Boost your earnings in these tax-free states in the United States

This article covers:

The financial landscape of the U.S. is a mosaic of diverse taxation systems, each with its own implications on net income. For many, state taxes present a significant consideration when determining take-home pay. However, seven U.S. states stand apart, offering no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. What makes these states financially attractive?

This article delves deep into the nuances of state taxes, the benefits of living in tax-free states, and the broader considerations one should factor in before making a move.

Comprehensive understanding of state taxes

Navigating the intricate web of American taxation can be likened to embarking on a nationwide journey, filled with a myriad of landscapes and terrains.

At the forefront is the Federal Income Tax, a ubiquitous presence that consistently chips away at every American paycheck, regardless of the state one resides in. Its constancy, though predictable, sets a backdrop against which the variation of the State Income Tax truly shines.

State Income Tax is less of a uniform entity and more of a mosaic, with patterns differing from one state to the next. For instance, California, a state famed for its entertainment industry, technology hubs, and picturesque landscapes, also draws attention with its whooping income tax rate that peaks upwards to 12.3% for its highest earners. Such a rate can be a stark revelation, especially when juxtaposed against economic powerhouses like Texas, which flaunts a zero-income tax rate.

However, the state taxation story doesn’t end with income tax; it’s just the beginning. Enter Sales Tax, an ever-persistent reality that consumers grapple with each time they make a purchase. States like Oregon offer a reprieve with a 0% rate, making it a haven for shoppers. On the flip side, Tennessee, with its steep sales tax rate of over 7%, demands a heftier chunk from consumers’ wallets. This spectrum illustrates the vast differences in states’ approaches to generating revenue from retail activity.

For those who have ventured into the realm of homeownership, Property Tax introduces another layer of fiscal responsibility. A state like Hawaii, known for its serene beaches and laid-back lifestyle, surprisingly offers a gentle touch with a mere 0.30% rate. However, head over to the bustling bylanes of New Jersey, and the narrative shifts drastically. Homeowners there grapple with a staggering 1.79% rate, making it one of the highest in the nation. Such variations significantly impact decisions about where to lay down roots and invest in property.

Finally, let’s delve into a tax that might seem niche but impacts specific consumer choices: Excise Tax. Often levied on luxury goods, alcoholic beverages, and tobacco products, its rates can sway decisions for aficionados of the finer things in life. While it can be seen as a way to curtail the consumption of certain goods, it’s also a strategic move by states to tap into revenue from non-essential purchases.

But why these complex layers of taxes? The answer lies in each state’s unique priorities and needs. Taxation isn’t merely a tool for revenue generation; it’s a reflection of state agendas. Some states might channel funds towards bolstering infrastructure, aiming for towering skyscrapers and smooth highways. Others might lean into healthcare, ensuring every resident has access to quality medical facilities. Yet others see education as the cornerstone, investing heavily in schools and universities.

In essence, the State Tax System isn’t just about numbers and rates; it’s a mirror reflecting the aspirations, values, and priorities of each state, offering residents and potential migrants a glimpse into what truly matters in their chosen homeland.

Here’s a summary of all the taxes:

- Income Tax: This tax is levied on an individual’s earnings. While federal income tax rates are consistent across the nation, state income tax rates can vary significantly.

- Sales Tax: Imposed on the sale of goods and certain services. Some states have no sales tax, while others may have varying rates.

- Property Tax: Based on the value of owned property, primarily real estate.

- Excise Tax: Special taxes on specific goods, like alcohol, tobacco, and gasoline.

In-depth overview of tax-free states in the U.S.

The vast and diverse American landscape offers plenty of opportunities, cultures, and lifestyles. Woven into this tapestry are varying tax structures that significantly influence residency choices and economic activities. Among the fifty states, seven stand out prominently for a singular fiscal feature: the absence of a state income tax. These states – Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming – are the financial Magnificent Seven, each with its distinct appeal and economic ecosystem.

Comparative analysis of tax-free states in the United States

No-Tax State | Total Tax Burden | Rank (Tax Burden) | Affordability | Best State to Live |

Alaska | 5.10% | 1 | 47 | 45 |

Wyoming | 6.14% | 3 | 33 | 35 |

Florida | 6.97% | 6 | 31 | 10 |

South Dakota | 7.37% | 8 | 14 | 15 |

Texas | 8.19% | 19 | 22 | 31 |

Nevada | 8.23% | 22 | 41 | 37 |

Washington | 8.34% | 26 | 44 | 1 |

Sources: WalletHub Tax Burden by State, U.S. News & World Report Affordability, and U.S. News & World Report “Best States to Live In” rankings

Diving into the world of tax-free states, it’s essential to understand not just the absence of taxes but also the overall tax burden that residents bear.

What is tax burden?

