How to invest in a foreign country? 9 things you must know!

This article covers:

- Save first, invest later

- Know your own risk or reward profile before investing

- Avoid listening to ‘expert’ advice offered by friends & ‘well-wishers’.

- Talk to an expat-friendly investment advisor or broker

- Be aware of your tax liability & compliance before investing in your home country

- You may be able to save money by buying foreign investments from your home country

- Don’t put all your eggs in one basket – build a globally diverse portfolio to spread your risk

- Invest, but don’t ‘overinvest’

- Invest in hedged instruments

- Managing your finances abroad can be challenging

- Before you go…

Expats living in foreign countries deal with their financial situations in many different ways. Some are spenders while some are savers, and a small section of expats are investors.

So, which kind of expat are you? Are you the:

- The spender: “I just want to have a good time; tomorrow will take care of itself!”

- The saver: “Who knows what will happen tomorrow? I’m going to save every penny I can!”

- The investor: “It’s not enough to simply save my money. I have to make it GROW!”

If you belong to the third category, then this article is for you.

Keep reading for some useful tips that you may want to consider before you invest your hard-earned money in your current country of residence.

Of course where, when and how much you invest would and should depend on your profile: your circumstances, responsibilities, short-term and long-term goals, income, current liabilities, etc.

So, before you actually invest, think very carefully about these factors as well as the ideas we have proposed.

Also, do your research and if possible, talk to an investment advisor, preferably one who specialises in advising expats.

Save first, invest later

If you have moved abroad, ideally the work you do in your new country should bring in more than enough money for you to spend as well as save.

Divide your income into 3 categories: Spend, Save and Invest.

How much you spend would depend on your lifestyle and personal circumstances. Self-analyse your overall spending patterns, prepare a weekly or monthly budget and stick to it!

Asking yourself these questions can help:

- What are my current expenses?

- How many are fixed and/or recurring?

- Can they be eliminated (Yes/No/Maybe) or at least reduced (Yes/No/Maybe)?

- How many expenses are variable? This is probably the most important question to answer because here’s where most of your savings can come from.

Also, add your discretionary (‘nice to have’) expenses to your budget. This will help you limit these expenses so your other essential (‘must-have’) expenses don’t have to take a hit.

After you create a spending budget, you will know how much you can feasibly save. Put this money aside for emergencies and don’t touch it unless absolutely necessary.

To get rid of the temptation to spend it on non-urgent needs, you can even repatriate this money home.

Invest the rest of your money – ideally, at least 50% of your total income. Read on for more ideas on how you can do this.

Know your own risk or reward profile before investing

Depending on your expenses, savings and financial responsibilities, ask yourself these questions first:

What is your risk-taking capacity?

How much money can you stand to lose if your investment is wiped out, say, due to currency rate fluctuations?

What would you consider a reward?

Different people have different perspectives when it comes to risk and reward.

Is a 10% return on investment on a low-risk government bond an acceptable reward for you?

Or would you rather invest in the more volatile stock market – and therefore riskier – but may also give higher returns?

What timeline are you considering?

If you’re planning to live overseas indefinitely and have the means for it, you may consider investing in foreign property assuming you can, legally.

Depending on where you live now, the returns may be significant when you eventually sell the property or rent it out now.

Property investment may attract a lower tax obligation in your home country than investments in stocks or bonds. But again, be aware of the laws in both countries about property purchases by expats, especially in the areas of taxation, compliance, and reporting.

If you plan to invest in tradable assets such as stocks or bonds, work out your acceptable ‘trading range’ in advance, i.e. your best-case and worst-case scenarios.

Set your own limits and identify at what point your transaction will be too costly and should, therefore, necessitate a pull-out by you.

Avoid listening to ‘expert’ advice offered by friends & ‘well-wishers’.

People in your personal and professional network may or may not have the financial expertise to advise you.

If you ask others for financial advice, keep in mind that their recommendations will be coloured by their own prejudices and beliefs, as well as their limited understanding of you and your situation.

Their knowledge of specific investment avenues for expats may be limited at best and outright wrong at worst.

Don’t just invest any of your hard earned money based on somebody’s advice, recommendations, or ‘hot tips’ even if you trust that person. Do your research through trusted sources.

Remember that although online search engines provide a wealth of information at our fingertips, some of the information is pure junk.

Talk to an expat-friendly investment advisor or broker

In many countries, new laws are being enforced with regard to expats’ foreign investments.

