Maximizing your savings : Tips for finding the best exchange rates for sending money to India from Singapore

This article covers:

Sending money from Singapore to India is a common practice, whether for personal or business reasons. However, the challenge lies in finding the most optimal money transfer service for the greatest convenience and savings. When it comes to sending money from Singapore to India, finding the right money transfer service with the best exchange rates and lowest fees can be a real headache. But fear not, this article has got your back with some top tips and tricks.

Firstly, keep an eye on exchange rates and currency trends to know when the time is right to send your dough. Secondly, don’t just blindly send your money, choose the right time to maximize your savings. Lastly, don’t get ripped off with hidden fees and charges, compare and contrast to find the best deal. By following these tips, you can avoid unnecessary costs and get the most bang for your buck.

Understanding exchange rates and their impact on your savings

Definition of exchange rates and their importance

Exchange rates may seem like a snooze-fest, but they actually play a big role in our daily lives. Picture this: you’re in Singapore, and you want to send some cash to your family in India. You’re gonna need to know the exchange rate – that’s the value of one currency in relation to another. Currently, the exchange rate between the Singapore dollar (SGD) and the Indian rupee (INR) is 1 SGD = 61.54 INR (23rd May 2023). So, for every Singapore dollar you exchange, you’ll get 61.54 Indian rupees. Pretty simple, right?

Well, hold on to your hats, folks, because the mechanics of exchange rates can get pretty complicated. Here’s the skinny: exchange rates are determined by the supply and demand of a currency. When a currency is in high demand, its value goes up, and the exchange rate goes up with it. On the flip side, when a currency is in low demand, its value goes down, and the exchange rate follows suit.

Factors that influence exchange rates

There are all sorts of factors that can influence exchange rates, like economic indicators, political events, and market trends. For example, if a country is experiencing high inflation, its currency may decrease in value, which can lead to a decrease in the exchange rate. And if there’s a big ol’ natural disaster or political upheaval? Buckle up, because that could have a major impact on the economy and, in turn, the exchange rate.

The impact of exchange rates on the actual amount that can be sent is huge, especially for individuals and businesses involved in international trade. Let’s say you’re a Singaporean business owner who imports goods from India. If the exchange rate of SGD to INR fluctuates downward, you’ll need to cough up more cash to get the same amount of goods. And that, it will lead to some seriously unhappy bank accounts. By understanding the impact of exchange rates and keeping up-to-date on the latest trends, individuals and businesses can make informed decisions and save some serious dough.

The impact of exchange rates on your savings

The impact of exchange rates on your savings can be particularly pronounced when considering currencies like the Singapore dollar (SGD) and the Indian rupee (INR). Suppose you have savings in SGD and plan to convert them into INR or vice versa. If the exchange rate between SGD and INR becomes more favourable for SGD, meaning that SGD strengthens against INR, your savings in SGD will have a higher value when exchanged into INR.

Conversely, if the exchange rate turns unfavourable, with SGD weakening against INR, the value of your savings in SGD will decrease when converted into INR. These fluctuations highlight the importance of monitoring exchange rates and considering their impact on your savings to make strategic decisions and ensure the optimal management of your financial resources.

To see just how wild exchange rates can get, let’s take a gander at a real-life case study. In 2019, the United States and China were in the midst of a trade war that caused all sorts of chaos. The US imposed tariffs on Chinese goods, which led to a decrease in the demand for the Chinese yuan (CNY). This caused the value of the CNY to decrease, leading to a decrease in the exchange rate between the CNY and other currencies, including the Singapore dollar (SGD).

The decrease in the exchange rate had a big impact on businesses that imported goods from China, as they had to pay more for the same amount of goods. But it wasn’t just businesses that took a hit – individuals who had investments in Chinese stocks or bonds also saw a decrease in the value of their investments.

So, what can you do to minimize the impact of exchange rates on your savings and investments? Well, first off, it’s important to understand the mechanics of exchange rates and the factors that can influence them, such as economic indicators and political events. From there, you can use expert tips and strategies for finding the best exchange rates when sending money from Singapore to India.

