International business payments

Experience secure, fast, and cost-effective global transactions. Pay and get paid internationally minus the high fees, complexity, and frustrations of a bank.

Unlock better rates & lower fees – Watch our guide

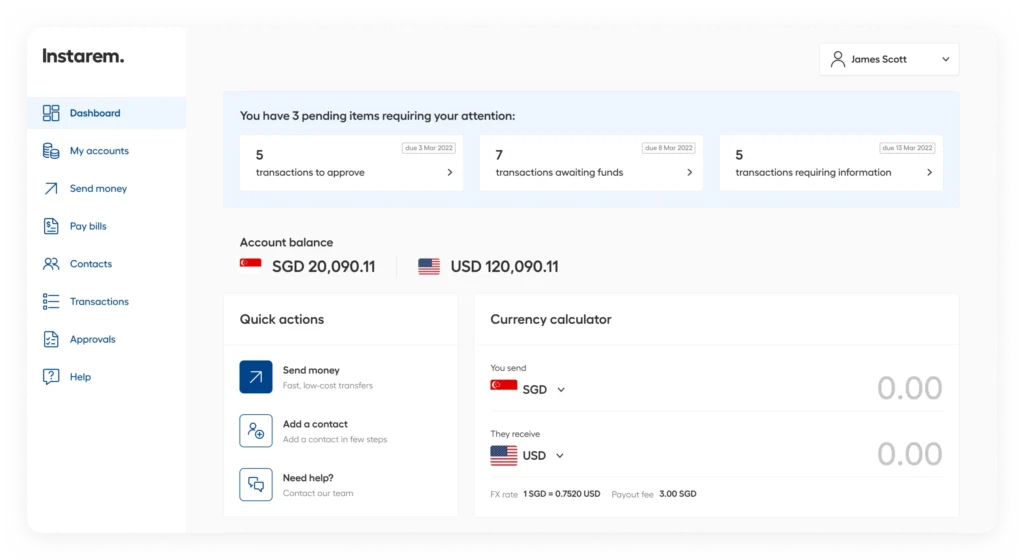

Your international business account

Make business payments

Pay your overseas suppliers or employees across 160+ countries and save money with great FX rates and low fees.

Receive business payments

Get paid easily in USD, AUD, SGD, HKD, JPY, NZD, EUR, and GBP without the hefty costs or multiple bank accounts.

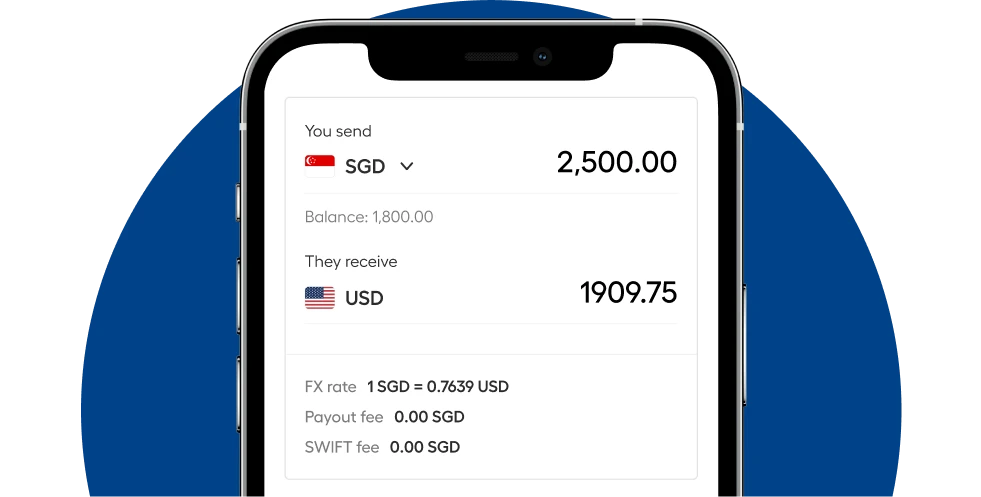

Transparent rates. Low fees. No surprise costs.

