Instarem is changing the game by making the amaze card available to everyone! This smart travel card is a must-have for anyone who loves to travel.

Until recently, this card could only be accessed by Mastercard debit/credit card holders.

But now, with the introduction of amaze wallet, everyone can have a chance to own an Instarem amaze card! You can now top up your amaze card through the new wallet feature and enjoy the same great benefits of using amaze:

- Save when you travel – enjoy superior FX rates, save on banks’ mark ups and FX admin fees when you pay overseas.

- Enjoy unlimited rewards – get Instarem’s InstaPoints on your non-SGD spend and convert to cashback or use as discounts on overseas money transfers.

- Pay your way – link your Mastercard bank cards to amaze and/or top up your wallet with PayNow your choice!

- Track your spending – get a personalised view and breakdown of your spends across all your cards in one place.

What is amaze wallet?

The amaze wallet has been a long-time companion of current amaze card users. amaze cashback has been credited to users’ amaze wallet on a quarterly basis.

Instarem has recently expanded the amaze wallet capabilities.

It now allows Singaporeans who don’t have a Mastercard to use amaze – by topping up their amaze wallet via PayNow and funding their transactions through amaze wallet.

This way, you can enjoy amaze’s benefits like great FX rates with every overseas purchase and cashback.

What’s the difference between pairing your amaze with Mastercard debit/credit cards and funding your amaze wallet with PayNow?

Below are the differences between linking amaze to your Mastercard debit/credit card and funding your amaze wallet with PayNow:

Funding type | Link card | Fund through amaze wallet |

Funding source | Mastercard debit/credit cards | PayNow |

How to use | Link Mastercard debit/credit cards to amaze | Use amaze through amaze wallet |

Additional rewards | On top of linked cards | Not applicable |

Limit | Maximum amount that can be spent on one receipt with amaze is SGD 50,000 or equivalent. Also subject to the linked card’s respective card issuer limit. | Maximum in the wallet is per daily “subject to limits as set in the app” and per calendar year “SGD 30,000 spend |

There are no fees if your transaction is made in FX.

For more details: Fees

amaze wallet top up fees

There are no fees charged for topping up your amaze wallet.

Still on the fence? Here are more benefits!

Enjoy all the benefits of Mastercard’s World tier with Instarem’s amaze card. You’ll get zero liability protection, ID theft protection, global emergency services, and more!

Android users can also use it on Google Pay for convenient payments.

On the lookout for good deals? Check out all the amaze card promotions. From travel to shopping and food, we’ve got you covered.

And the best part? The amaze card is free–there are no annual or processing fees!

Amazed yet? Here’s how easy it is to apply and set up

Applying for Instarem’s amaze card is a piece of cake. Follow the easy steps outlined below to get a hold of an amaze card.

