This article covers:

- How wire transfers work?

- How long does a domestic wire transfer take?

- How long does an international wire transfer take?

- Factors affecting wire transfer time

- Tracking a wire transfer

- Alternatives to wire transfers

- Tips for a smooth wire transfer process

- Conclusion

- Frequently asked questions about wire transfer duration

There are several options to send and receive money. Earlier, people commonly sent money through physically written checks or made cash handovers. But these methods have been replaced by the electronic system of money transfer. Out of the several ways in which someone can send and receive money electronically, wire transfers are pretty standard.

Wire transfer is an electronic transfer of funds from one bank, financial services company, or credit union to another over a secured network.

Along with the sending and receiving financial institution, a wire transfer also requires some additional information, like the receiving party’s full name and bank account details.

If you are wondering how to do a wire transfer and whether there is any wire transfer fee, here is a detailed guide to the wire transfer transaction time and process.

How wire transfers work?

Initially, wire transfers took place through telegraph wires, from where they got their present name. With the evolving technology, wire transfers began taking place electronically, and now, they do not involve any physical exchange of funds. Instead, they are settled virtually.

Two parties located in different geographical locations can transfer funds between them using wire transfers. Wire transfers are quick and secure, and the domestic and international wire transfer duration is fairly less.

To schedule a wire transfer, the sender has to pay instantly to the financial institution. The information needed from the sender here includes:

- The receiver’s complete name, address, contact number, and any other information required by the financial institution.

- The receiver’s bank account details and the bank branch details where the funds will be sent.

- The receiving financial institution’s details, including their name and the bank identifier, i.e., the routing number or the SWIFT code.

- The purpose of the fund transfer.

When complete information is available with the sending financial institution, the wire transfer process begins.

- The institution initiating the payment sends payment instructions to the receiver’s institution over a secure network, such as SWIFT.

- Once the receiver’s institution gets the information from the sending institution, they deposit funds in the receiver’s account from their own reserve funds.

- The sending and the receiving institutions settle the payment between them after the money is deposited into the receiver’s account.

- The wire transfer fee for domestic and international transactions may range between USD 0 to USD 50, and there may be a fee for sending as well as receiving wire transfers.

Note: Fees taken from Nerdwallet on 28th July 2023 at 12:30 PM IST.

How long does a domestic wire transfer take?

Wire transfers are the most popular because of their processing speed. Domestic wire transfers within the same financial institution may take place almost instantly or within a maximum of 24 hours. Domestic wire transfers between different financial institutions may take between one to three days to complete.

However, some incidents like human errors when filling out the form or public holidays can delay the wire transfer process by a few days.

Moreover, financial institutions have different wire transfer cutoff times.

You must request a wire transfer before the institution’s cutoff time to increase the chances of it getting processed on the same day. For example, if you initiate a wire transfer after the cutoff time on Friday, the transaction will not be processed before the coming Monday.

How long does an international wire transfer take?

Transferring funds overseas through a wire transfer usually takes longer than domestic transfers. Usually, it takes between one to five business days for an international wire transfer to complete. Even after it reaches the receiver’s bank, it could take some time to show in the receiver’s account. It is because the receiving wire transfer time for their financial institution may be higher.

International wire transfers may require currency changes, which may further add to the delay. Moreover, public holidays, human errors, and location-specific issues may delay international wire transfers by a couple of weeks in a few instances.

Note: We have answered some of the frequently asked questions about wire transfer duration at the end of this blog. These answers can give you more clarity about how long a wire transfer takes.

Factors affecting wire transfer time

Wire Transfer Timing: As discussed, every financial institution has a different cutoff time for wire transfers. The transfer gets delayed if it is initiated post the cutoff time. Moreover, the weekend falls at different times for various countries. As weekends are usually off for banks and other financial institutions, international wire transfers may take longer because a working day in one country may be a holiday in another.

- Wire Transfer Method: Wire transfers are carried out in two ways. The first is the Fedwire system. It uses the RTGS method of payment settlement, which happens almost instantaneously. The second method is the SWIFT network. Transfers over the SWIFT network do not happen directly, and the funds are passed through intermediary banks. Since there are multiple institutions involved, a delay at any of them can delay the entire fund transfer process.

