A comprehensive guide to the US healthcare system

This article covers:

- How healthcare works in the US?

- US healthcare glossary

- Understanding public healthcare in US

- US public healthcare costs

- Understanding private healthcare in US

- Types of health insurance plans in the US

- What is Affordable Care Act (Obamacare)?

- US health insurance costs

- Navigating health insurance marketplace

- How to pay for your insurance premium?

- Conclusion

- Before you go…

The US healthcare landscape is dominated by commercial health insurance, and the private sector serves as the backbone of most medical facilities. However, public healthcare is not all-encompassing; it’s a limited resource reserved for citizens and permanent residents who meet specific age criteria.

Navigating this system further reveals its high cost and intricacies. Employer-provided health insurance is a common buffer against the expense, widely used by both citizens and expats. Yet, insurance doesn’t guarantee cost-free services – out-of-pocket expenses often arise. Despite these challenges, the US healthcare system shines in its provision of high-quality care, with hospitals and specialists delivering top-tier services for those able to afford them.

How healthcare works in the US?

The United States healthcare system, a complex blend of both private and public elements, notably lacks universal healthcare provisions. The government does not provide comprehensive health benefits to citizens or visitors, meaning every instance of medical care received must be paid for by someone. This can pose a significant financial burden, as healthcare in the U.S. is notoriously expensive.

For example, a broken leg can result in a bill for approximately $7,500, while a three-day hospital stay could potentially cost around $30,000!

Consequently, health insurance is a critical safety net for most people in the U.S., including expats. This coverage serves to protect individuals from incurring substantial debts due to medical services. To maintain this coverage, regular payments, known as “premiums,” must be made to a health insurance company, which in turn agrees to shoulder some, if not all, of your medical expenses.

In this system, your “primary care provider” (PCP) plays a significant role in your health journey. After purchasing health insurance, you’ll choose a PCP within your insurance company’s network. This individual, who could be a nurse practitioner or a physician, will provide most of your medical care, from physical exams and lab tests to treatments for ongoing conditions such as diabetes or high blood pressure.

US healthcare glossary

Understanding U.S. healthcare requires familiarising oneself with a series of key terms. Here are some of the most important glossaries related to the U.S. healthcare system:

- Premium: This is the amount you pay for your health insurance every month.

- Deductible: The amount you pay for healthcare services before your health insurance begins to pay.

- Copayment (or Copay): A fixed amount you pay for a covered healthcare service after you’ve paid your deductible.

- Coinsurance: Your share of the costs of a healthcare service, calculated as a percent of the amount your insurance plan has determined as an allowable charge for the service.

- Out-of-pocket Maximum/Limit: The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance, your health plan pays 100% of the costs of covered benefits.

- In-network Co-insurance: The percent you must pay for care you receive from your insurer’s network of doctors, hospitals, etc.

- Out-of-network Co-insurance: The percent you must pay for care you receive outside of your insurer’s network of providers.

Understanding public healthcare in US

Although the US provides free public healthcare, the system operates quite differently compared to those in other developed countries, primarily due to its non-universal nature. Eligibility for public healthcare is determined by specific age and income requirements, creating a scenario where many working expatriates may not qualify for free public healthcare services in the US.

As a testament to its commitment to health, the US has established several publicly funded healthcare programs that collectively serve more than half of its population. Prominent among these are Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP), which play significant roles in delivering healthcare to the country’s residents.

Medicare

Medicare is a federal program in the United States designed to help cover healthcare costs for individuals aged 65 and older, as well as certain younger individuals with disabilities or specific diseases. Here’s a simplified breakdown of how it works:

- Eligibility: You are eligible if you’re a U.S. citizen or a permanent legal resident who has lived in the U.S. for at least five years, and you are 65 years or older. Certain younger individuals with disabilities or diseases like End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant) are also eligible.