1. Download Instarem App. For fast and easy registration, use the MyInfo with Singpass option to sign up.

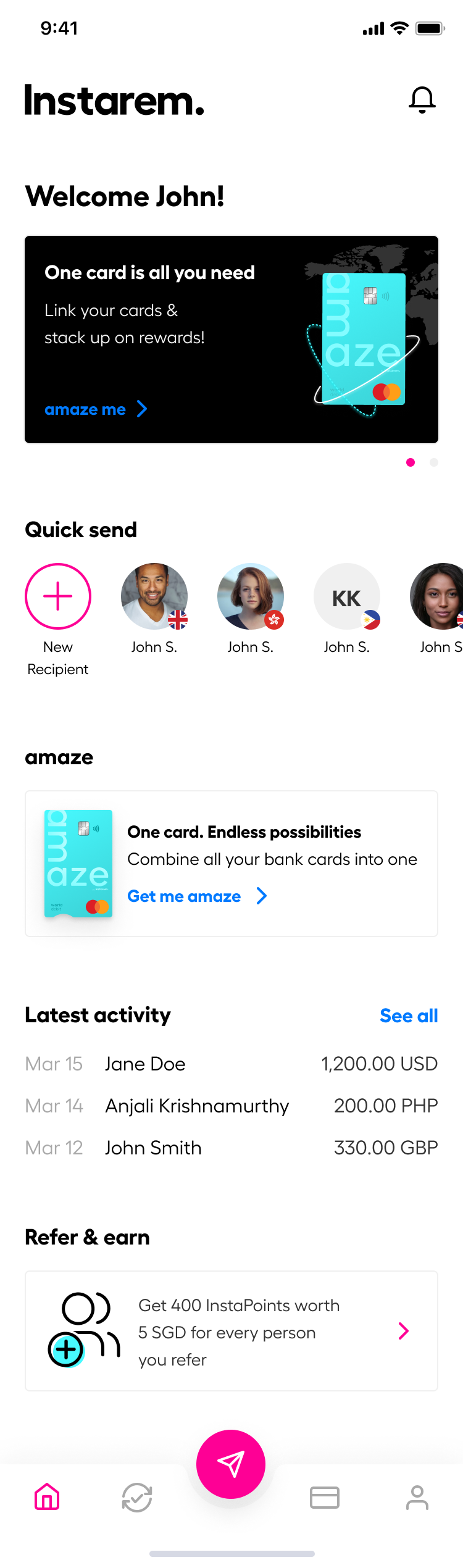

