4 reasons why you should send money with a credit card & how to do it

This article covers:

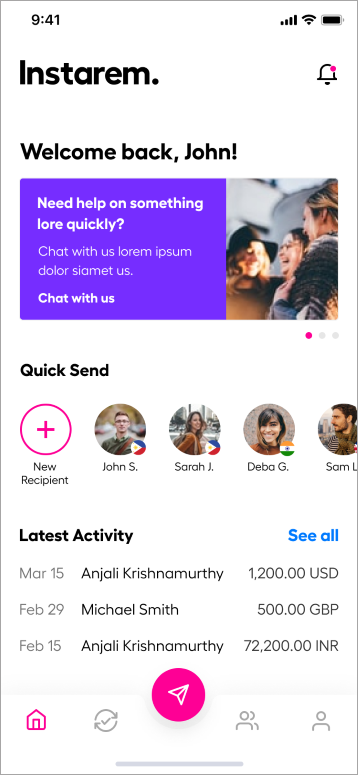

At Instarem, we are all about making things simple for you! One of our recently newly added features is funding your transfers with a debit or credit card. You can now enjoy easier, faster and even more convenient overseas transfers, without ever leaving the app.

Besides allowing you to send money at a higher limit and at typically instant speed, there are also other benefits to enjoy, that go way beyond the Instarem friendly and simple app interface.

Here are 4 reasons why sending money with a credit card makes better sense.

Convenience

Did you notice that paying with cash is no longer a key integral part of your payment habits?

Well, it comes as no surprise – credit cards are one of the top three methods for payment.

The impact of COVID-19 has also accelerated the adoption of credit card contactless payment. VISA has reported that contactless credit card transactions grew more than 30% between 2020 to 2021.

Besides convenience, credit card payments also allow you to house transactions under one card to track expenses.

Still uncertain about sending money with your credit card? Start by sending small amounts first. And for more convenience, save your credit card details in the Instarem app.

Credit card is not tied to your own savings account

Can you imagine the anxiety of sending $1000 instead of $100? All because you added one more zero by accident.

We all have our fat fingers moment. But when the money comes out of your own pocket, you are probably going to feel worse than heartbreak.

But hey, when you fund your transfer with a credit card, you are using borrowed money from the banks.

So even if you make a mistake, you might feel less of a pinch. The only hassle is that credit card refunds might take up to several days.

Having issues with your Instarem transaction? Contact our customer experience team via chat for any issues you face before we begin to process your transaction.

Better fraud protection

There is no denying that COVID-19 has played an explosive growth in credit card adoption. And with its growth comes a rise in fraud.

In 2019 alone, card fraud losses have reached $28.65 billion worldwide.

Banks and card networks like VISA and Mastercard are working hard to upgrade their payment technology. These upgrades will help with better fraud detection.

And for consumers like us, that makes credit cards a much safer platform for transactions. Credit cards leave a digital trail, which makes it a lot easier to trace back the transaction.

All you need to do is report the transactions you did not make, and you should be able to recover your money.

With that safety network in mind, you can have peace of mind when you send money with your credit card.

Earn rewards, cashbacks or miles

Finding the right credit card is one of the first adult decisions you might have to make.

You must take into consideration your lifestyle and your spending habits.

And banks are not making it any easier as they come up with better benefits (cashback, reward points and air miles) to attract folks to sign up for their card.

Well, if you have decided on a credit card, don’t let all the benefits go to waste when you send money. The only caveat is to check if your bank has excluded certain merchant codes from their rewards program.

How to send money with a credit card with Instarem?

First, download the Instarem app and sign up for an account. This is absolutely free.

If it is your first-time sending money via Instarem, here’s a quick guide on signing up and setting up your transfer for the first time.

Add credit card as payment method

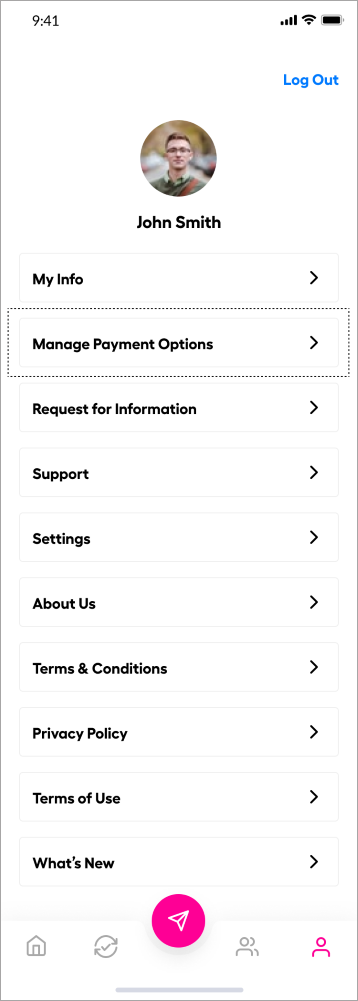

You can choose to add credit card as a payment by going to your profile (first button on the right) and select manage recipient.

