Best money remittance services in Australia compared

This article covers:

Planning to send money overseas but hesitant over security and numerous other factors? Do you know that in 2021 itself, over AUD$ 9.05 Million was transacted on digital platforms? The annual growth rate is also expected to rise to 12.24% by the end of 2025 with people and businesses being more connected than ever.

However, with so many money remittance companies available, it can get overwhelming. To assist you, we have summarised everything you need to know for a seamless experience.

Best way to remit money overseas

The traditional method is via bank transfer. In today’s rapid global development, banks such as ANZ, Citibank, HSBC, CBA, and Westpac provide such services. However, the premium exchange rate leaves little to be desired, due to its high margin.

More affordable alternatives come in the form of digital money remittance platforms. Besides being cost-friendly, it also provides a better user experience for a more intuitive money transfer action.

The last option is to make cash transfers with money transfer services like Western Union and MoneyGram. Unlike bank transfer, you don’t necessarily need a bank account to send or receive money. Which is why it is the most expensive option compared to bank transfers or digital money remittance platforms.

Which to choose?

The key questions every individual must ask before using a remittance service, especially if you are using the service for the first time are:

- Is the sender a company or individual?

- Which country is the money sent to?

- What is the sum remitted?

- How urgent must the receiver get hold of the money?

- How often will the service be utilised?

- Are there hidden fees or FX margins?

Once these have been answered, it would be easier to narrow down the choices at hand. If transferring money out of Australia is a regular occurrence, some remittance companies award their customers with loyalty programmes and business gain company incentives. This is an attractive bonus that will lower the overall cost of remittance.

