Demystifying income tax in the United States: A comprehensive overview

This article covers:

The tax system in the United States extends well beyond the well-known realm of federal income tax, weaving a complex, multi-layered structure that influences the lives of its citizens. While the federal income tax often commands the spotlight in conversations around taxation, it is only one part of a broader picture.

To truly appreciate the intricate nature of the U.S. tax system, one needs to delve deeper into the other layers of taxation, starting with the state level. A significant number of U.S. states exercise their own sovereign right to levy income taxes, adding a new dimension to the financial responsibilities of residents.

Venturing further, we find that the labyrinth of taxation does not end here. According to data from the Tax Foundation, an independent non-profit organisation that specialises in tax policy research, an impressive number of nearly 5,000 taxing entities across 17 states additionally impose local income taxes.

These municipal or county-level levies introduce yet another layer to the tax matrix. This intricate tax system – federal, state, and local – thus requires a more nuanced understanding to truly grasp the actual tax burden shouldered by the U.S. populace.

Understanding Income

The term “income” takes on a multitude of forms depending on the financial context. Gross income, in its most comprehensive sense, refers to the complete sum of an individual’s earnings or payments before any deductions or expenses are considered. However, this total doesn’t account for the substantial deductions that can impact the final amount available to the individual.

For a more precise understanding, we turn to net and discretionary income. Net income signifies the remainder after obligatory outflows, such as taxes or fees, are subtracted from the gross income. Discretionary income goes a step further, signifying the residual income after accounting for all necessary expenses, leaving what is available for non-essential expenditure or saving.

In the realm of taxation, ‘income’ typically encompasses types of revenue subject to income tax, such as salaries and sales revenues. However, this varies by jurisdiction, with some income types like inheritances and gifts often exempted.

Taxable income

In the context of income tax, the tax code is designed to portray a taxpayer’s genuine economic standing. It sets the guidelines that apply to a taxpayer’s personal revenue from all sources (excluding tax-exempt income), which is then counterbalanced with deductions relating to expenses and losses to ascertain taxable income. The tax framework also houses public policies that provide preferential tax conditions to individuals at specific income brackets or those engaged in particular economic activities.

These policy-oriented benefits range from tax exemptions on government bonds and preferential treatment for retirement savings to tax credits for those below a certain income threshold.

Additionally, they encompass incentives for promoting energy efficiency, reflected in the provision of unique tax credits. In essence, these special treatments within the tax code are strategic tools aimed at influencing economic behaviours and providing relief to certain segments of the population.

Types of Income

In the multifaceted world of taxation, understanding the different types of income and their specific tax implications is crucial. The U.S. tax code classifies income into several categories, each with distinct characteristics and tax treatments.

This classification system is based on the source of income, its regularity, and other factors. The primary categories include ordinary income, capital gains, and tax-exempt income. By taking a closer look at these categories, we can gain a more nuanced understanding of the U.S. tax system and its implications for taxpayers.

- Ordinary Income: This term primarily refers to income generated from routine sources, including but not limited to earnings from a job, interest accrued on savings, regular dividends from investments, income derived from property rentals, and distributions from pension plans or retirement accounts. Even Social Security benefits fall under this category.As per 2023 tax laws, ordinary income is subject to a progressive tax rate that ranges from 10% to 37%, depending on the taxpayer’s income level. An additional 3.8% net investment income tax applies to taxpayers whose net investment income exceeds certain thresholds, further contributing to their overall tax liability.

- Capital Gains: Capital gains signify the financial gains realised from the sale of assets that have appreciated in value. These assets are not limited to tangible property but extend to various types of investments, including but not limited to real estate, stocks, bonds, and other financial instruments. The U.S tax code differentiates between short-term and long-term capital gains, the latter of which applies to assets held for more than a year. For these long-term gains, the tax rates are set at 0%, 15%, or 20% depending on the taxpayer’s income.