What you see is what you pay. Our rates are fair, our fees are low and above all we are transparent, so you see what you are paying for with every transaction.

Exchange rates

Experience exceptional value for your transaction with our industry-leading FX rates.

Fees

Benefit from unparalleled cost savings with our low fees, often up to 5X cheaper than banks.

No extra charges

We don't impose setup or subscription fees, nor are there any hidden charges to surprise you.

Who we are

Part of NIUM, the first B2B payments unicorn in Southeast Asia. Instarem has been on a mission of making international payments easy and affordable for everyone since 2014. We are the go-to solution for businesses that need to move money quickly, reliably and at a lower cost than banks.

USD 6BN+

Money moved annually

160+

Countries you can pay

11

Jurisdictions we are licensed in

Why use Instarem

Up to 5X* cheaper than banks

Get competitive, bank-beating exchange rates and low fees.

Up to 12X* faster than banks

Most transactions are completed within the same day.

Secure and reliable

Regulated, licensed, and built on industry-leading technology.

*Based on traditional bank averages. Actual savings and speed vary by amount, destination, currency, individual bank policies, etc.

BPOs

Run payroll, pay vendors, and manage global teams with ease. Quick, low-cost international transfers, done right.

Logistics

Keep shipments moving with hassle-free international payments. Pay suppliers and freight companies on time, every time.

Tech industry

Scale faster with secure, seamless payouts. Whether you are a SaaS, or marketplace, we have got your global transactions covered.

Travel

Pay hotels, tour operators, and partners worldwide—fast. No delays, no high fees, just smooth global transactions.

Intra-company transfers

Managing cash flow between your international branches? Instarem makes it easy with fast, secure, and cost-effective intra-company payments worldwide.

Invoice payments

Simplify international invoice payments with Instarem. Make fast, secure, and cost-effective cross-border transactions for your business.

Payroll for global workforce

Simplify global payroll for your business with Instarem. Ensure timely, secure, and cost-effective salary payments across multiple countries with competitive exchange rates.

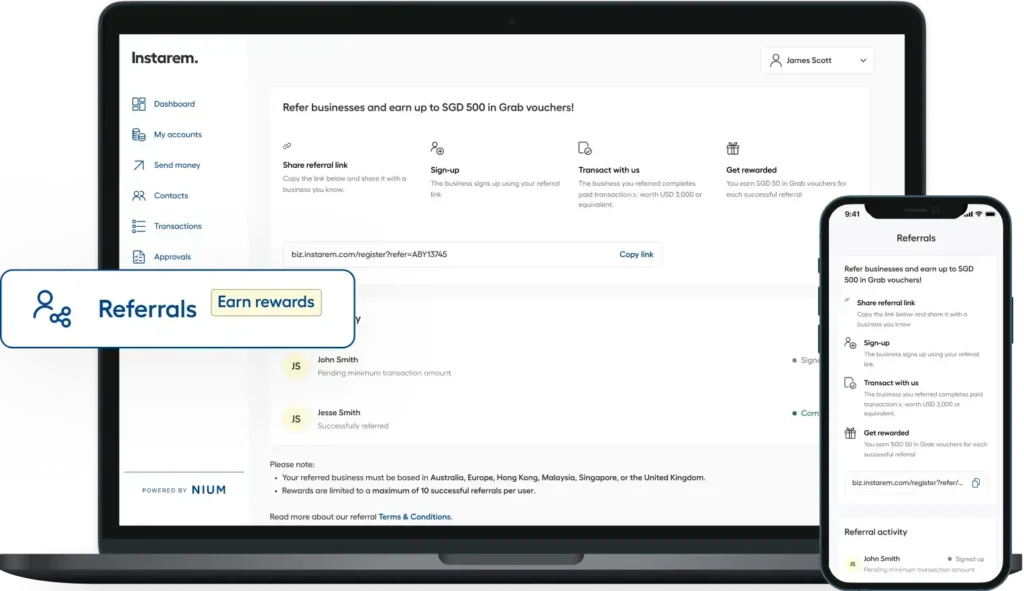

Refer a business

Get a 50 SGD Grab voucher for every successful referral*.

