Important financial considerations for studying abroad

This article covers:

So, you’re considering studying abroad, huh? It’s like deciding to jump off a cliff with only a parachute named “hope.” Sure, it can feel like you’re diving headfirst into a pool of homesickness and financial woes, but hey, who doesn’t love a good challenge?

You’ll get to broaden your cultural horizons and develop this fancy ‘glocal’ (global + local) mindset – it’s like having your cake and eating it too. Especially if your home country’s culture is as different from your destination as chalk and cheese. Imagine being an adulting kid, where mistakes are just part of the fun!

But here’s the catch – many folks fail to turn their ‘study abroad’ fantasy into reality because they overlook one tiny detail: money.

Sure, acing your English proficiency test or entrance exam is great, but without that green stuff, it’s like trying to drive a car without gas. Lack of planning often leads to a constant struggle to stay financially afloat, and trust us, that’s about as much fun as doing a math test.

Fear not, we’ve got your back! In this article, we’ve compiled a list of practical questions and tips about all the financial prerequisites you need to consider before you take the plunge.

Use this info as a launchpad for your planning process so you can have the epic, once-in-a-lifetime study abroad experience you’ve always dreamt about, without ending up living on a diet of instant noodles!

You Might Also Want To Read: 5 college degrees that will help you become an expat

Money matters: What you need to mull over before you fly the coop!

Welcome to the grand game of “Who am I and why does my wallet care?” Knowing yourself is like holding the cheat codes to figuring out the potential cost of your dream study programme. Forget about all other financial considerations for a second, the programme cost is going to be your biggest expense.

First up, what’s the price tag on your academic dreams? Well, it depends on a bunch of things: the type of programme, its duration, the institution, the country of study, and the ever-fluctuating currency exchange rates.

Duration of study and type of programme

In most parts of the world, private universities, schools, and polytechnics charge more than publicly-funded institutions. It’s like they’re the designer brands of education. And guess what? Being a ‘foreign’ student usually means you’ll have to shell out more than the ‘locals’, no matter what institution you choose.

Undergraduate courses are like long-haul flights – they last longer (3-4 years), so naturally, they cost more than postgraduate courses. But beware, there are exceptions. Specialist postgrad medical or technical courses might cost as much or even more than undergraduate arts or commerce programmes. And PhDs? They duration can range from 3 to 7 years.

Now, if you’re lucky enough to snag a scholarship, your costs might not skyrocket as high as an undergraduate programme. But if you’re an international student funding your own PhD, brace yourself – the cost for 4 or more years could rival that of a 4-year undergrad degree.

Country of study and exchange rates

Next up in our game of financial roulette: exchange rates.

Developed countries like the USA, Canada, Germany, New Zealand, Singapore, South Korea, and Australia have more favourable rates compared to developing countries. So, if you’re from a developing country and planning to study in a developed one, the exchange rate could be an unseen factor that affects your finances.

To put it in perspective, let’s consider two examples:

First up, we have a Malaysian student planning to study electrical engineering at Stuttgart University (Germany). She’s a foreign student from a developing country with a weaker currency than the Euro, studying at a reputable university with high fees, especially for foreign students. Plus, she’s not on scholarship, so she has to foot the bill for the full 4 years.

On the other hand, we have an Australian scholarship student applying for a PhD programme at the University of Sydney. He’s a domestic student, so his fees are almost non-existent. Plus, he pays in his own currency, so exchange rates don’t bother him. Also, being an Arts/Humanities programme, it’s cheaper than our friend’s Engineering programme.

So, the moral of the story? The cost of your dream course depends on who you are. It’s like a personalized price tag!

Show me the money: Financial aid for international students

Now let’s talk about how to finance this grand adventure. The most common forms of financial aid for our brave international explorers include:

- Loans: It’s like borrowing from a frugal aunt, but with interest.

- Grants: Free money! No strings attached. Well, except maybe your grades.

- University scholarships: The universities are so desperate for your brain, they’ll pay for it.

- Government scholarships: The government’s way of saying, “Go forth and conquer!”

- Charitable institution scholarships: Because someone out there cares about your education more than your bank account.

- Fellowships: A fancy name for “we’re paying you to study.”

Most universities offer grants, scholarships, and fellowships to deserving students, domestic or foreign. It’s like getting an academic golden ticket, but without the need to repay.

Even governments from Indonesia to India, Ghana to the USA, are handing out scholarships like candy at a parade. But beware, there’s usually a catch – like having to come back and work in your home country for a certain period. Remember, folks, there’s no such thing as a free lunch!

Loans, on the other hand, are like that friend who always remembers exactly how much you owe them. You have to pay back the borrowed money within a certain period as per the agreement. And let’s not forget about the interest. Oh, the interest!