- Tax-exempt Income: This refers to certain types of income that are legally exempted from taxation. A prominent example of this is interest paid on bonds issued by governmental entities. Such income is shielded from tax obligations as a way to encourage investment in these bonds. For instance, interest accrued on federal bonds and Treasury securities is not subject to state and local taxation, effectively enhancing the after-tax return for investors in these instruments.

Types of Income Tax

The U.S. tax system is a multi-tiered structure comprising federal, state, and local levels of taxation. Each level serves a distinct purpose and targets different aspects of the economy, often aligning with their administrative jurisdiction. Understanding these types of income taxes – federal, state, and local – not only provides a comprehensive view of the tax landscape in the U.S. but also helps us appreciate how taxes fund various public services and infrastructure.

- Federal Income Tax: Overseen by the U.S. Internal Revenue Service (IRS), the federal income tax is imposed on the global income of U.S. citizens and residents. This tax constitutes a significant revenue stream for the federal government, supporting various budgetary allocations including defence, infrastructure development, and social welfare programs such as Medicare and Social Security.

- State Income Tax: Regulated at the state level, this tax is employed to finance state-specific needs like education, healthcare, and transportation. The nature of state income taxes, including rates and regulations, can diverge considerably across states, reflecting the unique fiscal requirements and policy preferences of each state.

- Local Income Tax: These are taxes levied by smaller administrative units such as counties or cities. Less prevalent than their federal and state counterparts, local income taxes primarily fund local amenities and services. This can include schools, parks, and local infrastructure, providing essential resources to maintain and improve the quality of life in these communities.

Understanding Federal Income Tax

The United States employs a progressive federal income tax system, currently structured around seven distinct tax brackets:

- 10%,

- 12%,

- 22%,

- 24%,

- 32%,

- 35%,

- and 37%.

These percentages represent the tax rates applicable to different segments of your taxable income, with the rate increasing as your income rises. Which of these tax brackets and corresponding rates apply to you is determined by two main factors: your taxable income and your filing status.

Filing status typically falls into categories such as single, married filing jointly, married filing separately, or head of household, each having different income ranges for the tax brackets. It’s important to note that these brackets do not apply to your total income, but to each portion of your income within the bracket thresholds.

As mandated by the Tax Cuts and Jobs Act of 2017, these tax rates are set to remain constant through 2025. However, it’s worth noting that the income thresholds which delineate the tax brackets usually undergo annual adjustments. This is to account for inflation and prevent “bracket creep,” where taxpayers might find themselves in a higher bracket due to inflation rather than an actual increase in real income. These adjustments ensure that the federal income tax system maintains its intended progressivity and fairness over time.

2023 Federal Tax Brackets and Rates

2023 Tax Rate | Single | Married Filing Jointly | Heads of Household |

10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 |

12% | $11,001 to $44,725 | $22,001 to $89,450 | $15,701 to $59,850 |

22% | $44,726 to $95,375 | $89,451 to $190,750 | $59,851 to $95,350 |

24% | $95,376 to $182,100 | $190,751 to $364,200 | $95,351 to $182,100 |

32% | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 |

35% | $231,251 to $578,125 | $462,501 to $693,750 | $231,251 to $578,100 |

37% | $578,126 or more | $693,751 or more | $578,101 or more |

Understanding State Income Tax

The landscape of state income taxes across the U.S. is diverse, with tax structures varying significantly from one state to another. The systems employed typically fall into two primary categories: flat and progressive income tax structures.

In a flat tax system, also known as a single-rate structure, all taxpayers are subject to the same tax rate, irrespective of their income level. As of 2023, eleven states employ this method:

- Arizona (2.5%),

- Colorado (4.55%),

- Idaho (5.8%),

- Illinois (4.95%),

- Indiana (3.23%),

- Kentucky (4.5%),

- Michigan (4.25%),

- Mississippi (5.0%),

- North Carolina (4.75%),

- Pennsylvania (3.07%),

- and Utah (4.95%).

