This article covers:

- What are ACH transfers?

- How do ACH transfers work?

- Types of ACH transfers

- ACH Vs Wire transfer

- Making an international ACH payment: step by step

- Benefits of ACH transfers

- ACH transfers for businesses

- ACH transfers for individuals

- Setting up ACH transfers

- ACH transfer: fees and processing time

- ACH payment method Vs. alternative payment methods

- ACH transfers limitations and risks

- Before you go

- Frequently asked questions

If you have ever paid your utility bills directly from your bank account or paid an invoice from the supplier without writing a check, you are probably familiar with ACH or Automated Clearing House.

Instant ACH transfer online is one of the most frequently used methods of transferring money between bank accounts safely and quickly in the United States. Its popularity can be gauged from the fact that more than USD 43 trillion worth of transactions get processed through the ACH transfer system.

However, even though ACH payment is popularly used for fund transfers, many customers and businesses still have questions like, ‘What does ACH payment mean?’ or ‘What is the ACH processing method?’

In this guide, we are going to tell you the ACH meaning and explain how ACH transfers work.

What are ACH transfers?

For starters, ACH full form is Automated Clearing House. The ACH payment meaning can be simply understood as a payment made from one bank account to another through the Automated Clearing House network.

ACH transfers are commonly used for making money payments electronically in the United States.

The most common uses of ACH transfers are to make bill payments like household bills and for direct deposits from employers and government benefit programs. ACH transfers are extremely popular because they are inexpensive and easy to make. Moreover, they are reliable, and often companies use them for bulk payments, like giving salaries.

How do ACH transfers work?

ACH transactions contain data files that have information about the payment to be made. ACH processing consists of several steps: sending the data file to the originator’s bank and ending with transferring the funds to the receiver’s bank account.

Here is the process in detail:

- Step 1: Creating a setup — Before the ACH transaction starts, the ACH originator must ensure that they have the customer’s permission to transfer funds from the customer’s bank account. For this, the customer can give written permission by filling out an authorization form with the bank.

- Step 2: Initiating a transfer — The ACH originator sends the data files to the bank, informing them about the transfer. The bank here is called the ODFI or the Originating Depository Financial Institution. The data file contains crucial information like the nature of the transaction (credit or debit), bank account details, and routing numbers.

- Step 3: Batching the transactions — The ODFI collects the data files it receives and forwards them in batches to the ACH operator. The ACH operator here can either be the Electronic Payments Network (EPN) or the Federal Reserve Bank’s Automated Clearing House (FedACH).

- Step 4: Distributing the data files — The ACH operator sends the data files to the concerned customer’s bank. The customer’s bank is called the Receiving Depository Financial Institution or the RDFI.

- Step 5: Completing the process — On receiving the data file, the RDFI takes out funds from the customer’s bank account. The funds are sent to the originator’s bank account to complete the transaction.

Types of ACH transfers

There are two types of ACH transfers, which differ in their delivery speed and delivery expenses.

- ACH Credit Transfers: The ACH credit transfers request to ‘push’ money online from the requester’s account to accounts at different banks. For example, transfers for payroll or government benefit programs or transfers from the requester’s account to his another account or accounts of friends and family members.

- ACH Debit Transfers: The ACH debit transfers request to ‘pull’ money online into the requester’s account. For example, automatic payment for recurring bills.

ACH Vs Wire transfer

ACH transfers are different from wire transfers, and the two vary based on their processing time and costs. While ACH transfers are usually cheaper than wire transfers, they take a longer processing time.

We have a detailed blog on ACH vs Wire Transfer, but here is a quick ACH/wire transfer comparison for your understanding:

Feature | ACH Transfer | Wire Transfer |

Nature of Payment (Domestic or International) | Usually used for domestic transfers, although it can be used for international transfers too. | Commonly used for both domestic and international transfer through the SWIFT System. |

Cost to Send | Usually 0 to 3 USD | 10 to 50 USD depending on the destination |

Cost to Receive | Usually no charges | It takes around 15 USD to receive international wire transfers |

Processing Time | 1 to 2 business days for domestic transfers | Less than an hour for domestic transfers and 1 to 5 business days for international transfers |

Used to Deduct Money from an Account | Yes | No |

Used to Send Money from an Account | Depends on the bank | Yes |

Used to Deposit Money into an Account | Yes | Yes |

Making an international ACH payment: step by step

You can send an international ACH if your bank has a provision for it. Here is how you can make an international ACH payment from your bank:

- Step 1: Collecting the recipient’s bank details — The exact bank details you require for an international ACH differ for various countries. Usually, you must request the following details from your recipient:

- Their full name, as provided in their bank account.