Banks are notorious for their higher interest rates, but some countries like India offer specialised education loans with slightly more reasonable rates. The repayment terms are also less likely to make you pull your hair out: longer repayment period, longer non-repayment holiday, and even an interest discount for female students.

If your credit history is as clean as a whistle, getting a bank loan should be a breeze. But if your credit score is more like a bad report card, you might have to start considering other options.

In a nutshell, there are plenty of financial aid options out there. So, do your homework, and start digging for your gold!

Any other cost you are missing out on? Yes!

Programme fees are just the tip of the “costberg.” Studying abroad comes with a fun little assortment of costs that go beyond programme fees, and any financial aid you score may or may not cover these extras. So, let’s dive into this financial rabbit hole:

Pre-Departure Costs

These are the pesky little expenses that start nibbling at your wallet before you even leave your home. The pre-departure costs include:

- Airfare & other travel expenses: The cost of air travel changes more often than a chameleon on a rainbow. Book early to save some bucks. And don’t forget travel insurance – it’s like a safety net for your trip in case of any ‘oh-no!’ moments.

- Student visa: The cost and processing time for visas are as unpredictable as a cat on a hot tin roof. Budget for everything from application fees to biometrics and health checkups.

- Passport: If you don’t already have one, get ready to shell out some cash for a passport. Do it early, because processing times vary.

- Insurance: Many countries demand student insurance. Some universities include it in the programme fees, but many don’t. If they don’t, you’ll need to buy it separately.

- Preparation expenses: Travelling to a new country can feel like preparing for an expedition to Mars. You might need new clothing, accessories, electronics, etc. Be careful, these costs can pile up faster than dirty laundry.

- Academic supplies (books, tools, multimedia): Sometimes these are included in your programme fees, but sometimes they’re not. It’s like a surprise party nobody wants to attend. So, better keep some budget aside for this.

- Emergency fund: Even though many developed countries are going cashless faster than you can say “debit card”, it’s always wise to have some emergency fund stashed away.

Living Abroad Costs

Once you’re there, you’ll need to budget for:

- Food: Because you can’t survive on dreams and aspirations alone.

- Transport: Unless you plan to walk everywhere.

- Utilities: Or else you’ll be reading by candlelight.

- Rent: Unless you’ve found a friendly cave to live in.

- Internet and mobile access: How else will you update your Instagram?

- Entertainment: All work and no play makes Jack a dull boy, after all.

These living expenses can vary wildly from country to country, and even within the same country.

For example, if you’re studying in the UK, living in Liverpool or Glasgow is likely to be easier on your wallet than living in London. So, factor in these costs when preparing your budget, unless you fancy a diet of instant noodles for the entire duration of your course!

During the planning process, dig deep into the costs mentioned above. Don’t forget to consider your country’s inflation rate and possible exchange rate fluctuations. Use past data on inflation and depreciation to calculate how much extra you’ll need to arrange – whether it’s from your piggy bank or a bank loan.

While budgeting, it’s best to channel your inner pessimist and expect higher costs. It’s like packing an umbrella on a sunny day – better safe than sorry!

Guide to penny-pinching in a foreign land

Welcome to adulthood, where being able to do basic math suddenly becomes the difference between living comfortably and surviving on instant noodles. Understanding how numbers can be your loyal allies or sneaky enemies is part of the game.

That means there are some actions to take before and after you embark on your academic adventure abroad. Once you’ve got a grip on the kind and scale of expenses you’re up against, you’ll be primed to make some savvy financial moves.

5 penny-pinching prep before your flight

To kickstart your journey to financial wisdom, here are a few tasks to add to your pre-departure checklist:

- Become a currency exchange guru: You can’t dodge exchange rate fluctuations, but keeping an eye on them could help you handle your finances better in your new country. Download a currency converter app – it’s like having a financial wizard in your pocket.

- Get some foreign cash before you fly: Along with your emergency fund (reserved for use after you land), carry a little foreign cash to cover any unexpected hiccups on arrival.

- Job hunt before you leave: If your visa conditions allow, you could work part-time to cover expenses. Start applying as soon as you land. Remember, most countries require a working tax number before hiring you, so apply for this early.

- Open a bank account: Many banks offer special savings accounts for students. Open one before you leave to manage your money easily after arrival. Ensure a free ATM card is part of the package.

- Apply for a low or no-fee credit card: It’s safer and more convenient to carry a credit card than wads of cash. Plus, paying by card in the local currency saves you from the hassle of converting cash and can get you better exchange rates.

5 ways to stop your dollars from doing a disappearing act while studying abroad

Congratulations on starting your study abroad journey. Now, keep a watchful eye on your finances. Here are some tips:

- Stick to your budget: Especially if you don’t have a regular income. Don’t dip into your emergency fund unless it’s an actual emergency.

