A comprehensive guide to remittance advice: Types and creating your own

This article covers:

Modern payment solutions not only simplify international money transfers but also bring clarity and transparency to the process. And transparency here extends both ways – to the payer and the payee.

Hence, buying goods and services from someone and not establishing a proper paper trail of your business money transfers is not advisable in the financial sense. This is where remittance advice comes in.

It establishes communication with the recipient regarding your processed payment. Simply put, it is a confirmation of payment sent from the customer to the business or vendor.

In this blog, we will take you through remittance advice definition, types of remittance advice, how to create a remittance advice document, how to send one, and some common mistakes to avoid.

What is Remittance Advice?

Remittance Advice Meaning and Definition

Remittance advice is a document or letter the buyer sends to the vendor to notify them of the processed payment. It is confirmation that the payment has happened or is going to happen. In a sense, they are equivalent to cash register receipts, but they should not be confused with one another.

You get receipts or invoices after you have received a payment or service. Remittance advice is used when the customer wants to let the seller know when the invoice or receipt has been paid. Another way to refer to remittance advice is remittance receipt or payment advice, meaning the same thing.

Remittance advice letters are generally sent between the following parties:

- From a buyer to a seller

- From an employer to an employee

- From a financial institution to a payee

Their usage originated when cheques/checks were still widely used. This is still the case today, where if the payment is made by cheque/check, the remittance slip is sent with the payment.

Global businesses today also still use remittance advice to match open invoices with payments, as they receive payments and remittances in large amounts, and it can be difficult for them to handle remittances manually.

What Does Remittance Advice Look Like?

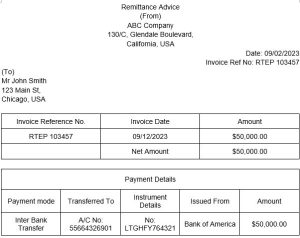

Remittance receipts detail the invoice number, items bought, and their corresponding payment information. It should be issued on company-headed paper and contain the contact details of a member of the company who can deal with any queries the vendor may have.

Here is an example of a business remittance template:

Generally, remittance advice forms include detailed cheque/check stubs and an invoice or a billing account statement section that is detached and mailed with the payment indicating the amount paid.

For example, if the customer pays by cheque/check, the payment may be sent with the remittance letter. These can also be issued as electronic remittance advice (ERA) or as paper remittances.

Other common applications of electronic remittance advice (ERAs) include claim payments from insurance providers and can also include remittance advice remark codes if there are any changes between the paid and billed amount.

Also Read – What is a Remittance Address?

Types of Remittance Advice

- Basic Remittance Advice: A basic letter that includes details needed to follow up on the invoice, like the reference number and the payment amount. It is often sent in paper form along with the cheque/check leaf sent by the buyer to the vendor.

- Removable Invoice Advice: An invoice that comes with a removable remittance receipt the customers are encouraged to fill in. This way, there is no additional burden on the customer’s side to send a separate remittance slip. Some organizations will include removable remittance receipts to their invoices as a payment coupon that the receiver must fill in and return once they have made their payments.

- Scannable Remittance Advice: These are generated automatically and sent to the vendor at the time of payment. Bookkeepers generally use this as an electronic notification option.

Importance of Remittance Advice

Helps Reconcile Accounts

While it isn’t mandatory to send remittance advice, it is considered a courtesy as it helps save vendors a lot of time with their month-end invoice matching and reduces any confusion surrounding payments.

Sending remittance advice forms also helps the customers as they ensure stress-free transactions since they have notified the vendor of their payment(s).

Provides Information on Payment Received

Remittance advice forms are confirmations of the payments made. They contain all the necessary information relevant to the payment made. For example, basic remittance advice forms will contain:

- Payee and payer information (names and contact details).

- Email address (for emailed remittance advice).

- Invoice date and reference number.

- Related purchase order number.

- Payment method and currency.

- Description of services of products.

- Payment amount and date.

