Instarem: Best Money Transfer Option for International Students

This article covers:

- Challenges Faced by International Students Regarding Money Transfer

- Instarem – Money Transfer for International Students Made Easy!

- Why International Students Need a Specialised Money Transfer Option?

- Instarem: An Overview

- Comparing Instarem with Other Money Transfer Options

- Benefits of Using Instarem

- How to Get Started with Instarem?

- Customer Support

- Before you go…

The life of an international student is exciting, challenging, adventurous, and everything but easy! Knowing what you are signing up for is always better when you plan to study abroad. While you might have researched and got your logistics covered, like the visa application, accommodation ideas, university papers and other basic requirements, there are still tons of things you must be aware of before starting. One among them is money transfer options.

Most countries allow students with a valid visa and obligations with other norms to work part-time whilst studying. Working part-time while studying has more advantages than one; some may even opt to send money abroad as a student.

Money transfer for international students has become necessary, but with numerous options and a lack of knowledge, it may be confusing. The below article is like a brief money transfer guide for international students. In this, we shall discuss international students’ challenges with money transfer and how Instarem can solve all your money transfer problems.

Challenges Faced by International Students Regarding Money Transfer

Studying abroad is a lifetime experience; however, when it comes to managing finances, international students face many challenges. If you are one of those who transfer money to their loved ones across borders, facing the below challenges is common.

Which is better – traditional v/s modern money transfer options?

Choosing between traditional financial institutions or bank transfers and online money transfer platforms is one of the first and most crucial decisions. Although traditional methods offer a wide range of student remittance services, the fee is typically higher than the modern online or app-based money transfer options.

How does the foreign exchange rate impact my transaction?

When studying in a foreign country, understanding foreign exchange rates is crucial. These rates determine your spending habits and can significantly impact the amount to be received by the recipient in another country. Given the constant fluctuations in foreign exchange, it’s beneficial to stay well-informed. Additionally, different money transfer services offer varying exchange rates; some may be competitive with small margins, while others might not be as favourable. These factors collectively influence the actual value of the money you send overseas.

Am I losing a lot because of transfer fees?

The money transfer service companies charge transaction fees to facilitate funds transfer. These transfer fees can vary from provider to provider; some may charge a flat fee, some charge a percentage of the transfer amount, and some charge a combination of both. When transferring money internationally, always consider the complete transaction value, including the fees, to understand the overall cost. As such, finding affordable money transfer options for international students can be tiring.

Will my funds be safely transferred?

Fund safety is always the priority when transferring money internationally. Due to the rise of cyber threats, it is vital to consider various security aspects to ensure that funds are transferred safely. Opting for options that provide secure and cost-effective money transfers for students is recommended. For example, ensuring the provider devises strong authentication measures, like multi-factor authentication or biometric verification, to add an extra level of security to the transaction.

Instarem – Money Transfer for International Students Made Easy!

Treating yourself and loved ones with your first earned salary is a joy not to be missed. But what happens when your first check is earned abroad, and your family and close friends are not nearby to celebrate? There’s Instarem for all your international student remittance needs!

Instarem – a student-friendly international money transfer service, is a faster, more convenient and affordable way to move money across borders.

- Quick* money transfer facility (most transfers are done within the same day)

- Send money to over 60 countries

- Get competitive exchange rates and low fees

- No hidden charges

- Licensed and regulated in 11 countries

- Easy money tracking through the app

- Earn rewards on every transaction

- Over 1 million customers

Also Read: Where to turn for support while studying abroad

Why International Students Need a Specialised Money Transfer Option?

Figuring out options for a secure and cost-effective money transfer for students is a challenging feat. Between banks and non-banking money transfer specialists, a few reasons put the latter in a more advantageous position, especially from an international student perspective.

Firstly, the cost. The cost of transferring funds abroad depends on the currency, the transfer mode, time and the amount. Almost all providers, banks, and money transfer specialists charge a fee, but banks usually charge more than the money transfer platforms. And saving money is extremely important for international students.

Secondly, the transfer through these platforms is, in many cases, faster compared to the traditional routes. So, your loved ones across the border need not have to wait longer to receive funds.

Specialised money transfer platforms offer transfer facilities in multiple currencies. For example, an international student in the US can conveniently transfer money to his home country, Nigeria. Many of these platforms also offer a currency converter tool wherein you can check how much the recipient will get against the amount you pay.These platforms are convenient to use, allowing students to transact online without hassle.

Ultimately, you value the money you’ve worked hard to earn. As such, when sending money abroad as a student, you would want to ensure your money is safe and reaches the recipient safely.

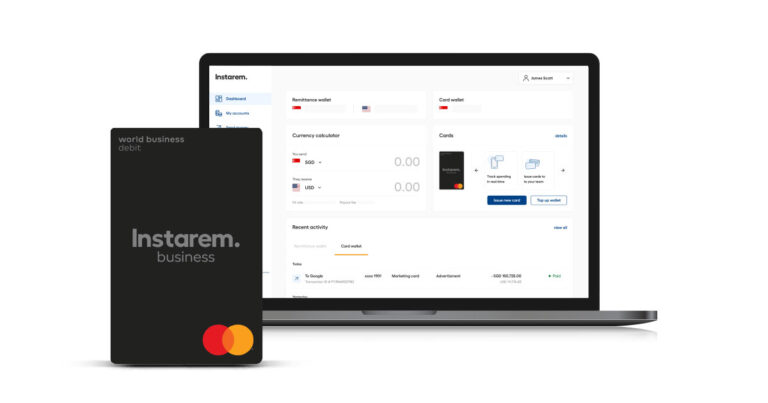

Instarem: An Overview

Instarem in Numbers | |

Customer Base | 1M+ |

Number Of Years In Operation | 9+ |

Number Of Locations Supported | 60+ |

Funds Moved Annually | $3BN |

Number Of Offices Across The Globe | 11 |

Comparing Instarem with Other Money Transfer Options

Comparing various money transfer services is important when you decide to transfer money online. Several players in the market have their set of features and pricing. The table below can help determine the best money transfer option for international students based on various factors.