- Watch out for ATM fees: Depending on your card and bank, you might face fees each time you withdraw cash. Try to use ATMs that are part of the Global ATM network and located inside banks.

- Beware of DCC fees & foreign transaction fees: Use a local card for purchases to avoid these charges. Many countries offer low-fee or no-fee options.

- Use a specialised remittance service: If you need money from home, avoid using your bank as they charge hefty transaction fees. Use a low-cost service instead.

- Be ready to make sacrifices: Skip the night out or the branded sweater if it doesn’t fit your budget. Focus on your studies now, luxuries can wait!

Before you go…

Embarking on the journey to study abroad, or waving goodbye as your child sets off on this adventure, is a thrilling experience filled with a flurry of emotions. Yes, it can be a tad overwhelming at times, especially when you have to sort out all the nitty-gritty details.

One crucial detail that requires careful thought is how to handle overseas money transfers. Amidst a sea of remittance options, finding a partner that offers excellent rates and is trustworthy and reputable can seem daunting.

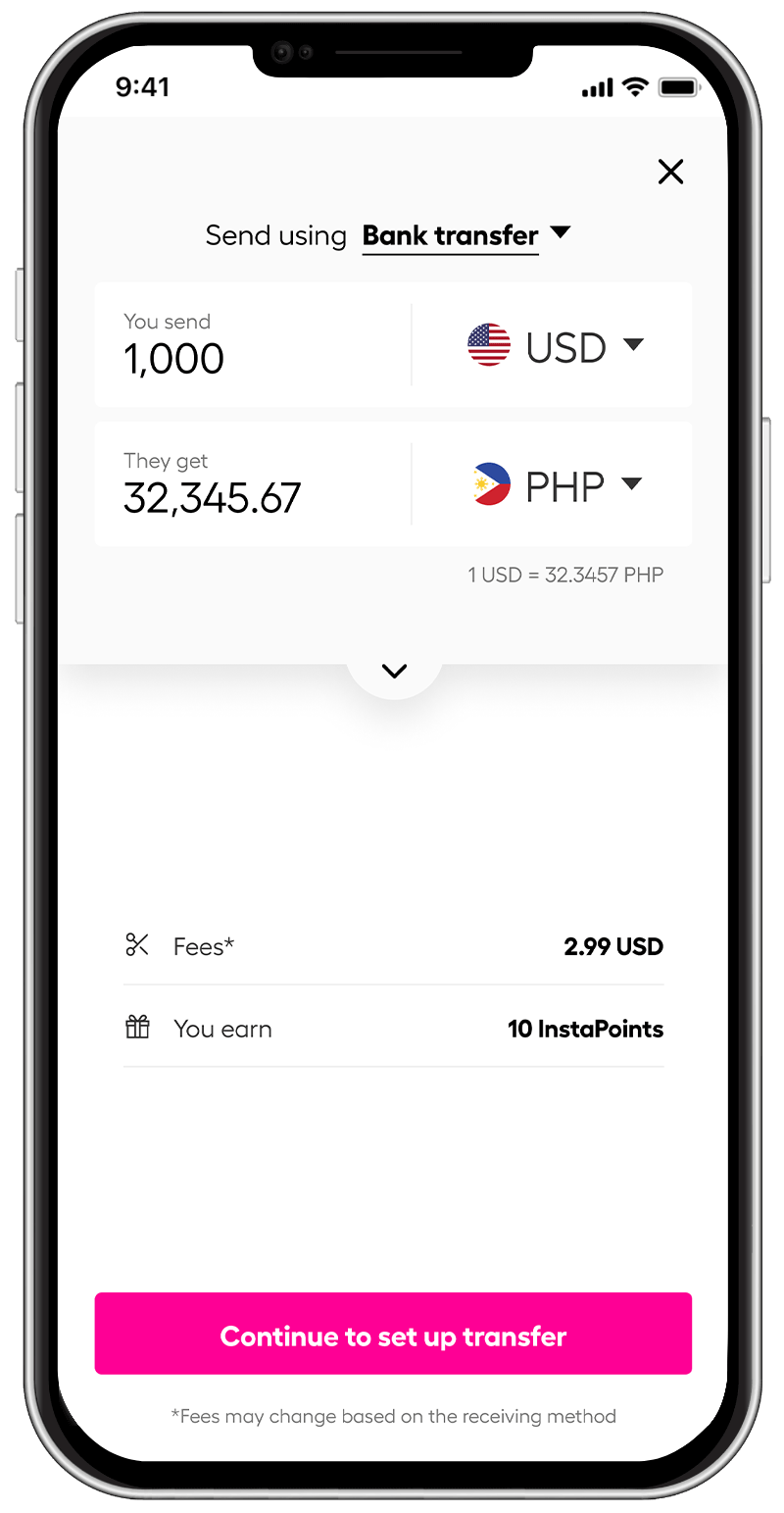

This is where Instarem steps in, offering a warm hand of assistance. We’re here to facilitate swift and straightforward international money transfers, with minimal fees and competitive foreign exchange rates.

