Wise vs Revolut: Which to choose? [2025 Review]

This article covers:

- Wise and Revolut: An overview

- Wise vs Revolut: Rating comparison

- Wise vs Revolut: Main features

- Wise vs Revolut: Pricing structure

- Wise vs Revolut: Exchange rates

- Wise vs Revolut: Supported countries

- Wise vs Revolut: Global reach

- Wise vs Revolut: Pros and Cons

- Final Thoughts: Who’s The Winner?

- Frequently Asked Questions

Both originating from the UK, Wise and Revolut have become popular platforms for getting money moving. Many have switched from traditional banks to using them for global payments, transactions, and everything bank services-related.

Though both offer excellent services, determining the best between Wise vs Revolut requires several considerations. You’ll need to know which provides greater flexibility, lower fees, more favourable exchange rates, the list goes on.

That’s why we’re here to compare Wise and Revolut—so that you can land on one that best suits your needs.

Read on to learn more.

Wise and Revolut: An overview

Going through an overview of Wise and Revolut helps you to gain a glimpse into their company profiles. This further allows you to assess which one provides the best services catering to your needs.

Wise

Wise, previously TransferWise, is a fintech company specialising in global payments. It’s an easy-to-use platform, equipped with intuitive features for cross-border transfers to 80+ countries in 50+ currencies.

What people love most about Wise is its low-cost fees and zero exchange rate markups. So the profit is entirely derived from transfer fees, which start from 0.4% and may increase depending on the currency involved and when payments are made with debit/credit cards.

Realising that people have different needs when it comes to using a remittance service, Wise launched three different products: Wise Account, Wise Business, and Wise Platform. This way, Wise can remain to be the top-of-mind choice, whatever the type of transaction is.

Revolut

Revolut is a neobank providing a broad range of banking services. With Revolut, not only are users able to make global payments to 150+ countries in 50+ currencies, but they can also enjoy features like cryptocurrency exchange, joint accounts, saving vaults, and more.

Its versatility isn’t the only factor that makes Revolut a preferred payment platform. Users can also benefit from its competitive pricing structure, as they can make fee-free payments up to a certain limit with no additional exchange rate surcharges during market hours.

And there’s more of Revolut as personal users can choose between plans, sign up to Revolut Business to accommodate business needs or register to Revolut <18 designed for minors who need guardians.

Wise vs Revolut: Rating comparison

Wise and Revolut have the same ratings on Trustpilot. This shows they’re equal opponents, and you may need to look past the ratings to decide which one is best for you.

Wise Rating

Revolut Rating

Wise vs Revolut: Main features

Given the tie in Wise vs Revolut’s ratings, comparing the main features they provide can help you decide which is best for you.

Let’s take a look at them in the following:

Wise’s features

Designed as a cross-border payment solution, Wise’s features are tailored to facilitate ease of transactions, whether it’s for sending and receiving money or to spend in countries around the world. With this goal in mind, users are provided with the following features:

Wise Money Transfer

Ever since Wise was still known by its TransferWise moniker, money transfer has been its mainstay feature. This feature allows users to make direct payments to 80+ countries in 50+ currencies at a low cost and reliable speed.

The fees incurred are significantly lower than when using traditional banks. You’ll only be charged around 0.25% of transfer fees –subject to changes if you’re sending to less popular currencies or using card payments– and no hidden fees on exchange rate markups.

Additionally, the time it takes for the money to be delivered to the recipient is reliable. For some currencies, you may even choose fast transfer for more immediate delivery. However, choosing this option will incur higher transfer fees on your end.

Account Details

Despite being popular for its direct bank transfers, Wise also supports in-app money receiving via its account details feature. Using account details, users can receive money in 12 currencies, including AUD, CAD, EUR, GBP, NZD, MYR, PLN, SGD, USD, RON, HUF, and TRY.

Multicurrency Account

As Wise progresses beyond just sending or receiving money, it’s now providing a multicurrency account feature. With this feature, you can store money in 50+ currencies to send to others or convert between currencies in seconds.

This is especially beneficial if you frequently use certain foreign currency. You can leave behind the hassles of exchanging money in banks or physical money changers, which often charge higher, less transparent fees.

Direct Debit

Paying bills on time can be a mundane task that we frequently overlook. This is why Wise offers a direct debit capability, in which users agree to allow service providers to withdraw their Wise balances when the payments are due.