Tips for finding the best exchange rates for sending money to India from Singapore

Sending money to India from Singapore can be a costly affair if you’re not careful. With so many different money transfer providers, fees, and exchange rates to consider, it can be overwhelming to figure out how to get the best deal. But fear not intrepid reader – here are some expert tips and strategies for finding the best exchange rates for sending money to India from Singapore.

a. Researching exchange rates and currency trends

First things first – before you even think about sending money, it’s crucial to do your research and understand the current exchange rates and currency trends. This will help you to make informed decisions and avoid any nasty surprises when it comes to fees and exchange rates.

One way to research exchange rates is by using an online currency converter like Google. These tools allow you to input the amount of money you want to send and the currencies you’re converting between and will provide you with the current exchange rate. Be sure to check the rates from multiple sources to get the most accurate and up-to-date information.

But don’t stop there! It’s also important to keep an eye on currency trends and fluctuations. For example, if you notice that the Indian rupee is on a downward trend, it might be worth waiting a few days or weeks to send your money in order to get a better exchange rate. Conversely, if you see that the rupee is on an upward trend, it might be worth sending your money sooner rather than later to lock in a good rate.

Case in point: in 2018, the Indian rupee hit a record low against the US dollar due to a variety of economic factors. This caused headaches for individuals and businesses who were sending money to India from other countries, as they had to deal with higher exchange rates and fees. By keeping an eye on currency trends and waiting for a better exchange rate, these savvy senders could have saved themselves some serious dough.

b. Choosing the right time to send money

Timing is everything when it comes to sending money and getting the best exchange rates. It’s important to keep an eye on global events that can impact exchange rates, such as elections, natural disasters, or economic crises.

One strategy is to send money during times when the market is less volatile. For example, sending money on a weekday when the market is open can be more advantageous than sending money on a weekend when the market is closed. Additionally, it’s worth considering the time zone differences between Singapore and India – sending money during business hours in India might result in faster processing times and better exchange rates.

Another strategy is to use a forward contract, which allows you to lock in an exchange rate for a future date. This can be useful if you’re planning to send money in the near future and want to protect yourself against future fluctuations in exchange rates. However, it’s important to read the fine print and understand any potential risks or fees associated with forward contracts.

c. Comparing fees and hidden costs

When sending money from Singapore to India, it’s important to keep in mind that there are many different fees and hidden costs associated with the transfer process. These fees can vary widely depending on the transfer provider, the amount of money being transferred, and the destination country.

One of the most common fees associated with money transfers is the transaction fee. This fee is charged by the transfer provider and can vary depending on the amount of money being transferred and the destination country. In addition to transaction fees, there may also be wire transfer fees, foreign transaction fees, and currency conversion fees to take into account.

- Transaction Fees: A transaction fee is a fee charged by the transfer provider for processing the transaction. This fee can vary depending on the amount of money being transferred and the destination country. Some providers charge a flat fee, while others charge a percentage of the total amount being transferred.

- Wire Transfer Fees: A wire transfer fee is a fee charged by the transfer provider for sending money through a wire transfer. This fee can vary depending on the provider and the amount being transferred.

- Foreign Transaction Fees: A foreign transaction fee is a fee charged by your bank or credit card company for using your card to make a purchase or transfer in a foreign currency. This fee can be a percentage of the transaction amount or a flat fee.

- Currency Conversion Fees: A currency conversion fee is a fee charged by the transfer provider for converting the currency from one currency to another. This fee can vary depending on the provider and the exchange rate being used.

To find the best currency exchange rates and minimize fees, it’s important to compare the rates and fees of different transfer providers. This can be done by using online comparison tools, checking with your bank or credit union, or simply doing some research online. By comparing the rates and fees of different providers, you can ensure that you are getting the most value for your money transfers.

For example, let’s say you need to send money to a family member in India. You could start by checking with your bank or credit union to see what their rates and fees are for international money transfers. However, you may find that their fees are quite high and their exchange rates aren’t very competitive.

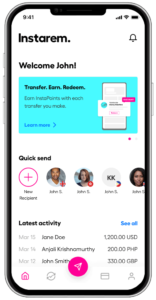

Alternatively, you could do some research online and compare the rates and fees of different transfer providers. There are many online cross-border money transfer platforms available, such as Instarem, that offer lower fees and better exchange rates than traditional banks.

Take Ayush as an example. Ayush needed to send money to family members in India on a regular basis.

Initially, he used a bank to transfer the money, but he found that the fees were quite high and the exchange rates weren’t very competitive. After doing some research and comparing different transfer providers, he switched to an online cross-border money transfer platform that offered lower fees and better exchange rates.