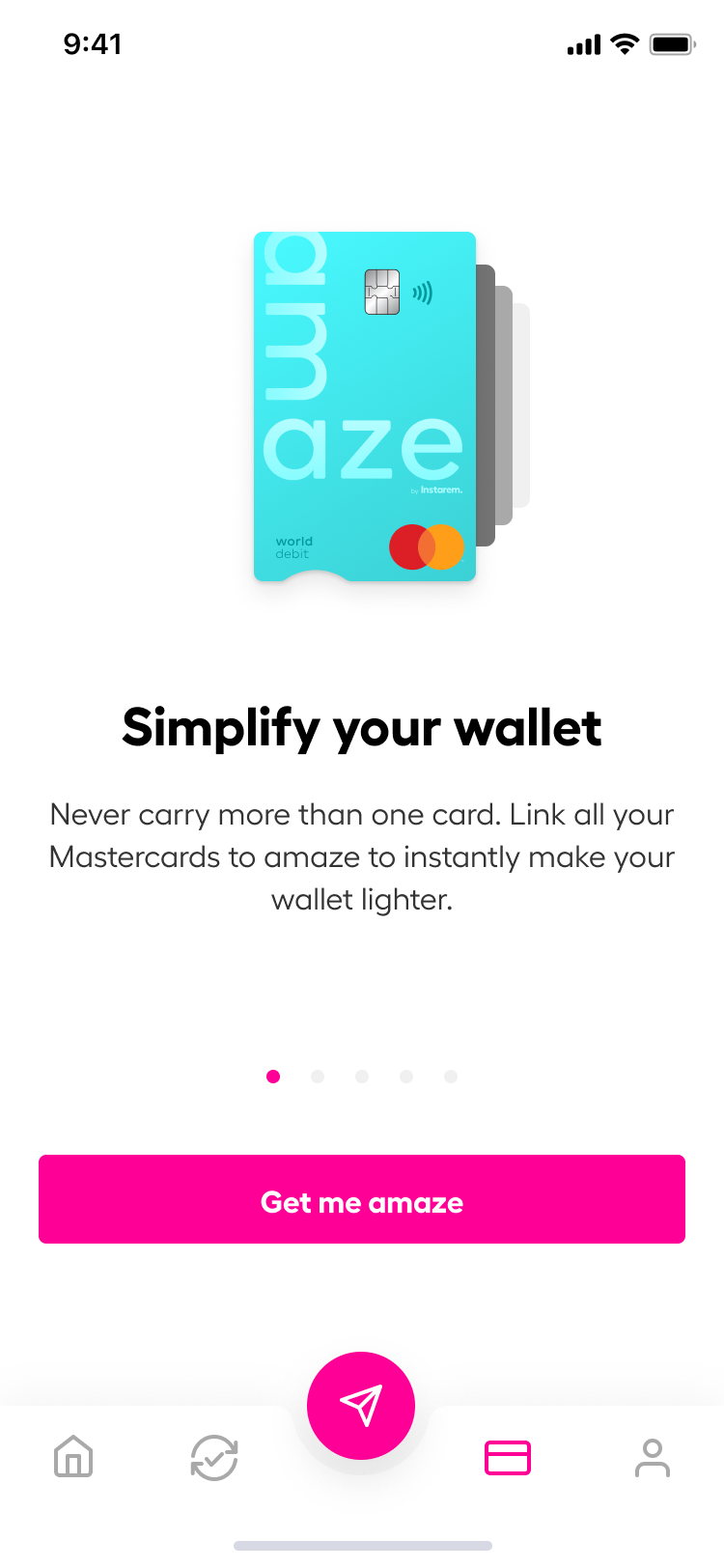

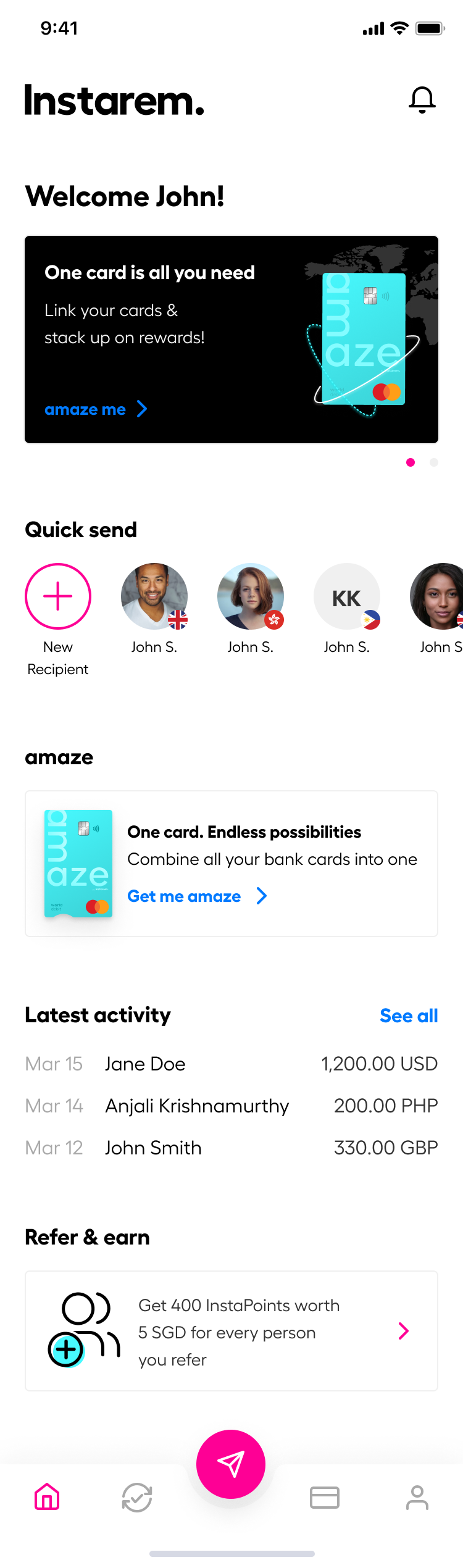

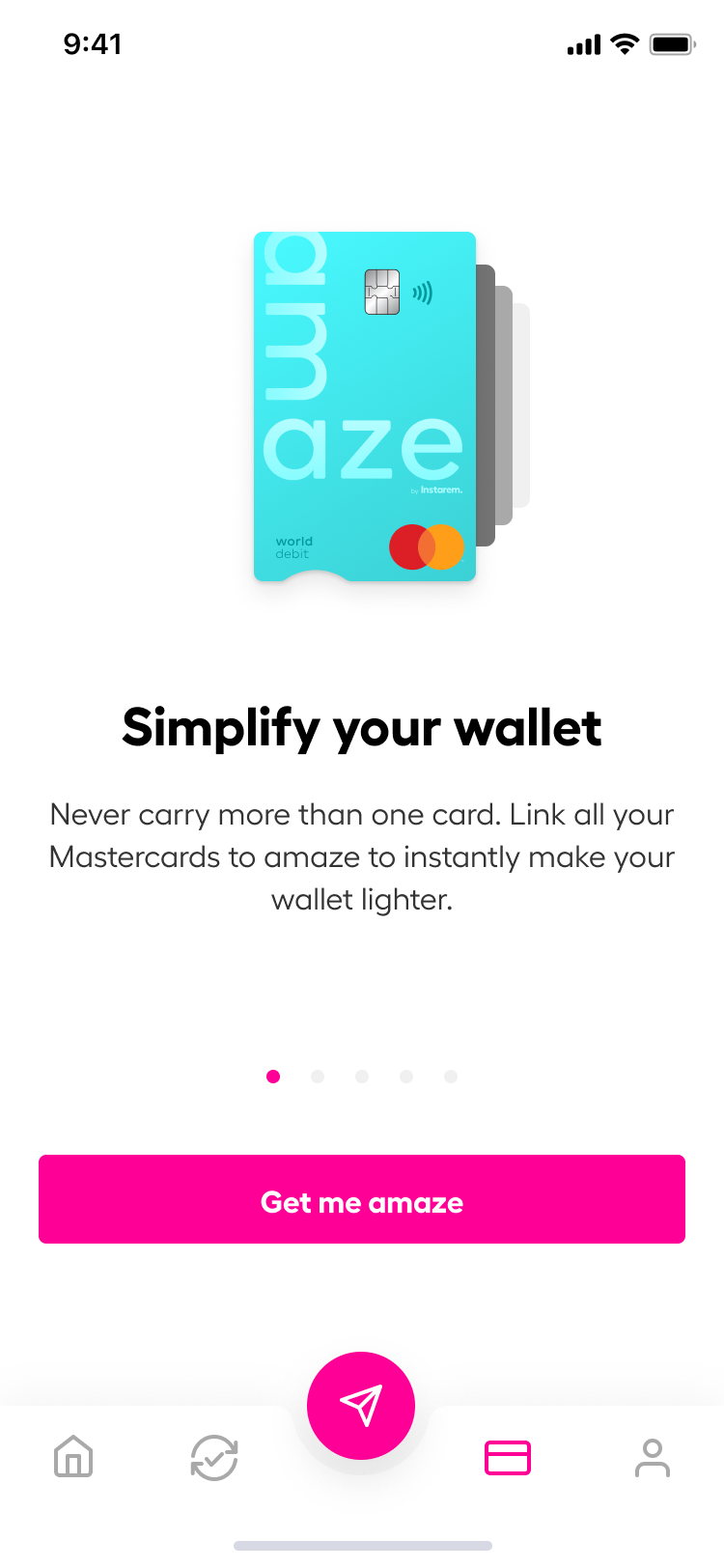

2. After your Instarem account is approved (check your inbox for a confirmation email), open the app and tap the card icon at the bottom to see this screen:

Tap ‘Get Me Amaze’ to start your card application.

