This article covers:

When you want to transfer money to someone, you can do it in numerous ways. You can either use traditional methods like cash or checks or opt for a more modern way of money transfer; these may include mobile apps, electronic transfers, etc. If you want to transfer money (especially overseas), and speed and ease in sending are your top priorities, a wire transfer can be a good option.

Wire transfers have many advantages for both the sender and the recipient, whether offline or online. With this system, you need not physically visit the bank branch or handle the bills and forms. Instead, you can authorize your transaction online through your bank or money transfer service providers. The funds are transferred within a few minutes or hours and are accessible to the recipient almost instantly.

Wire transfer rules and regulations enable the sender to move a large amount of money conveniently and speedily. In the article below, we shall discuss how to wire money, what are wire transfer details, and tips to ensure a smooth wire transfer process.

What is a wire transfer?

A wire transfer is an electronic transfer of funds from one individual or business to another. Traditionally, it refers to bank-to-bank transfers using any network such as SWIFT (international) or Fedwire (for US). However, many third-party non-banking money transfer companies offer this service.

The sender of the wire transfer provides all the instructions and details of the transfer. When a bank initiates a wire transfer, it is called ‘bank wire.’ A non-banking money transfer provider may even facilitate it. A wire transfer fee is usually associated with the transaction, which may vary based on several factors.

How do you wire money?

There are two ways through which a wire transfer can be initiated:

Bank-to-bank wire transfer

A bank wire transfer can be initiated by visiting the bank branch or online. If you plan to visit the branch and initiate this fund transfer process, you would be required to fill a wire transfer form, provide details and pay the relevant wire transfer fee. The fee typically varies from one bank or credit union to another.

Additional wire transfer details may be required for international bank transfers, and the process may take longer than a domestic one. Also, the processing fee and charges may be higher. It is important to note that the receiving bank may also charge a fee.

Wire transfer service providers

Alternatively, you can send an online wire transfer through a third-party payment service provider. These providers use funds from your bank account to initiate a transfer. Bank account details are not required while transferring from a non-banking provider, but specific details regarding the recipient and cash pickup are needed.

How to do a wire transfer — step by step guide

Wire transfer is a fast, reliable, and easy way to transfer money domestically and internationally. This method of money transfer is irreversible. Hence, you must provide correct information and follow the entire wire transfer process to the T.

Let us learn how to send money internationally or domestically via wire transfer.

Step 1: Choose the wire transfer provider

Both banks and third-party companies aid in sending funds through wire transfers. Select a wire transfer provider bank or non-bank provider depending on your need and other features offered. You must consider some factors before selecting a wire transfer provider or bank.