- Payment Errors: Errors like incorrect or incomplete details or insufficient funds in the bank account can also delay the wire transfer process.

- Individual Financial Institution’s Processing Time: Every financial institution has a separate processing time for wire transfers. Some banks have a lengthier fraud prevention process that takes relatively more time. Since there are multiple institutions involved in the wire transfer process, the processing time for each one affects the overall wire transfer duration.

- Wire Transfer Destination: Some destinations within the United States or other countries have a longer payment time. Additionally, they may fall in a different time zone than the sender’s country. All this may delay the wire transfer process.

Tracking a wire transfer

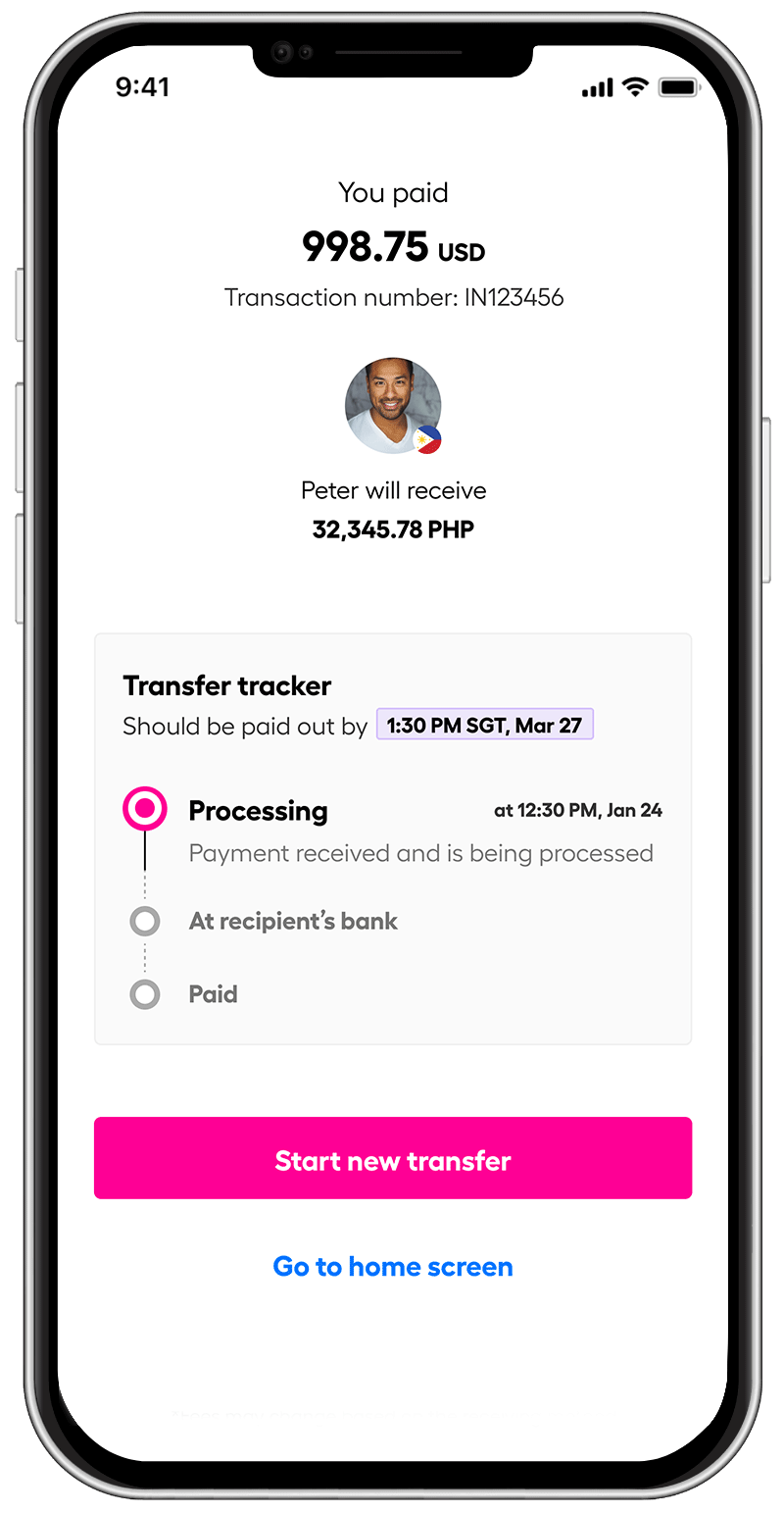

Since you are now aware of the usual time a wire transfer takes and the reasons for which it can be delayed, you can conveniently identify if there is a delay in the process. To help you with this, a wire tracking system is available to monitor a wire transfer.

Every wire transfer made to or from the US has to pass through the Federal Reserve Bank. The bank assigns every wire transfer transaction with its own unique input message accountability data (IMAD) ID or the output message accountability data (OMAD) ID. The ID number includes the following information:

- Date of transaction

- Identifier for the source bank or an identifier for the destination bank

- Sequence number

If a wire transfer takes longer than it should, you may request the financial institution to track it down with the help of the identification number.

Alternatives to wire transfers

Earlier, the only alternatives to a wire transfer were writing a physical check or sending a money order. Physical checks and money orders were often exposed to delays or misplacement in the mail. Electronic fund transfers are free from such worries.

Another electronic method to transfer funds apart from wire transfers is through the Automated Clearing House. However, this method is not good for immediate fund transfers as ACH transactions are processed in batches.

The revolution in fintech has created innovative and secure ways to transfer funds. For example, you can now transfer funds internationally through an online fund transfer service provider without providing your bank details.

Instarem is a leading international money transfer service provider which allows you to transfer funds to over 60 countries securely and conveniently.

Tips for a smooth wire transfer process

- Have a dedicated account for wire transfers: Have a dedicated zero balance account for wire transfers and restrict processing of other payment types from this account. It will help eliminate fraud from the wire transfer process.

