A Comprehensive Debt Management Guide For Expats

This article covers:

Moving to another country can be one of the most exciting and rewarding experiences of a person’s life. Those who have never lived in a foreign country often assume that living the expat life is all fun, games and glory. Most expats will tell you that the first reaction to their proposed move abroad from most people is starry-eyed excitement – “Wow, you’re so lucky!”.

What most people (soon-to-be expats and non-expats alike) don’t realise is that expats often struggle with crippling debt while leaving their home country and settling in a foreign country. Financial repercussions aside, debt can also have adverse psychological and physical effects on an expat. If they are struggling with debt, they need to find ways to effectively manage it in the short-term and eliminate – or at least minimise it – in the long term.

Fortunately, there are some techniques that expats can use to manage their overseas debt. In this article, we provide two types of insights:

In Part 1, we provide some information on what an expat can do to avoid overseas debt in the first place.

If you are already in debt? Don’t panic. Part 2 of this article will give you some information on how to manage your existing debt so it doesn’t overwhelm you in your new expat life.

Part 1 – How To AVOID Overseas Debt

The proverb, ‘Prevention is better than cure’ couldn’t be truer than in this context. If you are reading this part of the article, congratulations, you have no debt and want to keep it that way!

So what are some of the actions you can take to avoid falling into the debt trap while abroad?

1. Plan Your Finances Before You Leave Your Home Country

This may seem like an obvious piece of advice, but amazingly, it is also the most ignored.

If you already have a job lined up and know how much your income is likely to be, preparing a budget should not be very difficult. Use a financial management programme (good old Excel works just fine) to identify expected income and expenses. Needless to say, your income must be greater than your expenses!

Do keep some money aside for emergencies, such as accidents or sudden illnesses, especially if you are not covered by insurance.

The keyword: BUDGET

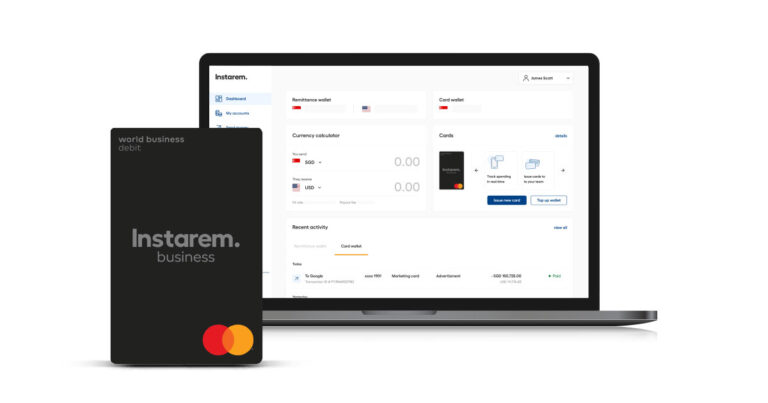

2. Use A Specialised Money Transfer Service To Get Money From Home

If you don’t have a job lined up but plan to look for one after you land, make sure you have enough savings in your home country that you can dip into from your new country. Open a bank account in your new country, and use a low-cost online remittance service like InstaReM to transfer money between your home and adopted country.

InstaReM is cheaper than most banks and offers excellent transfer rates across a number of currencies and countries in Asia, Europe, North America and Oceania.

With InstaReM, you get:

- Zero-Margin FX Rates: Mid-market rates sourced directly from Reuters with absolutely no margins added.

- Best Transfer Amount Guarantee: That’s right! We give you the best transfer amount there can be.

- Nominal transaction fee and no hidden charges: What you see is what you get – no nasty surprises.

- Easy Sign Up, Straightforward Transfers: The service is extremely easy to use. All you have to do is sign up, verify your account, upload the relevant documents and start transacting!

The keyword: SMART CHOICES

3. Save Money & Keep Track Of It

Again, obvious and ignored!

Unless you have a fabulous job or some other source of steady income in your new country, you must save money for the future. You never know when you’ll need it! Don’t splurge on expensive items or holidays that you cannot yet afford. If you are moving to a country with a stronger currency than your home country (for example, India to the USA), it is critical that you save even more. Exchange rate fluctuations can eat into your nest egg and render it empty and useless in no time.

If the bank in your new country gives you the option of transferring some of your money to a free ‘savings’ account, use it! Transfer this money and don’t touch it unless absolutely required. Use the other regular/checking account to pay for your expenses such as food, accommodation, travel, etc.

The keyword: FRUGALITY

4. Buy Insurance

In many situations, travel insurance can save your life and your sanity. If you are moving abroad for a short time only, buy a policy that is valid for the entire duration of your trip. Make sure that it covers emergencies such as loss of passport, illnesses, accidents, etc. Read the fine print to understand the rules and exceptions. And make sure that the insurance covers the country you are travelling to.

If you are travelling for a longer period, research the insurance options in your new country. Some countries allow expats to buy health and car insurance, but not life insurance. Find out what is possible. And again, read the fine print!

