International money transfers

- Fast

- Secure

- Low-cost

Send money overseas from the United States of America. Make every dollar count with a trusted service preferred by customers worldwide. Experience the convenience of transferring money online from United States of America. Enjoy fast and secure transfers right at your fingertips.

Enjoy a special FX rate and zero fees on your first transfer. T&Cs apply Sign up today!

Payment by

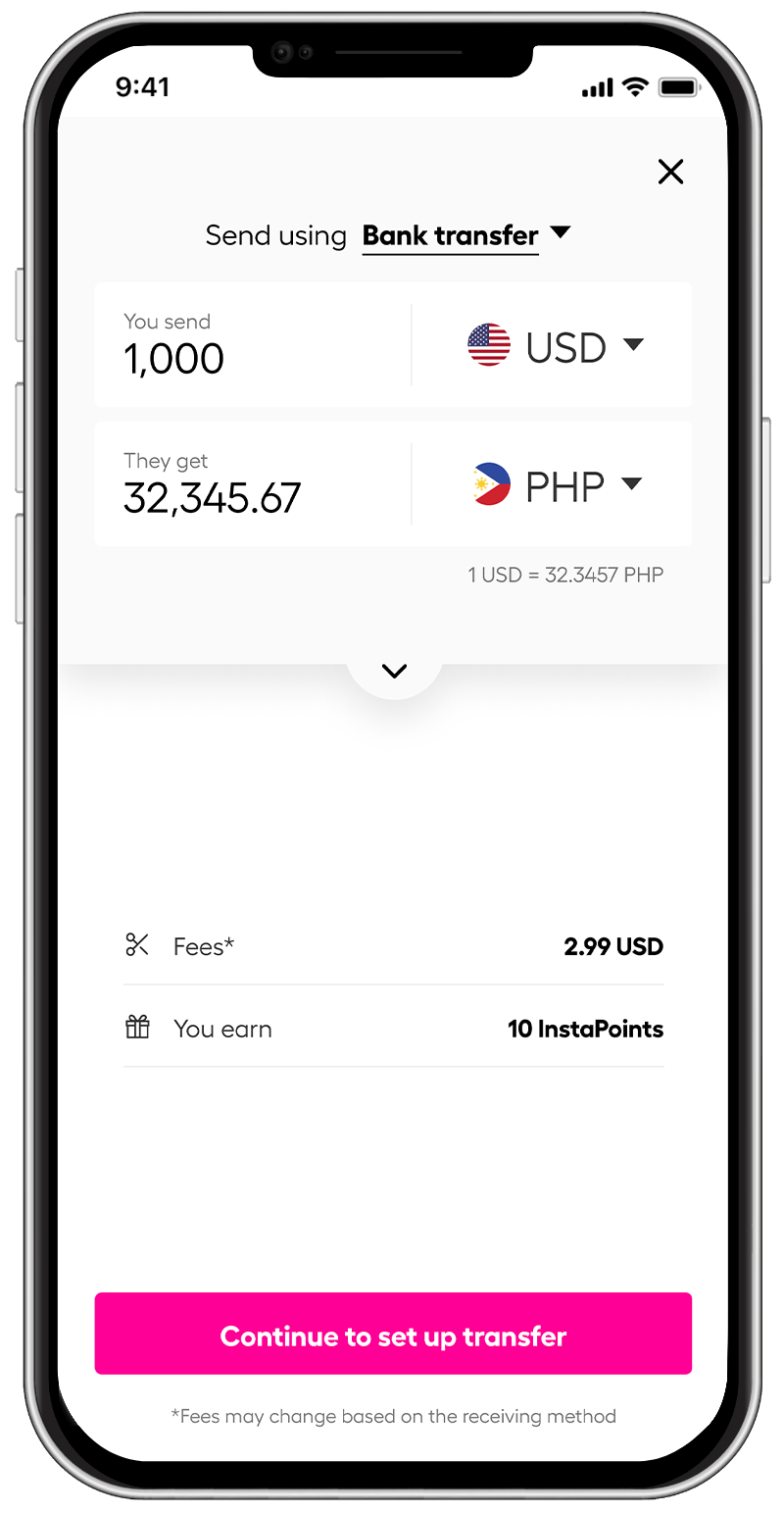

Our fees USD 4.5 Fees and exchange rates vary by sending amount, currency, payment method and receiving country. Please change these parameters to view the applicable fees.