- Parts of Medicare: Medicare consists of four parts, each covering different aspects of healthcare:

- Part A (Hospital Insurance): Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B (Medical Insurance): Covers certain doctors’ services, outpatient care, medical supplies, and preventive services.

- Part C (Medicare Advantage Plans): A type of Medicare health plan offered by private companies that contract with Medicare. These include all benefits and services covered under Part A and Part B, usually including Medicare prescription drug coverage (Part D).

- Part D (Prescription Drug Coverage): Helps cover the cost of prescription medications. This is also offered through private companies that contract with Medicare.

- Cost: While Part A is usually free for those who have paid Medicare taxes for at least 10 years, Part B comes with a monthly premium. Parts C and D costs depend on the specific plan chosen. There may also be deductibles and co-pays involved.

Remember, Medicare doesn’t cover all healthcare costs, and it isn’t free. It’s important for those eligible to understand the nuances of what is and isn’t covered, and what expenses they might need to cover out-of-pocket.

Medicaid

Medicaid is a state and federal program in the United States that provides health coverage to people with low income, including some low-income adults, children, pregnant women, elderly adults, and people with disabilities. Here’s a straightforward breakdown of how it works:

- Eligibility: Eligibility for Medicaid depends on income level, family size, disability, and other factors. Eligibility rules vary from state to state. In all states, Medicaid provides health coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities.

- Coverage: Medicaid programs must provide a comprehensive set of services, including doctor visits, hospital expenses, home health care, and other medical services. Some Medicaid programs pay for these services directly, while others use private insurance companies to provide Medicaid coverage.

- Cost: Medicaid coverage is often free or comes at a very low cost to eligible individuals. The specific costs, including copayments and premiums, depend on the state’s rules.

- Application: Applications for Medicaid are made through the state Medicaid program or the Health Insurance Marketplace. Once approved, coverage typically begins on the first day of the month you apply.

It’s important to note that Medicaid programs must follow federal guidelines, but they vary somewhat from state to state. Therefore, potential recipients should understand the specific details of Medicaid in their respective states.

Children’s health insurance program (CHIP)

The Children’s Health Insurance Program (CHIP) is a state and federal partnership in the United States that provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid. Here’s a simplified explanation of how it works:

- Eligibility: The program is designed for families who earn too much to be eligible for Medicaid but not enough to afford private health insurance. While it’s primarily intended for children, in some states, it also covers pregnant women. Each state has its own rules about who qualifies for CHIP.

- Coverage: CHIP provides comprehensive coverage for routine check-ups, immunizations, doctor visits, prescriptions, dental and vision care, inpatient and outpatient hospital care, laboratory and X-ray services, and emergency services. The benefits might vary slightly by state as states have flexibility in creating their program.

- Cost: While not free, CHIP comes at a low cost. Families who qualify for the program won’t have to pay more than 5% of their annual income for it. Some routine check-ups and preventive care are offered for free in most states

- Application: You can apply for and enrol in CHIP any time of the year. You need to fill out an application through the Health Insurance Marketplace or your state Medicaid/CHIP agency.

Remember, the specifics of CHIP can vary between states, including the costs and the coverage provided. It’s crucial for potential recipients to understand the particular details of CHIP in their respective states.

US public healthcare costs

Public healthcare costs in the United States can vary greatly, largely dependent on the specific plan a person is enrolled in. For Medicare, which is one of the primary public healthcare programs in the country, the costs are broken down as follows:

- Medicare Part A – This is typically free for most people who have paid Medicare taxes for a specified duration. However, for those who haven’t, the cost can range from $250 to $450 per month. In addition, there are also deductibles and coinsurance applicable. The deductible, which is the initial out-of-pocket expense you must cover before your insurance takes effect, is around $1,400 for a hospital admission. Following this, there’s a coinsurance cost, which is a percentage you pay for your care after meeting your deductible. For extended hospital stays, this coinsurance can range from $350 to $700 per day after a certain period.

- Medicare Part B – This plan carries a monthly premium that ranges between $130 to $450. There’s also an annual deductible of $185 that must be met before coverage kicks in.

