This article covers:

With the world coming closer economically, more people are moving out of their home countries to earn a living, and they often send money to their families back home.

Moreover, businesses these days prefer collaborating with their suppliers and customers over the Internet. It has given rise to the use of remittance as the preferred method of paying invoices, especially to other businesses stationed abroad.

Remittance is the process of transferring money from one party to another. It includes money transferred against an invoice, to pay a bill, and sent as a gift, among other reasons. It is mainly used for funds transferred by a migrant to his family and relatives back in the home country.

However, it is also widely used for business purposes.

Remittances are a significant source of income for several developing countries. It helps improve people’s living standards in slow-growing economies. People in underdeveloped countries open bank accounts with remittances, which aid the country’s economic growth.

To help you understand remittance better, we will know in detail how to define remittance, remittance meaning, how remittance works, and its other essential aspects in this post.

What is remittance?

Remittance is the process of international money transfer to a party that most likely lives abroad. The word ‘Remittance’ is derived from another word, ‘Remit’; remit meaning ‘to send back.’

The use of remittance is on the rise for transferring funds privately and for business-related payments. It helps people working abroad ensure the safety of their family and relatives back home.

Additionally, it is a safe payment method for businesses and generates revenue for a country.

What is remittance in banking?

Remittance meaning in banks’ terminology is the process of transferring money from one bank account to another as a payment or gift.

Types of remittance

Now that the remittance definition is clear, here are the types of remittances available. Remittance is divided into 2 categories:

Inward Remittance: Inward remittance applies to funds that are received from one account to another domestically or internationally. For example, if an NRI working in the United States sends money to his parents living in India, it is termed as inward remittance for the parents.

Outward Remittance: Outward remittance is the exact opposite of inward remittance. When funds are transferred from a domestic account to an overseas account, it is called outward remittance. For example, if parents living in India send money to their child studying in the United States, it will be an outward remittance for the parents.

Must Read: Inward Remittance vs Outward Remittance

Remittance differs from other international money transfer methods. You may choose the suitable method by considering the following parameters:

- Time taken for the money transfer

- The amount of money you want to transfer

- The cost of transferring the desired amount of money

Do you know? India, Mexico, and China were the top 3 countries to receive the most inward remittances as fund transfer in the year 2022 in the low to middle-income bracket.

How remittance works?

The process of sending and receiving remittance

The process of remittance of funds can happen in different ways. However, the basic route a remittance transaction takes to complete the payment cycle, irrespective of the method, is as follows:

A remittance process can only take place if the funds required to carry out the remittance are present in the sender’s bank account. If there are insufficient funds, the transaction will get canceled at this stage.