More detailed remittance advice forms include details like:

- Amount paid by invoice number (or payroll period).

- Amount withheld.

- Discount(s) taken.

- Deductions

- Payment reference numbers.

- Paper document numbers.

- Gross and net amount.

Helps in Tracking Payments

Remittance receipts help businesses match payments with their invoices and allow them to track payment histories and the current status of payment-related invoices. They are also helpful in tracking payment delays.

For example, they prove useful for banks when they make payments on behalf of their account holders. In this case, the remittance advice is sent to the payment receiver, which will list details like payment date, sender details, etc.

Aids in Dispute Resolution

Remittance slips prove useful for internal documentation purposes as they usually list all the invoices being covered with a payment.

For example, pay stubs are a form of remittance advice as they usually include employer information and other details like payment amounts, date, payroll periods, hours worked, overtime, payment deductions like taxes, and other payment contributions.

They help organizations keep track of employee salaries and other budgetary allocations.

How to Create Remittance Advice

Steps to Create Remittance Advice

If you are planning on sending remittance advice forms and want to create your own, here are some mandatory details that you must include:

- Your Company Details

The receiver should know who they are receiving the remittance receipt from. So you should include details like:

- Company name

- Company address

- Contact information

- Payee/Receiver Details

Here you need to mention the details of the person you have made the payment to. So include information like

- Payee’s Name and Address (can be the company name and address)

- Contact information

- Invoice Number

An invoice number is essential as this is what will be used to pull up your records. The accounting team will use your invoice reference number to match the remittance advice to your invoice and mark it as paid.

- Payment Date

Add the payment due date and the date when you have sent out the remittance advice.

- Payment Amount

Although an invoice number is sufficient, including the payment amount(s) is good practice since it can be used to cross-check their bank account statements.

- Payment Mode

Including the mode of payment will boost your transparency. Whether it be a bank-to-bank transfer, cheque/check, or a UPI payment like Google Pay, do include it.

Since each payment mode has its own time frame for when payments are delivered and processed, it alerts the receiver of when and where to expect your future payment(s).

- Expected Date Of Payment Delivery

You can also choose to include an assumed payment delivery date, as each payment mode consumes a certain amount of time to process a payment.

You should now be able to create a remittance form using all of these details. For example, if you are an employer sending remittance advice, it should contain these details:

- Employer and employee information

- Net and gross salary

- Additional allowances (overtime pay or other reasons).

- Deductions and employee contributions

- Payment date

Tips for Creating Accurate Remittance Advice

- Test and Monitor

Regularly testing and monitoring your strategy in comparison to your objectives will help you identify gaps and opportunities for improvement.

This can be done through reports, surveys, feedback forms, dashboards, or audits to collect and analyze the data on your electronic funds transfer (EFT) payments and their remittance receipts.

You can also measure metrics like payment timelines and accuracy, security and compliance issues, and risks.

- Adjust and Improve

Based on your test and monitor results, your next step is to make suitable adjustments to your remittance advice forms. It can involve updating or changing its format, simplifying or standardizing its content layout, or automating its creation process to mitigate the risk of errors.

You should also consider and incorporate feedback from payees and stakeholders, as they are the ones who use and benefit from your remittance advice.

Best Practices for Remittance Advice Creation

Remittance advice forms can be sent as paper documents, through email, or as electronic files. Some suppliers or vendors prefer to receive their remittance receipts in a particular format, so it is best to check with them first when creating your remittance advice form.

Moreover, today, you do not need to create your remittance advice forms manually. While you can write them yourself, you can save a lot of time by generating these forms automatically through your accounting software or through or through a payment solution.

Not only does this save a lot of time, but it also significantly cuts down on errors during the creation process.

Also Read – Types of remittance: Inward Remittance vs Outward Remittance

Common Mistakes to Avoid While Creating Remittance Advice

Mistakes in Data Entry

Remittance advice forms riddled with calculation errors or spelling mistakes can often result in payment disputes and even discredit a business.