Over time, he was able to save a significant amount of money by switching to a more cost-effective transfer method.

Using an online cross-border money transfer platform, the individual was able to send money to India quickly and easily, without having to deal with the hassle of going to a bank or filling out complicated paperwork. The platform also offered competitive exchange rates and low fees, which meant that the individual was able to send more money to his family members in India without having to worry about excessive fees or hidden costs.

Strategies for maximizing your savings when sending money to India from Singapore

Saving money on international money transfers? It’s not a scam, it’s just smart. Trust us, your wallet will thank you later! When it comes to sending money to India from Singapore, finding the best exchange rates and minimizing fees is essential for maximizing your savings on money transfers. Here are some strategies to help you make the most of your money transfer:

a. Consider alternative transfer methods

Traditional banks may not always offer the best currency exchange rates or the lowest fees. Consider using alternative transfer methods such as online money transfer platforms like Instarem or others. These platforms offer competitive exchange rates and lower fees, which can help you save money. Instarem, for instance, offers low fees and low exchange rates when sending money overseas.

In addition, some alternative transfer methods like mobile wallets or prepaid debit cards may offer additional benefits such as cashback or rewards points that can further maximize your savings on money transfers.

b. Negotiating with your bank or transfer provider

When it comes to sending money from Singapore to India, finding the best exchange rates and minimizing fees is essential for maximizing your savings. One strategy that can help you save money is negotiating with your bank or transfer provider.

Negotiating with your bank or transfer provider may seem intimidating, but it can be an effective way to lower fees and get better exchange rates. Here are some tips to help you negotiate with your bank or transfer provider:

- Do your research

Before you start negotiating, it’s important to do your research and understand the current exchange rates and fees. This will help you to make informed decisions and have a better understanding of what you should be asking for. You can use online comparison tools to compare rates and fees, or check with other banks or transfer providers to see what they offer.

- Know your worth

When negotiating, it’s important to know your worth as a customer. If you have a high account balance or transfer large sums of money, you may be able to negotiate better rates or lower fees. Be prepared to discuss your account history and usage, and explain why you are a valuable customer.

- Be polite but firm

When negotiating, it’s important to be polite but firm. Explain your request clearly and calmly, and be prepared to negotiate back and forth.

- Ask for specific changes

When negotiating, it’s important to ask for specific changes. For example, you could ask for a lower transaction fee or a better exchange rate. Be clear about what you are asking for, and be prepared to negotiate the details.

- Be prepared to walk away

If you are not satisfied with the outcome of your negotiation, be prepared to switch providers. There may be other banks or transfer providers that offer better rates or lower fees, so it’s important to survey and ask around to find the best rates for yourself.

c. Making the most of your money transfer:

To make the most of your money transfer, consider the following tips;

- Choose the right time to send money: Exchange rates can fluctuate throughout the day, so it’s important to choose the right time to make your transfer. Monitor exchange rates and choose a time when the exchange rate is most favourable.

- Send larger amounts of money: Some transfer providers offer better exchange rates for larger transfers. If possible, try to send larger amounts of money to take advantage of these rates.

- Avoid unnecessary fees: Read the terms and conditions carefully and avoid unnecessary fees such as credit card fees or fees for changing the transfer details after the transfer has been initiated.

And there you have it, folks! All the tips and tricks you need to avoid getting ripped off when sending money from Singapore to India. Now, it’s time to take action with Instarem!

Go forth and conquer the world of exchange rates like the financially savvy wizards you are with Instarem as your trusted partner!

Sending money from Singapore to India can be a costly affair if you’re not careful. It’s crucial to understand the mechanics of exchange rates and their impact on your savings, as well as to research the best currency exchange rates and currency trends before sending your money. Choosing the right time to send your money and comparing fees and hidden costs of different transfer providers are also essential in minimizing unnecessary costs. The strategies outlined in this article, such as using alternative transfer methods, negotiating with your bank or transfer provider, and making the most of your money transfer, can help individuals and businesses alike to maximize their savings and avoid any unpleasant surprises when sending money from Singapore to India. By following these tips and tricks, individuals and businesses can make informed decisions and save some serious dough in the process. Remember, it’s not about being a penny-pincher, it’s about being smart with your hard-earned money.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app