First time rate Enjoy this special rate and zero fees on your transfer now. Act fast, offer ends soon!

Special rates and zero fees are valid for new customers on their first transfer between USD 500-USD 9,999.

Looking to send more than USD 20,000? Register your interest now to enjoy exclusive rates.

Why Instarem

Everybody has their thing. Ours is helping you transfer money internationally from United States of America with the least amount of fuss. We are not your average money transfer provider. Our technology is smarter, faster, and more reliable. You can call it hassle-free. We call it Money Simple.

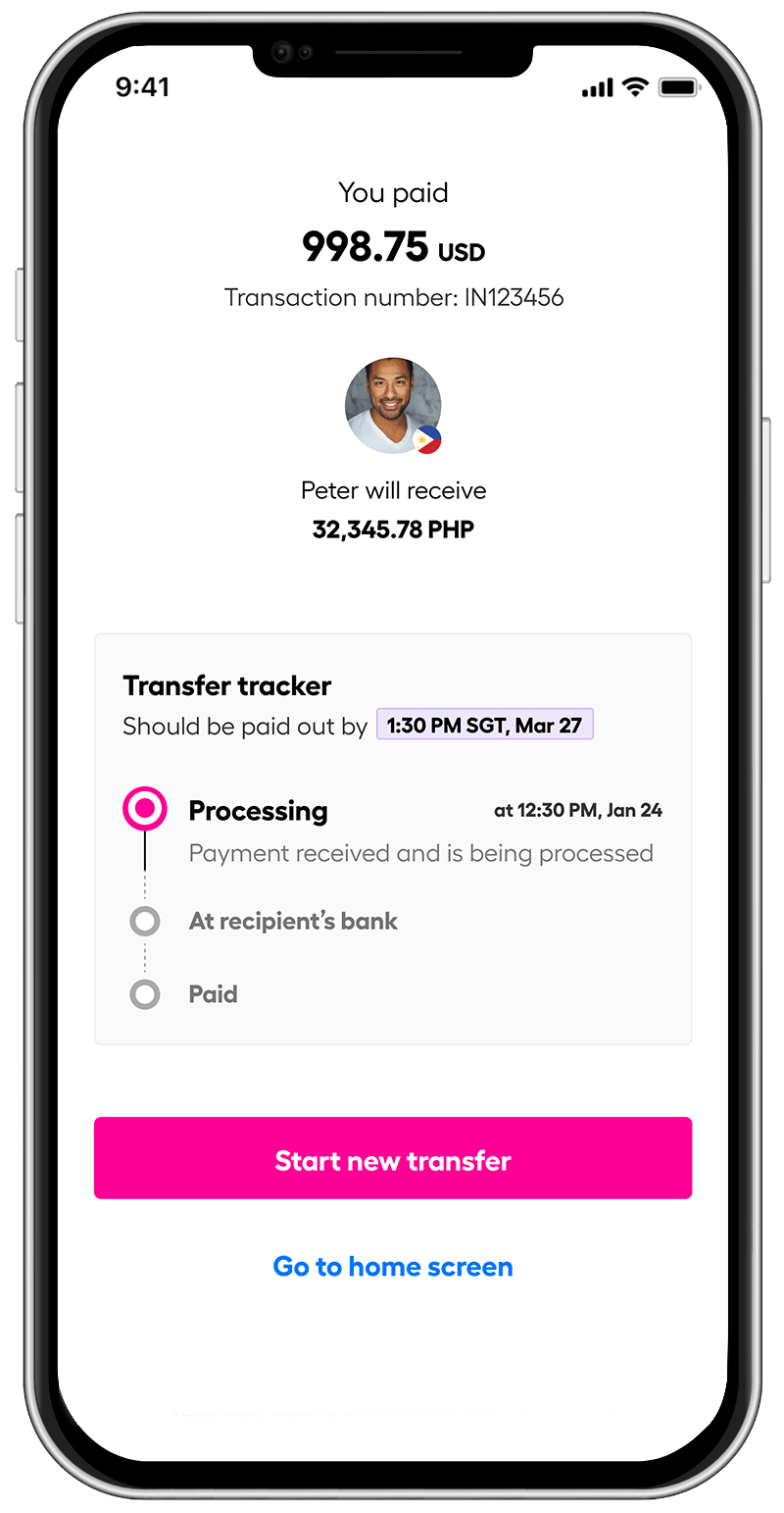

Fast

Usually within 1-2 business days*