Conversely, a progressive tax structure applies higher tax rates to higher income levels, mirroring the structure of the federal income tax system. While some states tie their marginal tax brackets to the federal tax code, many opt to create their own. To keep pace with inflation, certain states adjust their brackets annually, akin to federal practices. Some of the states with the highest income tax rates are California (13.3%), Hawaii (11%), New York (10.9%), New Jersey (10.75%), Oregon (9.9%), and Minnesota (9.85%). All other states with a progressive tax system have top rates under 8%.

Moreover, a handful of states, namely Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming, levy no income tax on their residents. In an exception to this norm, New Hampshire, while not taxing earned income from salaries and wages, does tax income generated from interest and dividends. This vast array of tax structures reflects the differing economic and policy contexts in each state, shaping their unique approaches to taxation.

States | |

States with no to little income tax | Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming, Washington*, New Hampshire** |

States with a flat income tax | Arizona (2.5%), Colorado (4.55%), Idaho (5.8%), Illinois (4.95%), Indiana (3.23%), Kentucky (4.5%), Michigan (4.25%), Mississippi (5.0%), North Carolina (4.75%), Pennsylvania (3.07%), and Utah (4.95%) |

States with a Graduated-rate Income Tax | Alabama, Arkansas, California, Connecticut, Delaware, Georgia, Hawaii, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Vermont, Virginia, West Virginia, Wisconsin, and the District of Columbia. |

Note:

*Applies to capital gains income of high-earners.

**Applies to interest and dividends income only

Steps by Steps Guide to Filing Taxes

Filing taxes in the U.S. can be a complex task, but by following a systematic process, one can navigate the steps with greater ease:

- Determine if you need to file: The first step in the tax filing process is to ascertain whether you are required to file a tax return. This generally depends on your income, filing status, and age. The IRS also provides a comprehensive tool called “Do I Need to File a Tax Return?” to assist with this.However, it’s worth noting that even if filing a tax return isn’t mandatory for you, there could be potential benefits to doing so. For instance, you may be eligible for a tax break that could lead to a refund. Therefore, it could be advantageous to consider filing a tax return if:Income tax was withheld from your wages over the course of the year.

You made estimated tax payments, or you applied the previous year’s refund to this year’s estimated tax.

You’re eligible for specific tax credits. - Choose a filing method: There are three primary ways to file your taxes:a. Manual Filing: You can manually fill out IRS Form 1040 or Form 1040-SR and send it by mail. This method can be more time-consuming and may require a good understanding of tax laws to ensure accuracy.b. Online Filing: If you’re no stranger to using tax software, the process of online tax filing might already be familiar territory for you. Several major tax software providers, including TurboTax, H&R Block, TaxAct, and TaxSlayer, extend their services to include access to human tax experts. These professionals can provide clarifications, review your tax return, and can even assist in filing your taxes online.Meanwhile, the IRS Free File program enables eligible taxpayers to access filing software companies to do online tax preparation and filing for free. To qualify, your adjusted gross income for 2022 must have been $73,000 or less. Furthermore, the IRS grants all taxpayers access to fillable, electronically submittable tax forms free of charge. Additional free tax-filing resources, specifically tailored for military members and seniors, are also available.c. Hiring a Tax Preparer: If your tax situation is complex or you prefer personal assistance, hiring a professional tax preparer could be beneficial. These individuals are well-versed in tax laws and can help you take advantage of all possible deductions and credits.

- Understand how your taxes are determined: Understanding your tax bracket, the difference between gross and taxable income, and how deductions and credits work is key to calculating your tax obligation accurately.

- Gather your tax filing information: Regardless of whether you’re employing a tax preparer or handling the tax filing on your own, it’s essential to assemble all relevant financial documents. This includes proof of income, potentially tax-deductible expenses, any tax credits you might qualify for, and records of taxes you’ve already paid over the course of the year. Here’s a condensed version of what you’ll need to gather, although our comprehensive tax prep checklist provides more detailed guidance:

- Social Security numbers: This includes your own number, as well as those of your spouse and any dependents, if applicable.