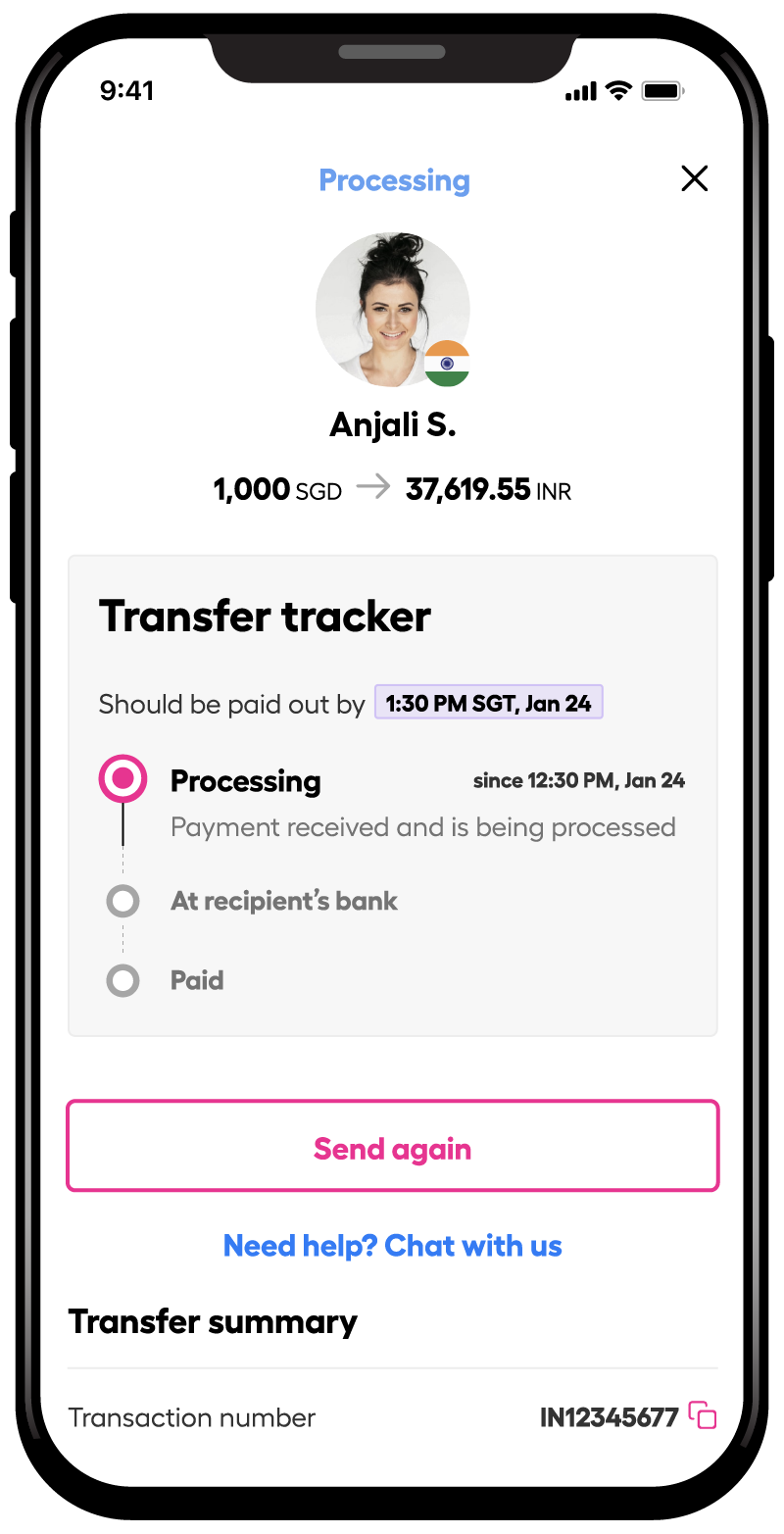

- You can remit funds by visiting your bank. Alternatively, you can use a money transfer service provider to remit funds. Some leading service providers have mobile applications that allow you a seamless remittance process.

- Once the transaction is issued, the funds will be transferred to the recipient’s account.

- The funds are transferred based on the foreign exchange rate and the transfer fee charged by the service provider.

- Once the remittance process is complete, the recipient can access the funds in their local currency after applicable deductions.

If you transfer money to a bank account, you will have to provide the recipient’s bank name and bank account number. To avoid giving your bank details to receive funds via remittance, you can use the services of a money transfer service provider.

You can receive payment in your virtual account with the money transfer service provider by giving a virtual account number. Once you receive the payment, you can transfer this money to your local bank account. It adds to the remittance transaction security.

Must Read: What is a Remittance Address? A Complete Guide

Fees and exchange rates associated with cash remittance

The fee for the remittance services may differ for various money transfer service providers.

You may have to pay up to $45 for domestic outward remittance to a bank in the United States. For an international outward remittance, the bank may charge you anywhere between $50 to $60. The bank receiving the inward remittance may also charge a fee on the fund transfer.

You may find other ways to reduce this cost. For example, if you transfer money from the US, you can opt for an Automatic Clearing House (ACH) network transfer. ACH transfers cost less than wired transfers. You can check with your bank for the specific charges applicable.

Alternatively, an international money transfer service provider may charge you much less for remittance services. With Instarem, for example, you can remit funds for an affordable# fee and foreign exchange rate.

Note: The fees have been taken from Investopedia on 07th August 2023, at 01:35 PM IST.

Must Read: What is (FIRC) foreign inward remittance certificate?

Advantages of remittance

- Providing financial support to family: The first and foremost benefit of remittance is providing financial support to family and close relatives. People who migrate to various countries send a part of their earnings back home to provide for their families using remittance services. The family can use this money for their various financial requirements, such as food, accommodation, education, medical treatment, etc.

- Financial inclusion: Financial inclusion of all economic sections is essential for any society. Remittance helps improve the financial inclusion of the unbanked and underbanked people into a country’s economic system.