*Limited to 10 referrals

Secure cross-border payments

Experience the confidence of secure cross-border transactions with our globally licensed platform. We prioritise your peace of mind, rigorously protecting your funds in partnership with regulated financial institutions and tier 1 banks worldwide.

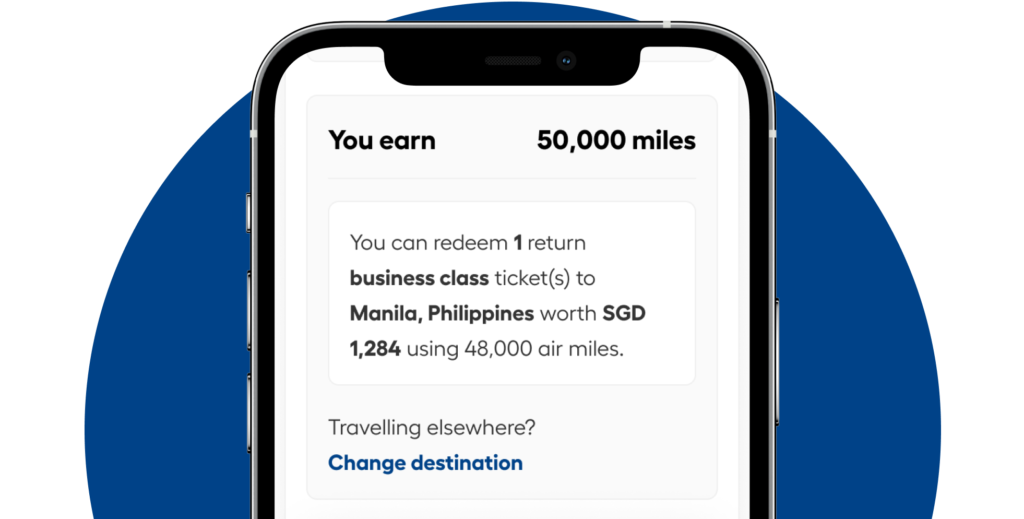

Make money transfers more rewarding

Curious how your money transfers can earn you rewards? Every time you use your credit card to make a payment with us, you’re stacking up miles faster. Try our calculator to see how quickly they add up. More miles, more perks—let’s keep them coming!

Our trusted investors

How we help businesses

How Instarem supports Airserve Marine Travel’s global operations with faster, smarter cross-border payments

The company Airserve Marine Travel is a regional leader in corporate and marine travel management…

From high fees to high touch: How TRUVI transformed global payments with Instarem

The company TRUVI is a premier luxury travel and lifestyle concierge company specializing in personalized…

From bank delays to borderless speed: How OnlineHKdeal streamlined global reimbursements with Instarem

The Company OnlineHKdeal is a fast-growing e-commerce business that connects global shoppers with…

Shipping smiles, saving costs: How Instarem powers Fly Box Korea

The Company Fly Box Korea is a cross-border e-commerce business that brings Korea…

Charlotte Travel boosted efficiency and cut cross-border costs — here’s how

The Company Charlotte Travel Hong Kong Limited is an award-winning, family-run luxury travel…

Enabling seamless cross-border transactions for AECC Global, an education consultancy

In light of COVID-19, education consultancies see an increasing need for fast and secure…

Ready to grow your business?

Tap into our expertise to streamline your payments, boost your operations, and scale your business. We are just a click away. Reach out now if you want to hear more.

Our latest articles

Revolut Business vs MoneyGram Business: Which is better for your business?

Choosing the right business account makes a big difference in how you manage your finances…

Revolut Business vs WorldRemit Business: Which is better for your business?

Choosing the right business account makes a big difference in how you manage your finances…

OFX Business vs Airwallex Business: Which is better for your business?

Choosing the right business account makes a big difference in how you manage your finances…

Revolut Business vs TransferGo Business: Which is better for your business?

