7 best alternatives to Wise for money transfers in 2025

This article covers:

- Overview: Which Wise alternative to choose?

- List of 37 countries where users can set up an Instarem account:

- How does it differ from Wise?

- Instarem pros and cons

- List of 8 countries where users can set up an OFX account:

- How does it differ from Wise?

- OFX pros and cons

- List of 9 countries where users can set up an Revolut account:

- How does it differ from Wise?

- Revolut pros and cons

- List of 30 countries where users can set up an Remitly account:

- How does it differ from Wise?

- Remitly pros and cons

- List of 40 countries where users can access Western Union Online Transfers:

- How does it differ from Wise?

- Western Union Pros And Cons

- From which countries can users Can Set Up A PayPal Account?

- How does it differ from Wise?

- PayPal Pros And Cons

- From which countries can users can set up a MoneyGram account?

- How does it differ from Wise?

- MoneyGram Pros And Cons

- Comparison between each Wise alternative

- About Wise

- Not sure which one to use for transferring money? Check out best alternatives to wise based on the destination country you’re sending money to

- Time to decide on a Wise alternative that provides fast and low-cost overseas transfers!

- Frequently Asked Questions

For those who frequently do international transactions, Wise is one of the popular payment solutions. It offers innovative features that allow its users to send and receive money globally to and from 160+ countries in 40+ currencies.

However, it’s not the only available solution. Many other remittance services are worthy of being considered as Wise alternatives.

Let’s discover the top 7 alternatives you can also use to send money globally in this article.

Overview: Which Wise alternative to choose?

There are multiple options of Wise alternatives you can choose from. They include:

- Instarem

- OFX

- Revolut

- Remitly

- Western Union

- PayPal

- MoneyGram

Ensure that you select one that suits your money transfer needs. Find out more about each of Wise alternatives in the following:

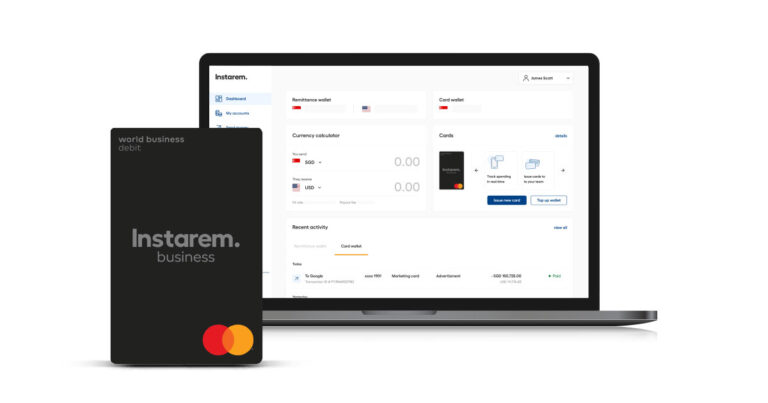

Instarem: Best in fast and cost-effective transfers

Instarem is an international payment solution that counts as a Wise alternative. It provides faster and cheaper overseas transfers than most banks. Instarem covers 60+ countries in 10 currencies and gives rewards in the form of InstaPoints for every completed transaction.

Everyone can now send money overseas more affordably using Instarem. Individuals can opt for Instarem Personal, while Instarem Business helps SMEs and corporations of any size to make and receive business payments seamlessly.

In addition to offering fast and cost-effective transfers, Instarem provides users with amaze card. It makes a convenient option for travelling as users can avoid extra fees for overseas transactions.

