10 financial New Year’s resolutions to keep for 2024

This article covers:

- 1. Start a side hustle

- 2. Make smart investments

- 3. Travel smart

- 4. Pay off your debt

- 5. Establish a budget

- 6. Set a savings goal

- 7. Learn about money and finances

- 8. Set a retirement goal

- 9. Donate to charity

- 10. Send money abroad to loved ones

- Setting financial resolutions is a great place to start when it comes to improving your finances, the next step is to take action.

New year, new resolutions! As we approach the end of another hectic year, it’s time to reflect and embrace a fresh start with the coming new year. Staying mentally and physically fit, eating healthy, and travelling is all common resolutions that make it on the list.

Aside from these, financial goals, which could be difficult to achieve, rarely make it on the list despite the fact that they could have a significant impact on the year.

Jumpstart 2024 by considering some financial to-dos in your New Year resolutions.

Don’t know where to begin? Here are some New Year resolutions to help you improve your financial health in order to achieve your goals and have a financially rewarding 2024.

1. Start a side hustle

Starting a side hustle while having the security of a day job is a good way to build an income, develop passion, and work towards becoming your own boss.

Consider your regular job as a safety net against the risks you’re taking while testing the viability of your side hustle.

These days, there are plenty of side hustles that you can start immediately. From starting a blog, to renting out spare rooms or properties on AirBnb.

But instead of diving head first into the first thing you find, evaluate your needs and current skills to find an income supplement that is doable and achievable for yourself. It’s a definite bonus if you find something you love doing or something that you’re good at.

It won’t be a walk in the park as you do need to devote time nurturing your side project on top of maintaining your full-time responsibilities. Begin by:

- Assessing all your current responsibilities and allocating the time that you can dedicate to your side project.

- Identify the aspects of your life that you may have to sacrifice and create a system of positive triggers and routines in order to push yourself to succeed when the going gets tough.

2. Make smart investments

Many people are afraid of investing. It is especially daunting for people who have a lot of debt to pay off or for anyone who is already in a bad financial position.

To begin with, there are many different types of investments to consider, and it can be difficult to determine which ones are best for your portfolio.

Stocks, bonds, cryptocurrency, and Exchange-Traded Funds (ETFs) are all options that you can explore. Some are suitable for beginners, while others may require more experience.

Each type of investment comes with different levels of risk and reward, which you should consider before deciding on an asset allocation that is fitting for your goals.

It can be useful to understand the value of dollar-cost averaging (DCA), an investing strategy in which an investor splits the total amount to be invested into periodic purchases of a target asset in order to reduce the effect of volatility on the entire purchase.

Before you start investing, it is advisable to consult with professionals and trade/ invest within your capacity.

3. Travel smart

Travelling on a budget may come with restrictions.

But travelling with a plan gives you the financial capacity to do everything you want, and still have money in the bank.

To begin with, choosing a place where your home currency is worth a fortune rather than where it is worth a pittance would support a limited budget.

For instance, the majority of Southeast Asian countries are one-third the cost of Japan. Besides this, flexibility in your trip dates, adaptability in your lodging choices, and even basic things like taking food to the airport can all help you to save money and stress.

Here are some travel tips for a smooth journey:

- Check the government travel advisory and follow its advice. Do keep in mind that the advice may change in a moment’s notice.

- Check your flight status as you might experience changes on travel dates and time.

- Ensure you have proper travel documents, especially any sort of certifications to verify you are eligible to travel.

- Practice social distancing.

- Stay updated on any travel restrictions or travelling rules.

4. Pay off your debt

If you have outstanding credit card debt, consolidating it on a balance transfer credit card can help you save on interest while also giving you enough breathing room to pay the bill over time.

Set aside a budget for additional obligations such as college loans, car loans, or any property loans, to ensure that you are always on top of these payments. And unless you’ve completely settled off some debt, avoid opening up a new debt avenue or it will burden your financial situation even further.

The goal is to reduce your debt to zero or at least reduce the balance and give you more control over what you owe.

5. Establish a budget

Having a good budget will determine your financial success for the full year, therefore making a financial plan is essential. Conduct an analysis of your income, expenses, and investments, including your previous spending habits to get a complete picture. You can keep track of your monthly spending the old-fashioned way, with a pen and paper. But if you don’t want to get buried in numbers and you can’t afford an accountant, consider giving personal finance websites and budgeting apps such as Mint.com and PocketGuard a try to help with your budgeting.

6. Set a savings goal

To avoid overspending, set defined and attainable goals. Begin by deciding on an objective, such as saving money for a vacation or a down payment on a new home. Then set a timeline and milestones for yourself to achieve your goal. Once you get the hang of things, set a monthly target for yourself.

Next, make sure you’re using the appropriate tools for your savings goal. For instance, you may consider mutual funds if you plan to save money for more than five years. You might also choose to open a high-yield savings account to receive a higher rate of interest on your monthly savings balance.

7. Learn about money and finances

Knowledge and understanding of all things related to money are critical to building long-term wealth. You will also learn more about the different ways you can manage your money successfully.

There are many methods to do this, from doing research on the internet, enrolling in classes, reading financial books, or subscribing to personal finance newsletters.

Set a monthly goal for yourself to explore at least one in-depth source that will provide you with more insight into a particular area of financial topics. Start with the basics on personal finance and move towards investments and stock markets once your understanding progresses.

Here are some reading materials to get you started:

- Rich Dad Poor Dad

- Why Didn’t They Teach Me This in School?

- The Automatic Millionaire

- How to Make Money in Stocks

- The Intelligent Investor

- The Little Book That Still Beats the Market

8. Set a retirement goal

Setting a long-term financial goal such as planning out your retirement savings can help you stay on track and make your money work for you. To have a comfortable, secure, and enjoyable retirement, you must first build the financial cushion that will cover it.

Retirement planning begins with evaluating your retirement goals and how much time you have to meet them. Then you should investigate the various types of retirement accounts that can assist you in raising funds for your future. Consider investing the money you save so that it continues to grow and you can achieve your goals sooner.

9. Donate to charity

Good financial resolutions don’t always have to do with just saving money. In fact, resolving to donate to a worthy cause is a brilliant way to spread positivity and make a meaningful difference in 2024. If you are a higher-rate taxpayer, giving can also help you to cut down on your taxes.

Take time to research relevant charities that are close to your heart and to make sure that you are donating to legitimate organisations. Further, protect yourself by limiting the organisation’s use of your personal information.

Household names like Giving.sg or Unicef are ideal because they regularly share information with donors about how their donations are spent via newsletters.

10. Send money abroad to loved ones

In the age of the internet, you can, however, send love to the people you care about easily with a click of a button from the comfort of your home.

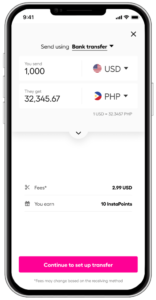

There is an abundance of remittance services to choose from and if you are looking to send money abroad while enjoying low fees, good exchange rates, and swift transfers, then Instarem could be your best option.

Not only will your care package arrive promptly, but it will also be more cost-effective than conventional bank telegraphic or cash transfers.

*rates are for display purposes only.

Try Instarem for your next transfer.

Download the app or sign up here.

Setting financial resolutions is a great place to start when it comes to improving your finances, the next step is to take action.

Keep in mind that you don’t have to tackle everything on this list all at once. Improve your financial health by taking one step at a time and using these resolutions as a checklist to help you make some real progress toward your financial journey next year.

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem is not associated with the promotions mentioned in this article.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.