- Their local bank account number.

- Their routing number

- Their complete address

- Step 2: Logging in to your online banking account — The easiest approach to make an international ACH transfer is through your online banking account. Log into your account and visit the payment area to find the international or global ACH transfer option.

- Step 3: Entering the transaction details — If your bank allows international ACH transfers, you will be guided through the steps to enter the transaction details, like the recipient’s bank details, the amount to be transferred and the recipient’s currency. Some banks allow you to send a message to the recipient and send an email notification informing them of the payment.

- Step 4: Confirming the transaction — Before processing the transfer, confirm all the details you have entered. The bank may also require you to go through a verification process for security reasons. Once you are done with the verification and checking, you can confirm the transaction from your end.

Benefits of ACH transfers

- Convenience: The first benefit of ACH transfers is that it is extremely convenient paying recurring bills, like utility bills and mortgage payments, through ACH, and consumes much less time than writing, mailing, and tracking physical checks.

Automated payments ensure businesses receive the bill payments on time and need not harass the customers with constant follow-ups and reminders. - Lower cost: ACH transfers usually cost much lower than other payment methods. Most ACH transfers are free of charge, or even if there is a fee, it is usually very low.

- Security: ACH transfers are highly secure, and they require validation from the processing center. Moreover, the customer’s checking account history can be obtained to get details for previous transactions and to see if there have been any bounced checks or bogus payments made from the account.

- Lower chances of payment failure: ACH payments are made directly from one bank account to another and have a lower failure rate.

- Reversible: ACH payments are reversible, which makes it possible to track the payment and the paying and receiving parties. It adds to the security and assurance of the transactions.

ACH transfers for businesses

Businesses that want to receive payments via ACH transfer have to follow a few additional steps to accept payments from customers:

Opening a bank account: A business that wants to receive ACH payments must first open a bank account because ACH transfers are carried out from one bank account to another.

Setting up an ACH payment support: The business’s payment processing provider may not have ACH payments as part of the standard payment options. Therefore, the business may have to get ACH added to the payment options. The process of setting up an ACH payment support may vary for different providers.

Getting consent from the customer: Businesses must get a written consent form from the customer that allows them to request ACH payments from the customer’s account as a one-time payment or as recurring payments.

A business can either collect the customer’s bank details and initiate a payment from a customer at their end or request the customer to institute it by providing them with their bank details.

ACH transfers for individuals

Individuals can make ACH transfers through direct payments. For example, if you pay your electricity bill every month with your online bank account, it is an ACH transfer.

Under a direct ACH transfer, an ACH debit shows in the sender’s bank account. It also gives information on the receiver and the amount of fund transfer. The person receiving the money registered it as an ACH credit transfer in their bank account.

Setting up ACH transfers

- Choosing an ACH Service Provider: Choosing the right ACH service provider is the first step to setting up an ACH transfer. While some companies offer ACH transfers as a paid add-on feature, others may provide ACH and credit/debit card processing as a combined package, which comes to be cheaper.

- Understanding Compliance and Security Requirements: There are several security requirements for ACH processing for businesses. These NACHA (National Clearinghouse Association) rules apply to every business that initiates an ACH transfer using a system to create an entry into the ACH network. An ACH originator must take care of all the security requirements and compliance by NACHA to ensure the security of the data files and processing.

- Account Verification and Authorization: The business must verify the account information to ensure that the account is open. Either the customer or the business can verify if there are sufficient funds in the account to make the payment. The customer must also authorize the transfer of funds from their account to the business’s account.

