Learn all about swift code & its uses – A complete guide

This article covers:

- Key pointers about swift code

- SWIFT code meaning

- Who uses the SWIFT and BIC code system?

- Do I need a SWIFT or BIC Code to make an international payment?

- How does SWIFT work?

- How do you find your SWIFT/BIC code?

- Is SWIFT code same for all branches?

- Importance of Swift codes in international transactions

- Do’s and don’ts when using SWIFT code

- Conclusion

Any geographical boundaries no longer bind the global workforce in today’s times. Individuals and businesses look beyond their home countries for opportunities and better lifestyles. This has increased international money transfers (commonly called “remittances“). A report by The World Bank states that remittances grew by 5% to USD 626 billion in 2022.

So, if you regularly transfer money overseas or have ever transferred money abroad, you must be aware of the entire process. It may sound a bit taxing, but with technological advancements, the process is now a breeze. Also, you must be aware that the international money transfer process differs from the domestic one.

For transferring money abroad, you typically need a unique code called a SWIFT code digit. In the article below, we shall discuss what the SWIFT code is, its importance in the international money transfer process, and why finding the correct SWIFT code for a bank is crucial.

Key pointers about swift code

- SWIFT code full form is Society of Worldwide Interbank Financial Telecommunication, also known as BIC.

- BIC full form is Bank Identifier Code and is approved by the International Organisation for Standardisation.

- Individuals and banks use SWIFT codes to transfer money, especially international transfers.

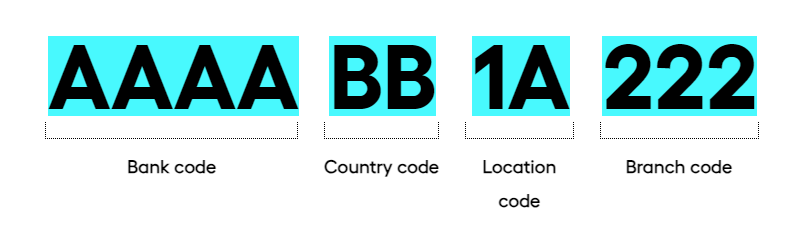

- A SWIFT code digit consists of 8 to 11 characters identifying the country, location, bank, and branch.

- This system is used by banks and other financial institutions all over the world.

- SWIFT is the world’s largest and most efficient international payment and settlement method.

SWIFT code meaning

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. A SWIFT code acts as an identification number for banks and other financial institutions worldwide. It is also interchangeably called the Bank Identifier Code (BIC), which shows the location and details of the bank. A BIC code meaning is the same as the SWIFT code. The International Organisation approves the Code for Standardisation (ISO).

Sometimes there can be confusion regarding SWIFT and BIC codes. In simple terms, SWIFT is the name of the overall messaging system (between the banks), and BIC is the code used for the system. Hence, in most cases, these terms are used interchangeably to describe the system (SWIFT) or the code (BIC).

Example of a swift code format

As mentioned, SWIFT codes denote the institution (bank code), country code, location code, and branch code.

Banks that opt for an 11-digit code may do so to identify the specific branch through which the transaction takes place. This is a common example if there is more than one branch of the same bank located in the same area.

Take a look at what a SWIFT code looks like.

Who uses the SWIFT and BIC code system?

SWIFT is an easy cross-border payment solution wherein a SWIFT code is necessary for every bank that makes an international transaction. Every bank must opt for a SWIFT code to join the network and receive and make payments. The main aim of this code is to conveniently, securely, and accurately make international payments through a digital language. This electronic system is used worldwide across banks and uses cloud technology to quickly transmit codes between participating banks.

Various parties use this code. People sending money to their families in different countries would require a SWIFT code. Similarly, businesses, such as those involved in exporting goods or services (or any other business), may frequently require a SWIFT code to receive payments.

More than 200 countries and over 11,000 institutions are included in the SWIFT network and use this system regularly. In fact, it is considered the most prominent international payment network in the world.