Wise Cards

The fact that global transactions aren’t just about sending or receiving money, Wise comes with its Wise Cards –available in physical and digital forms. Using Wise Cards, users can transact with online or offline global merchants and withdraw cash overseas at more competitive exchange rates.

Part of the process of using Wise Cards involves topping up the balance, which incurs small transaction fees. Users can then use the cards without incurring any additional fees as they’ve been charged previously.

Jars

The ease of transactions that Wise provides might influence users to spend carelessly. For this reason, Wise comes with its jars feature that allows users to set aside their budget for certain necessities, such as bills, emergency funds, digital subscriptions, and more.

(Optional) Wise Business

The features mentioned beforehand are designed for Wise Personal accounts. In cases where users need more advanced, enterprise-friendly payment features, Wise has them covered with Wise Business.

Wise Business users have access to the same features as Wise Personal. The difference is that Wise Business enables account holders to make batch payments to up to 1,000 accounts, grants team members access to physical and digital cards, pays invoices, integrates Wise with accounting software, and much more.

Revolut’s features

Unlike Wise, which focuses on low-cost international transfers, Revolut caters to wider finance needs, with its main strength lying in its multicurrency cards. But this does not exclude other features, which are explained below:

Revolut Card

Being the main feature offered by Revolut, Revolut cards provide ease of transactions when travelling abroad. Users can choose between the available plans –Standard, Plus, Premium, Metal, and Ultra– and spend in overseas merchants or withdraw cash more affordably.

Not only can users save more on exchange rates when spending abroad, but they’re also eligible for extra benefits that vary depending on the chosen plan. These include travel insurance, airport lounge access, accommodation cashback, and more.

So when it comes to comparing the Wise card vs Revolut card, the first offers more savings to use abroad, while the latter gives more convenience and extra benefits tailored to travel needs.

International Transfer

Given that global transfers have become the norm, Revolut offers a seamless international transfer feature. This feature allows users to send money to 150+ countries in 30+ currencies with a few clicks.

The transfers made are also fee-free up to a certain amount per month. Only after exceeding the limit are users charged 0.5% of the fair usage fee. But this highly depends on the chosen plan, as higher-tier plans have no fair usage fee, allowing users to make fee-free transfers without limits.

Payments

Almost everything has transitioned to digital, and this includes payments we make every day. With Revolut, users can easily make and receive payments via chat, split the bills seamlessly, and send extra special money gifts to loved ones.

However, this feature is only available for use between Revolut users. This means that payments to unregistered users can only be made via international transfer.

Joint Account

Sharing income for daily necessities is made easier with Revolut’s joint account feature. This feature allows users to easily contribute to a shared balance with their partner, friend, or parent while also tracking their spending together.

Users may also obtain a physical card linked to their joint account, enhancing the convenience of daily spending for shared needs.

Saving Vault

Aside from the versatile payment cards, Revolut also makes an attractive platform due to its saving vault feature. With this feature, users can save their money in 25+ currencies and earn up to 3.5% interest rates.

Investment Portfolio

Earning more out of your money is made possible with Revolut’s investment portfolio feature. Choose between the instruments that suit you best, whether it’s cryptocurrencies, stocks, or commodities.

Multicurrency Account (Available on Revolut Business Account)

With more and more businesses operating in more than one country, Revolut provides a multicurrency account that Revolut Business users can use. This feature enables users to divide expenses incurred in multiple currencies, resulting in enhanced transparency.

Though it’s only available for Revolut Business accounts, Revolut Personal users also have access to similar multicurrency capabilities. Unlike Wise, Revolut encourages users to store their multicurrency balances in Revolut cards, which they can then use in the same way Wise does.

Wise vs Revolut: Pricing structure

When it comes to pricing structure, there are differences to highlight between Wise and Revolut. Wise, claiming to be a low-cost international payment platform, prioritises competitive exchange rates and transparent fees. While Revolut may or may not incur higher fees, depending on how you use it.

We’ll break down their pricing structures below:

Wise

Opening a Wise account is free and the transfer fees start as low as 0.25% of the total value. Other factors, like the destination currency or payment method, may influence the fees. They’re likely to be higher when the currency is less popular or when users pay with cards.

For ATM withdrawals using Wise cards, users are entitled to 2 fee-free withdrawals per calendar month. Wise will charge fixed and variable fees on the 3rd withdrawal onwards, depending on the amount and currency withdrawn.

Nonetheless, Wise is always transparent about its pricing structure. Check fees for sending money overseas, as well as the Wise card pricing scheme, to find out how much fees are charged to make international transfers or to cash abroad.