Service | Fees (if sending money from USD to INR) | Transfer Speed | Locations supported | USP |

Instarem | Transaction fees between 0.25% and 1% and no hidden charges. | Within the same day, depending on the destination country | 60+ | Competitive exchange rates, quick transfer, can cancel the transaction if still pending, earn reward points |

Wise | 8.08 USD | 0-1 business days, depending on the destination country | 150+ | Convenient to use, free domestic transfers, quick transfer time |

Remitly | 3.99 USD | 3-5 business days | 150+ | Competitive rates, wide presence |

MoneyGram | 2.99 USD | 0-1 business days, depending on the destination country | 200+ | Choices for transfer and receipt methods, wide presence, competitive rates |

Worldremit | 2.99 USD | Within the same day, depending on the destination country | 130+ | Better exchange rates, quick transfer, multiple transfer options, including cash pick up. |

Information taken from respective websites as on 13th Oct, 2023.

Also Read: Studying abroad? 7 biggest fears and how to overcome them

Benefits of Using Instarem

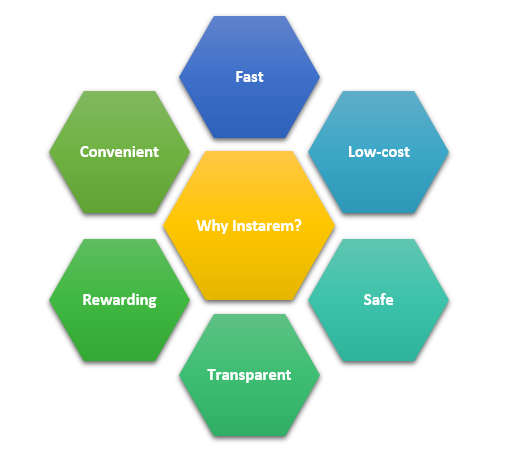

Instarem offers student-friendly international money transfer services. With a few clicks of a button, you can send money from the country you are pursuing education to your home country or elsewhere. Let us look at some of the benefits of using Instarem.

- Instarem offers you competitive, bank-beating exchange rates. There is full transparency and no hidden charges.

- The transfer time is usually within a day, depending on the currency.

- The app is convenient, easy to navigate and allows you to start the transfer process in just a few clicks.

- You can keep track of the transaction and even cancel it if it is pending.

- Each Instarem transaction rewards you with InstaPoints, which you can redeem as discounts in future transactions.

- Send money to over 60 countries safely. We are licensed and regulated in 11 countries.

How to Get Started with Instarem?

Sending money abroad as a student can be a challenging task. Finding a trusted provider like Instarem, which can help you send money overseas within the best possible time, at the best possible rate and hassle-free manner, is certainly great to have.

Here’s how you can send money conveniently with Instarem.

Step 1: Check the prevailing rates and fees

First things first, visit our website and enter the send amount and the send currency. Ensure to enter the correct receipt currency for applicable rates and fees upfront and without hidden charges.

Step 2: Create an account

Next, create a free account by signing up. Keep your identification and address proof handy before starting. You can also download the Instarem app from the Google Play Store or the App Store. To create an account, you must enter your country of residence and personal details and upload the documents to approve your account.

Step 3: Select payment method

Once your account is verified, you can select your preferred payment method. Instarem supports multiple payment methods like bank transfers, debit or credit cards, and wire transfers.

Step 4: Add recipient details

Add the recipient’s details, including name, contact details, receiving methods, etc.

Step 5: Funding the transfer

Once the recipient is added, you can select them, choose the receiving method, fill in your transfer details and transfer the funds. It is always advisable to review your transaction summary before the final transfer.

Step 6: Track your transfer

Your money can typically be received within a day, depending on the currency; you can, however, track your transaction status easily on the Instarem app.

Customer Support

To know more about Instarem and our services, visit our Help Center and get access to extensive money transfer guides. You can also Live Chat with our support agent and get instant replies to your queries.

Also Read: 7 Best Cities To Study Abroad For Students On A Budget

Before you go…

If you are an international student, you no longer need to worry about the complexities of student remittance or paying high transaction fees when you use Instarem. Our student-friendly international money transfer services are a secure and fast option for those seeking a hassle-free, cost-effective global transaction solution.

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

* Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

#When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Reference Links:

- https://www.timeshighereducation.com/student/advice/what-best-way-transferring-money-international-student

- https://www.idp.com/global/student-essentials/money-transfer/search-results/

- https://goniyo.com/blog/best-international-money-transfer-apps-for-indian-students-abroad/

- https://www.transwap.com/blog/how-to-overcome-financial-difficulties-as-an-international-student

- https://www.telegraphindia.com/edugraph/career/how-can-international-students-choose-secure-money-transfer-channels-finally-answered/cid/1953329

- https://www.compareremit.com/remittance-company-reviews/instarem-money-transfer-service-review/.