- Transfer speed and convenience

- Multiple transfer options

- Wire transfer rules and regulations compliance

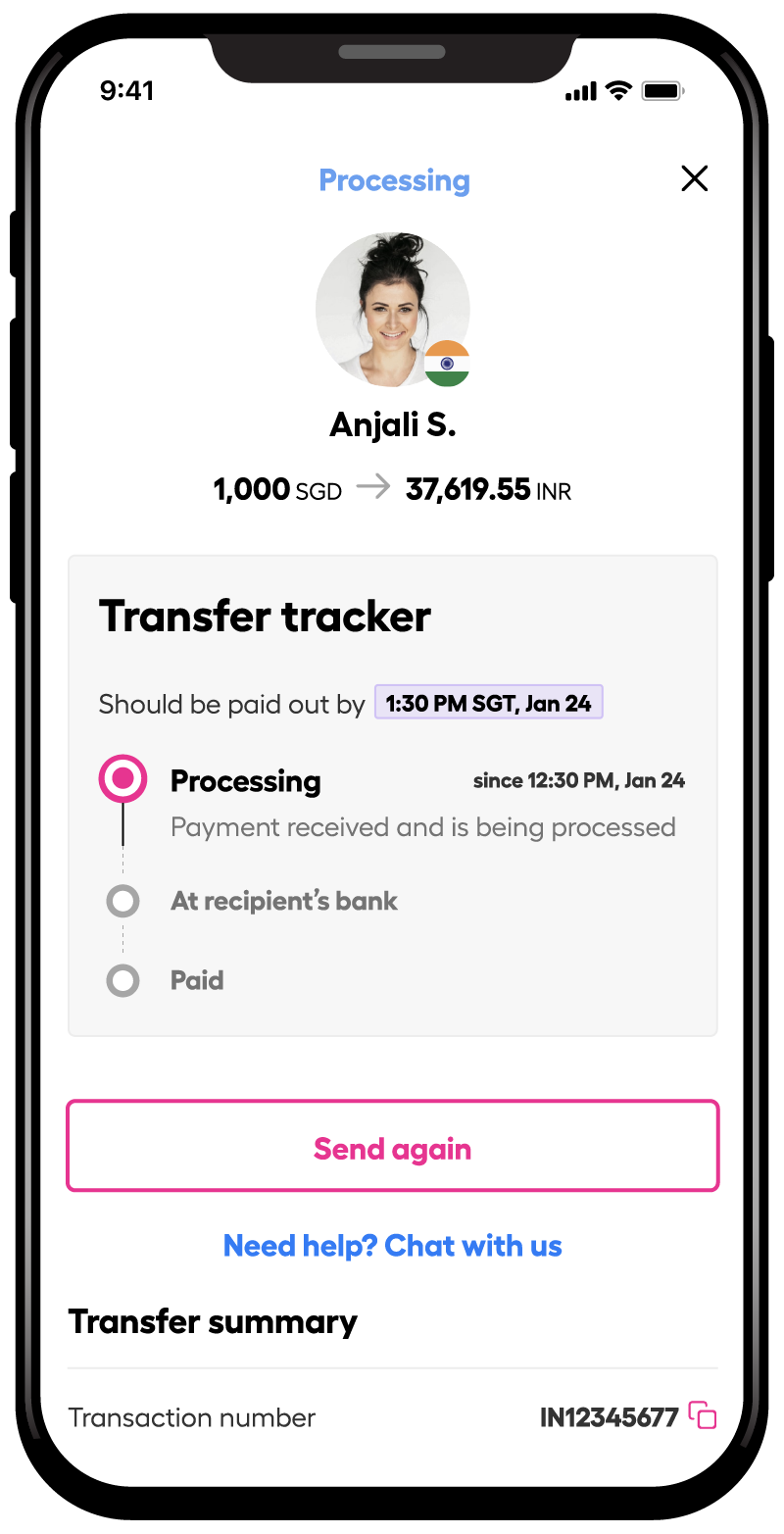

- Wire transfer tracking facility

- Wire transfer limits

- Global accessibility

- Transparent wire transfer fee structure

- Competitive exchange rates

- Quality of customer support

Step 2: Gather all the information you need

The sender will require specific details about the recipient when sending funds through a wire transfer. Some of the vital information the sender must provide if they do a bank transfer would include the recipient’s name, address, contact details, bank account details, receiving bank’s routing or SWIFT code, or any other information as required by the bank.

It is always important to check with the bank or other providers if there are any additional requirements. Based on their requirement, gather information from the recipient to avoid rejection or protection from errors.

Step 3: Understand terms and conditions and other crucial details

Before sending a wire transfer, whether local or international, you must learn about the provider’s fees, exchange rate, taxes, delivery date, the final amount after charging the fee, etc. Knowing the country-specific basic wire transfer rules and regulations is equally important.

Step 4: Fill up the wire transfer form

Now that you have the necessary information and understand the basic terms and conditions on how to do a wire transfer online or offline, you must fill out the wire transfer form. Regardless of the mode of wire transfer, that is, doing it online or speaking with your provider’s customer service, it is crucial to follow the instructions closely and provide precise information.

The transaction is unlikely to be reversed if the information is missing or the recipient’s name or account details are wrongly mentioned. For example, if you are sending money from the US to India, the fund transfer will be stalled without adequate information. Hence, you must ensure all the information is correct and that the money goes to the intended recipient.

Step 5: Pay the required charges

After you fill in the form, you must pay the relevant wire transfer fee. Once the transfer is done, you will receive a confirmation which may include details such as the receiver’s name, transfer date, transfer amount, contact information for the wire transfer provider, etc. If any issues arise, it is best to save the receipt for future reference.

What information do you need for a wire Transfer?

Typically, depending on the wire transfer method, you will need to provide specific information.

Wiring money instructions through the bank

- The recipient’s full name and address

- The recipient’s bank account details like the account number and the type of account etc.