So when creating your remittance advice, make sure that all important details like invoice number, payment amounts, and the total amount are accurate and included with the correct currency in case of international money transfers.

For example, if you send money to India from the US, the payment amount must be written in USD. To mitigate payment disputes, you must also include the correct transfer fees and payee information.

Incorrect Payment Amounts

Your remittance receipts should include clear and accurate payment amount information, and details like deductions and additional allowances (if any) should never be left open to speculation.

Omission of Important Information

Any and all payments made during the transaction must be included in your remittance advice form. You must always strive to ensure full transparency between you and the receiver to ensure that both of you are on the same page.

When creating your remittance advice form, remember to include invoice reference numbers, payment modes, payment amounts, payee information, contact details, and other necessary information to ensure that your remittance slip matches your invoice.

Best Practices for Remittance Advice Delivery

Your remittance advice letters must be sent as soon as possible after making a payment. This lets the receiver acknowledge your payment promptly, reducing the chances of late fees or interest charges.

Here are some best practices to follow while sending your remittance advice forms.

Methods for Delivering Remittance Advice

- By Post

Some vendors send the remittance slip along with the invoice. You must fill it out and send it back by post to the address mentioned on the invoice. This method is used if you are paying by cheque/check, as it is common practice to send a remittance receipt along with your cheque/check.

- By Email

This is the most prevalent method of sending remittance advice documents and is the easiest. You only need the receiver’s email address. Ensure you get the right email address, as it may get lost when sent to a general company email address.

- Other Digital Methods

Some accounting software enable you to automatically create a remittance advice form, which is then sent to the corresponding recipient when an invoice is cleared.

So when the remittance advice form is created, it could trigger a text, an email, or notification in your accounts software for the recipient.

Choosing the Right Delivery Method

Your chosen method for delivering remittance receipts should consider your company size, the number of suppliers, vendors, contractors, and also the profitability.

For instance, a smaller company may choose to send their remittance advice forms with their payments. In comparison, larger companies tend to give suppliers and vendors access to their invoice software or account payable systems to send notices within the system.

Ensuring Secure Delivery

Due to ease and efficiency, many companies today are beginning to automate their remittance advice processing. This allows them to process information quickly, ensuring that invoices and payments are reconciled immediately.

It helps keep the business’s net income numbers at their most accurate, and automation also greatly reduces human errors while keeping records as current and accurate as possible.

Also Read – What is LRS: Liberalised remittance scheme

Remittance Advice FAQs

1. What is remittance advice?

In simple terms, remittance advice is confirmation that the payment was sent from the buyer to the seller. This can be in the form of a physical document like a slip or through electronic forms sent by email.

2. What details does business remittance advice include?

The key details a business remittance slip should include are the following:

- Invoice number.

- Payment amount.

- Method of payment.

- Payer and payee details like names, addresses, and contact information.

3. How does a seller handle a customer remittance advice?

When receiving a remittance advice form from the customer, the seller matches the invoice number on the customer’s invoice to the one stated on their remittance advice form. This allows them to verify that the customer has paid their invoice fees.

4. Is sending remittance advice required?

Sending a remittance receipt is not mandatory but is considered more of a courtesy. Moreover, larger companies still send remittance advice to their vendors to notify them of their payments as they tend to pay larger remittances.

5. Is a remittance advice proof of payment?

It is not. Remittance advice is more aa confirmation that the payment was made. Many things can go wrong between a buyer sending the payment and the funds actually reaching your bank account (like insufficient funds or incorrect information).

For this reason, auditors do not consider remittance slips as proof of payment and rely on bank statements to confirm proof of payment.

Conclusion

Remittance advice forms provide confirmation of payment between the payer and payee. While they are not mandatory today, it is still good practice to include them during business money transfers.

They help you keep track of your finances internally, and automating this process helps ensure accuracy. To ensure an additional layer of security during your remittance process, consider using Instarem. We offer money transfer solutions that are fast*, secure, and low-cost@.