And select add credit card and fill in your credit card details:

Send money with credit card

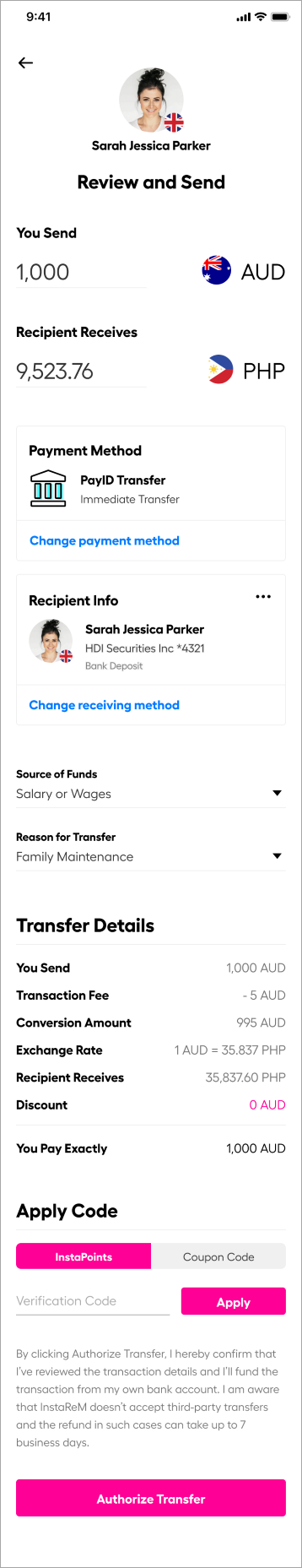

After logging into your account, simply follow the below steps.

Go to Send button (Pink arrow in the middle)

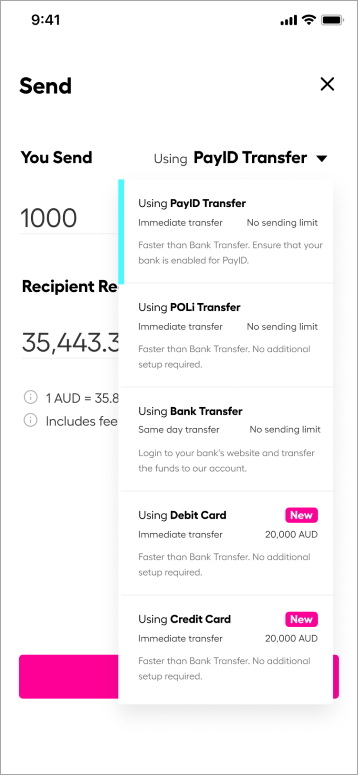

On the top right-hand corner, you will be able to select the method for transfer. Choose Credit Card.

Don’t forget to include the currency and amount you intend to send.

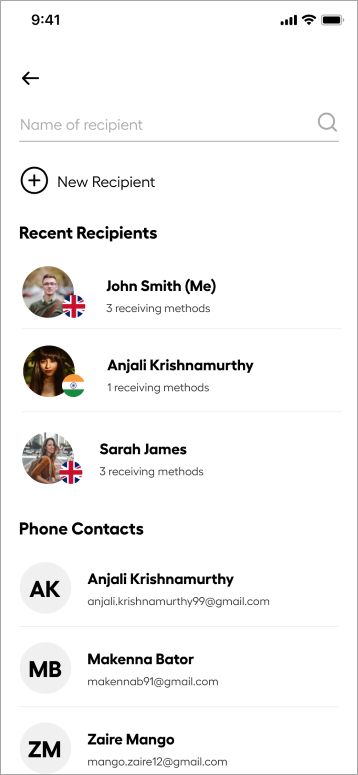

Now select the added recipient.