For example, in the USA, the 2010 Foreign Account Tax Compliance Act (FATCA) gives the IRS more power to enforce US laws regarding taxation and reporting of foreign investments made by American expats.

As a result of this official clampdown, many foreign institutions no longer allow American expats to open overseas investment accounts with them. Some US brokerage firms are also unwilling to work with these expats.

Of course, such situations are not restricted to the US alone and can cause a lot of confusion among expats in many countries.

That’s why it is important to find an investment advisor who specialises in working with expats.

The advisor should be able to advise you on the best investment avenues for you as well as on your tax liabilities and reporting responsibilities. The advisor should also give you up-to-date information on the laws of your home country and resident country so that you don’t unwittingly do anything illegal in either.

However, do remember that these are your investments, not your advisor’s. Therefore, keeping track of your investments and if necessary, pulling out of them, is your responsibility alone.

Be aware of your tax liability & compliance before investing in your home country

In some countries, expats who qualify for certain ‘foreign earned income exclusion’ limits may be able to avoid ‘double taxation’

Double taxation is a scenario where they have to pay taxes on their income and investments in their home country as well as their current country of residence.

Find out if you qualify. If not, any profits you make on your foreign investments may be subject to taxes in your home country and at higher rates than the gains on any investments you make in your home country.

Also, your country’s laws may make it mandatory for expats to keep extensive records and report all their foreign investments and gains, say through yearly income tax returns.

These rules may apply to foreign-purchased mutual funds, hedge funds, cash management products, foreign pension plans, and even some types of insurance policies. Educate yourself on these requirements and comply with them without fail.

If you plan to invest in digital currencies such as Bitcoin in your new country, find out if the laws in your home country allow you to do so.

If the rules are unclear, err on the side of caution and avoid investing in digital currencies.

Expats must also be aware that some foreign pension plans – even those sponsored by their employers – may give them tax benefits in their country of residence but not necessarily in their home country.

Many such plans do not fall under double taxation avoidance treaties and investing in them may actually have negative tax consequences for expats.

Be aware of these details. Otherwise, you may end up losing a large proportion of your profits to taxes.

Even more importantly, ignoring the tax implications could lead to future fines, penalties, and even imprisonment.

You may be able to save money by buying foreign investments from your home country

It is important to know where your foreign investment is ‘housed’.

For example, if you are an American now working in Germany, you can invest in German bonds and stocks by purchasing them through an agent in the US or by purchasing them directly through an agent in Germany itself.

The investments themselves might be indistinguishable from each other, but those purchased through an agent in the US are considered to be ‘housed’ in the US.

Therefore, they would be subject to a lower tax rate than the investments bought and ‘housed’ directly in Germany.

So although both you and your investments are housed in Germany, you end up paying higher taxes and thus lowering your profits. Research such rules in your home country before you make your investments in your country of residence.

After all, money saved is money earned!

Don’t put all your eggs in one basket – build a globally diverse portfolio to spread your risk

Risk is an unavoidable element of every financial investment and overseas investments are no exception to this rule.

When you invest your money in a foreign country, there is an additional risk that you should be aware of – ‘forex’ risk. This is the risk of losing money due to fluctuations in currency exchange rates.

If you are from a developing country, say Nepal, and have moved to a developed country, say Canada, chances are that your Canadian investments will earn you good returns vis-à-vis your Nepalese investments.

This is because the Canadian Dollar (CAD) is stronger than the Nepalese Rupee (NPR) and is likely to remain so in the future as well. In other words, the strong exchange rate is in your favour.

However, if the CAD was to ever depreciate against the NPR and you decide to get rid of your CAD investments to cut your losses, you will end up in a bought high-sold low situation. Result: you will incur a loss on your investments.

Therefore, whether you buy or sell foreign currencies, goods, stocks or property, you must consider forex risk in your investment strategy.

A globally diversified multi-instrument investment portfolio is one such way. Investing in multiple currencies and instruments will help you to spread your risk and increase your chances of making a profit.

Before investing, do keep in mind the simple economic principle of risk & reward – any investment that offers very high future rewards to foreign investors likely involves a lot of risk.

Invest in countries with low debt/GDP ratios and rising currencies. Also, check the currency’s past volatility patterns and exchange rates vis-à-vis your home currency.

These data points will give you a better idea of how risky or not it could be for you to invest in foreign currency.