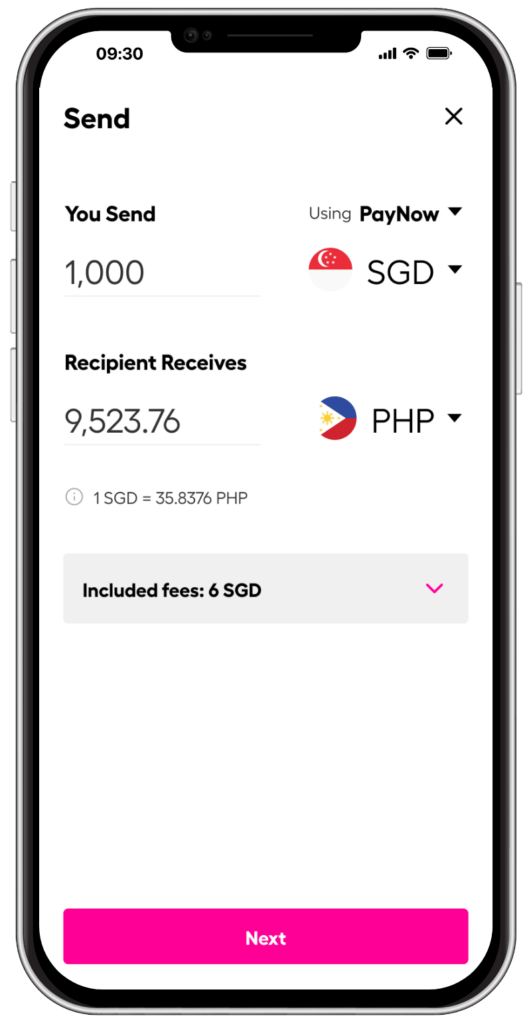

Lastly, as an international payment solution with transparent fees, Instarem also has users covered with currency converter, allowing them to observe transfer fees and exchange rates from the initial to the destination currency. In turn, users can estimate how much money the recipient will receive after conversion and transfer fee deduction.

*rates are for display purposes only.

Download the app or sign up here.

List of 37 countries where users can set up an Instarem account:

- Australia

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hong Kong

- Hungary

- Iceland

- India

- Ireland

- Italy

- Japan

- Latvia

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- United States of America

How does it differ from Wise?

As a fast and cost-effective international payment solution, Instarem distinguish itself from Wise by rewarding users with InstaPoints after every completed transaction.

So, whenever users transfer money or spend money abroad using their amaze card, they will be automatically rewarded with InstaPoints that they can redeem on money transfer discounts and amaze card cashback.

Instarem pros and cons

Pros:

- Faster and cheaper than most banks

- Global coverage with transfers to 60+ countries

- InstaPoints reward system

- Scheduled transfers (available in Singapore)

- Amaze card/multicurrency wallet (available in Singapore)

- Convenient funding methods (bank transfers, debit and credit cards, PayNow)

Cons:

- Limited countries and currencies coverage

- Restricted availability for users from certain countries to set up an Instarem account

- The cash pickup option is only available in the Philippines

OFX: Best in personalised support

OFX is a global payment solution you can choose when you need 24/7 personalised support from brokers to send money overseas, especially in large amounts. OFX also supports money transfers to 170 countries in more than 50 currencies.

List of 8 countries where users can set up an OFX account:

- Singapore

- Australia

- Hong Kong

- Canada

- Europe

- New Zealand

- United Kingdom

- United States

How does it differ from Wise?

OFX provides dedicated and personalised support from brokers, making it an ideal Wise alternative for those needing assistance with large international transfers.

OFX pros and cons

Pros:

- 24/7 personalised support

- Global coverage with transfers to 190 countries in 55 currencies

- Capabilities for handling large amounts

Cons:

- US$1,000 transfer minimum

- Exchange rate markups

- Only support bank-to-bank transfers

Revolut: Best in affordable money transfers

Revolut is a remittance service that provides bank transfers to 100+ countries in 50+ currencies. Choose it as your Wise alternative if you’re looking for affordable money transfers, as Revolut offers fee-free overseas transfers up to £1,000 and between Revolut customers.

List of 9 countries where users can set up an Revolut account:

- European Economic Area (EEA)

- Australia

- New Zealand

- Singapore

- Japan

- Brazil

- Switzerland

- United Kingdom

- United States of America

How does it differ from Wise?

Revolut stands out from Wise by providing fee-free overseas transfers up to a certain limit and catering to those seeking cost-effective international money transfers.

Revolut pros and cons

Pros:

- Low-cost overseas bank transfers

- Fee-free transfers up to £1,000

- Availability in 100+ countries and 50+ currencies

Cons:

- Higher fees for larger transactions

- Less competitive exchange rates

- Limited customer service support

Remitly: Best in flexible delivery options

Remitly is an international payment solution you can trust for sending money to 170+ countries in 100+ currencies. It’s a Wise alternative that provides a range of delivery options, including cash pickups, bank deposits, mobile money, and more.