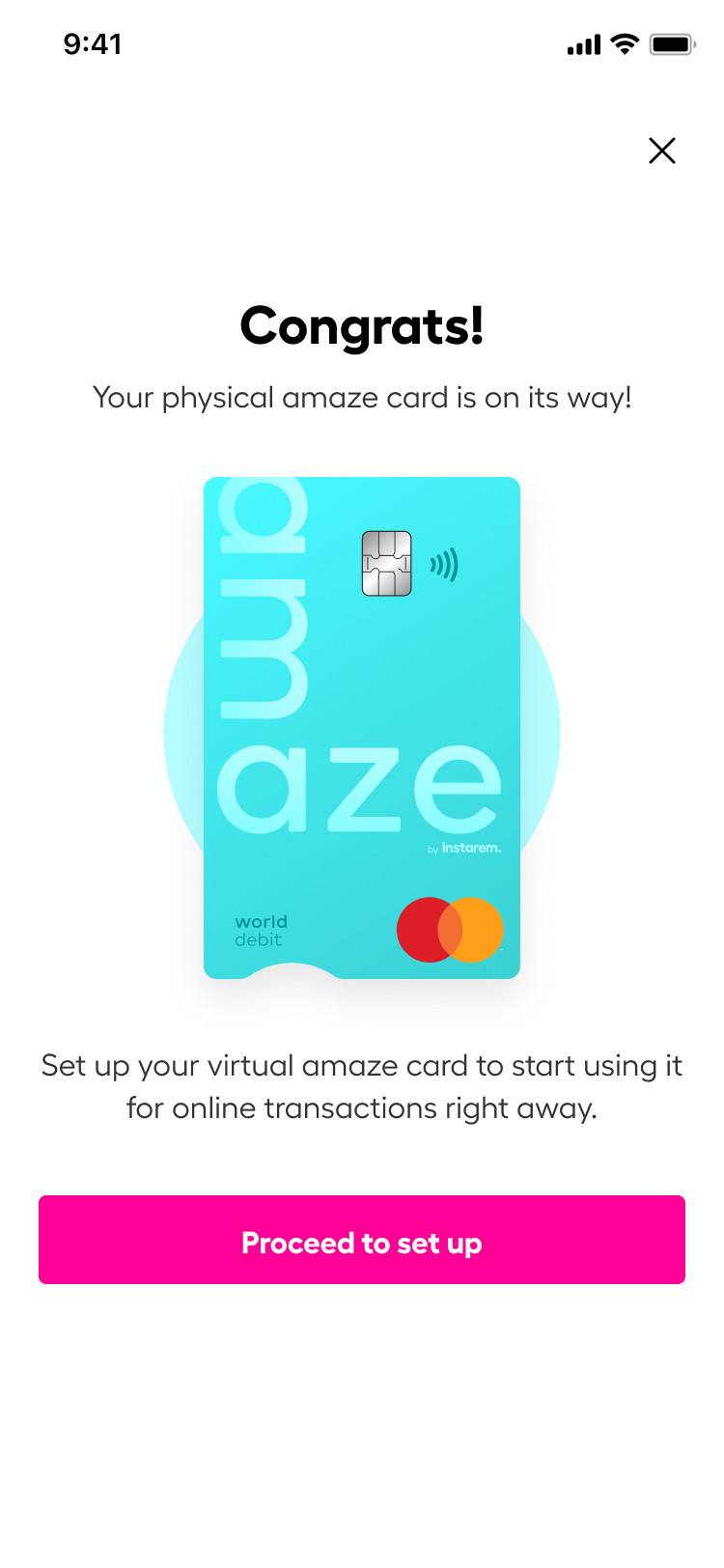

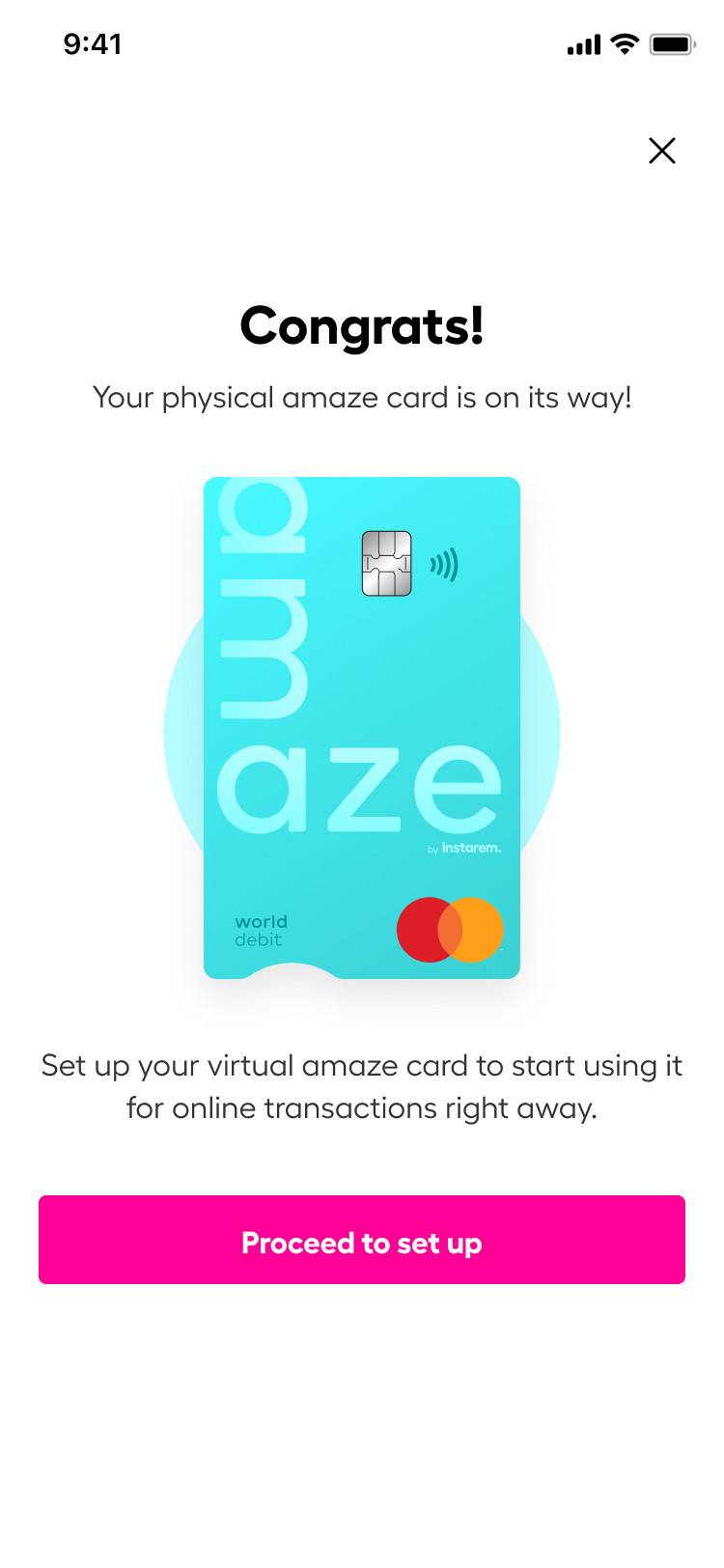

3. After entering the name you want on your amaze card, check your delivery address details. Once that’s done, click the T&C checkbox and then ‘Confirm’.

4. The next screen will prompt you to add either add your Mastercard details to link it to your virtual amaze card or link your fund source to your amaze wallet.

Don’t have a Mastercard? Top up the amaze wallet with PayNow

So you’ve got your new amaze card, and now it’s time to link up with a funding source!

Select the option to top up your amaze wallet and input the amount you want to add to your amaze wallet. Do note that the minimum top up amount is SGD20.

