Comparative guide to the best business current accounts for international transactions in Malaysia

This article covers:

- What Is a Current Account?

- What’s the Process for Opening a Business Current Account in Malaysia?

- Any Fees and Charges That I Should Know Of?

- Comparing International Money Transfers From Current Accounts in Malaysia*

- How to Compare Current Accounts for International Money Transfers

- Use Instarem for your cross border payment instead

It’s both exciting and thrilling to be a business owner. Obtaining a company bank account might not be a top priority while you’re learning how to sell and market your products and services, especially if you can utilize your personal account for any business-related expenditures.

In order to safeguard yourself, save time, preserve company image, accept more payment types, and finally obtain a loan or a business credit card, it is advisable to separate personal and professional expenses. Here we look at the best business bank account or current account available to help you grow your company.

What Is a Current Account?

A current account, also known as a checking account, is like a regular savings account that allows you to deposit money and conduct transactions and withdrawals. The primary difference from a conventional savings account is that it permits you to write cheques, use the bank’s overdraft service, and make large transactions on a daily basis, making current accounts more attractive for businesses.

What’s the Process for Opening a Business Current Account in Malaysia?

Depending on the bank, the application process may vary somewhat. For example, you might need an introduction from a previous client, but some branches may be able to waive this requirement.

Typically the documents needed include:

- Letter of introduction from an existing customer

- Company stamp

- Photographic ID for all directors and signatories on the account

- Company proof

- Directors’ approval, confirmed in company resolution

Any Fees and Charges That I Should Know Of?

Most banks in Malaysia impose a few standard charges and fees on current accounts, including:

- Service charge: RM5 to RM15, half yearly

- Account statement request: From RM2 to RM25

- Cheque book: RM0.15 Stamp Duty per leaf

- Cheque book processing fee: RM0.50 per leaf

- Stop payment instruction: From RM10 (sufficient fund), up to RM150 (insufficient fund)