List of 30 countries where users can set up an Remitly account:

- Australia

- Austria

- Belgium

- Canada

- Cyprus

- Czech Republic

- Denmark

- Finland

- France

- Germany

- Greece

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Malta

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Spain

- Sweden

- United Arab Emirates

- United Kingdom

- United States of America

How does it differ from Wise?

Remitly distinguishes itself from Wise by providing a variety of delivery options, such as cash pickups, bank deposits, mobile money, and more. In turn, users can select the method that best suits their preferences for how the transfers will be received by the recipients.

Remitly pros and cons

Pros:

- Wide coverage with transfers to 170+ countries

- Flexible delivery options, including cash pickups, bank deposits, and mobile money

- Competitive exchange rates

Cons:

- High transfer fees to some countries

- No money transfer calculation tool

- Restricted availability for users in certain countries to send money

- US$2,999 daily transfer limit

Western Union: Best in diverse payout methods

Western Union is an international money transfer service that allows you to send money to 200 countries worldwide and 130 currencies with multiple payout methods, including cash pickups, direct-to-bank, and mobile wallets. Choose this as your Wise alternative if you send money to less-used currencies without worrying about higher fees.

List of 40 countries where users can access Western Union Online Transfers:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Ukraine

- United Kingdom

- Canada

- United States

- Australia

- New Zealand

- Hong Kong

- United Arab Emirates

How does it differ from Wise?

Western Union offers a wide range of payout methods, including cash pickups, direct-to-bank, and mobile wallets. It also covers more currencies, benefiting those who are dealing with less commonly used currencies.

Western Union Pros And Cons

Pros:

- Diverse payout methods, including cash pickups, direct-to-bank, and mobile wallets

- Global coverage with transfers to 200 countries

- Flexibility with less-used currencies

Cons:

- Expensive transfer fees

- Less competitive exchange rates

- Lack of fee transparency

PayPal: Best in fast transfers

PayPal is a digital money transfer service that supports 200+ countries in 25 currencies. It’s an ideal Wise alternative if you send money to a regular PayPal user and prioritise fast transfers over low-cost fees.

From which countries can users Can Set Up A PayPal Account?

Basically, everyone from any country worldwide where PayPal is available can set up an account. However, PayPal is restricted in the following countries:

- Afghanistan

- Cuba

- Haiti

- Central African Republic

- Iran

- Iraq

- Libya

- North Korea

- Syria

- Liberia

How does it differ from Wise?

PayPal emphasises fast transfers, making it a suitable alternative for users who prioritise speed over low-cost fees and often transfer funds to other PayPal users.

PayPal Pros And Cons

Pros:

- Fast transfers

- Global coverage with transfers to 200+ countries

- Convenient for transfers to regular PayPal users

Cons:

- Expensive and confusing transfer fees

- Less competitive exchange rate

- A popular platform for scams and phishing

MoneyGram

MoneyGram is a global transfer platform that provides low-cost money transfers to 200+ countries and territories. Choose this as a Wise alternative if you wish the recipient to receive the money through cash pickups, direct-to-bank, or mobile wallets.

From which countries can users can set up a MoneyGram account?

MoneyGram allows users from the following countries to set up an account and make in-app money transfers:

- Australia

- Austria

- Belgium

- Brazil

- Bulgaria

- Canada

- Chile

- Croatia

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- United Kingdom

- Greece

- Hong Kong

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Lithuania

- Malta

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Spain

- Sweden

- Switzerland

- United States

How does it differ from Wise?

MoneyGram offers a range of delivery options, including cash pickups, making it an ideal choice for users who prefer varied options for their recipients.

MoneyGram Pros And Cons

Pros:

- Low-cost money transfers

- Global coverage with transfers to 200+ countries

- Varied delivery options, including cash pickups

Cons:

- Exchange rate markups

- Varying fees based on the destination, payout method, and transfer value

- Limited customer support

Comparison between each Wise alternative

Following an understanding of Wise’s pros and cons, as well as its notable features, the million-dollar question is: is there any Wise alternative that provides more or less the same services?

