Outsourcing? Here Is How You Can Pay Your International Invoices!

This article covers:

Have you been thinking of outsourcing work to individuals or companies across the borders? Paying overseas workers can be a bit complicated as payment options available for local contractors may not be suitable for overseas payments. Besides, businesses often lose a lot of money while paying international bills due to FX spreads and hidden charges. If you too are looking for a trustworthy and transparent remittance service provider, you are not the only one. Here’s what you need to know about paying an international invoice:

Banks

Most businesses have their banking accounts with their preferred banks, hence using banks to pay international invoices is the easiest method. No hassles as the account is already set-up. However a banking route comes with its own pitfall. For starters, they cost an insane amount of money. Most businesses simply do not compare the FX rates that banks offer to them with other money transfer providers – either because of a lack of awareness, or because of simple inertia. Sadly, businesses end up paying more directly affecting their cost of project, and eventually the bottomline. Since SMEs and businesses pay their local invoices through their business bank accounts, they think that it is the right way to pay international invoices as well. And that’s where the issue lies. Banks add margins to actual FX rates – rates that can be seen on Google or Reuters; and involve hidden charges.

If you have been paying international invoices via banks, it’s time to take stock and compare your bank’s FX rates with other services. Contrary to their promise, banks devour a huge chunk of your money through FX spreads, exorbitant fees and hidden charges. Another paint point is the time taken to process the transfer.

Money Transfer Operators

Another popular mode of money transfer, MTOs too have their set of pros and cons. While they offer speedy transfers and decent exchange rates, they could charge staggeringly high transfer fees. They also leave your account vulnerable to hackers, etc.

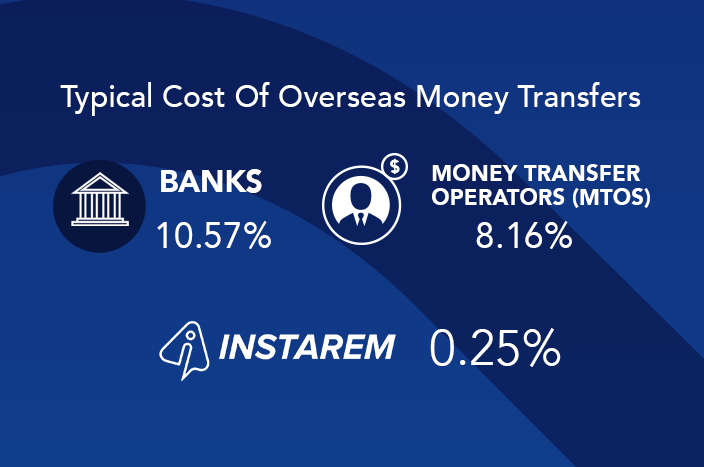

Meanwhile, a World Bank report cites that the global average cost of sending money overseas stands at 7.13% in Q1 of 2018. As for MTOs, the International MTO Index is 8.16%. Banks have been found to be the most expensive type of service providers with an average transaction cost of 10.57%!

FinTech Startups

However, with FinTech startups such as Instarem Pte Ltd. are shaking up the remittance landscape, businesses now have a number of alternatives that are faster, cheaper and are just as secure if not more.

The digital money transfer companies are challenging the monopoly of banks and MTOs by calling them out for lack of transparency and hidden charges. Online money transfer platforms use the latest technology to send money internationally, thereby reducing middlemen, and in effect slashing remittance costs.

Instarem is one such platform dedicated to making international money transfers cost-efficient for individuals, SMEs and businesses. At Instarem, your transactions are kept free from sneaky markups on exchange rates. Their fee entails a small percentage of the amount transferred and they do not sneak in any hidden charges on your money transfers. You get to see the exact break up of your transaction on the receipt and also the amount that your beneficiary will receive. The best part is that your transactions are processed much faster than banks and MTOs where internal processes hold up your money for weeks. Even the World Bank has ranked Instarem the No. 1 cost-effective remittance platform in several corridors around the globe, including India.

Instarem For Businesses

Apart from offering hassle-free and cost-effective remittances to individuals, the company also enables corporations and SMEs to make bulk payments using its institutional platform Instarem for Businesses, which is a configurable solution for corporate / SME users to manage and control their high-volume remittances to multiple beneficiaries in multiple currencies via a seamless process.

Complete transparency is guaranteed whether businesses use the Instarem Web platform, or the Instarem MassPay platform The charges are displayed upfront. No secrets. No shocks to the bottom line. Once the fees are deducted, your money is sent to the freelancer or vendor located abroad.

Here’s how Instarem MassPay is making a difference:

As a FinTech company, InstaReM reports to a number of regulatory bodies globally, and just like banks and other financial institutions, it has preventive measures designed to safeguard users’ profiles against unauthorised access, fraud and money laundering. Let’s take a look at how InstaReM MassPay works:

You can visit Instarem Business Pages right away to see how much an international payment would cost you and then compare the rates to other services.

Get the app

Get the app