- Account closing fees: RM10 to RM30, within 3 months or 6 months of opening

- Account dormant fees: RM10

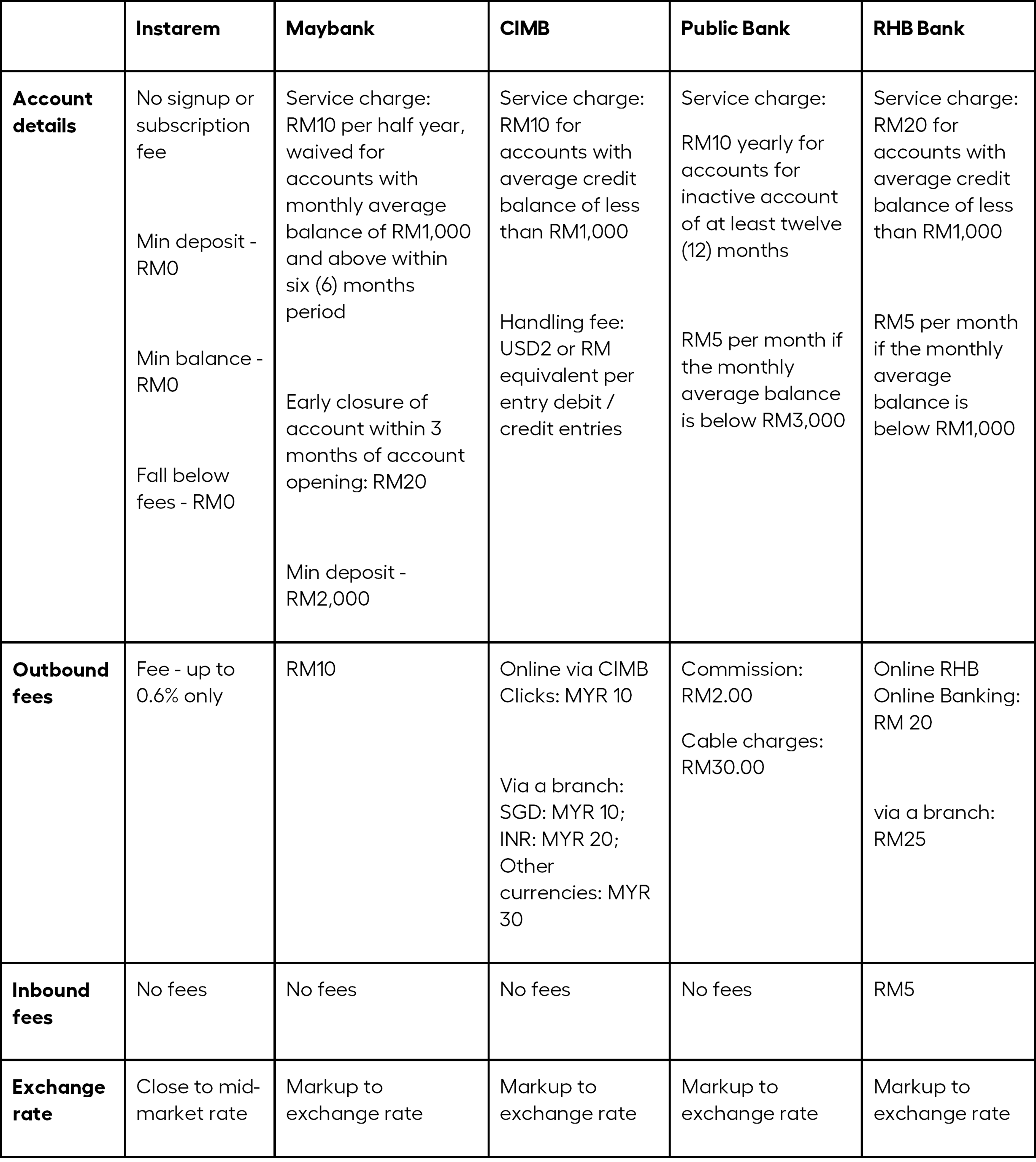

Comparing International Money Transfers From Current Accounts in Malaysia*

How to Compare Current Accounts for International Money Transfers

While comparing your options, the most important variables you must consider are:

Security and compliance

Sending money abroad may be worrisome no matter where you send it, because you’re dealing with foreign countries and currencies. When picking a remittance service, find out if they take all the necessary precautions to move your money securely and whether they conform to the most rigorous security requirements, such as requiring a KYC procedure.

Fees

Banks frequently charge their customers for the banking services they provide, as well as account maintenance. These fees may be charged at different rates, including subscription costs, processing charges, transaction fees, cheque issue and clearance expenses, overdraft or excess costs, and more. The costs and rates might differ from one bank to the next, so it’s vital to pick a bank that charges a fee you’re willing to pay.

Banks and other foreign-money transfer services add a premium to the rate they use for exchange, adding a margin to the mid-market exchange rate. Customers might be unaware of this markup, which can result in their international payments being more expensive than expected.

Minimum deposit and balance

Your choice of a business account must be made keeping in mind the minimum deposit and balance that you are required to maintain in your account at any time.

User access

For managing expenses, business account users operating a limited company generally choose a corporate account with multi-user access. Business accounts with multi-user access provide comprehensive access to authorized users as well as personal business debit cards.

Limits on transfers and currency conversion fees

While choosing a business account, it is important to consider the currency conversion fees and other limits on foreign transfers that the institution may impose.

Extra features

Other than the fundamental banking features, some business accounts come with extra features and added benefits like budgeting tools, payroll automation, expenditure tracking and analytics, and more, which can be beneficial to your business.

Customer support

Institutions and banking services that provide exceptional client service assistance will keep their client’s business accounts running smoothly by avoiding hassles and financial blunders.

Use Instarem for your cross border payment instead

Over the recent years, Instarem has grown as a pioneering digital payments platform operating globally. It’s a quick, easy, and safe way to send money and move funds between countries and across borders. It allows for the efficient transfer of salaries, rent, supplier payments, contractor fees, and other payments at a lower cost than traditional banking systems.

Instarem currently has a global reach of over 170 countries, multi-currency wallets, offers close to mid-market exchange rates, and comes with no hidden charges. In addition, Instarem provides a variety of services for seamless account management, such as the ability to manage global accounts from a single dashboard, bespoke reports creation, and digital invoicing and monitoring.

Furthermore, Instarem caters to a wide range of companies, including international trade and manufacturing, business consultancy firms and start-ups. If your company is looking for a business account that offers excellent FX rates, simple and efficient management, as well as same-day and real-time business payments, then Instarem may be the right solution.

*Information below is correct as at 1 May 2022, below is general information only We don’t consider your personal objectives, financial situation or needs and we aren’t recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice.

**Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.