coordinating across different time zones, managing different cultural nuances, and keeping tabs on large-scale operations can make your head spin.

But if there’s one thing that’ll give you sleepless nights, it’s managing cash flow. Currency fluctuations, fickle profit margins, and confusing finance regulations can throw even the most experienced business owners for a loop.

Don’t worry, though, we’ve got your back. We’ve done our research and compiled the top five strategies to keep your cash flow in check and your creditworthiness intact. After all, it’s all about strategizing it right, right?

What is cashflow?

Cash flow may not be the most exciting term in the world, but it’s essential to keeping your business alive and kicking.

Cash flow is the financial equivalent of a heartbeat for your business. Just like a doctor monitors the cardiovascular function of a human, a business owner must keep a watchful eye on cash flow.

Inflows, outflows, sources, and usage may sound like complicated jargon, but they’re all just fancy ways of saying you need money to keep the lights on.

A cash flow statement might not make it to your bedside table reading material, but it’s a crucial financial report that tells you where your money is coming from and where it’s going. The next time you hear someone say they’re ‘in the red’ or ‘in the black,’ they’re referencing a company’s cash flow. Analyzing cash flow can be done in several ways, but it boils down to figuring out if there is enough money to keep the business solvent.

What is cash flow management?

Managing your business finances is like playing a game of chess. You need to monitor, analyze, and optimize every move to make sure you come out on top. That’s where cash flow management comes in.

Why is cash flow management important?

So why is managing cash flow so important?

Cash flow management is like your knight in shining armour, riding in to save the day. By keeping tabs on your finances, you can predict how much money will be available to cover debts, payroll, and those pesky vendor invoices. Plus, effective cash management strategies will help your business grow faster than a beanstalk.

All in all, cash flow management is the key to living happily ever after in the business world.

5 overseas cash flow management strategies

As if managing cash flow wasn’t already a daunting task, now imagine doing it for overseas businesses. But fear not, there are strategies that can make this mountainous task seem like child’s play. Here are five strategies on how to manage cash flow in business.

1. Hold a foreign currency account for your business

Hey, business owners! Are you tired of losing money every time you exchange currency for your overseas transactions? Say no more!

A foreign currency account is here to save the day. Not only does it keep your cash ready for sudden payments, but it also eliminates currency exchange risks. Let’s take a look at a real-life example. An overseas supplier has just sent you an invoice that needs to be cleared immediately. With your foreign currency account, you can make the payment quickly, without having to worry about finding a currency exchange shop.

Don’t waste your time and money on unnecessary fees. Get a foreign currency account and be the boss of your international transactions. Both onshore and offshore banks offer this valuable service, so why not give it a shot?

2. Use cashflow management software or budgeting tools

Running an international business is no easy feat. With countless invoices in various currencies, keeping track of your cash flow can feel like an endless game of whack-a-mole. Thankfully, technological innovations such as cash flow management software have come to our rescue!

With cashflow management software like QuickBooks, Scoro, Centage, Profix, Planguru, and more, calculating total currency exposure has never been easier.

Say goodbye to manually crunching numbers and hello to automated efficiency! These tools not only save you time and labour but offer high security and regularly update their features to keep you ahead of the game.

Having a clear understanding of your inflow and outflow in your home currency puts you in the driver’s seat to make well-informed decisions and keep your business afloat.

3. Avoid redundancy, omission & errors

Double counting can be great when you’re playing blackjack, but not so much when it comes to managing cash flow.

To avoid this financial faux pas, it’s important to keep a keen eye on receipts from trade receivables, refunds, and the sale of inventory. But it’s not just redundancies that can throw a wrench in your cash flow management.

Common errors like forgetting to track inflows and outflows of cash, mistaking net profits for cash flow, neglecting to reconcile your books, and skimping on tax form analysis can wreak havoc on your finances. So, whether you’re trying to beat the house or just keep your financials in check, remember to avoid the double count and, instead, keep things balanced.

4. Leverage the currency option

Ah, forward contracts- the hero that saves you from the wrath of currency rate fluctuations. These contracts work their magic by ensuring that you can buy a specified amount of currency at a fixed exchange rate. But wait, there’s more!

Enter currency options- the slimmer, more flexible sibling of the forward contract. Unlike the rigidness of forward contracts, currency options give you the liberty to hold back on exercising them if the exchange rate isn’t in your favour.

It’s like having a ‘Plan A’ and a ‘Plan B’ for your currency exchange needs! These options come in handy when the demand is uncertain, or the purchasing parameters are unknown. So, if you’re feeling unsure about the future of currency rates, consider the charm of currency options.

5. Maintain healthy relationships with international vendors and customers

A wise person (and probably a successful business owner) once said, “Healthy relationships make the world go round.” And when it comes to keeping healthy relationships with international vendors and customers, it can also make your cash flow go around too.

Take for instance Authentic Wine Explorers, who source rare and highly sought-after wines from around the world. To secure these scarce wines, they must pay for them promptly, as wineries get to choose who they sell to. Founder William knows that keeping good relationships with suppliers is key to keeping their business running smoothly and avoiding grumpy phone calls about unpaid bills.

I mean, who wants to deal with that? So, if you’re looking to avoid a cash flow headache, just remember, a little kindness to your international business partners can go a long way.

Before you go…

As small business owners, the last thing we need is yet another headache. And we all know that foreign currencies can create a real throbbing pain in our cashflow.

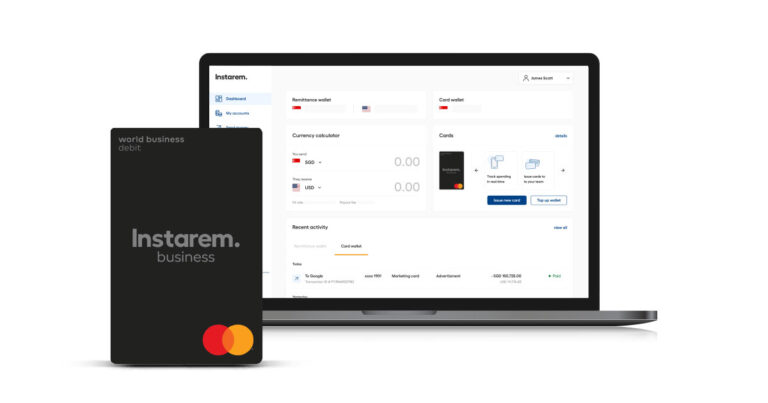

Enter Instarem.

With Instarem, we can make overseas money transfers as easy and cost-efficient as popping an aspirin.

Plus, our payment solutions are like a cold compress for those times when we just need to quickly access mobile transactions or set up single-recipient payments in a flash. And don’t even get me started on the joys of QuickBooks® integration for global transactions – no more manual data entry books! So, join us in saying goodbye to those awful missed payments and hello to the potential that Instarem business can unlock.

**Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.