Let’s take a look at the comparison between each of the pre-mentioned Wise alternatives in the following:

Provider | Fees | Transfer Time | Card Availability | Payout Options |

Wise | From 0.4% of transfer value using bank transfers and Wise balance. | A few hours, up to a day. In rare cases, transfers can take 2 days. | Digital and physical cards. | Direct-to-bank and between Wise accounts*. *Only for supported currencies. |

OFX | No transfer fees, but exchange rate markups apply. | 1 – 2 business days. | None | Direct-to-bank. |

Revolut | 1.99% to other Revolut users, 2.49% of the value + US$0.60, subject to a minimum fee of US$1.30 for bank transfers, 2.49% of the value +US$0.60 for card transfers. | A few hours up to a day. In some cases, transfers can take 3 business days. | Digital and physical cards. | Direct-to-bank and between Revolut accounts. |

Remitly | US$1.99 for economy transfers and US$3.99 for express transfers | 3 – 5 business days for economy transfers, up to 4 hours for express transfers. | None | Direct-to-bank, debit card deposits, mobile wallets, and cash pickups. |

Instarem | 0.25% to 1% of the transfer value. | A few minutes to 1-2 days, depending on the destination country and currency. | Digital and physical card. | Direct-to-bank and cash pickups (only in the Philippines). |

Western Union | US$20-30 for domestic transfers and US$35-50 for international transfers. | Within minutes for cash pickups and mobile wallets, 3-5 business days for direct-to-bank transfers. | None | Direct-to-bank, cash pickups, and mobile wallets. |

PayPal | 3.49% of the transfer value + US$0.49 fixed fee. | 30 minutes – 24 hours for transfers between PayPal accounts and 3 – 5 business days for direct-to-bank transfers. | Debit and credit card. | Direct-to-bank and between PayPal accounts. |

MoneyGram | Varies depending on the transfer amount, payment type, delivery method, and pickup location. | Within minutes for cash collections and up to 1 day for direct-to-bank and card transfers. | Prepaid physical card. | Direct-to-bank, cash pickups, and debit card deposits. |

About Wise

Wise (formerly TransferWise) was founded in January 2011 in London, United Kingdom. It has made low-cost and borderless money transfers possible. Individuals and corporations no longer need to engage in expensive and complicated bank wire transfers when using Wise.

The prices offered by Wise are not only affordable by looking at the transfer fees alone. Wise performs conversions using mid-market exchange rates, making international transfers to a range of foreign currencies even cheaper.

Wise now supports international money transfers to 160+ countries and 40+ currencies. It also offers Wise cards, available to use in 160+ countries, making it the ideal combination for low-cost international transfers and the convenience of spending in foreign countries.

Wise main services

As a popular payment solution, Wise offers innovative and helpful finance services catering to individuals, SMEs, and larger corporations. Take a look at the services in the following:

Wise transfers

Wise transfers are the main feature offered. You can send money globally to 70+ countries in different 48+ currencies with more affordable fees compared to wire transfers and mid-market exchange rates.

Additionally, Wise also offers multiple payment options. Get the convenience of low-cost fees when you use your account balance. Otherwise, you can also use a debit or credit card with adjusting fees according to the destination country and currency.

Multicurrency account

Multicurrency account is a feature where you can hold 22+ currencies in your Wise account. You need to first top up your account through a debit or credit card in your local currency for Wise to convert to the intended currencies using mid-market exchange rates.

Later, you can use the feature to send money abroad or spend like a local by using Wise cards. In turn, this eliminates the hassles of conversions every time you need to use the currencies to transfer or spend in the destination countries.

Account details

Receiving money from abroad is possible by filling out your account details and sharing them with individuals or businesses who want to pay you. This feature is currently available in 12 currencies: AUD, CAD, EUR, GBP, NZD, MYR, PLN, SGD, USD, RON, HUF, and TRY.

However, when you use this feature to receive money, you’ll only get payments in the currency corresponding to your account details. Ensure you choose the correct currency and account details to share with the payer.

Scheduled transfers

Scheduled transfers make it simple to send money at a later date of your choice. This eliminates delays in sending money to your recipient while also maintaining trust between both parties.

Here’s how to use this feature:

- Simply click on scheduled transfers on the web or mobile interface

- Confirm the payment method (your balance or external accounts)

- Enter the amount of money

- Choose the date you’d like to transfer by clicking the calendar icon

- Choose the frequency (one-time, monthly, bi-weekly, or weekly)

- Select Confirm

Payment requests

Payment requests allow you to ask individuals or businesses to transfer your money. This feature enables a seamless process for receiving money online. Simply generate an invoice, share your payment links, and receive funds directly to your Wise account.