Revolut

Though using Revolut can be as affordable as using Wise, it has more variables that affect its pricing structure. What are those? We’ll explain below:

Plans

Revolut has a total of 5 plans: Standard, Plus, Premium, Metal, and Ultra.

Each plan incurs different fees for services, international transfers, and ATM withdrawals.

Standard | Plus | Premium | Metal | Ultra | |

Service Fee | Free | £3.99/month | £7.99/month | £14.99/month | £45/month |

International transfers | Fee-free for the first £1,000 limit per month. Once the limit has been reached, a 1% fair usage fee will apply. | Fee-free for the first £3,000 limit per month. Once the limit has been reached, a 1% fair usage fee will apply. | No fair usage fee. | No fair usage fee. | No fair usage fee. |

ATM withdrawals | Fee-free for £200 or 5 withdrawals. A 2% fee applies when the limit has been reached. | Fee-free for £200 withdrawals. A 2% fee applies when the limit has been reached. | Fee-free for £400 withdrawal. A 2% fee applies when the limit has been reached. | Fee-free for £800 withdrawal per month. A 2% fee applies when the limit has been reached. | Fee-free for £2,000 withdrawal per month. A 2% fee applies when the limit has been reached. |

Transaction Time

Aside from the fees associated with the chosen plan, Revolut charges an additional 1% exchange fee for transactions made outside of market hours or during the weekends. This surcharge applies regardless of whether you have reached the fee-free limit or not.

Wise vs Revolut: Exchange rates

When it comes to sending money to a foreign currency, both Wise and Revolut have their exchange rate structures. Wonder which is more favourable? Take a look at the breakdown below:

Wise

When it comes to exchanging foreign currency, Wise uses mid-market exchange rates, anytime users transact, and without hidden markups. This means the only way they profit is through their transfer fees, making it a low-cost platform for budget-conscious users.

More interestingly, Wise locks in the rates for the next 48 hours after users make their transactions. This capability ensures the recipient receives the same amount as sent by the sender, even when there’s any delay, as long as it remains within the 48-hour window.

Revolut

Similar to Wise, Revolut also uses interbank rates when foreign currencies are involved. This means they impose no hidden markups on the exchange rates, as long as the transactions are made within the market hours.

Transactions made after market hours or over the weekends, on the other hand, will incur a 1% surcharge. This is why users are advised to make payments during market hours or to schedule payments to avoid additional fees.

Wise vs Revolut: Supported countries

After considering the features, fees, and exchange rates, have you settled on either Wise or Revolut? Wait a minute, you still need to confirm whether or not your preferred global payment platform supports your country.

A list of countries supported by Wise

Almost all countries around the globe are supported by Wise. However, an exception applies to certain countries where users can’t open or log in to Wise accounts. The countries include:

- Afghanistan

- Belarus

- Burundi

- Central African Republic

- Chad

- Congo

- Democratic Republic of the Congo

- Cuba

- Region of Crimea

- Eritrea

- Iran

- Iraq

- North Korea

- Libya

- Myanmar

- Somalia

- Republic of South Sudan

- Russia

- Sudan

- Syria

- Yemen

- Venezuela

- Ukraine regions: Donetsk, Luhansk, Kherson, Zaporizhzhia

A list of countries supported by Revolut

Revolut’s global coverage is quite extensive, making financial management and international transfers convenient for users from the following countries:

- Belgium

- Bulgaria

- Czechia

- Denmark

- Cyprus

- Latvia

- Lithuania

- Luxembourg

- Spain

- France

- Croatia

- Italy

- Poland

- Portugal

- Romania

- Slovenia

- Hungary

- Malta

- Netherlands

- Austria

- Iceland

- Liechtenstein

- Norway

- Slovakia

- Finland

- Sweden

- Germany

- Estonia

- Ireland

- Greece

- Australia

- New Zealand

- Singapore

- Japan

- Brazil

- Switzerland

- United Kingdom

- United States of America

Wise vs Revolut: Global reach

In addition to considering whether or not your country is supported by Wise or Revolut, another thing to think about is their global reach. This is especially important if you need to send money to less popular countries or currencies.

Wise’s global reach

Being a low-cost global payment solution, Wise supports international transfers to 80+ countries in 50+ currencies. Even if the country you intend to send to isn’t on the list, you can still make payments in GBP, EUR, or USD.

Revolut’s global reach

As a payment solution catering to wider finance needs, Revolut also supports overseas payments to 150+ countries in 50+ currencies. This means you can send it almost anywhere around the globe.

