This article covers:

Have you heard about the latest developments in the fintech industry? Some experts are referring to it as the ‘fintech winter,’ which has been influenced by factors like high inflation and rising interest rates, resulting in company valuations taking a hit and industry-wide layoffs.

However, amidst these challenges, there’s a silver lining of hope. Certain companies are spotting opportunities amidst the chaos. Startups are boldly emerging in the pre-seed and seed stages, actively seeking out the best talent available. They are offering leadership roles to capable candidates, redefining the job market, and capitalizing on the pool of skilled professionals affected by the current crisis.

If you happen to have a good handle on the technical competencies required for a career in this cutting-edge field, you’re in luck – because not only are you now highly employable, but the job opportunities available to you are practically endless.

And while certain senior-level positions may also call for a handful of soft skills to boot (hello, leadership, problem-solving, critical thinking, and relationship management), smart and savvy candidates can rest assured that these additional qualifications only serve to make them that much more attractive to potential employers.

So, here are the top paying jobs in fintech along with their average salaries.

Take note, these salaries are averages and factors like experience and location can come into play, but that doesn’t mean you can’t aim for the stars!

With the constantly evolving fintech industry, these in-demand positions may change over time, so keep your eye on the prize and see where your career in fintech can take you.

Data Scientist

Skills Required: Bachelor’s or Master’s degree in mathematics, statistics, computer science, or a related field. Proficiency in advanced statistical modelling tools, programming, mathematics, and statistics is necessary.

Average Salary: Up to $152,000 USD per year

Data scientists are the superheroes of the digital age! They have the unique ability to solve the most complex of problems using their technical skills, creativity, and sheer curiosity.

With the explosion of data being generated every moment, data-driven decision-making has become critical to stay ahead of the competition. This is where our data scientists come in – they are a precious resource with the analytical and technical skills necessary to mine valuable insights from vast swathes of data.

By building predictive models and anticipating future trends, they enable businesses to become more proactive and gain a significant competitive edge.

Product Manager

Skills Required: Bachelor’s or Master’s degree in product management, promotional skills, organizational skills, and related technical expertise.

Responsibilities include: Understanding user needs, monitoring competitive trends, defining product vision, prioritizing features, and working with stakeholders.

Average Salary: Up to $146,000 USD per year (in Silicon Valley)

Imagine the incredible impact a product manager can have on your daily life, like making your binge-watching experience on Netflix even better! Ever noticed that “skip intro” button when you’re engrossed in your favourite series?

Well, you can thank a product manager for that! They’re the magicians who understand your desire to dive right into the action, making sure you can skip those intros effortlessly. It’s these ingenious product managers who listen to your needs, streamline the user experience, and deliver features that bring a smile to your face every time you press that magical “skip intro” button.

With their visionary skills and customer-centric approach, they transform simple moments into pure joy!

Cybersecurity Analyst

Skills Required: Proficiency in digital communication, incident investigation, governance, risk management, compliance, virtualization, technology-specific skills, and analytical capabilities.

The job involves: Vulnerability testing, security access monitoring, audits, breach identification, and more.

Average Salary: Up to $106,000 USD per year with CISP Certification

As a cybersecurity analyst, you’ll be like a secret agent protecting computers and the internet from tricky bad guys.

You know how we lock our doors to keep our rooms safe? Well, you’ll do something similar, but for computers. You’ll use special skills and tools to make sure cybercriminals will not break into your digital stuff.

Imagine you’re a detective searching for clues. That’s what you’ll do – find sneaky signs that show if someone is trying to be naughty with your computers. But don’t worry, you’re super smart and well-trained to catch them before they can do any harm.

You’ll also help make computers even stronger by fixing any weak spots. You’ll keep the digital world safe and sound for all of us to use.

With more and more cyberattacks happening all around the world, your skills will be in big demand.

Blockchain Developer

Skills Required: Proficiency in programming languages such as C++, Java, and blockchain-specific skills like Solidity, Ripple, and Hyperledger Fabric.