Low-cost

Competitive FX rates and low fees

Safe

Licensed and regulated in 11 countries

Transparent

All costs are upfront, no hidden charges

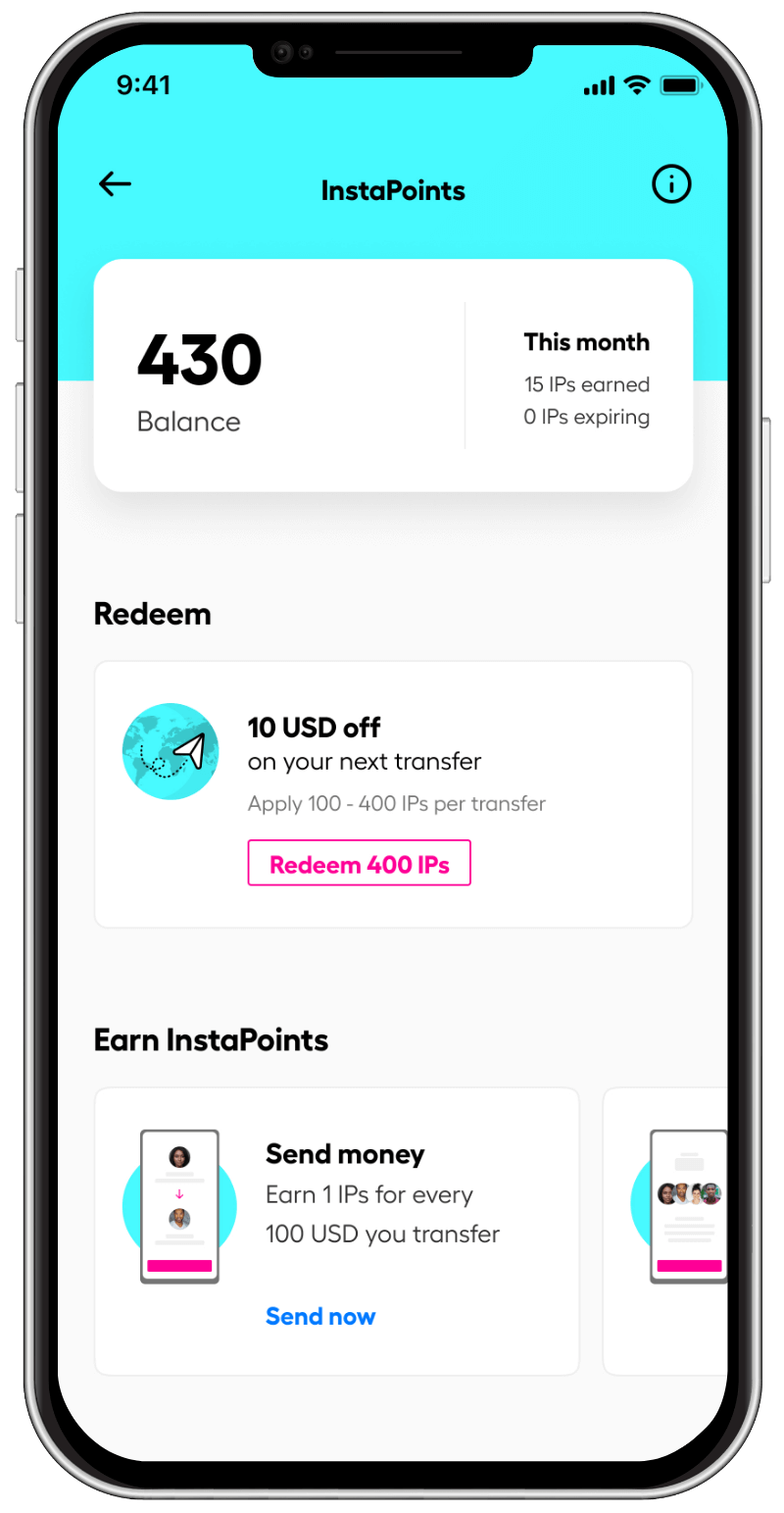

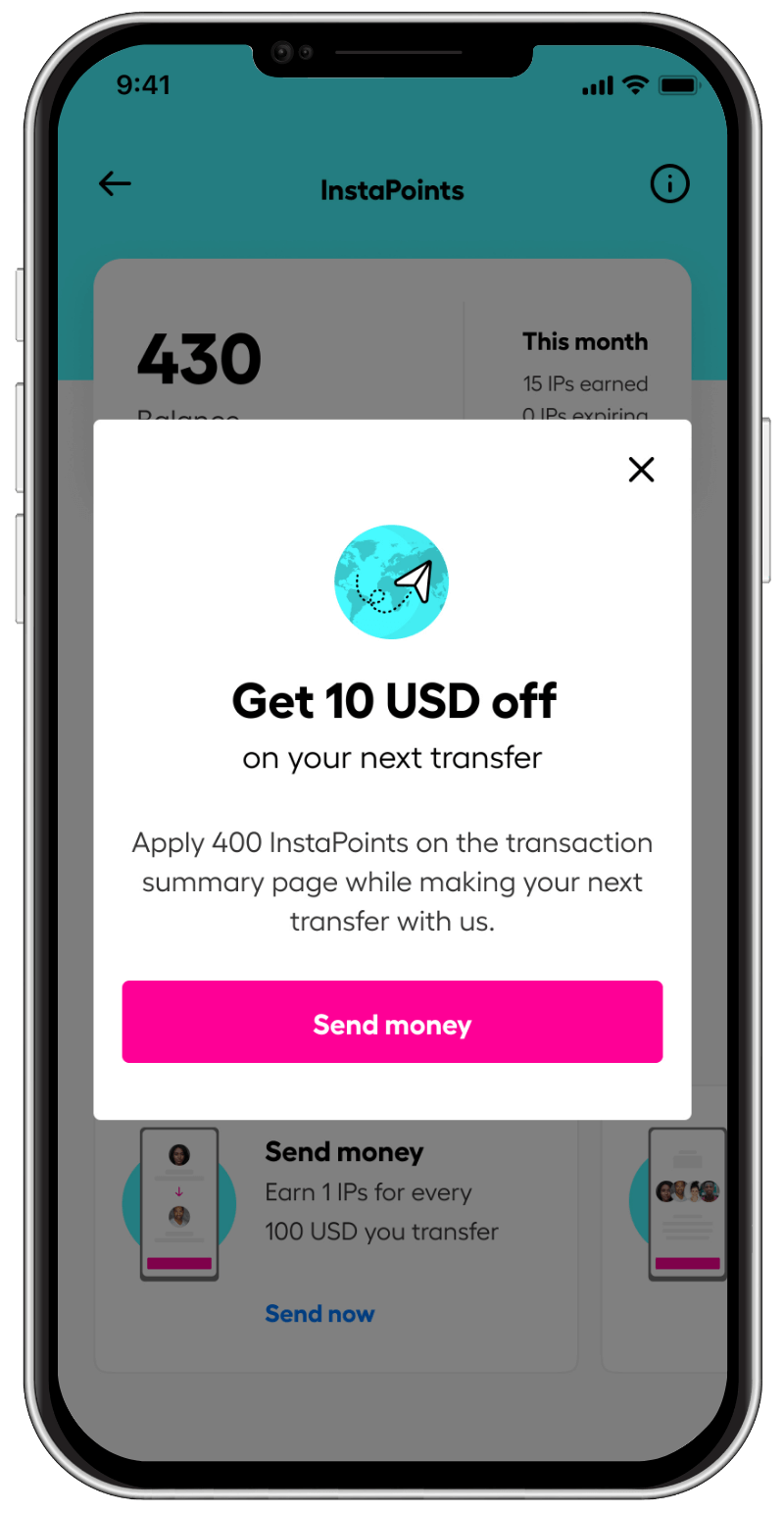

Rewarding