- The recipient’s bank account number or IBAN (depending on the transfer country). For example, the account number is typically substituted with the IBAN if the money is transferred from the USA to Europe or the UAE.

- The recipient bank’s SWIFT Code for international wire transfer and ABA or routing number when transferring money within the US. The SWIFT Code of the receiving bank or branch is the most crucial information for international wire transfers.

Wiring money instructions through a money transfer company

- Sender’s profile login details

- Recipients’ full name as it appears on their government-issued ID

- Recipient’s full address and country code

- Details of the method of payment selected, such as credit or debit card details

Wiring money instructions through mobile payment services

- Sender’s profile details

- Recipient’s profile details

- Payment details (mostly sender’s bank account information)

How long does a wire transfer take?

The time taken for domestic and international wire transfers varies considerably. While domestic wire transfers may be done on the same day or even in minutes (depending on the capability and the correspondent’s bank’s network), international wire transfers may take 3-5 business days.

The wire transfer processing time differs for both these types because the domestic transfer goes through a domestic network, whereas international transfer engages in multi-level international regulations and processes.

Some common factors for delay in international wire transfers may include:

- More number of financial institutions and intermediate banks involved

- Time zone differences

- Difference in currency

- Different regulations

- Cut-off timings

Tips to ensure a smooth wire transfer process

Wire transfer is a straightforward process. Yet, it is always best to take precautions to ensure a smooth wire transfer process.

- Ensure you enter the correct information: Your transaction may not get processed, or the funds may be wired to the wrong recipient if incorrect information is provided. Typically, the funds are transferred almost instantly in a wire transfer and are immediately accessible.

Hence, revoking the instruction may be highly challenging. Thus, you must ensure that the details mentioned in the instruction, like account number, recipient name, and SWIFT code, must be correct. It is best to re-check the details before giving the instructions. - Make a single large payment instead of multiple short payments: Since wire transfers are quick and more reliable than checks, it comes at a cost. The service provider usually charges a fee to process a wire transfer transaction.

Wire transfer fees for international transactions are generally higher than domestic wires. Thus, if you wire a small amount of money regularly, it may cost you more than if you wire a significant amount in one go. Thus, the former is time and cost-effective, safeguarding you from multiple transaction-fee. - Estimate changes in the exchange rate: When doing an international transfer, the exchange rate is one of the major determinants affecting the final transfer amount. Hence, if you transfer money overseas, consider the exchange rate fluctuations to ensure the required amount reaches the recipient.

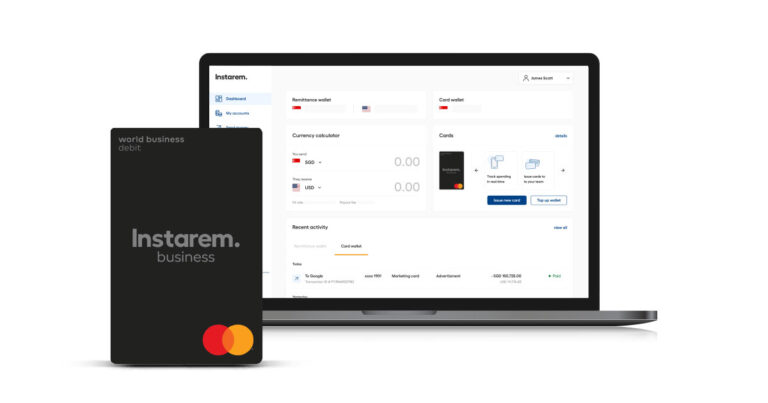

Many banks and money transfer service providers like Instarem offer currency conversion facilities through which you can quickly determine how much you are paying and how much the recipient will receive. - Familiarize yourself with the fee structure: Wire transfer fees may vary based on various factors; these may include the provider selected, destination (domestic or international), mode of sending money, and amount of money being transferred. It may vary from one transaction to another. Hence, it is essential to understand the fee associated with the wire transfer transaction.

Conclusion

Wire transfers have made money transfers relatively easier and hassle-free. If done carefully, it makes transferring money abroad a breeze. With just a few minutes to set up and initiate a wire transfer, possessing lesser risk of fraud compared to the check, and making funds available to use as soon as the transfer is complete are the main benefits of this transfer mode.

Whether sending money to your family overseas or sending international business payments, consider opting for a fast**, reliable, and cost-effective*** money transfer tool – Instarem.

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

* *Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.