Responsibilities include: Developing and optimizing blockchain protocols, managing frontend or backend development, monitoring smart contracts, and handling centralized or decentralized data.

Average Salary: Up to $102,000 USD per year

Imagine possessing a super-secure, magical notebook where everyone can share information but absolutely no one can alter the written data.

This is actually what a blockchain developer works on building and designing. They create decentralized applications (dApps) and smart contracts based on blockchain technology while comprehending its architecture and protocols. They develop 3D models, designs, and content such as those used in games. It’s exciting to know that once a piece of information is written on the blockchain, it’s there forever, and no one can erase or change it.

A blockchain developer works in tandem with others to ensure that it remains shielded from anyone who might try to tamper with it. With their specialized codes and encryption techniques, rest assured, it remains safeguarded from any prying eyes.

Blockchain technology is immensely fascinating, and the people who develop it are the real wizards of our digital world.

App Developer

Skills Required: Analytical skills, understanding of databases, JavaScript, machine learning, deep learning, AI, and programming languages like Python, Java, C++, etc.

Responsibilities include: Understanding client app requirements, designing prototypes, writing high-quality source codes, testing and troubleshooting apps, and more.

Average Salary: Up to USD $87,000 per year

Nowadays, there’s an app for nearly everything we need. From staying organized to learning new things, mobile app developers are the talented minds behind all of this tech marvel. They use their coding skills and creativity to turn amazing ideas into real-life apps on our smartphones and tablets.

These app developers are like digital architects, carefully crafting visually appealing and user-friendly apps with cool graphics and sounds. But what’s even more awesome is that they never stop exploring. They’re always on the lookout for ways to make their apps even better, continuously improving the experience for all of us.

And if something goes wonky, they’re quick to fix it with their technical expertise.

Financial Analyst

Skills Required: Bachelor’s degree in Accounting, Economics, Finance, Mathematics, Statistics, along with CFA certification.

The job involves: Tracking the company’s financial performance, analysing market conditions, making strategic decisions, and creating forecasts and models.

Average Salary: Up to USD $87,000 per year

Despite the Fintech winter, the demand for financial analysts is soaring higher than ever before.

These experts are essential for the growth and success of fintech start-ups. They play a crucial role in managing and analysing the company’s finances, helping to make smart decisions and reduce costs. From budgeting and financial reports to forecasting future revenues and market trends, financial analysts are the backbone of the financial side of these companies.

But their impact goes beyond that. Firms also rely on their expertise for advice on matters like stock splits and bond issues. Additionally, they help develop pricing strategies that keep companies competitive and appealing to their customers.

Overall, financial analysts are vital players in the fintech world. They ensure that companies comply with financial laws and regulations while also charting a course for long-term growth and success. With their skills and knowledge, they contribute significantly to the success and stability of the fintech industry.

Looking for an exciting career in fintech but don’t see your ideal job listed?

The reality is you’re not limited to the jobs listed here.

With a range of fastest-growing skills needed, such as operations, artificial intelligence, customer experience, cyber security, and fundraising, the opportunities are endless.

However, if you have your sights set on becoming an expat, it’s important to give yourself the best chance of success.

Consider studying courses that have high job demands in your desired location. This will give you an extra advantage when you arrive, ready to embark on your next adventure.

With certifications and qualifications under your belt, you’ll be ready to take on whatever challenges come your way!

PS: When you make that big move, you’re sure to have plenty of thrills (and maybe even a few spills) along the way. Just don’t forget to stash some cash in that emergency fund before you jet off – you never know what adventures await.

Before you go…

Have you ever dreamt of relocating to a new country with a fintech job in hand? Well, it’s time to make that dream a reality. But before you embark on your exciting new adventure, don’t forget to speak on the importance of an emergency fund. It’s the safety net that will keep you afloat during unforeseen circumstances.

And as an expat, you need to keep the money flowing overseas with ease.