Earn rewards on every transaction

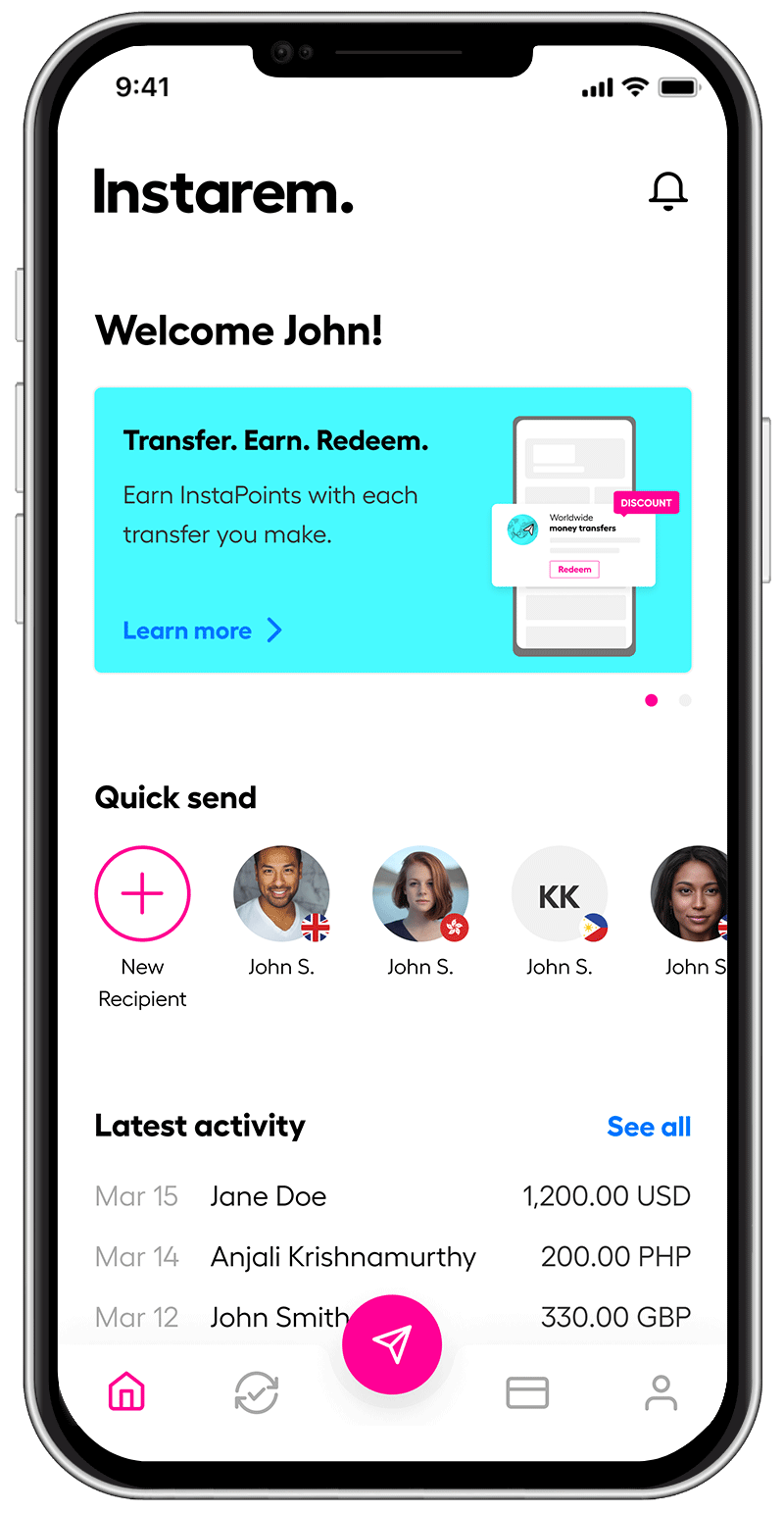

Fast and secure international transfers

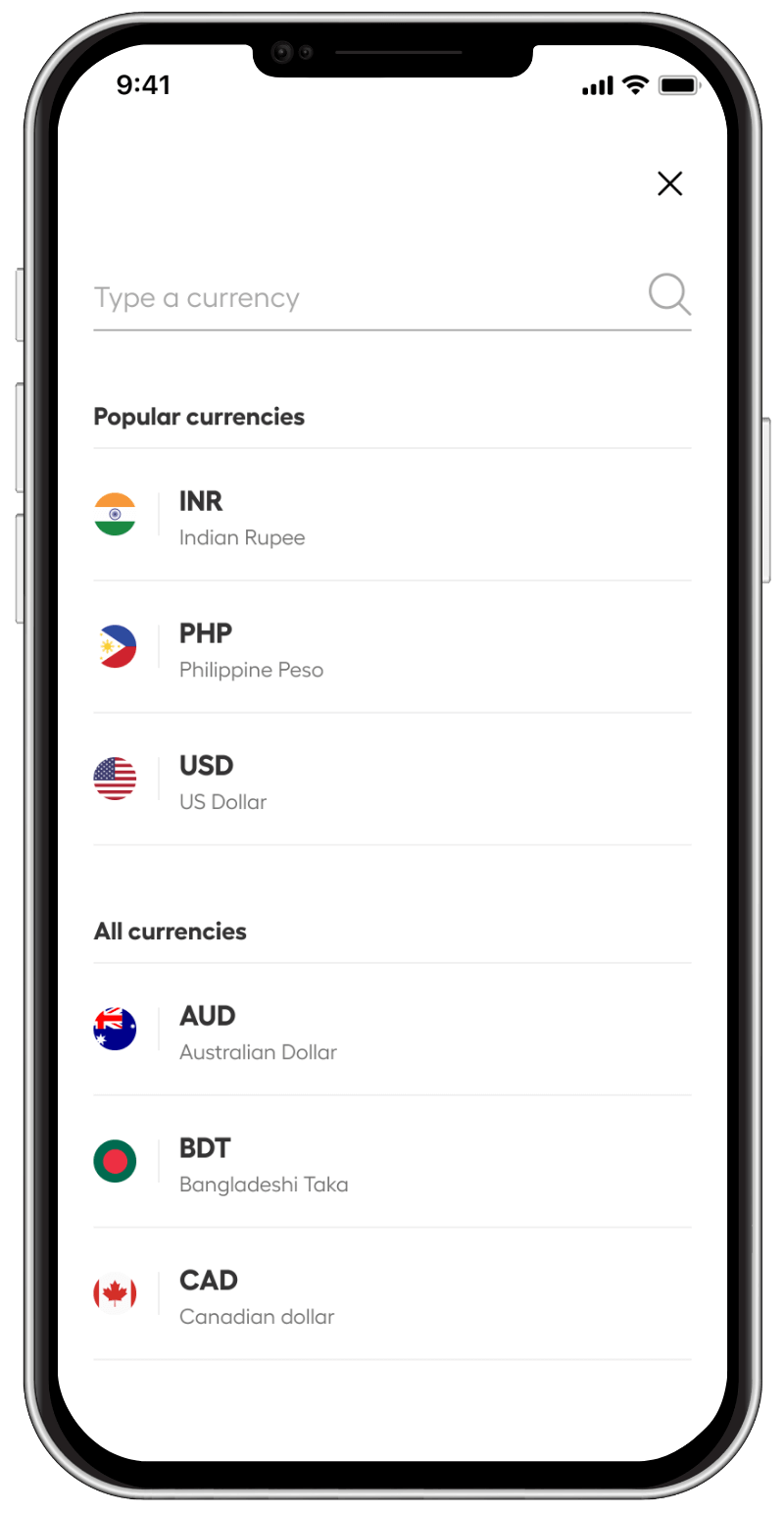

Send money with confidence to 60+ countries in the world in minutes.