Choosing the right business account can significantly impact how you manage your finances. We’re…

Revolut Business vs Airwallex Business: Which is better for your business?

Choosing the right business account makes a big difference in how you manage your finances…

MoneyGram Business vs Airwallex Business: Which is better for your business?

Choosing the right business account makes a big difference in how you manage your finances…

FAQs

A B2B money transfer refers to the process of moving funds between businesses. This can include paying suppliers or transferring money between business accounts for buying goods or paying for services.

Business money transfers allow businesses to send and receive funds electronically, either within Singapore and/or internationally. To get started, simply sign up and create an Instarem business account in Singapore. With your account set up, you can easily start sending business payments with Instarem.

The transaction limits for B2B payments vary depending on the country’s regulations. Typically, banks allow businesses to have higher transaction limits, but it’s essential to check with your bank for specific limits applicable to your account and transactions.

For detailed information about Instarem's transaction limits, please reach out to bizsupport@instarem.com.

For detailed information about Instarem's transaction limits, please reach out to mybusiness@instarem.com.

Instarem does not charge any fees for opening an international business account. This means:

- No sign-up or account set up fee

- No subscription fee

You only pay when you use our service to make business payments. We offer full transparency by showing all fees upfront before you confirm the transaction.

To open a business account with Instarem, you'll need to provide the following information and documents:

- Official name of your company, as registered.

- Country where your business is registered.

- Business registration documents showing that your business is legally registered.

- Major stakeholders' details along with their identification documents

- Your business’s registered address along with a document to verify it.

- A valid, government-issued ID for the primary account holder.

Please note that document requirements may vary by country, and additional documents may be needed. For any queries, please reach out to bizsupport@instarem.commybusiness@instarem.com.

Yes. For example, you can use your Instarem business account to send money to employees’ or freelancers’ personal bank accounts for paying their salaries.

Instarem business accounts are available for a variety of business types, from small and medium enterprises (SMEs) like startups or established companies with more complex financial needs, to freelancers and sole proprietors running their own businesses.

Want to find out how we can support your business? Click here to know more.

To open an Instarem business account, you will need to meet the following criteria:

- Registered business entity: Your business must be legally registered in your country of operation.

- Valid documentation: You’ll need to provide necessary documents such as business registration certificates, proof of address, and identification of key individuals.

- Compliance with local regulations: Your business must comply with the regulatory requirements in your country and the countries you intend to transact with.

Currently, Instarem doesn’t offer the option to set up automatic payments for businesses. If you need help with managing your payments or finding alternative solutions, please contact bizsupport@instarem.commybusiness@instarem.com.

Safeguarding your funds is our top priority. We follow strict regulations set by authorities in the countries where we operate. Here's how we ensure that your money stays safe:

- Separate accounts: We keep your money separate from our own by placing it in a safeguarding account with a reputable bank.

- Regulatory compliance: We follow stringent rules and guidelines from regulatory bodies to ensure maximum security.

- Regular reviews: Independent experts periodically assess our safeguarding practices to ensure we meet all obligations.

- Advanced security measures: We use industry-standard encryption and security protocols to safeguard your transactions.

- Global standards: We comply with international financial safety standards and regulations.

To learn more about how we keep your funds safe, click here.

We usually verify your business account within 2-3 working days. It might take a bit longer if we need additional information or documents from you. But don’t worry — our representatives will reach out to you and guide you through every step of the process. We’ll keep you posted throughout the process to ensure everything moves along smoothly.

Cross-currency transfers

Instarem doesn’t charge fees for cross-currency transfers via the business account. However, our partner banks apply a small fee for processing. Since these fees are set by the banks, we can’t provide an exact amount in advance.

Same-currency transfers

Instarem charges a nominal fee for same-currency business transfers. We clearly show you the fees upfront before you complete the transfer, so you’ll know exactly what you’ll pay and what your recipient will receive. Our transaction fees vary depending on several factors, including:

- The country you’re sending money from

- The country you’re sending money to

- The amount you’re sending

- The payment method you’re using