- Medicare Part C – This plan is offered by private insurance companies approved by Medicare and it combines Part A and Part B benefits and often Part D as well. The monthly cost for this can vary significantly, typically ranging between $400 to $600. The exact cost can depend on the specific benefits and network of providers included in the plan.

- Medicare Part D – This is a prescription drug coverage plan. The cost includes the premium for the plan, plus an additional $15 to $80 per month depending on the specific coverage of the plan.

Understanding private healthcare in US

In the United States, the private health insurance market plays a crucial role in the healthcare system, offering a myriad of options for residents, including expatriates. These plans vary significantly in terms of both coverage and cost, ensuring that there’s likely a plan that aligns with each person’s unique needs and circumstances.

However, comprehensive plans that offer broad coverage tend to be on the expensive side, putting them out of reach for many people.

The private health insurance industry in the U.S. operates through several avenues:

- Employment-Based Coverage: This is one of the most common ways people obtain health insurance in the U.S. Many employers offer health insurance as part of their benefits package, covering a portion of the premiums, with the remainder typically deducted from the employee’s paycheck. This coverage can extend to an employee’s spouse and dependents as well. However, the extent of coverage varies by employer and plan, and in some cases, individuals might choose to purchase additional private insurance for more comprehensive coverage.

- Health Insurance Marketplace: Established under the Affordable Care Act (often referred to as “Obamacare”), the Health Insurance Marketplace allows individuals, families, and small businesses to explore and purchase health insurance plans. Plans offered on the Marketplace are divided into four categories – Bronze, Silver, Gold, and Platinum – with varying levels of coverage, deductibles, and out-of-pocket costs.

- Direct Purchase from Insurance Companies: If a person prefers, they can bypass the Marketplace and purchase health insurance directly from a private insurance company. This can be an attractive option for those who want more plan options or who don’t qualify for premium tax credits available through the Marketplace.

It’s important to note that self-employed individuals also have the option to purchase insurance either through the Marketplace or directly from an insurance company. Additionally, certain professional or trade organisations may offer health insurance options for their members.

Regardless of the method chosen, private health insurance costs can vary widely based on the coverage level, the policyholder’s health status, age, geographic location, and other factors.

Types of health insurance plans in the US

The U.S. health insurance landscape offers a variety of plans, providing flexibility in coverage and cost to suit diverse healthcare needs. Two broad categories include plans compliant with government standards, often referred to as Obamacare or Affordable Care Act (ACA) plans, and short-term plans offered by private insurers.

ACA-compliant insurance plans typically fall into one of the following network types:

- Preferred Provider Organizations (PPOs): With PPO plans, members have the flexibility to visit any healthcare provider, including those outside the network, though out-of-network care generally comes with higher costs. No referral is required to see a specialist, providing more direct control over one’s healthcare decisions.

- Health Maintenance Organizations (HMOs): HMO plans limit coverage to care from doctors and hospitals within the network, except in emergency situations. Members usually have a primary care doctor who coordinates their care and provides referrals to specialists within the network.

- Point of Service Plans (POS): POS plans combine elements of PPOs and HMOs. Members can visit doctors in and out of the network, like a PPO, but they usually need a referral from a primary care doctor to see a specialist, similar to an HMO. Out-of-network care often comes with higher costs.

- Exclusive Provider Organizations (EPOs): EPO plans cover care only if you use doctors, specialists, or hospitals in the plan’s network, except in an emergency. You don’t need a primary care doctor or referrals to see specialists.

Health insurance plans are typically represented by their network-type acronym in marketplace descriptions, allowing consumers to readily identify the plan’s structure.

In addition to network types, ACA-compliant plans are also grouped into “metal” categories based on cost-sharing between the insurer and the insured:

- Bronze: The insurer covers approximately 60% of healthcare costs, and the insured pays around 40%. Bronze plans usually have lower premiums but higher out-of-pocket costs. These are suitable for people who want protection against serious illnesses or injuries but don’t expect to need extensive medical care.