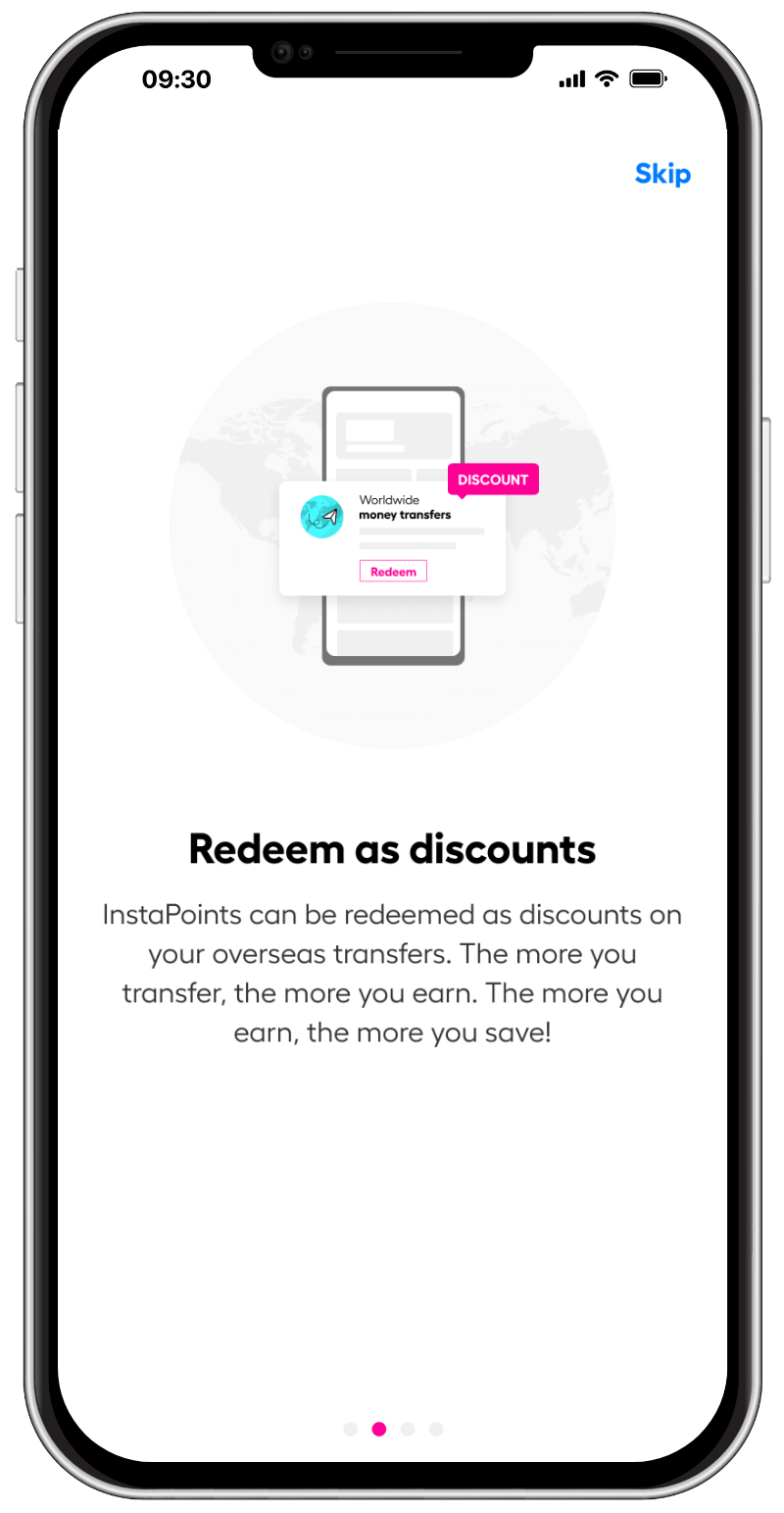

Earn rewards with every transaction

Each Instarem transaction will reward you with InstaPoints. The bigger the transaction amount, the greater the number of points you earn.

Looking for an easy global payment solution for your business?

We provide fast and cost-effective international payments for all your business needs. With us, you can focus on what truly matters.

What our customers say

Ready to get started?

Learn more about how we transfer your money abroad or create an account to start transferring today.