Select PayNow as your top up method and enter your PayNow details. Then, follow the on-screen instructions to complete your top up.

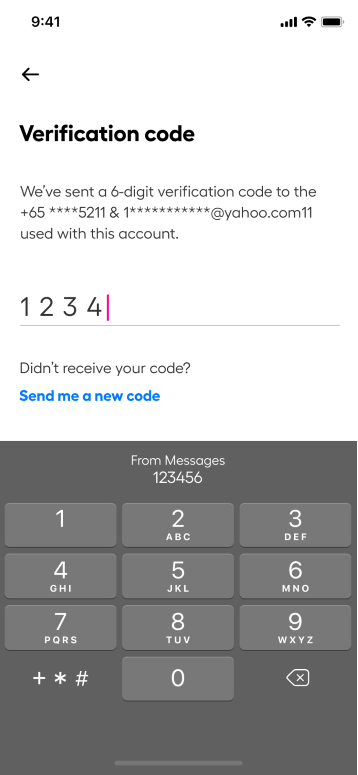

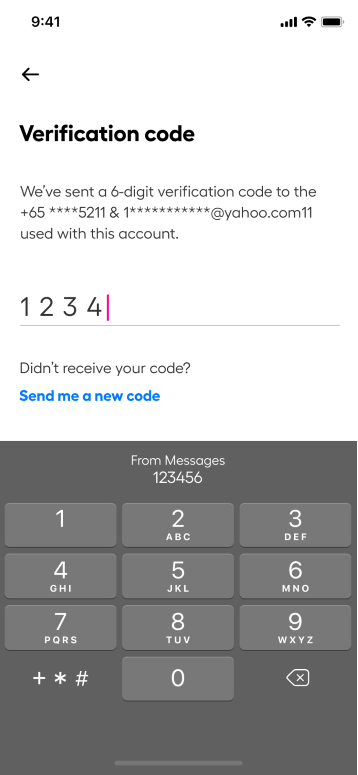

You will receive a verification code in your email. Key in the verification code.

Once you are done, you can start using your amaze card for your travel and shopping!

Need help?

- Check out the amaze Frequently Asked Questions to troubleshoot any difficulty that you might encounter along your card application journey and more.

- Go to Help Centre on the app and send an enquiry or fire up the ‘Ask Adam’ chatbot for instant assistance.