10 best digital money remittance services in Singapore

This article covers:

Sending money across the globe without costing a fortune sounds ideal. In reality, however, this sounds unattainable. Or is it?

The expected global remittance for 2021 would be $713 billion with $152 billion from South Asia alone. If you transfer money overseas regularly, this might be an alarming issue for you. Remittance fees can usually be expensive which ideally could be put to better use. Whether you are remitting money back home or getting a hold of international assets, it all comes down to cutting down the unnecessary extra costs which bring us to the main issue – “How do I do that exactly?”

What is remittance?

Fundamentally, ‘remittance’ is the movement of money from one country to another typically by migrant or foreign workers. Some that utilize this service are those that buy international assets such as property investments or pay tuition fees, medical bills, mortgage, accommodation during overseas holidays, and more.

This is where the additional fees slip in. Every overseas transaction you make will cost you remittance fees which derive from the transfer fee and exchange rate. The exchange rate depends on the destination country remitters wish to send out to and usually differs from time to time.

How do I remit funds and how does it work?

There are various methods to remit or transfer funds safely from a South Asia country such as Singapore. Let’s have a look at the top 3 methods below:

1. Non-digital cash transfers

The most simple and traditional method to transfer funds across the globe is using cash transfer services. All you need is cash in hand and a physical outlet that offers money transfer services such as MoneyGram and Western Union. The receiver will then be able to acquire the money instantly.

Cons: Cash transfer is the most expensive method to remit funds as the fees are higher compared to other methods. Generally, acquiring such a service will cost you additional fees that could go as high as 5.05% especially if you use a debit or credit card

2. Banks

Banks such as Citibank, DBS, UOB, OCBC, HSBC, etc. might be the most obvious way to send money overseas, but the fees are costly. You could opt for online banking transfers instead which is way more convenient and slightly cheaper.

Cons: Although this is the most comfortable choice as you are accustomed to your preferred bank, this method might be slow and not cost-effective. Local banks do not usually practice fee transparency, so it might be a burden for you to figure out the additional fees ahead of time.

3. Online money transfer service

Evolution and technology have made things easier that serve us plenty of benefits, which comes to no surprise that digital money transfers are the easiest and cheapest method to remit funds or transfer them internationally. You will be able to get a competitive rate with the additional benefit of convenience.