The SWIFT network provides services to the following:

- Banks

- Exchanges and depositories

- Clearing houses

- Trading houses, brokerages, security dealers

- Asset management companies

- Corporates and other businesses

- Treasury market participants and service providers

- Foreign exchange and money brokers

- Individuals

Do I need a SWIFT or BIC Code to make an international payment?

To make an international money transfer, a SWIFT code is one of the most important details that must be furnished. This code helps ensure the funds are transferred to the right location accurately and securely. For example, if someone is sending you an international transfer, this code becomes necessary to identify your bank and verify payment.

Hence, a SWIFT code digit is needed for every transfer of money to or from a foreign country. However, an International Bank Account Number (IBAN) may also be needed to transfer money within the Eurozone.

How does SWIFT work?

Firstly, we must understand that SWIFT is not a bank or financial institution and hence does not hold or facilitate the movement of funds between banks. Hence, when an individual or business uses the SWIFT network, they are not sending money in the real sense but only sending messages from one bank or financial institution to another to quickly and securely communicate about funds transfers. Hence, it is a “payment order” between two banks.

For the SWIFT system to be operational, banks open accounts with each other called Nostro and Vostro accounts.

Let us take an example to understand how the SWIFT network works.

If Jonathan, situated in New York, wants to transfer money to his friend Fred in Milan via wire transfer, he will first have to visit his bank.

He must submit the required details like the transfer amount, the recipient’s name and contact number, and banking account details with the recipient’s banking SWIFT code.

The sender, Jonathan’s bank, will then send a SWIFT message to Fred’s (recipient’s) bank to accept the transfer. Once the recipient’s bank approves the message, the payment and transfer are complete.

How do you find your SWIFT/BIC code?

One of the common questions that may come to your mind is – how to get a SWIFT code. Many may also refer to it as a SWIFT address, the meaning of which is the same. There are various ways to find or locate your SWIFT code like:

- Bank account statements

- Online banking portal

- Bank’s website

- Contact your bank

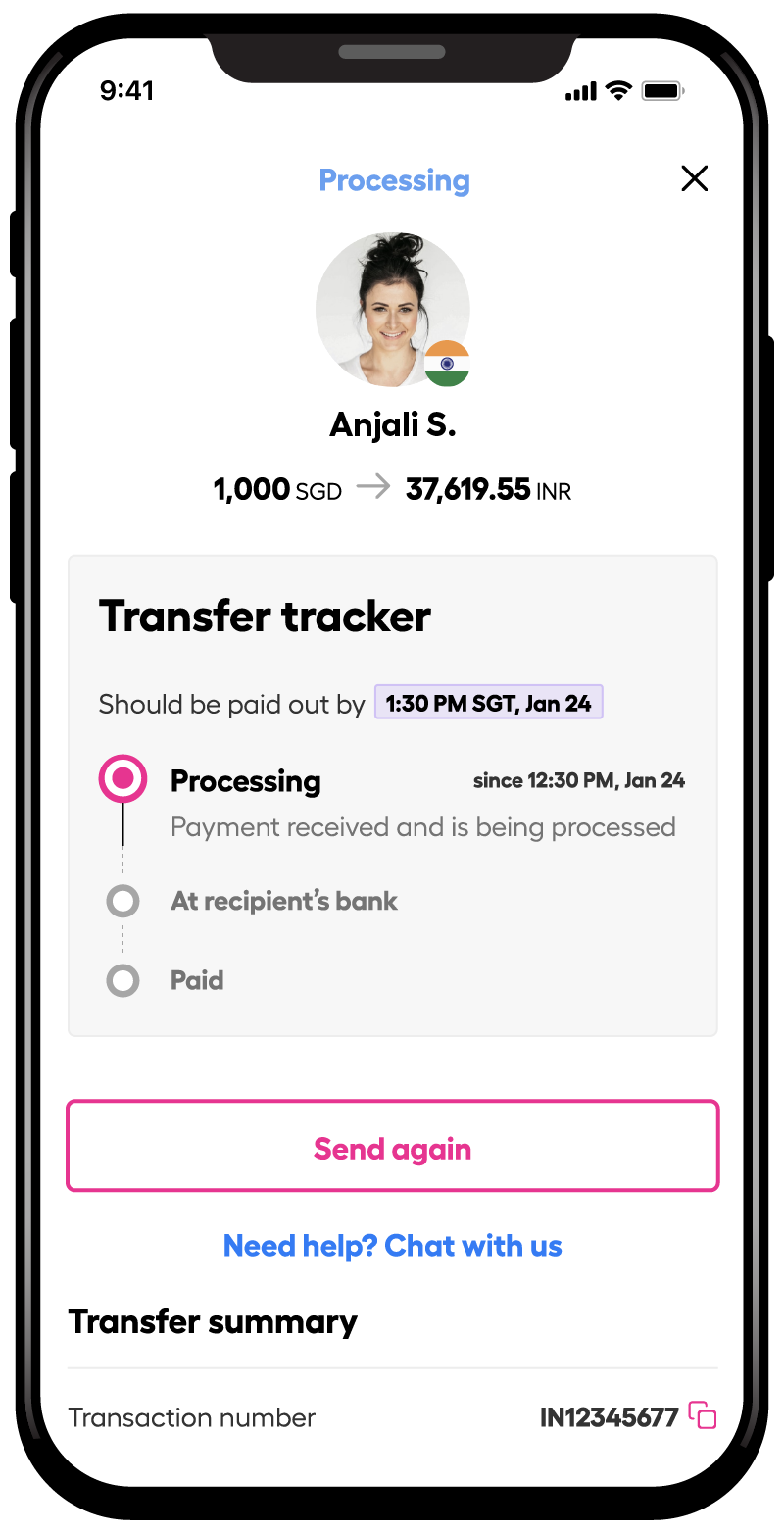

You can also use Instarem’s BIC/SWIFT code finder, an easy online tool for finding the correct SWIFT Code for a bank before making an international transfer.

Is SWIFT code same for all branches?

SWIFT code may be the same or vary for different branches, and this entirely depends on the bank. Some banks may choose to have a single SWIFT code for all branches, whereas some may have different for different branches. Banks may often opt for unique SWIFT codes for branches in the same area.

If you are unsure of the SWIFT code, you may use the bank’s main branch or the head office SWIFT code to send money or use an online SWIFT code finder.

Importance of Swift codes in international transactions

- The importance of the SWIFT code is as follows:

- It allows banks to ensure that the money is sent to the correct location

- The messaging system swiftly, accurately, and securely sends and receives money transfer instructions.

- It helps reduce fraud instances related to international money transfer

Apart from the abovementioned importance, here are some of the other uses of the SWIFT code or network.

- It offers business intelligence solutions like dashboards for detailed, real-time reports of their messaging.

- It also offers compliance services to address compliance issues and financial crimes.

Do’s and don’ts when using SWIFT code

Here are some tips to ensure no errors while using the SWIFT code.

- Find the correct SWIFT code of the recipient’s bank

- Ensure there are no typing mistakes; hence prefer copying and pasting from digital format to avoid the likelihood of errors.

- Ensure usage of correct SWIFT code format. DO NOT add space between the code; otherwise, it will be termed invalid and prevent it from getting processed.

- Ensure the recipient details entered, apart from the SWIFT code, are correct to avoid disappointment.

- Remember, if you send a payment using a SWIFT or BIC code that does not exist, the payment process will not be completed. The payment shall be returned to you, but reversing the transaction might take a few days. Also, you might be charged a fee for the same.

- If you realize that the SWIFT code mentioned is incorrect, it is best to contact your bank immediately and cancel the transaction

Conclusion

Both BIC and SWIFT code meaning in bank terms, refer to the same. The banks and financial institutions use them to communicate with each other securely, predominantly by giving money transfer instructions. A SWIFT code is an essential aspect of the international wire transfer process or SEPA (Single Euro Payments Area) payments, which is necessary for the transaction to stay complete. You can find your bank’s SWIFT code through various means, including your bank account statement or an online SWIFT code finder.

Looking for low-cost**, fast***, hassle-free and reliable money transfer options?

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Get the app

Get the app