With the help of remittance, people who do not have a bank account can receive and use money received from overseas. It aids the development of families and the country as a whole. - Economic development: Remittance allows families to have funds from their families working abroad. Similarly, businesses conduct their financial transactions through remittance. It gives a boost to a country’s economy.

People have a higher purchasing power, and the circulation of money increases. Further, it helps with employment generation. Better circulation of money uplifts the nation’s economic cycle and results in significant economic development. - Convenience: Remittance has made the process of international money transfer safe and convenient. People working abroad need not wait weeks and months to deliver money to their families back home.

For example, your aging parents need not wait to get medical treatment or surgery done, and you can send them money quickly through remittance even if you work in another country.

Remittance examples

Here are a few examples to help you understand how people use remittance services in there day to day lives:

- People working abroad send money to their families back in their home countries so that their family members can meet their regular expenses, like paying school fees and rent.

- Paying electricity or water bills through checks.

- Transferring money to a prepaid card so that your family members can use it in another country.

- Sending money abroad as a gift on special occasions like weddings and birthdays.

- Paying bills for services that were carried out in your absence when you were away.

- Taking payment to service providers in another country on behalf of your family or close relatives, for example, paying their mobile or internet bills.

- Parents send money to the children studying abroad for their college fees, accommodation, and other expenses.

As stated above, remittance is not only a crucial source of family income but is also essential to the development of a country, particularly countries with modest economic growth. For underdeveloped economies, remittance can be the most important source of income for people.

For example, petroleum and petroleum products form one of the most important exports for Mexico. In the year 2015, Mexican citizens working in other countries as migrant workers sent more than $24 billion back home to their families. This amount was higher than the money generated by the country by selling oil.

Challenges and risks of remittance

Potential risks of remittance

Financial intelligence units have identified some risks in remittance with financial institutions like money transmitters and depository institutions that provide remittance services. Remittance can be a target for money laundering and funding of anti-national acts like terrorism. It can be used to transfer funds from various criminal activities, such as drug and human trafficking, and trading illegal arms and ammunition.

Due to the large volume of remittance transactions and negligence of the multiple entities involved, suspicious transactions and transactions of funds related to illicit activities may go unnoticed.

Regulatory challenges in remittance

The methods countries use to record their inward remittance transactions are usually kept confidential, which makes the regulation of remittance further difficult.

Several underdeveloped and developing countries like Afghanistan and Somalia do not have a formal financial system or even a formal government structure.

It makes it further challenging for regulatory and supervisory bodies to supervise and regulate cross-border money transfers as immigrant workers from such countries often use informal remittance methods to transfer money to their families.

Having strict remittance rules and regulations in place can take care of these concerns and make the fund transfer process safe and risk-free for individuals and nations.

Security concerns related to online and mobile remittance

Although digital payments have made financial transactions almost instantaneous and accessible to people, they come with their own security concerns.

- Malware attacks: Mobile and online remittances are vulnerable to malware attacks. Malware can use various entry points from different sources, such as emails, pop-ups, malicious websites, etc., and quickly transfer within the network. It may ultimately result in a networking crash.

- Cloud computing security concerns: Financial services usually depend on cloud-based platforms. In the absence of a proactive security system, cloud networks can be an easy target for hackers and attackers.

- Breaches in the payment application: When people use mobile and other online applications to transfer funds, they need to enter sensitive information. Additionally, money transfers can be done with a click of a button with these applications. Although this is extremely convenient, it may be the easiest operating ground for hackers and miscreants if the application is not secure enough.

- Identity theft: Online and mobile applications usually use biometrics and passwords for routine and one-time payments. If the application is not secure enough, hackers can replicate user passwords and biometric data to gain access to transactions and accounts.

At Instarem, we take pride in being a highly secure money transfer service provider, licensed and regulated in 11 countries, to offer a safe online and mobile application to users.

Tips for remittance

The best practices for sending remittances

- Choosing a reliable remittance services provider: The primary way to secure your fund transfers is by choosing a reliable service provider.