- W-2 form: This form illustrates how much you earned in the past year and how much tax you’ve already paid. If you’ve had multiple jobs, you may have multiple W-2 forms.

- 1099 forms: These forms indicate that an entity or individual — other than your employer — has paid you money.

- Retirement account contributions: Details of any contributions you’ve made to retirement accounts.

- Property taxes and mortgage interest: Records of property taxes paid and any mortgage interest accrued.

- Charitable donations: Receipts or documentation of any charitable contributions made over the year.

- State and local taxes paid: Records of any state and local taxes you’ve paid.

- Educational expenses: Documentation of any education-related expenses, which could qualify for certain deductions or credits.

- Unreimbursed medical bills: Records of any out-of-pocket medical expenses.

- Last year’s federal and state tax returns: These can serve as a reference and help provide consistency with the current year’s tax filing.

- Settle with the IRS: After filing your tax return, you’ll either need to pay the IRS if you owe additional tax, or you’ll receive a refund if you’ve paid more tax than necessary during the year. The IRS provides several payment options, including direct bank transfers, debit or credit card payments, or mailed checks. If you can’t pay the full amount at once, the IRS offers payment plans and other resources.

Understanding Tax Deductions and Credits

A tax deduction is a specific amount you’re allowed to subtract from your income, which reduces how much of your income is subject to tax. You have two options when it comes to these deductions: take a fixed, “standard” amount off your taxable income, or make a list (itemise) of specific costs you’ve incurred, which are then deducted.

The option you choose depends on which one gives you a greater overall deduction. If the combined total of your itemised costs is more than the standard amount, then it’s usually better to itemise. When you itemise, you can include certain things like mortgage interest, donations to charity, medical costs that weren’t reimbursed, and certain state and local taxes.

Standard Deduction vs. Itemised Deduction

Itemised deductions are specific expenses recognized by the IRS, which you can subtract from your taxable income. There’s a wide variety of itemised deductions available. On the other hand, the standard deduction is a fixed amount you can reduce from your adjusted gross income, without needing to justify it with specific expenses.

For most taxpayers, the standard deduction is often the more beneficial choice and can lower your tax bill more effectively. However, if you’ve encountered certain significant events or unforeseen costs in the tax year – such as sizable medical bills or buying a house – opting to itemize your deductions might result in greater savings on your tax bill.

Standard Deduction Table

Filing Status | 2022 Standard Deduction | 2023 Standard Deduction |

Single | $12,950 | $13,850 |

Married Filing Separately | $12,950 | $13,850 |

Heads of Household | $19,400 | $20,800 |

Married Filing Jointly | $25,900 | $27,700 |

Surviving Spouses | $25,900 | $27,700 |

Common Itemised Tax Deductions

In the complex landscape of American taxation, numerous itemised deductions exist that can significantly lower your taxable income, allowing taxpayers to potentially save considerable amounts on their tax bills. With more than hundreds of itemised deductions and tax credits available, let’s delve into some of the most prevalent itemised deductions.

- Medical and dental expenses exceeding 7.5% of your adjusted gross income.

- State and local taxes that include income taxes, real estate taxes, and personal property taxes (up to $10,000).

- Home mortgage interest on up to $750,000 of secured home mortgage debt ($1 million if you bought the home before Dec. 16, 2017).

- Charitable donations deduction.

- Casualty and theft losses from a federally declared disaster.

- Child tax credit (CTC) of up to $2,000 per child, with $1,500 of the credit being potentially refundable.

- Child and dependent care credit (CDCC) of up to 35% of $3,000 of expenses for one dependent or $6,000 for two or more dependents.

- American opportunity tax credit (AOC) of up to $2,500 you spent on tuition, books, equipment and school fees.

- Lifetime learning credit of up to $2,000 you spent on tuition and fees.