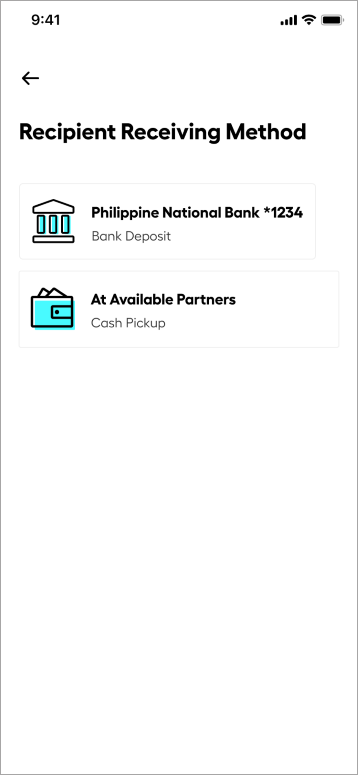

Choose their preferred receiving method and fill in your transfer details.

Next, review your transaction summary and authorize the transfer.

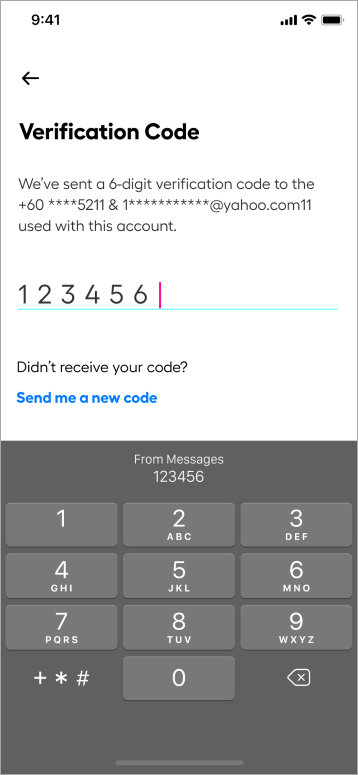

Fill in your verification code and you are done.

And you are done. It’s that simple.

If credit card isn’t your choice of payment, Instarem also offers other popular payment methods like Bank Transfers. PayID and Poli are also available for customers in Australia, FXP Transfer in Malaysia, PayNow in Singapore and ACH in US.

| Country | Currency | Payment Method |

| Australia | AUD | PayID, Bank Transfer, credit/debit transfer |

| Austria | EUR | Debit Card, Bank Transfer |

| Belgium | EUR | Debit Card, Bank Transfer |

| Bulgaria | EUR | Debit Card, Bank Transfer |

| Croatia | EUR | Debit Card, Bank Transfer |

| Cyprus | EUR | Debit Card, Bank Transfer |

| Czech Republic | EUR | Debit Card, Bank Transfer |

| Denmark | EUR | Debit Card, Bank Transfer |

| Estonia | EUR | Debit Card, Bank Transfer |

| Finland | EUR | Debit Card, Bank Transfer |

| France | EUR | Debit Card, Bank Transfer |

| Germany | EUR | Debit Card, Bank Transfer |

| Greece | EUR | Debit Card, Bank Transfer |

| Hungary | EUR | Debit Card, Bank Transfer |

| Iceland | EUR | Debit Card, Bank Transfer |

| Ireland | EUR | Debit Card, Bank Transfer |

| Italy | EUR | Debit Card, Bank Transfer |

| Latvia | EUR | Debit Card, Bank Transfer |

| Liechtenstein | EUR | Debit Card, Bank Transfer |

| Lithuania | EUR | Debit Card, Bank Transfer |

| Luxembourg | EUR | Debit Card, Bank Transfer |

| Malta | EUR | Debit Card, Bank Transfer |

| Netherlands | EUR | Debit Card, Bank Transfer |

| Norway | EUR | Debit Card, Bank Transfer |

| Poland | EUR | Debit Card, Bank Transfer |

| Portugal | EUR | Debit Card, Bank Transfer |

| Romania | EUR | Debit Card, Bank Transfer |

| Slovakia | EUR | Debit Card, Bank Transfer |

| Slovenia | EUR | Debit Card, Bank Transfer |

| Spain | EUR | Debit Card, Bank Transfer |

| Sweden | EUR | Debit Card, Bank Transfer |

| United Kingdom | GBP | Bank Transfer, Debit Card |

| Hong Kong | HKD, USD | Bank Transfer, Debit Card |

| India | INR | Bank Transfer |

| Malaysia | MYR | FPX Transfer, Bank Transfer |

| Malaysia | USD | Bank Transfer |

| Singapore | SGD | PayNow, Bank Transfer, Credit/Debit Card |

| Singapore | USD | Bank Transfer |

| United States | USD | ACH / direct debit, Set up Instarem as Payee, wire transfer |

You Might Also Like To Read: Everything you need to know about Instarem points and how to redeem them