- Restrict international wire transfers: Overseas wire transfers are more prone to fraud than domestic transfers. If you do not plan to send international wire transfers, block them from your dedicated wire transfer account.

- Create wire templates: If you send wire transfers frequently, set up a standard wire transfer template with the help of your financial institution. It will help reduce manual errors in the process.

- Request for a bank callback service: You can request a bank callback service for high-volume or non-repetitive wire transfers, where the bank will call you up to get final approval before initiating the fund transfer. It further enhances the transaction security and makes the transfer process smoother.

- Verification of the payee: Several financial institutions now verify the payee before processing a wire transfer for both domestic and international fund transfers. The payee’s name is taken from the sender and matched with the bank details to ensure that the transfer is being made to the genuine account.

Now, for example, if you are looking to send money to India from the US, you can check these steps for a smooth transfer.

Conclusion

Wire transfers are an electronic method of transferring money between parties domestically or internationally. You may have to pay a wire transfer fee for sending or receiving funds through wire transfers, and the transaction may take a while to clear in a few cases.

A faster and inexpensive way to transfer money internationally is through an online money transfer service like Instarem.

With Instarem, you can send money quickly**, securely, and at affordable exchange rates*** with just a click of a few buttons.

Download the app or sign up here.

Frequently asked questions about wire transfer duration

- Are wire transfer funds available immediately?

The wire transfer speed is usually very high, and you can transfer large amounts of funds. Wire transfer funds between non-banking financial institutions are available within a few minutes. - How long do wire transfers take from bank to bank?

Funds transferred through a domestic wire transfer between banks are usually available in 3 days. - How long does a wire transfer take within the same financial institution?

A wire transfer within the same financial institution can complete within 24 hours in most cases. - How long does a wire transfer take to clear between countries?

A wire transfer between two countries can take up to 5 days. There may be an additional delay for certain countries like Afghanistan. - Can you wire money on the weekend?

Most banks are closed on weekends, so you may not be able to make a wire transfer on weekends. However, some financial institutions allow wire transfers over weekends. You can inquire with your financial institution about it.

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

**Fast – 75% of our transactions are completed in 15 minutes. Depending on the funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.