- Student loan interest deduction of up to $2,500.

Gambling loss deduction. - 401(k) contributions deduction.

- Health savings account contributions deduction.

- Self-employment expenses deduction.

- Home office deduction for associated rent, utilities, real estate taxes, repairs, maintenance and other related expenses.

Tax Deduction Limit

Tax deductions are subject to various limits and restrictions, which can significantly impact the amount you’re able to deduct. Let’s consider a few examples:

- Mortgage Interest Deduction: If you have taken a mortgage for buying, building, or improving your home, you can deduct the interest you pay on the loan. However, this deduction is capped. For home loans taken out after December 15, 2017, the limit is $750,000, or $375,000 for a married person filing a separate return. For loans taken out before this date, the limits are $1,000,000 and $500,000, respectively.

- Medical and Dental Expenses: If you’re itemised deductions, you can deduct the part of your medical and dental expenses that exceeds 7.5% of your Adjusted Gross Income (AGI). For instance, if your AGI is $50,000, you can deduct the portion of your medical expenses that exceeds $3,750 (7.5% of $50,000).

- State and Local Taxes (SALT) Deduction: The SALT deduction is a federal tax deduction for state and local taxes you paid during the year. This deduction is limited to $10,000 per return, or $5,000 if you’re married and filing separately.

- Charitable Contributions: Generally, the limit on cash contributions to charitable organisations is 60% of your AGI. However, there are exceptions depending on the type of donation and the organisation. Some contributions may have a limit of 20%, 30%, or 50% of your AGI.

Capital Loss Carryforward

Capital loss carryforward is a provision in the U.S. tax code that allows taxpayers to offset their taxable income with capital losses from previous years. Capital losses occur when you sell a capital asset, like stocks or real estate, for less than what you originally paid for it.

These losses are reported on Schedule D of your tax return, which is separate from Schedule A used for itemised deductions. Capital losses are first used to offset any capital gains you might have in the same tax year. If your losses exceed your gains, you can use these losses to reduce other types of income, such as wages or interest income.

However, there is a limit to how much capital loss you can use to reduce your other income in any single tax year. For the tax year of 2022, you can claim up to $3,000 ($1,500 if you’re married and filing separately) in capital losses against other income.

But what if your capital losses are more than $3,000? That’s where the capital loss carryforward comes in. The tax code allows you to carry forward these excess losses into future tax years. This carryforward mechanism has no expiration, which means you can continue to carry forward the losses until they’re entirely used up.

For instance, let’s say you have $5,000 in capital losses and no capital gains in 2022. You could deduct $3,000 of this loss against your other income for 2022. The remaining $2,000 could then be carried forward to offset your gains or other income in 2023.

In this way, the capital loss carryforward provision helps mitigate the impact of a bad investment year by allowing you to reduce your future taxable income, potentially leading to significant tax savings over time.

Conclusion

Understanding the U.S. tax system is essential to ensure you meet your tax obligations and take full advantage of the deductions and credits available to you. It’s a multi-tiered system with federal, state, and local taxes, which can sometimes feel overwhelming due to its complexity and annual changes.

Key components to understand include how income is taxed at different rates based on tax brackets, the distinction between standard and itemised deductions, and the numerous tax credits that could lower your tax bill.

Special provisions like capital loss carryforward can also play a vital role in your tax planning, particularly for those involved in investments.

While tax filing can be a daunting task, several resources, from online tax software to professional tax preparers, are available to guide you through the process. It’s crucial to keep abreast of tax law changes and engage in proactive tax planning. Understanding and effectively navigating the U.S. tax system can potentially save you a significant amount of money and avoid unnecessary complications.

Remember, taxes are an integral part of financial planning, so taking the time to understand the system will benefit you in the long run, whether you’re an individual taxpayer or running a business.