Invest, but don’t ‘overinvest’

It’s ridiculously easy to go overboard with foreign investments, particularly if you are presently gaining from them.

Expats from developing countries who are now living in a developed country and enjoying its benefits – including good gains from investments – can get especially overjoyed with what they see as ‘great profits.

They also tend to assume that the good times will continue in the future as well.

If you have any foreign investments, remember that a wonderful profit-producing ‘bull’ market in your new country may very quickly turn into a loss-inducing ‘bear’ market, due to several factors such as

- global political conditions,

- international relations between countries,

- changing market realities,

- new technological trends, etc.

Keep an eye on your investments and pull out, if necessary.

Invest in hedged instruments

It’s important to understand that currencies, unlike stocks or bonds, are a ‘zero-sum’ and ‘relative’ investment game.

This means that in a currency pair, when one currency appreciates, the other must necessarily depreciate.

This is why hedging is a good strategy when making foreign investments. Hedging allows investors to fix the purchase price of an instrument and minimise the possible adverse effects of future exchange rate fluctuations.

If you have foreign investments, leave the exchange rate risk unhedged when your home country’s currency is depreciating (falling in value) against the foreign investment currency.

But if your home country’s currency is appreciating (rising in value), you should hedge your risk to minimise future losses.

You can do this by investing in currency-hedged overseas assets such as currency mutual funds or Exchange Traded Funds (ETFs), currency options, futures or forwards.

Although currency-hedged ETFs are slightly more expensive than non-hedged ETFs, they are also less volatile and therefore better able to protect you from currency fluctuation-induced losses.

Managing your finances abroad can be challenging

Moving abroad and living the expat life can be an amazing, life-changing experience. But it also comes with several challenges, especially when it comes to investments and money management.

Don’t let fluctuating exchange rates, taxes, or your limited knowledge prevent you from making wise and profitable foreign investments.

The recipe for a successful foreign investment portfolio includes solid research, some help from a reputable expat-friendly financial advisor, a dose of pragmatism and plenty of common sense.

As long as you have all these ingredients, you can prudently manage your foreign investments, maintain good financial health and grow a successful portfolio wherever you are.

Before you go…

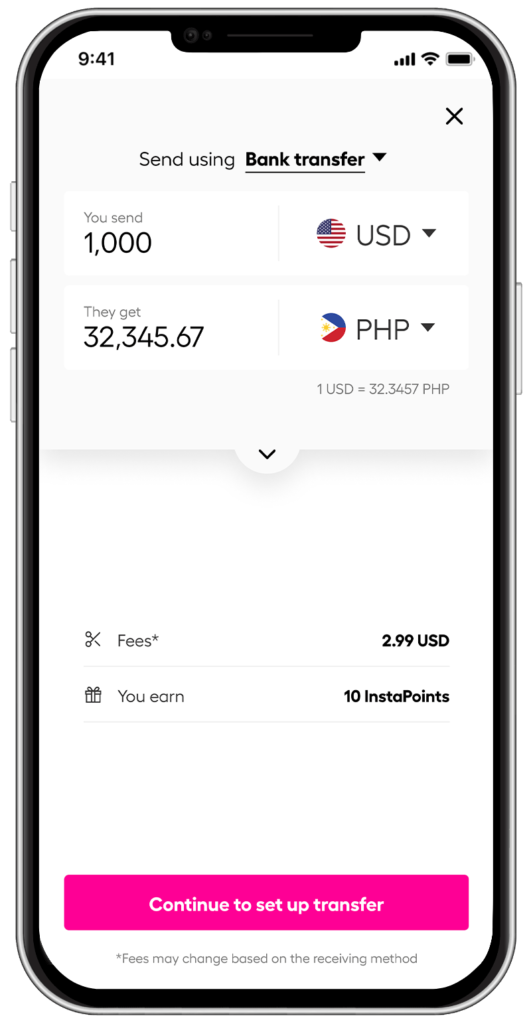

Planning to send money back home for investment?

Don’t transfer money between bank accounts though! Banks charge hefty transaction fees!

To avoid losing out on overseas money transfers, it is always a wise move to select a money transfer service provider that allows you to instantly transfer money at a reasonable cost and with no hidden charges.

As an expat, you would be able to transfer money via Instarem to 60+ countries at low fees and great rates.

*rates are for display purposes only.

Try Instarem for your next transfer.

Download the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.