The 5 most in-demand skills in the FinTech industry

This article covers:

What Is FinTech?

In its simplest form, fintech (financial technology) can be defined as the use of technology to improve financial services. This includes robo-advisory and asset management firms, online lenders, online banks, peer-to-peer lending platforms, mobile payment firms, and online remittance firms.

Fintech start-ups are changing the way we bank, invest, and pay for things. They’re making financial services more efficient, accessible, and affordable for everyone.

The fintech revolution has been fueled by advances in technology, which have allowed start-ups to create innovative new products and services.

These products have made it easier and cheaper for people to access financial services, and have also made it possible for businesses to operate more efficiently.

The fintech sector is still relatively in its early stages, and there is no telling what the future will hold. But one thing is certain: fintech is here to stay.

Trends in the fintech industry

The fintech sector has come a long way in a short period of time. Just a decade ago, the industry was relatively small and unknown.

The fintech sector has attracted billions of dollars in investment and spawning hundreds of new companies. According to the Robert Walters Fintech Talent Report 2022, the total investment worldwide has seen an increase of up to 87% from 2010 to 2021.

Advertised jobs in fintech firms have also seen an increase of 176% in 2021.

UPDATE: As of June 2022, fintech winter has arrived – it looks like the fintech industry is going through yet another down period. According to research firm CB Insights, there was an 18% drop in fintech funding between the last quarter of 2021 and the first of 2022.

Several major companies have announced hiring freezes and layoffs, and job growth in the sector has slowed significantly.

While this may seem like bad news for the fintech industry, it’s important to remember that the industry has been through downturns before and always managed to bounce back.

So, while the fintech sector may be down now, it’s only a matter of time before the industry starts to pick up again.

Fintech professionals & in-demand skills

According to Robert Walters Fintech Talent Report 2022, here are the fastest growing skills needed:

- Operations

- Artificial intelligence

- Customer experience

- Cyber security

- Fundraising

Operations

Operation managers are responsible for leading large projects that involve many different parts of the company.

They work to prioritize, develop, and launch new products and features that relate to fintech.

Information is collected and used to build products and help solve problems. These designed solutions, systems and processes will help operations run smoothly.

The results of their efforts will impact all stakeholders in the company, such as legal, operations, compliance and business profits.

Artificial intelligence

Have you ever wondered what artificial intelligence specialists do?

Artificial intelligence specialists help by making machines smarter. They work with data scientists to create models that will help the business. They also keep the company up to date on new technology and ways to use data so the company can be successful.

The models they build will help businesses in a lot of different areas. These include personalization for sales and marketing, chatbots, detecting fraud, and preventing money laundering.

Customer experience

Fintech customer service representatives are the front line of defence when it comes to customer experience. They are responsible for handling customer inquiries and concerns, as well as providing guidance on using fintech products and services.

While customer service in any industry can be challenging, fintech customer service reps face unique challenges due to the constantly changing landscape of the industry. They must be able to quickly adapt to new technologies and processes, as well as keep up with the latest changes in regulations.

In addition, they need to be able to build rapport with customers and resolve conflicts effectively.

Don’t underestimate feedback from customers.

Customer experience professionals can use this valuable feedback to support the design of user-friendly interfaces, develop customer service strategies, and conduct user research.

By paying close attention to customer feedback, businesses can ensure that they are meeting the needs of their customers and providing a positive customer experience.

Cyber security

As fintech companies store large amounts of data, they are a prime target for cyber-attacks. Cybersecurity professionals work to protect customer data and prevent hackers from accessing sensitive information.

Cyber security skillsets are often divided into three categories: technical, management, and operational.

Technical skillsets involve understanding and using technologies to secure information systems. This can include everything from working with firewalls to developing encryption algorithms.

Management skillsets involve developing and implementing policies and procedures to protect information systems. This can include everything from creating incident response plans to managing user access control lists.

Operational skillsets involve monitoring and responding to security threats.

This can include everything from conducting penetration tests to analysing log files.

Each of these skill sets is important in its own right. But together, they form the foundation of a strong cyber security program.

Fundraising

Fintech start-ups need to raise capital to grow and scale their businesses. Fundraising professionals work with investors to secure funding.

To stand out in the highly competitive fintech fundraising space, fundraising specialists need a well-designed deck and impressive data visualisations. But fundraising isn’t just about looking good on paper – you also need to be able to communicate your vision and pitch effectively.

To be successful in this role, fundraising specialists need excellent communication and interpersonal skills. They must be able to build relationships with potential donors and explain the importance of their work compellingly.

In addition, fundraising specialists must be well-organized and detail-oriented, as they are often responsible for managing multiple campaigns at once.

Fintech is a rapidly growing industry with plenty of opportunity for those who have the right skills

If you’re looking to start or further your career in fintech, be sure to brush up on these in-demand skills.

And if you have secured a fintech job, don’t forget to use Instarem to help you manage your money when you relocate overseas.

Here are a couple of reasons to consider Instarem:

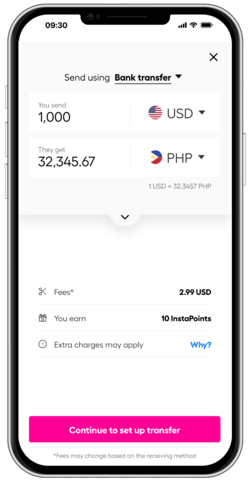

Cost-effective

Low transfer fees enable you to send money to multiple destinations without burning a hole in your pocket.

Easy and fast

Transferring money to other countries is typically an instant transaction.

Earn loyalty points

You will be rewarded with loyalty points which are referred to as ‘InstaPoints’ for every transaction and referral you make via Instarem. You will then be able to redeem your points and get great discounts for future transactions. Remember, the more you transfer, the more you earn!

Transparency

Absolutely no hidden costs. You will be in the know of the exact rates and fees applied to your money transfer.

*rates are for display purposes only.

Try Instarem for your next transfer.

Download the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.