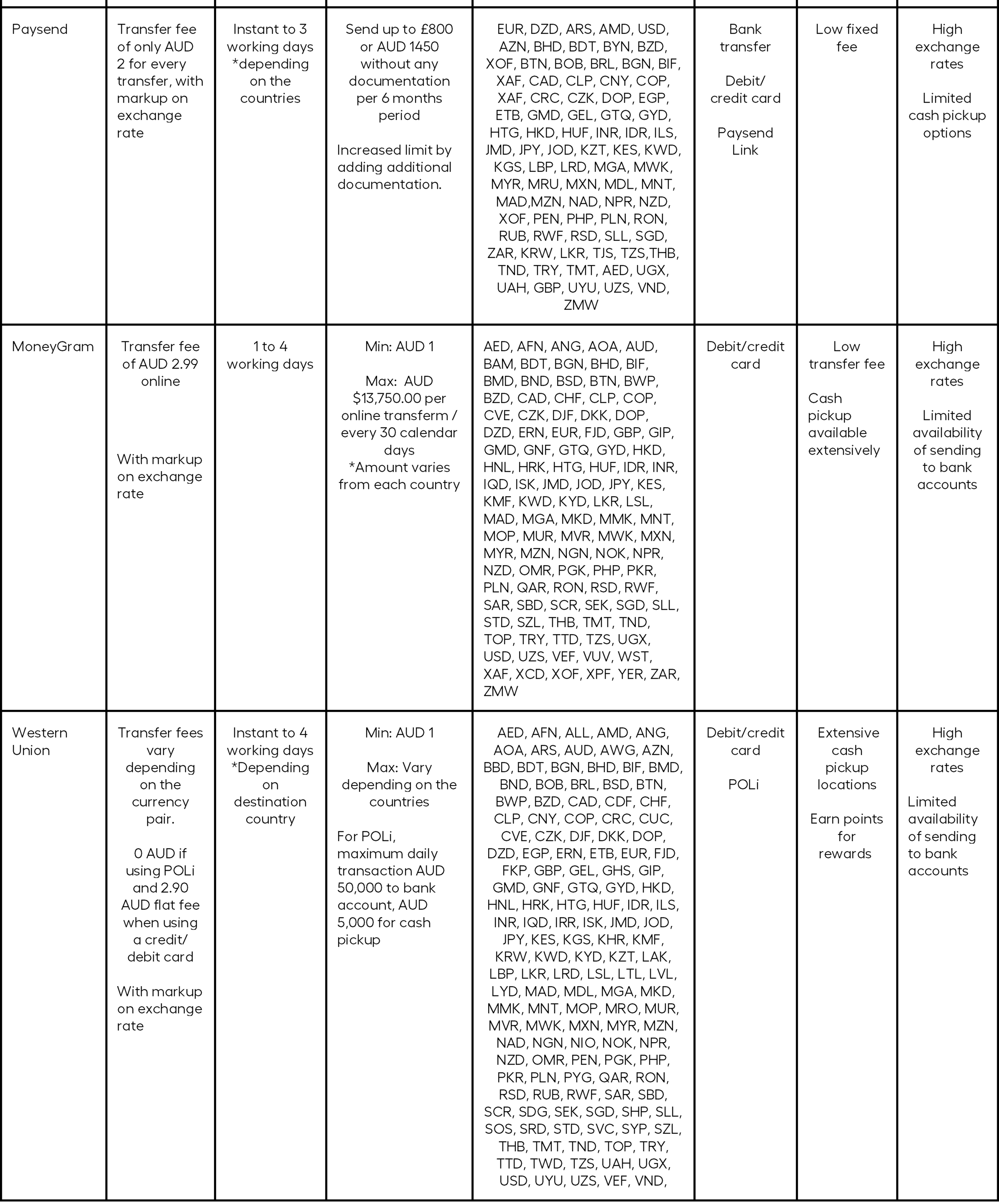

For optimum benefit to you, Australia’s top eight money remittance platforms have been identified in a clear summary of available services*. You can easily cross-compare their fees, maximum transfer amounts, exchange rates, and so on.

*data as extracted from the named platform providers public website correct as at 15 Nov 2021)

From the table of best services and most affordable options, you will see that Instarem not only offers low fees but it also provides best in value of exchange with a very small mark up over the exchange rate. Moreover, it does not markup exchange rates for Australians. Instarem is also the only option that provides almost instant transfers, 24-hour customer support and guarantees the best transfer amount. Should you frequently remit money overseas, its redeemable loyalty points to lower transfer fees is also an attractive perk.

Optimizing your money transfer

When choosing your preferred platform, It is most important to look out for the best Exchange Rates in the market while keeping in mind that almost all digital money transactions impose a Transfer Fee. It is key to strike a balance between the two, ensuring the sender gains from remitting with minimal charges.

It is also prudent to confirm the available Transfer Methods and Collection Options for both parties. As of 2021, 89.1% Australians are equipped with at least one credit card (23.06million card holders) and less than 1% have stayed true to traditional banking. Since most remittance platforms link to the bank account and most accept credit cards, Australians have it easy…unless of course you intend to send money to a country with limited financial service. Then you would need to check on the collection options provided for the receiver’s convenience.

For Australian businesses who are looking to use the service for large sums of money, over AUD999 in each transaction, there are two key factors to pay attention to. Transfer Limits of each remittance platform as well as the Turnaround Time will play a vital role in an efficient process that will better optimise their funds.

4 thing to look out for

Hidden Fees

- Everything digital is convenient, but it is not without risk. It is important to read up find prints as well where hidden fees are often classified as “other charges”. If you did not catch it before, you will be able to identify it in your receipt where the receiver only gets AUD990 when you sent AUD1,000. The missing AUD10 would then be attributed to hidden charges. While this might be alright for a one-off transaction, it can quickly add up to a substantial amount if you remit money overseas on a regular basis.

Fake Rates

- Never take things at face value, especially when the exchange rate offered is significantly lower than the published rate at the bank. Do some digging into reviews and customer feedback to ensure it is a legitimate company before proceeding.

Tax and Regulation

- Avoid legal issues for both you and the receiver. Not all digital remittance companies comply to every country’s tax and regulation ordinances. Do some research into the chosen platform’s terms and conditions, as well as the destination’s online money transfer laws. Always confirm details such as identification documents, transfer limits and receiver’s clearance to claim the funds before proceeding.

Scam

- There have been many fraudulent cases when sending money online. To avoid being scammed, do not send money to a stranger, do not share your password with anyone, check your account balance online frequently and ensure that you use a reliable and secure platform to transfer your hard-earned money. Should anything be amiss, report it to the service platform or bank you frequent immediately.

An alternative way to sending money overseas: Instarem

The best platform checks the most boxes in terms of service, quality and accessibility. Instarem wins hands down when it comes to overall offerings, especially when they have better exchange rates, lower fees, and faster turn-around time. Moreover, a reward system from Instarem allows you to earn InstaPoints which is extremely beneficial for those who are making a transfer often.

See how Instarem works and find out for yourself.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app