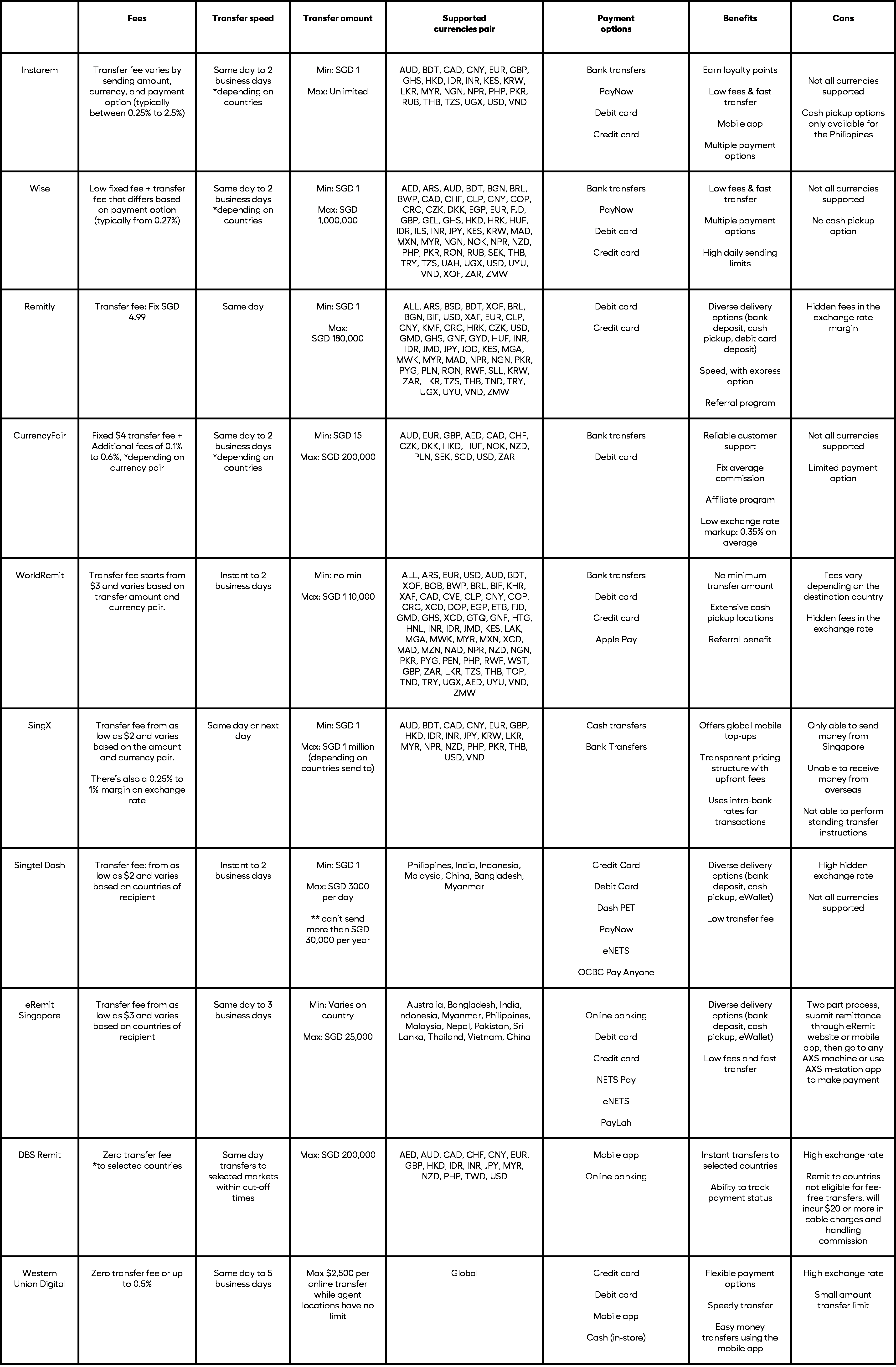

Cons: There are hundreds of organizations that offer such service which might take you forever to pick the best. But, don’t worry, we did the work for you. Listed below are the top money transfer services in Singapore:

*Based on remittance from Singapore to other countries

It is essential to practice vigilance when using any financial service. Always be on the lookout for:

- Scams

At first glance, some companies might offer attractive benefits that seem too good to be true. When in doubt, always conduct research or contact the official customer support line to check the authenticity of the service provider. - Taxes and regulation

It is best to choose company providers that adhere to government taxes and financial regulations to avoid any mishaps in the future. - Hidden fees or false rates

Sometimes it may seem as if you’ve gotten the best deal out of your transaction, only to be caught by surprise when making the final payments.

More on that, here.

Sending money overseas should not strip you from your hard-earned money. The key to getting the most out of such a service is to always make a comparison between trusted money transfer services and be on the lookout for the lowest fees, transparent exchange rate, and flexible delivery, which brings us to our top choice.

An alternative way to sending money overseas: Instarem

Instarem, or Instant Remittance was developed in 2014 and is trusted globally among more than two million customers. Check out this list below to find out why Instarem is the best choice for you:

- Cost effective provider

Instarem offers the lowest transfer fees that enable you to send money from Singapore to all over the world without burning a hole in your pocket. - Easy and fast

There are plenty of modes to transfer money as listed from the table above such as Instarem’s very own mobile app that offers a quick transfer process without any fuss. On top of that, transferring money from Singapore to other Asia countries is typically instant transaction. - Trusted and secure

Instarem is strictly regulated by nine financial regulators across the globe. Instarem is a trusted licensed service provider with licenses in Australia, Singapore, Hong Kong, Malaysia, India, UK, US, EU, and Canada. - Earn loyalty points

You will be rewarded with loyalty points which are referred to as ‘InstaPoints’ for every transaction and referral you make via Instarem. You will then be able to redeem your points and get great discounts for future transactions. Remember, the more you transfer, the more you earn! - Transparency

Instarem offers close to the mid-market fees with absolutely no hidden costs. You will be in the know of the exact rates used for your money transfer.

See how Instarem works and find out for yourself.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app