However, an exception applies to certain countries, including:

- Afghanistan

- Algeria

- Angola

- Belarus

- Burkina Faso

- Burundi

- Cambodia

- Central African Republic

- Congo

- Democratic Republic of the Congo

- Crimea

- Cuba

- Côte d’Ivoire

- Egypt

- Eritrea

- Guinea

- Guinea-Bissau

- Guyana

- Haiti

- Iran

- Iraq

- North Korea

- Laos

- Lebanon

- Libya

- Myanmar

- Nigeria

- Pakistan

- Palestinian Territory (Occupied)

- Panama

- Russian Federation

- Sierra Leone

- Somalia

- South Sudan

- Sudan

- Swaziland

- Syrian Arab RepublicTrinidad and Tobago

- Tunisia

- Uganda

- Vanuatu

- Venezuela

- Yemen

- Zimbabwe

- Ukrainian Territory: Luhansk, Donetsk, Zaporizhzhia, and Kherson

Wise vs Revolut: Pros and Cons

Just like nothing is perfect, so are Wise and Revolut. With their excellence, some downsides come along. Your task now is to decide which option has the benefits you’re looking for in a payment solution.

Wise

Pros:

- Low-cost transfers: Transferring money overseas with Wise is affordable as you’ll only be charged starting from 0.4% of the transfer value.

- Widely supported among countries around the globe: You can sign up and start making transactions with Wise from almost anywhere in the world.

- No exchange rate markups: Sending money to foreign currencies incurs no exchange rate markups, as Wise uses mid-market rates anytime you transact.

Cons:

- Fewer countries to send money to: Compared to Revolut, Wise has less reach of countries you can send money to.

- Has limited in-app features: As it focuses on providing low-cost transfers, Wise’s in-app features are mainly designed to send, receive, or store money.

- Fewer benefits on Wise Cards: Wise cards are designed to help users save on exchange rates without offering further benefits.

Revolut

Pros:

- Fee-free payments up to a certain limit: Sending money with Revolut is affordable, and even free if the amount stays below the monthly limit.

- Broader global reach: Revolut supports transfers to 150+ countries in 30+ currencies.

- More benefits from using the cards: Aside from allowing users to save on exchange rates, Revolut gives added benefits from using the cards, such as travel insurance, airport lounge access, accommodation cashback, and more.

Cons:

- Exchange rate surcharges during the after-hours: Making transactions with Revolut outside of the market hours or during the weekends incurs an additional 1% exchange rate surcharge.

- Some plans incur monthly fees: Certain plans offered by Revolut incur monthly fees that start from £3.99/month to £45/month.

- Higher fees on larger transfers: Despite offering fee-free transfers up to a certain limit, the fees can go even higher than Wise’s once you’ve reached the limit.

Final Thoughts: Who’s The Winner?

Deciding on the winner between Wise and Revolut is entirely personal. One may benefit from the low-cost and no exchange rate markups offered by Wise and the others may be looking for a more versatile finance management app like Revolut.