- Silver: The insurer covers around 70% of healthcare costs, leaving about 30% to the insured. Silver plans are a middle ground in terms of both premiums and out-of-pocket costs. These plans can offer extra savings for lower-income individuals through cost-sharing reductions.

- Gold: The insurer pays about 80% of healthcare costs, and the insured is responsible for roughly 20%. Gold plans typically have higher premiums but lower out-of-pocket costs, making them a good choice for those expecting to use a fair amount of healthcare services.

- Platinum: The insurer covers approximately 90% of healthcare costs, leaving about 10% to the insured. Platinum plans come with the highest premiums but offer the lowest out-of-pocket costs. These plans are beneficial for individuals who require frequent medical care or have chronic health conditions.

Basic coverage under these plans typically includes hospitalisation, outpatient and emergency care, specialist appointments, and prescription medications. However, the specifics can vary significantly from plan to plan, so thorough research and comparison are crucial when choosing a health insurance plan in the U.S.

What is Affordable Care Act (Obamacare)?

The Affordable Care Act (ACA), also known as Obamacare, marked a significant shift in U.S. healthcare policy when it was implemented with the goal of expanding access to healthcare. It introduced several changes, including:

- Removal of coverage limits: The ACA abolished lifetime and annual coverage limits, thus ensuring that individuals with serious health issues would not run out of coverage when they needed it most.

- Creation of the Health Insurance Marketplace: The ACA established a government-regulated platform, known as the Health Insurance Marketplace, where individuals can purchase health insurance. This Marketplace made it easier for individuals to compare and buy health insurance plans, enhancing competition and transparency.

- Extended coverage for young adults: Under the ACA, young adults can stay on their family’s insurance plan until they turn 26, providing them with healthcare coverage during a stage of life that often involves transitions between education and employment.

- Protection for those with pre-existing conditions: The ACA prohibited insurance companies from denying coverage or charging higher premiums based on gender or pre-existing health conditions. This was a significant win for consumer rights, providing protections for millions of Americans with health conditions that had previously made them uninsurable.

- Establishment of essential health benefits: The ACA defined ten essential health benefits that all qualifying health insurance plans must cover. These include preventive and wellness services, maternity and newborn care, mental health and substance use disorder services, and more.

These measures have transformed the healthcare landscape, but they also sparked significant debate and continue to evolve due to policy changes and legislative challenges. It’s crucial to stay informed about current healthcare laws and regulations when considering health coverage options.

US health insurance costs

The cost of private health insurance in the U.S. hinges on a number of key factors. These include:

- The specifics of the insurance plan itself, such as the type of plan, the coverage it offers, and any deductibles or out-of-pocket maximums.

- The enrollee’s personal characteristics also come into play, including their age, geographical location, and whether they use tobacco.

- The size of the insurance pool (i.e., the number of people enrolled in the plan) and the health of those enrollees can influence costs.

- External factors such as healthcare inflation and regulatory policies can significantly impact the final insurance premium.

The cost of private health insurance is shaped by a complex interplay of plan specifics, individual characteristics, broader demographics, and external economic and policy contexts.

It’s also worth noting that the premiums will fluctuate year by year and with that, whatever you are seeing in this year might not be applicable next.

ValuePenguin provides a very comprehensive overview of the average health insurance costs. However, we can look at the national average costs based on the insurance tier and plan type to get a good idea of the costs.

Monthly health insurance cost by tier

Navigating health insurance marketplace

Navigating the Health Insurance Marketplace in the U.S. involves several steps designed to help individuals select the most appropriate health insurance plan. Here’s a detailed guide:

- Creating a Marketplace Account: The initial step involves setting up a Marketplace account by providing basic information such as your name, address, and email. If your state operates its own Marketplace, you’ll need to select the dedicated state and proceed.