Before you go…

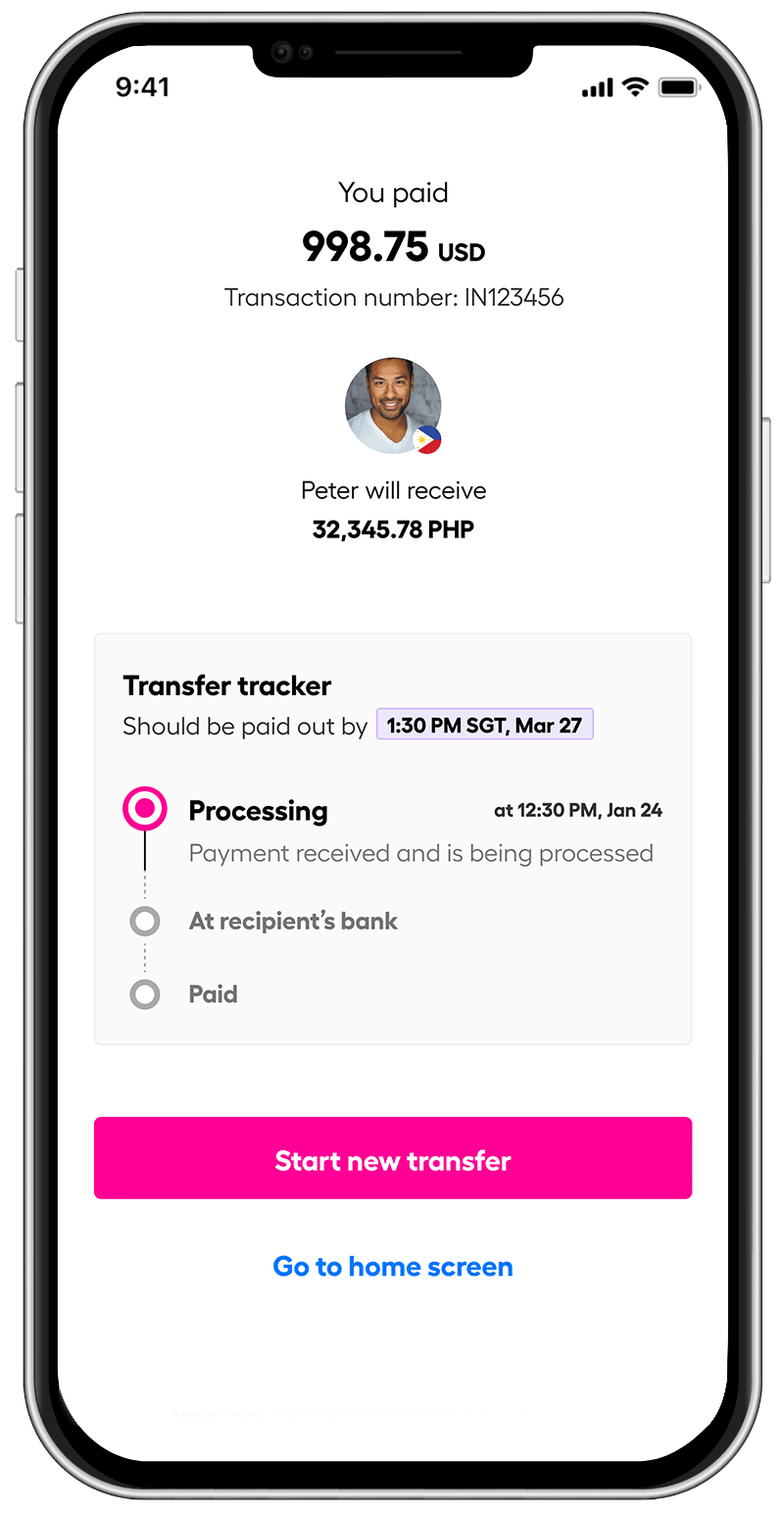

Managing finances in a foreign country can be challenging, especially when dealing with different currencies and cross-border transactions. When you need to send money to India or handle international transactions, financial services like Instarem offer a practical solution to these challenges.

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.