- Integration with Accounting and Payment Systems: The ACH transfer must be integrated with the accounting and payment systems to ensure a smooth transfer of funds. If there are any errors in the transaction or a return code is generated, the system will not process the payment, and the concerned parties will be notified accordingly.

ACH transfer: fees and processing time

- ACH transfer fees: The ACH charges are usually lower than other payment methods. Most ACH transfers are free, and even if the bank charges a fee, it is usually very nominal. For example, while most debit ACH transfers are free, you may have to pay a nominal fee of 3 USD for credit ACH transfers from one bank to another.

- ACH transfer time: The ACH processing time is usually longer than other payment methods, and it may take up to several business days to process an ACH transfer. The primary reason behind this is that ACH payments are processed in batches and not in real-time. A bank may process an ACH transaction between one to two business days. Additionally, the receiving bank may also hold the transaction for a day or two, which adds to the transfer’s processing time.

ACH payment method Vs. alternative payment methods

Although ACH transfers are secure and cost-effective, they usually take several days to get processed. Alternatively, you can use other methods, like debit cards, credit cards, direct debits, prepaid cards, digital wallets, mobile payment apps, money orders, checks, and cash payments, to make a payment.

Out of these methods, international money transfer service providers are the most viable and preferred options these days.

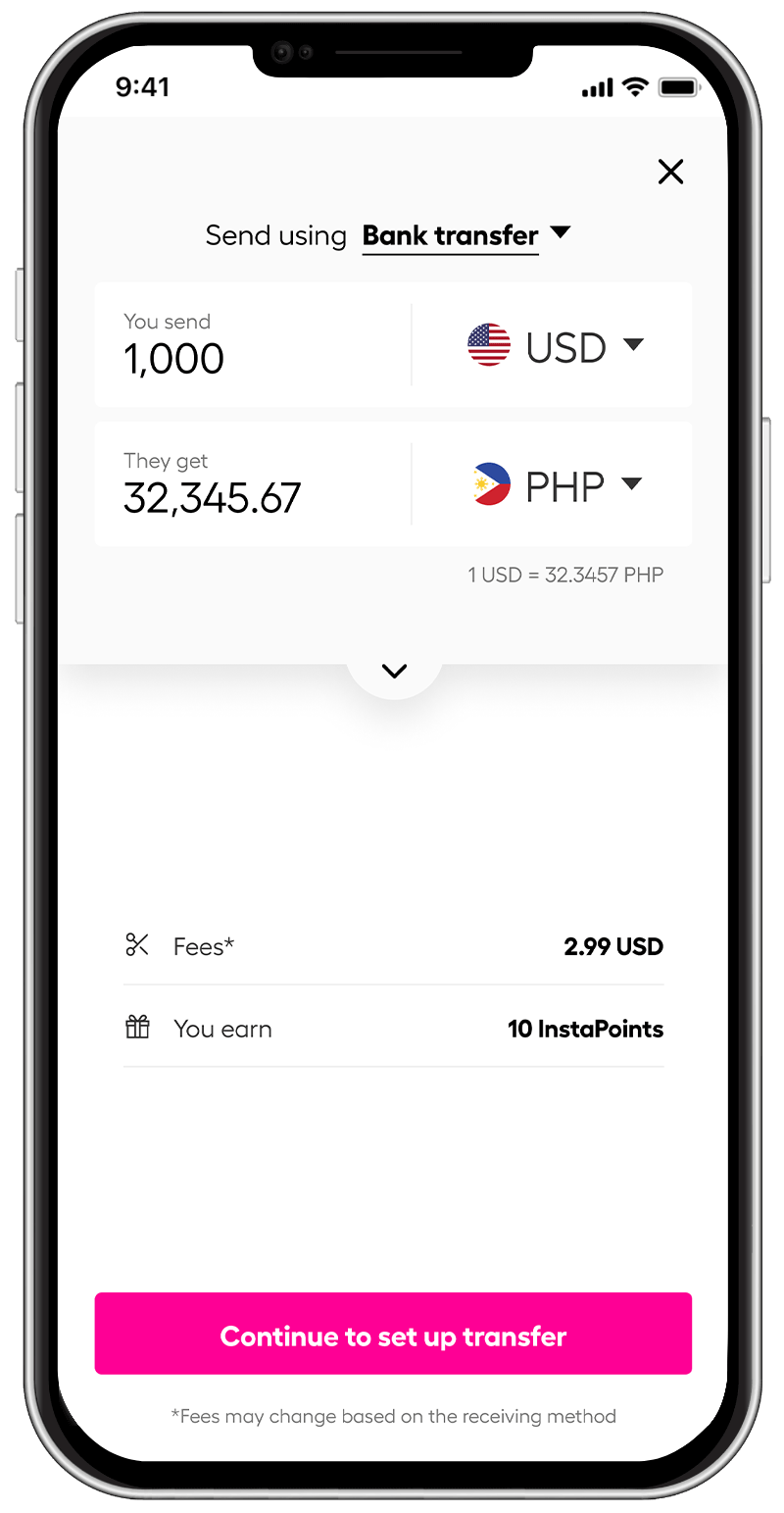

Instarem is a money transfer service trusted by customers worldwide to transfer funds online. With Instarem, you can transfer money in a few simple steps from one country to another without any hassles and keep track of your transactions. Additionally, you get reward points for every individual transaction you make through Instarem.

ACH transfers limitations and risks

- Transaction limits: Your bank may impose a transaction limit on the amount of money you can send via ACH transfers. There can be a per-transaction limit or a daily/ weekly/ or monthly limit on ACH transfers. The bank may also put a limit on bill payments or transfers from one bank to another. Moreover, the bank may not have a provision for international ACH transfers.

- Excess withdrawal penalty: Certain types of withdrawals or transfers have a monthly limit, and making ACH transfers beyond the limit may attract a penalty to your savings account. If you routinely make excessive ACH transactions from your savings account, the bank may convert it into a checking account.

- High processing time: ACH transfers may take 1 to 3 business days to process the transaction, which is considered slow compared to other instant payment options.

Before you go