- Preparation for Application: Next, get ready to apply. This step requires gathering relevant documents and information necessary for the application process. Prepare an estimate of your income, which is crucial for the application. If you need assistance with the process, there are resources available to guide you.

- Receive Instant Eligibility Results: After you submit your application, you’ll receive immediate “Eligibility Results”. These results will indicate whether you qualify for a Marketplace health insurance plan with savings, such as tax credits to help pay your premiums, or lower copayments, coinsurance, and deductibles. Additionally, the results will reveal if you’re eligible for free or low-cost coverage through Medicaid and the Children’s Health Insurance Program (CHIP).

- Enrol in Health Coverage: Once you understand your eligibility, the next step is to enrol in a health coverage plan. You’ll be able to compare the various health plans and their prices available in your area and enrol in the one that best suits your needs. If you require dental coverage, there are options for that as well. After you choose a plan, you must pay your first premium directly to your insurance company for your coverage to start.

- After Enrollment: After enrollment, you’ll receive a packet in the mail, which includes your new insurance card and additional information about your health plan. From here on, you can begin using your coverage. If your circumstances change (e.g., moving, having a baby, or adopting a child), or if there’s a shift in your income or household, it’s essential to update your application as soon as possible as these changes could impact your coverage options and savings. If you’re eligible for Medicaid or CHIP, you will receive further instructions from your state about enrollment and the next steps.

How to pay for your insurance premium?

Upon selecting a health insurance plan, your premium payments are directed straight to the insurance provider, not to the Health Insurance Marketplace. It’s crucial to remember that your coverage does not initiate until your first premium is paid.

To maintain your coverage, it’s vital to consistently pay your monthly premiums on time. Failure to do so may result in the termination of your coverage by the insurance company.

To manage and make your monthly premium payments via HealthCare.gov, follow these steps:

- Log into your Marketplace account.

- Select your application under the “Your Existing Applications” section.

- Click on the blue button labelled “Pay Your First Health Insurance Monthly Premium.”

- If online payment is an option, you can click on the green “Pay for Health Plan Now” button. This will redirect you to your insurance company’s website for payment.

It’s important to note that not all health insurance companies accept online payments. If that’s the case, they should have provided you with alternative payment methods. If you haven’t received this information or you’re uncertain whether your payment was successful, contact your insurance company directly. Their contact information should be available in your plan brochure or on their official website.

Conclusion

In the complex landscape of U.S. healthcare, expats face a series of unique challenges and considerations. Dominated by both private and public sectors, the healthcare system brings forward an array of options, intricacies, and costs that expats must navigate skillfully.

One key component is public healthcare, which involves programs such as Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP). While these programs offer certain coverage, their availability to expats is typically limited. Costs associated with these programs are influenced by multiple factors, including deductibles and coinsurance, further complicating the process.

On the other hand, private healthcare in the U.S. provides a multitude of insurance options, allowing individuals to select a plan that best suits their needs and financial abilities.

From employer-provided coverage to insurance purchased through the Health Insurance Marketplace or directly from a company, private insurance plans can widely differ in their pricing and coverage. The Affordable Care Act, or Obamacare, has been a significant milestone in enhancing the accessibility of healthcare. It offers important provisions like the elimination of coverage refusal based on gender or pre-existing conditions, and the introduction of a yearly fine for individuals without insurance. It has also standardized the concept of ten essential healthcare benefits that qualifying health plans must cover.

As such, despite its complexity, the U.S. healthcare system offers potential pathways to adequate healthcare coverage for expats, necessitating careful understanding and management of their chosen options and the associated costs.

Before you go…

Understanding the intricacies of health insurance payments in the US can be challenging, especially for expats.