*rates are for display purposes only

Instarem is your loyal ally, helping you to send money overseas to over 60 countries worldwide. If you’re seeking a hassle-free and cost-effective way to manage overseas transfers, you’ll find Instarem to be a comforting solution.

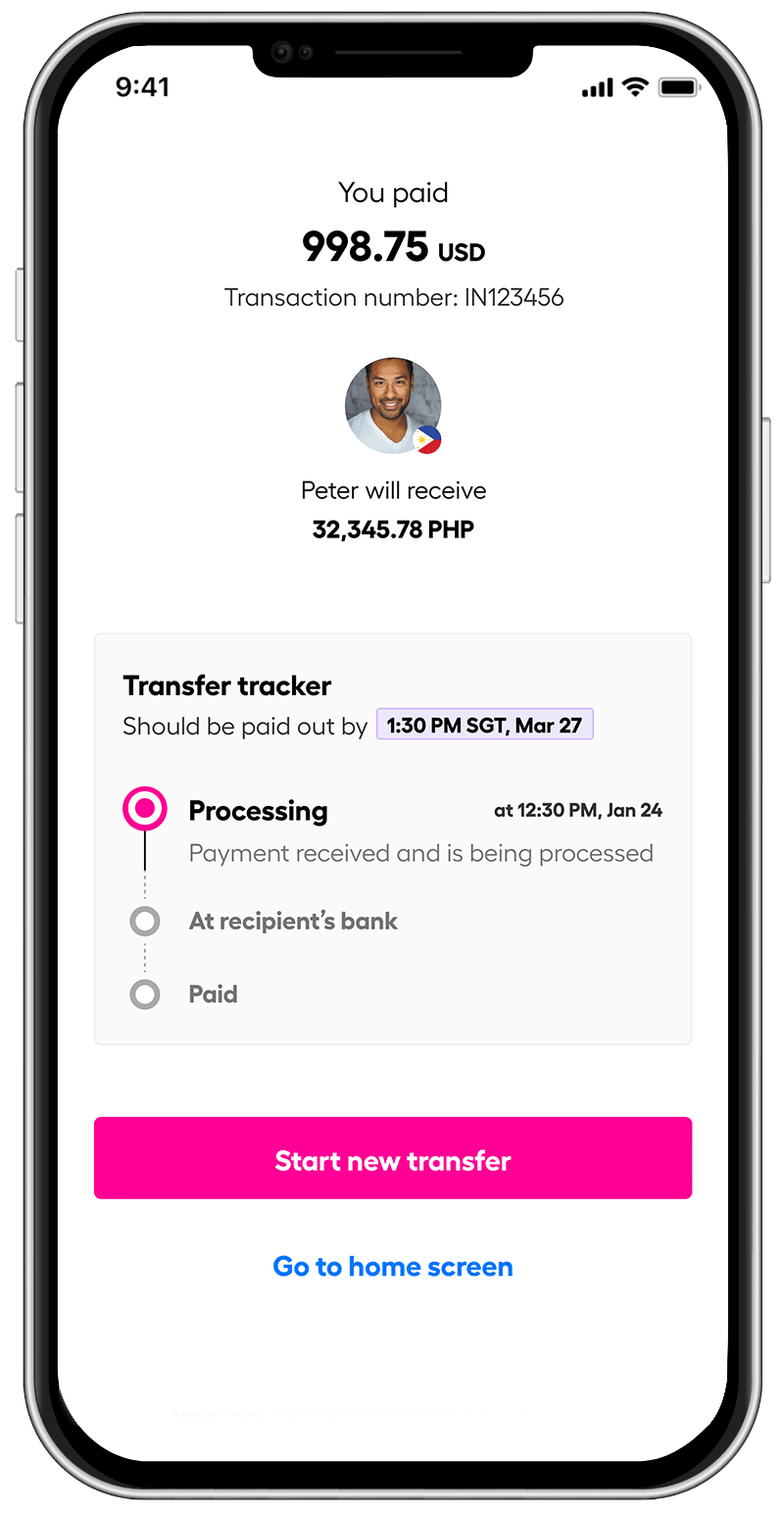

Our user-friendly platform enables you to make a transfer with just a few clicks, and our app lets you keep an eye on your transaction, providing you with that much-needed peace of mind.

Download the app or sign up on the web and see how easy it is to send money with Instarem.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.