Choose a licensed and regulated and be wary of offers that seem to be too good to be true. It can be a sign of a scam if you are asked to send money through an unusual means or if you are offered a commission for transferring a huge amount of money. - Compare exchange rates and fees: When you send money internationally through remittance, the foreign exchange rate between the two countries is applicable on the fund transfer. Additionally, service providers charge a fee for their services. The foreign exchange rate and the fees can vary depending on the service provider you choose. Therefore, compare the fees set by the service provider to know the exact cost of remittance for your transaction.

- Ensure security: You may use the remittance service to transfer a significant amount of money through a single payment or as regular transactions. Therefore, security is essential when sending a remittance.

Avoid sharing your service provider account details with anyone, and choose a reliable partner for your fund transfers.

How to avoid common scams and pitfalls associated with remittance?

It is easy to fall prey to several money transfer scams, like being scammed by fake immigration officers, scammed by someone impersonating your close relative, a lottery scam, and a relationship scam. To avoid these scams, you can take care of the following:

- Do not remit money to a stranger: Never send money to a stranger who fails to furnish sufficient and genuine identification. If the person claims to be a distant relative or a friend in need of money, do not hesitate to ask for official identification proof.

- Avoid making a sizable fund transfer through a single remittance: Avoid remitting large amounts of money, especially if you are making a donation towards a charity. It is advisable to research an organization before making a cash remittance to them. When remitting money to someone outside your family or closely known friend circle, remit money in small multiple transactions instead of a single large transfer.

- Stay alert: You can be duped with more money than you remit, as the scammer can get access to your bank account as well. Therefore, It is advisable to stay alert when remitting funds. Do not click on unreliable links or download anything from unreliable sources. Do not provide your mobile or computer’s remote access to anyone. Go through the terms and conditions of the service provider and read the customer reviews before making a payment.

It is advisable to read in detail about how you can protect yourself against scams associated with remittance.

Frequently asked questions (FAQs) about remittance

- What is the meaning of remittance?

Remittance is the process of transferring money from one party to another, domestically or internationally. It is most commonly used by people who migrate to another country for work to send money to their families in their home country. It can also be used to make business transactions, payment of bills and invoices, and for gifting money. - What is a Liberalized Remittance Scheme (LRS)?

The Liberalized Remittance Scheme is a money transfer scheme by the Reserve Bank of India for Indian residents. The scheme allows Indian residents to send up to $ 250000 outside India in a given financial year. The scheme cannot be used by corporates, partnership firms, trusts, etc. Under the scheme, you can remit money In any freely convertible foreign currency to make several capital account transactions like purchasing property abroad, investing in shares and mutual funds overseas, extending NRI loans, etc. - Who is the remitter?

Remitter is the party that sends funds in a transaction. The remitter, which can be an individual or a business organization, initiates the remittance transaction with the receiving party. - What is the difference between remittance and payment?

Remittance can be used for a payment towards a bill or an invoice. However, it is most commonly used for a money transfer made internationally to friends and family living in the remitter’s home country. - What details do you need for remittance?

If you remit funds through a bank, you will have to give the recipient’s bank name and bank account number. To avoid giving your bank details to receive funds via remittance, you can receive payment in your virtual account with the money transfer service provider by giving its virtual account number. Once you receive the payment, you can transfer this money to your local bank account. - What are the types of remittances in banking?

The various types of remittances in banking are:- Remittance via demand drafts

- Remittance via checks

- Remittance via wire transfers

- Remittance via electronic funds transfers

- What is remittance advice?

Remittance advice is proof of payment sent by one business entity to another as proof of payment against an invoice. It provides additional clarity and security to the customer and the supplier about invoice processing. - What is the difference between a bank remittance and a bank transfer?

While bank remittance refers to funds sent from one entity to another, bank transfer usually refers to sending funds from one account to another for the same entity.

Conclusion

Remittance is a fund transfer process most commonly used by people working overseas to send money back home. It can also be used for business transactions like payment of invoices and bills.

The remittance industry has shown encouraging digital transformation by using technology and innovation. Online digital platforms and mobile applications are steadily reducing cost, time, and friction in remittances and increasing convenience, security, and transparency in international fund transfers.

Although remittance can be cumbersome, with Instarem, a leading international fund transfer service provider, you can seamlessly send money to India and other destinations through a fast* and simple process with affordable# exchange rates and fees to more than 60 countries.

Try Instarem for your next transfer by downloading the app or sign up here.

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

*Fast – 75% of our transactions are completed in 15 minutes. Depending on funding method.

#When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.