The keyword: PROTECTION

Part 2 – How To MANAGE Overseas Debt

Okay, so you’re in debt, and probably panicking about how you can manage it without going losing your sanity.

First things first – understand that undue anxiety will not make the problem go away. Face reality and figure out what you can do, before debt collectors come knocking on your door and take away your remaining choices.

Next, read up for some concrete ideas on what you can do to manage your debt abroad without souring your expat experience forever.

1. Create A Debt Management Plan (DMP) – Preferably With A Professional

Now that you know that ignoring the situation and hoping it will disappear on its own is counter-intuitive, you must map out a clear plan of action. If you can, seek professional advice and have an honest discussion with your advisor about your assets, liabilities, income and expenses. Make a complete list of all your debts: loans, credit card, cash payments, interest rates, miscellaneous expenses, and know the exact value of your total debt.

Prioritise your debts in order of importance, work out the maximum you can afford to repay every month or week, as the case may be, draw up a repayment schedule and stick to it. Regular repayments are critical in order to maintain a healthy credit rating as an expat.

DMP is quite a popular debt solution for Britons who have left Britain more than 3 years ago, and are using a debt management advisor to implement the DMP. The advisor will carry out all negotiations with the expat’s creditors (to reduce the size of the payments, for example) in return for a monthly management fee. One problem with starting a UK DMP is that it will adversely affect the expat’s credit rating. Another debt management option available to expats from England and Wales is the Individual Voluntary Arrangement (IVA). The IVA allows debtors to make regular payments to an ‘insolvency practitioner’, who will then divide and pay out the owed money to creditors.

Once you have created your DMP, make sure it includes information about your creditors. Then if you can, organise to meet with them in person to negotiate smaller payments and a longer payment schedule. Building a relationship with your creditors will build trust, which might help you in the long term, especially if you ever find yourself short on cash and need a reprieve or two.

The keyword: PLANNING

2. Identify Your Spending Patterns & Cut Down On Your Expenses

If you consistently find your expenses exceeding your income, and are using credit cards or personal loans to cover the shortfall, know that this is not a sustainable solution to your continuing financial woes.

As the first step to breaking the vicious cycle, identify all your recurring expenses. Then categorise these expenses into basic, essential and optional. Promise yourself that you will avoid all optional expenses until you have your debt under control.

Step 2 – identify cheaper options for food, transport and accommodation. You may have to make some sacrifices, but remember the end goal – ‘No Debt’. This will help take some of the sting away.

This is also a good time to make a weekly and monthly budget, and stick to it! After you have paid out all your expenses (regular + debt-related), if there is any money left over, save it for the future. And do keep some money aside for emergencies.

The key word: DISCIPLINE

3. Consolidate Your Debt

A debt consolidation plan can be a good option for servicing debt more efficiently. It enables you to combine multiple high-interest debts such as credit cards into a single payment. The payment is usually at a reduced interest rate, and because it consists of one single regular payment, you can untangle the financial mess made by your multiple bills, creditors and interest rates.

To consolidate the debt from multiple credit cards, you can roll all your credit card balances into one 0% interest balance transfer credit card. Shop around for a card that offers an interest-free period. This can save you some interest and also help you in paying off your debt faster.

This is quite a popular option for expats from developed countries like the USA and Australia.

The keyword: MERGE

4. Put Away Your Credit Cards

Plastic can be extremely convenient and user-friendly. Unfortunately, these same qualities also make plastic hazardous to a person’s self-discipline and financial health.

Put away your credit cards, if any of the following points apply to you:

- You are an unemployed expat living on home savings

- You are an employed expat with a low income

- You are an employed expat with a low income and big expenses

Until you have completely paid off the outstanding balance on your existing debt, avoid using your credit card. Pay for your purchases with cash instead of credit. At the same time, identify your spending patterns and cut down your expenses.

The keyword: CREDIT=BAD

5. Use Your Home Savings To Clear Your Expat Debt

In addition to the tips above, you might consider utilising some of your savings back home to pay off the debt in your new country. Don’t transfer money through banks. Banks charge transaction fees and currency conversion fees that can hit your wallet pretty hard over multiple transactions. A low-cost remittance option like InstaReM is ideal for transferring money between countries and currencies.

Keep in mind that if you are moving from a weak currency country to a country with a stronger currency, the exchange rate difference can deplete your home savings account in a very short time. Therefore, using your home savings to pay off new debt should not be your first choice.

The keyword: MONEY TRANSFER

Final Thoughts

Being in debt is never a pleasant experience for anybody. Depending on a number of factors, including the amount owed, type of creditor (regular bank versus unscrupulous money-lender), personal situation, etc., debt can make a person do irrational and sometimes even illegal things. Our advice? DON’T!

In short, running away is not the answer. When it comes to repaying debt as an expat, you must be rational, systematic and disciplined. Debt is not the end of the world, even if it feels like it at the time.