ACH is an electronic method to transfer money from one account to another over an electronic network. The ACH network is a batch processing system, and although it is secure and cost-effective, it may take several days to process a transaction.

Alternatively, you can use an online money transfer service like Instarem to transfer money fast** and at affordable*** exchange rates to more than 60 countries globally.

*rates are for display purposes only

Try Instarem for your next transfer by downloading the app or sign up here.

Frequently asked questions

- What is an ACH transfer, and how does it work?

An ACH transfer is a payment made from one bank account to another through the Automated Clearing House network. The steps involved in the working of an ACH transfer are as follows:- Step 1: Create a setup to get authorization from the customer to transfer funds from their account.

- Step 2: Initiate a transfer by sending the data files to the bank.

- Step 3: Batch the transactions by the ODFI to send them to the ACH operator.

- Step 4: Distribute the data files to the concerned customer’s bank.

- Step 5: Transfer the funds from the customer’s account to the originator’s account.

- What is an example of an ACH payment?

Paying electricity or other utility bills or making a mortgage payment from a bank account are examples of ACH payments. - What is the difference between ACH and RTGS?

ACH and RTGS are both methods of fund transfer. While funds are transferred in batches under ACH transfers, they are immediately processed in real-time under RTGS transfers.ACH transfers are good for recurring payments, while RTGS transfers are suitable for one-time payments.

The processing time of an RTGS fund transfer is within 24 hours, while it may take anywhere between 1-3 business days to process an ACH transfer.

- Are Swift and ACH the same?

ACH and SWIFT are not the same. While ACH is used to make payments domestically within the United States, SWIFT is used to make international payments.While ACH is an electronic monetary network that connects one bank with another, SWIFT is an electronic money transfer network that allows banks to send money globally.

- Can you send an ACH internationally?

Yes, you can send funds internationally using ACH. However, it can be time-consuming, and you can opt for an alternative payment method like online fund transfer through a payment service provider like Instarem. - Which countries use ACH?

Several countries across the world, including the United States of America, the United Kingdom, China, Japan, France, Europe, India, Italy, etc., use the ACH fund transfer method. Essentially, ACH is a fund transfer system in the US, but it also works in countries that have bilateral ties with the US.

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

**Fast – 75% of our transactions are completed in 15 minutes. Depending on funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.