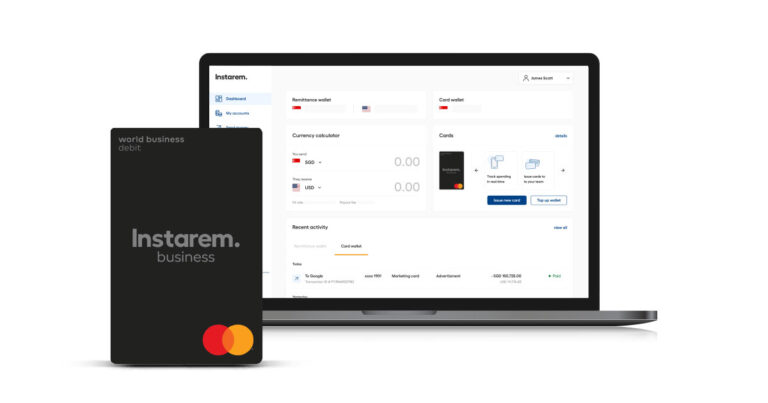

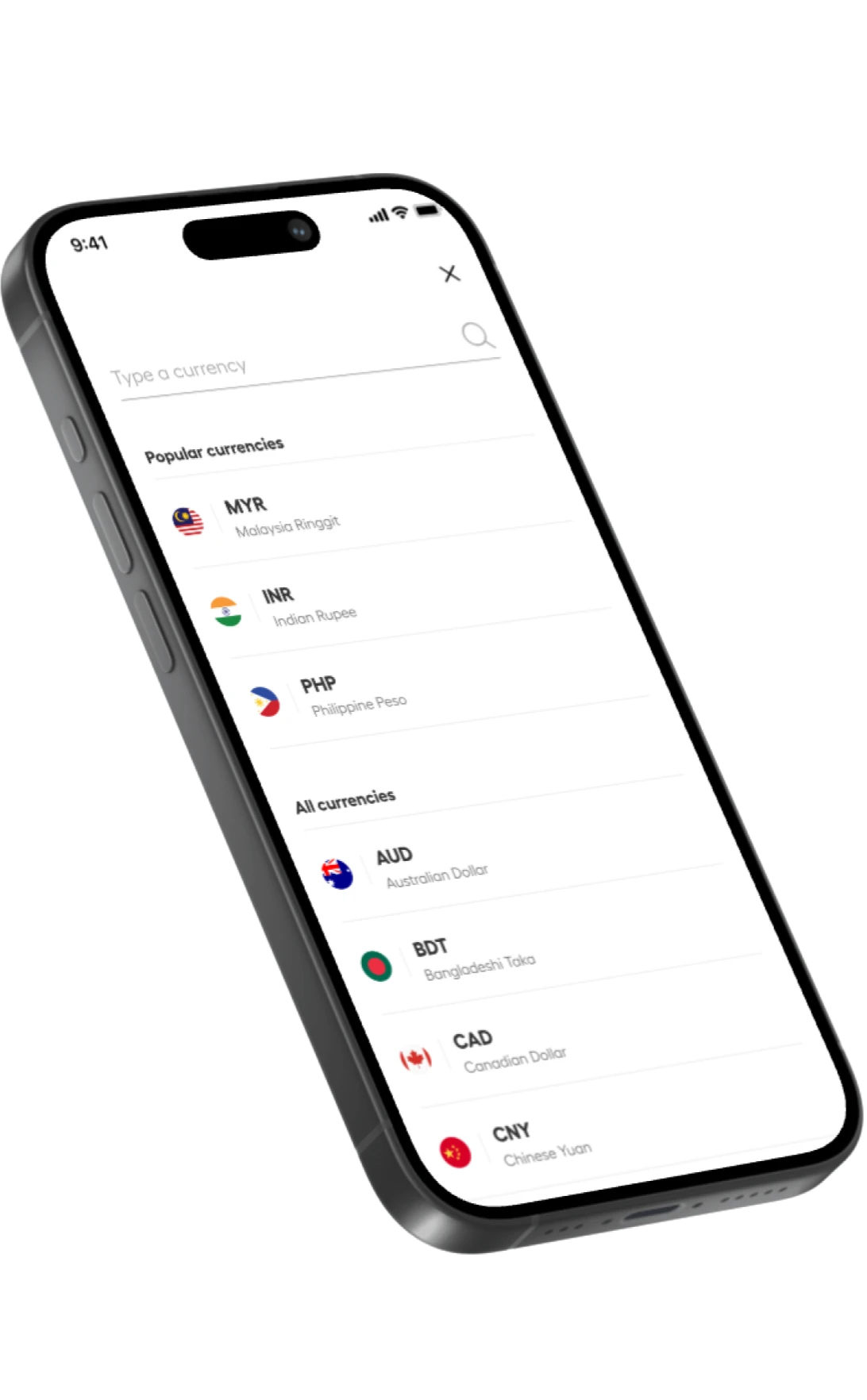

So it’s beyond our scope to determine who’s the winner between the two. But if you ask for an alternative, we’d gladly introduce you to Instarem.

Instarem is a worth-noting global payment platform that eases the process of sending and receiving money in multiple currencies. The fees are also affordable, much lower than traditional banks, making it a top choice for cost-conscious individuals.

And, it also comes with an amaze card, which allows for similarly low-cost overseas merchant transactions such as Wise and Revolut.

Wonder how Instarem works? Experience the convenience by yourself – Download the app or sign up today!

Frequently Asked Questions

Is Wise better than Revolut?

Wise may or may not be better than Revolut, as it highly depends on what you’re looking for in a payment solution. If you’re looking for a low-cost platform, then Wise is the right suit. Otherwise, if you need more versatile capabilities, then you may consider Revolut instead.

Revolut versus Wise, which one’s more affordable?

When it comes to affordability, Wise wins. This is because its fees are low and consistent, with no exchange rate markups applied regardless of market hours.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products.