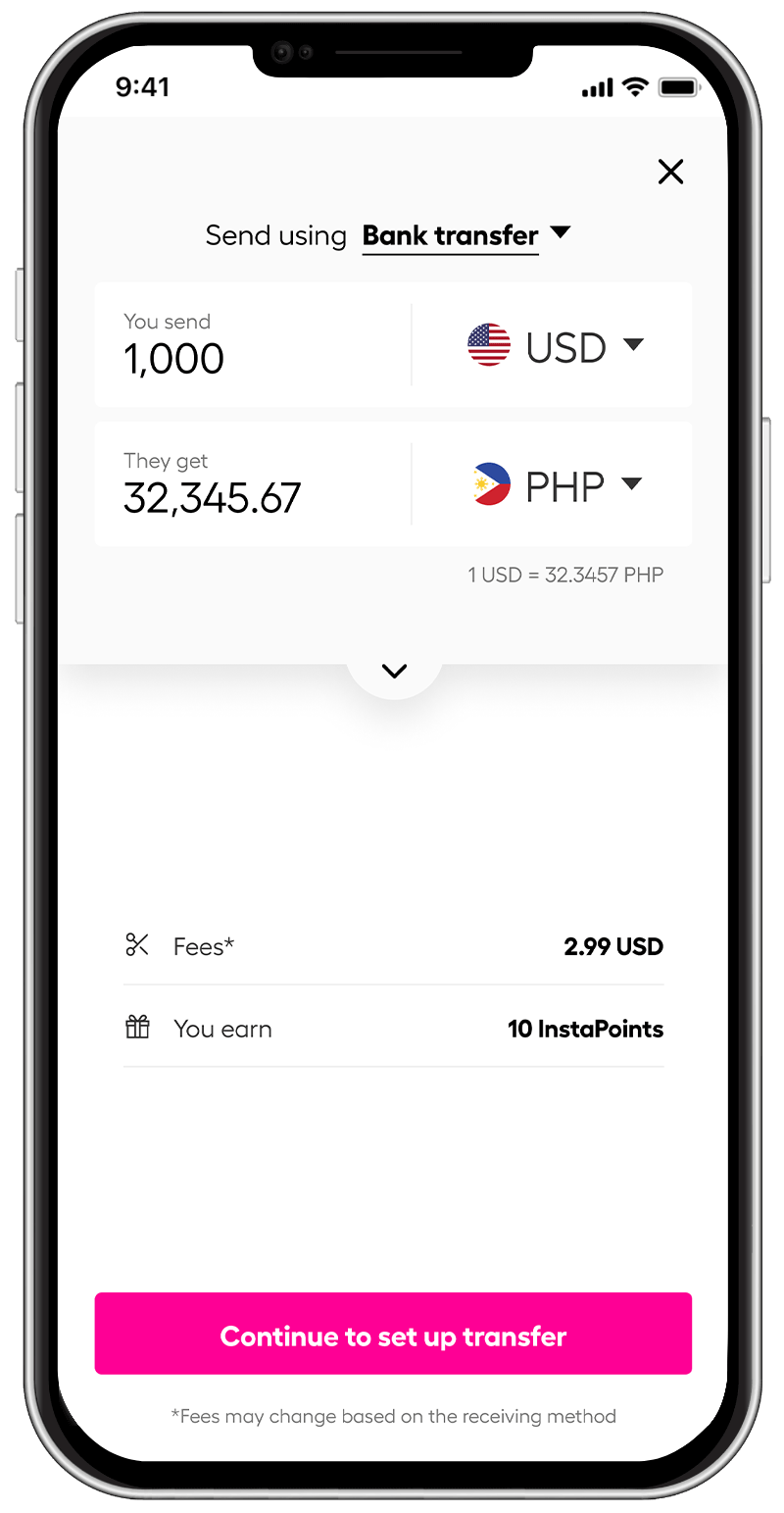

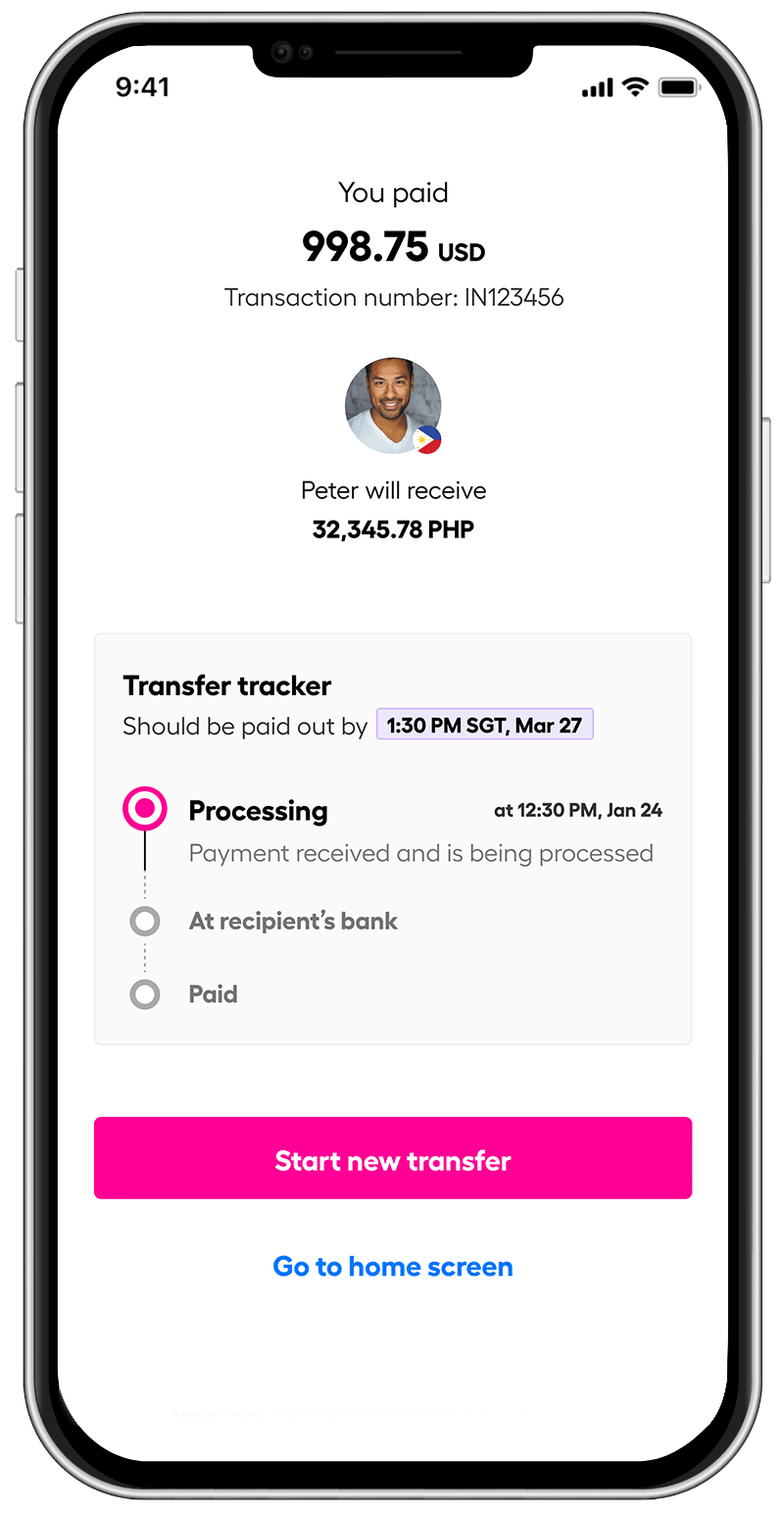

Fortunately, Instarem, a global money transfer platform, simplifies the process. You can easily fund your US account from anywhere in the world with Instarem, ensuring your health insurance payments are always timely.

*rates are for display purposes only.

Its straightforward platform and competitive rates make cross-border payments smooth, keeping your coverage intact while in the US.

Send money overseas with Instarem now. Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.