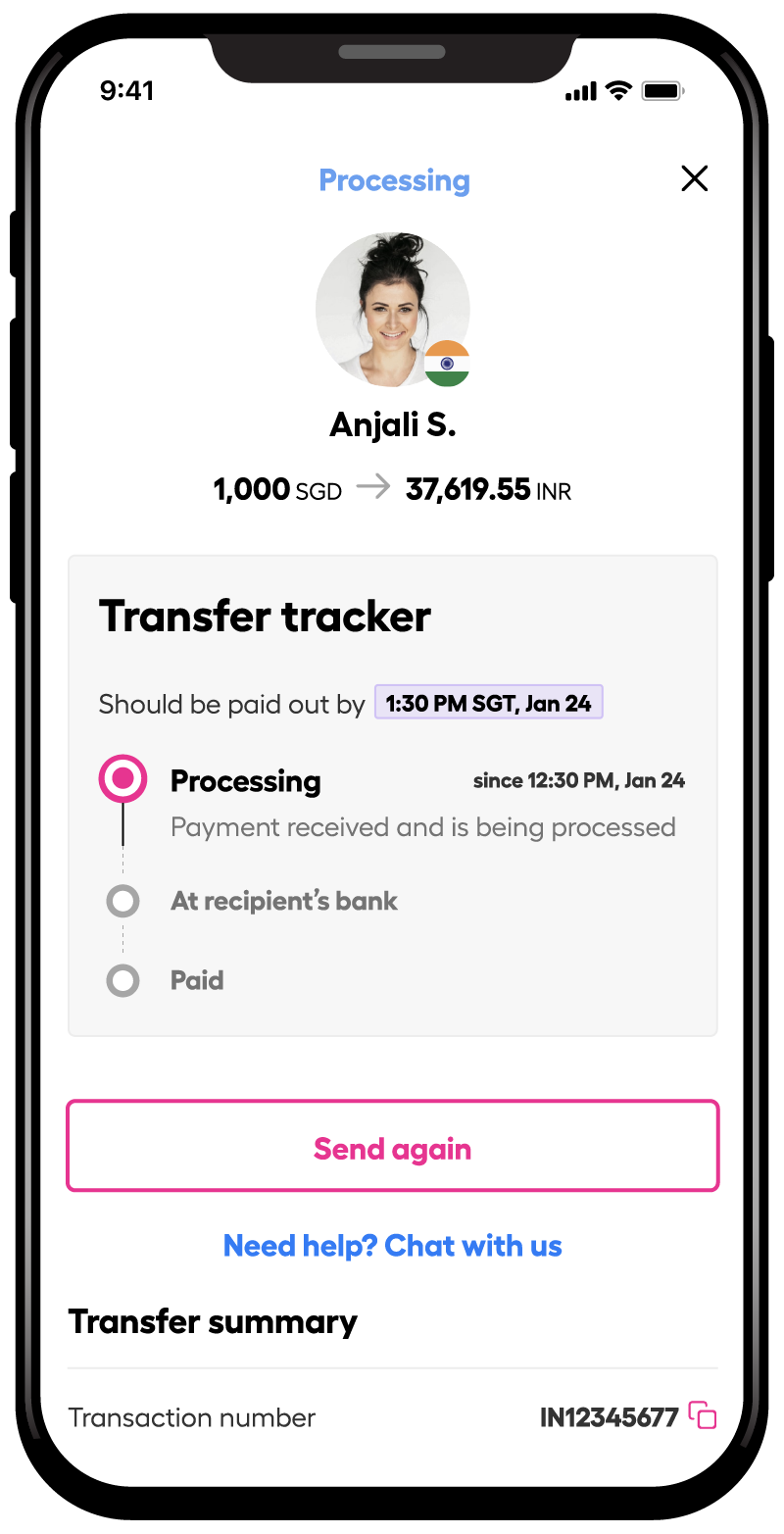

That’s where Instarem comes in.

With Instarem, you can transfer money quickly and securely without all the extra fees.

So, get ready to take the world by storm with your new fintech job and a reliable way to send money overseas. Your future is bright and prosperous, and Instarem is here to make sure it stays that way.

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.