Same like with your account details, you can only receive payment in 12 currencies using payment requests. This includes AUD, CAD, EUR, GBP, NZD, MYR, PLN, SGD, USD, RON, HUF, and TRY.

Direct debits

Direct debits are helpful to allow you to make on-time payments, such as electricity, gym subscriptions, insurance, and many more. To use it, you can simply give your Wise account details to the company you want to pay.

Currently, you can only set up direct debits from AUD, CAD, GBP, EUR, and USD accounts.

Read more about Wise in this Wise Review.

Wise pros and cons

Wise pros | Wise cons |

Low-cost and transparent fees: Transferring money using Wise is affordable with zero hidden fees. | Limited currencies to receive in-app payments: Wise only supports 12 currencies for users to receive in-app payments. |

Mid-market exchange rate conversions: No exchange rate markups to send money globally. | 48-hour limit on fixed exchange rates: If your transfers took more than 48 hours, the rates could change. |

Send money directly to bank accounts in 70+ countries: Recipients across 70+ countries can directly receive money deposits in their bank accounts. | Limited customer support: There’s no 24/7 support from Wise, you can only directly contact them during office hours. |

Hold money in 50+ currencies: Open and hold money in 50+ currencies of your choice. | No cash pickups and mobile wallet delivery options: Transfers are only to bank accounts or between Wise apps. |

When is it right to choose Wise?

- When you want to send money to 70+ supported countries with low fees and no exchange markups.

- When you wish to spend money overseas with no additional fees using Wise cards

- When you receive regular payments from supported currencies.

- When you wish to hold 50+ currencies in a single account.

When is it not ideal to use Wise?

- If you wish to send money for cash pickups or mobile wallet deposits.

- If you send money in less-used currencies.

- If you need face-to-face risk management support in a physical branch.

- If you need 24/7 customer support.

Not sure which one to use for transferring money? Check out best alternatives to wise based on the destination country you’re sending money to

Wise is a global remittance that supports transfers to 160+ countries in 50+ currencies. However, it’s not the only option for sending money. We’ve compiled a list of the best alternatives to Wise that provide fast, affordable, and reliable transfers to a variety of destination countries.

Let’s take look into the following:

- India: Instarem is an ideal option for sending money to India. It offers fast and affordable transfers, from which you can earn InstaPoints to earn discounts on your next transfers.

- South Africa: Remitly provides fast, low-cost, and reliable transfers to South Africa. You can choose how your recipient will receive the money, whether it’s through direct bank deposits, mobile wallets, or cash pickups.

- Taiwan: OFX offers the most affordable transfer fees to Taiwan. This makes the best way to transfer money, especially in larger amounts.

- Philippines: Sending money to Philippines is best done using Instarem. Not only it offers fast and low-cost transfers, you can also choose cash pickups option for your recipient to collect the transfers.

Time to decide on a Wise alternative that provides fast and low-cost overseas transfers!

Making international transfers is made easier with Wise. The transfer fees are low, and it uses mid-market exchange rates with no hidden costs.

But Wise isn’t the only available option. There are other Wise alternatives you can try to send money globally. You can find the right one by considering the country coverage, available currencies, payment options, and many more.

If you’re still unsure of which alternative to Wise for you to transfer money overseas, you can consider Instarem instead. It offers low-cost international transfers just like Wise, and you can get InstaPoints on each completed transaction. Sign up today!

Frequently Asked Questions

Is there a better alternative to Wise?

There’s no better or worse alternative to Wise. It’s all about making informed decisions based on your needs and several factors like payment options, transfer fees, delivery options, and more.

Is there any alternative to Wise card?

Yes, there’s an alternative to Wise card that similarly provides seamless overseas spending. Get yourself accustomed to Instarem’s amaze card that gives you amazing exchange rates, ultimate convenience, and awesome rewards. Read more about amaze card here.

Which app is similar to Wise?

There are numerous Wise alternatives that offer similar services. However, if low-cost transfers and a seamless mobile app experience are what you’re looking for, you can try Instarem.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.