This article covers:

A Trade War is a tit-for-tat situation wherein two or more countries impose trade restrictions on one another. There are many weapons used in this war – tariffs, regulations, currency manipulations, import quotas, government subsidies and also intellectual property rights (IPR) violations. History has it that in Trade Wars, often, all sides lose, as participating countries suffer lower economic activity, unemployment, and inflation. In today’s globalized era, even non-participating countries suffer a collateral damage.

InstaReM, as a facilitator of global trade by way of efficient cross-border money transfers, is concerned about the global developments during the past few months, the impending trade wars to be specific. To make sense of the situation, we dived into the history and uncovered a few illuminating examples of Trade Wars, each of which have led to disastrous results!

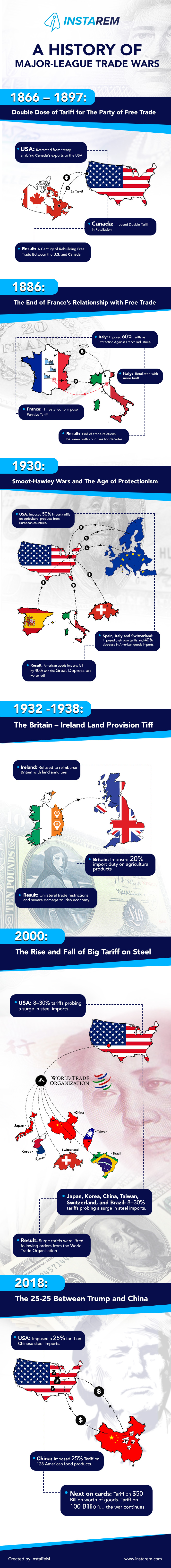

1866 – 1897: Double Dose of Tariff for The Party of Free Trade

The U.S. retracted from Canadian–American Reciprocity Treaty, which enabled a large increase in Canada’s exports to the United States and a rapid growth in the Canadian economy. Thereafter, Canadian economic nationalists decided to pay their southern neighbor back through a tariff retaliation. By 1879, some American giants like, Singer Manufacturing, American Tobacco, Westinghouse and International Harvester had moved their production to Canada to avoid paying high import taxes. And by the late 1880s, 65 U.S. manufacturing plants had relocated to Canada – this time driven by protectionism. In 1897, when the Republicans passed the protectionist Dingley Tariff Act, which further raised the tariffs, Canada decided to respond with a double dose of tariff retaliation. It, thereafter, took nearly a century for free trade between the U.S. and Canada to develop.

1886: The End of France’s Relationship with Free Trade

Soon after its unification, Italy turned to protectionism to enable the growth of domestic industries. Italy raised tariffs to as high as 60% in order to protect its industries from French competition. The French government, on the other hand, threatened to impose punitive tariffs, if Italy did not lower its own. To that, France retaliated by passing the Méline Tariff Act of 1892, which is said to have ended the country’s relationship with free trade with Italy. Both nations felt the weight of the trade war and Franco-Italian trade fell drastically, followed by dislocations in the countries from where they got their supplies. Unintentionally, this resulted in Italy’s trade alliances with Germany and Austria-Hungary in the years leading up to the First World War.

1930: Smoot-Hawley wars and the age of protectionism

Enacted in June 1930, The Smoot-Hawley Tariff Act raised import duties by as much as 50%. This was an act of protectionism against agricultural imports since American farmers struggled with increased competition against European farmers and declining prices from over-production after WWI. In retaliation, European countries such as Spain, Italy, and Switzerland imposed their own tariffs resulting in a 40% decrease in American goods imports. The act, instead of reviving the economy, aggravated the Great Depression! All of these developments continued to escalate through the 1930s, turning a trade war into a real war, i.e. World War II.

1932 to 1938: The Britain – Ireland Land Provision Tiff

The Anglo-Irish Treaty of 1921 enabled Irish tenant farmers to purchase lands under the Irish Land Acts in the late-nineteenth century. This required the Irish government to reimburse Britain with land annuities from financial loans granted to the farmers. In 1931 the Irish government refused to continue with the reimbursements. To recover the annuities, Britain retaliated with the imposition of 20% import duty on Free State agricultural products into the UK. Going forward it resulted in the imposition of unilateral trade restrictions by both countries causing severe damage to the Irish economy.

2002: The Rise and Fall of Big Tariff on Steel

U.S. President George W. Bush placed tariffs on imported steel, which took effect from March 2002. They were imposed to give U.S. steelmakers protection from a probed detrimental surge in steel imports. Thereafter, more than 30 steel manufacturer declared bankruptcy. To harvest the situation, the European Union announced retaliatory tariffs on the United States. A case was filed at the Dispute Settlement Body of the World Trade Organization (WTO) by Japan, Korea, China, Taiwan, Switzerland, and Brazil to decide whether or not the steel tariffs were fair. In November 2003, the WTO ruled against the U.S. steel tariffs, stating that they had not been imposed during a period of import surge—steel imports had actually dropped during 2001 and 2002—and that the tariffs, therefore, were a violation of America’s WTO tariff-rate commitments. The tariffs were thus lifted in December 2003.

2018: The 25-25 Between Trump and China

President Trump’s administration will impose a 25% tariff on steel imports and a 10% tariff on aluminum imports. This is a big deal, considering the United States is the world’s biggest steel importer. It’s not yet clear if the President intends to exempt allies like Canada and the European Union. China in retaliation has slapped tariffs as high as 25% on 128 American food products – the same rate that Trump has imposed on Chinese steel imports. However, China’s tariffs are relatively modest since they only target some $3 bn of goods per annum and avoid particularly large imports such as soybeans – of which China imported $14 bn worth from the US last year.

Update: Trump takes on Canada and Mexico

Mexico, much like the rest of the world, retaliated to the USA announcing tariffs on steel and aluminum imports by imposing a series of tariffs against US exports to its market valued at $3 billion. They plan to hike the price of products including pork, apples, potatoes, bourbon and different types of cheese. Ranging between 15% and 25%, the tariffs could raise the price of US goods by that amount, cutting deeply into US exports to its neighbor.

Canada, on the other hand, retaliated against the same by proposing 10% duties on maple sugar and syrup, a powerful industry in the French-speaking province of Quebec that could hurt producers in Maine. Canada also proposed tariffs on goods ranging from goods like ballpoint pens, mattresses, and toilet papers.

Sources: www.marketwatch.com, www.economist.com, www.tomorrowsworld.org/magazines,

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.