Tax burden represents the total amount of taxes paid by residents as a portion of their income. It’s a comprehensive measure that gives a holistic view of how much an average citizen contributes to the state’s coffers. It doesn’t merely focus on one type of tax but encompasses all – from income, sales, and property to excise taxes.

How is tax burden calculated?

The tax burden is typically calculated as a percentage. It is derived by taking the total tax revenue collected by the state and dividing it by the total income of its residents. The formula is:

Tax Burden(%)= Total Tax Collected by the State÷ Total Income of the State’s Residents × 100

So, if a state collects $10 billion in taxes and the combined income of its residents is $200 billion, the tax burden would be 5%.

What Does tax burden mean for eesidents?

A lower tax burden implies that residents are retaining a larger portion of their earnings. It’s an indicator of the efficiency of the state’s fiscal policies and how sustainably they can fund public services without overburdening the residents.

However, a lower tax burden doesn’t automatically mean residents are better off. If a state has minimal taxes but lacks essential services, infrastructure, or quality education, then the benefits of low taxes might be offset by the cost of living or reduced quality of life.

While these states do not impose an income tax, they vary in other tax burdens. Knowing a state’s tax burden can provide a more comprehensive view than just looking at specific tax rates. It aids potential movers in several ways:

- Alaska: With the lowest total tax burden of just 5.10% of income, Alaska sits at the top, though its affordability and overall ranking as a place to live are a tad lower.

- Florida: Popular for its beaches and weather, Florida has a total tax burden of 6.97%. Its affordability is relatively middle-of-the-pack, as is its ranking as a desirable place to live.

- Nevada: Known for its entertainment hubs, Nevada’s tax burden stands at 8.23%. However, its affordability and livability rankings are slightly below average.

- South Dakota: This state enjoys a total tax burden of 7.37%, along with a reasonably high ranking in affordability and desirability.

- Texas: The expansive state of Texas sees a total tax burden of 8.19%. It falls in the mid-range for both affordability and overall appeal.

- Washington: While it lacks an income tax, Washington compensates with a total tax burden of 8.34%. Interestingly, it ranks first as the best state to live in.

- Wyoming: With a tax burden of 6.14%, Wyoming is quite competitive, holding average scores in affordability and overall appeal.

In essence, while the allure of tax-free states is undeniable, it’s crucial for potential residents and businesses to peer beneath the surface. Every state, even among the Magnificent Seven, has its balance sheet, with compensations and trade-offs intricately designed to cater to its unique needs and priorities.

Detailed analysis of the impact of living in a tax-free state

The allure of living in a tax-free state draws many individuals and businesses, enticed by the possibility of increased take-home pay and reduced financial burdens. However, it is essential to comprehend that the absence of state income tax does not necessarily equate to fewer expenses or an improved standard of living. Several nuanced considerations and trade-offs come into play.

Higher sales or property tax

The old adage, “There’s no such thing as a free lunch,” holds particularly true in the realm of state taxes. States may not impose an income tax, but they must generate revenue in other ways to fund public services, infrastructure, and more.

For instance, Texas, a state that doesn’t levy state income tax, tends to compensate through higher property taxes, placing a considerable burden on homeowners. Meanwhile, Washington, also income-tax-free, imposes a sales tax rate that often surprises newcomers. Residents might save on income but end up spending more on consumer goods.

Limited public services

Income tax is a primary revenue source for many states, enabling them to fund public amenities and services. States that forego this tax might experience budgetary constraints, potentially leading to underfunded public services, including libraries, parks, and public transportation.

Higher cost of living

Some tax-free states, like Alaska, have notably high living costs. From grocery items to fuel, residents may find that daily expenses are considerably higher than the national average. The tax savings may be negated if residents are spending significantly more on basic necessities.

Lower average wages

An often-overlooked aspect of living in a tax-free state is the potential for reduced earnings. In some states, the average wages are below the national median, which can offset the financial benefits gained from the lack of state income tax.

Variable business taxes

Entrepreneurs should approach tax-free states with a discerning eye. While they might benefit from personal income tax exemptions, the state could have other business taxes or fees that affect the bottom line. Understanding the broader tax landscape is crucial for businesses to truly benefit.

Key factors to consider when moving to a tax-free state

Deciding to relocate to another state is more than just about immediate tax savings. It’s about envisioning a life in a new locale, amidst a different socio-economic backdrop. To paint a holistic picture, one must zoom out and view the state in its entirety. Let’s merge our insights on tax burdens, affordability, and quality of life rankings to give you a thorough breakdown.

1. Job market conditions

Before relocating, it’s imperative to gauge the economic pulse of the target state. Here’s a perspective:

- No-Tax State & Job Market Synergy: For instance, while Texas might not have an income tax, it’s a burgeoning hub for tech start-ups, especially cities like Austin. This could be an indicator of a robust job market for tech professionals.

- Total Tax Burden & Average Salaries: A lower tax burden might signal higher net salaries, but it’s essential to check the average pay scales for your industry in the prospective state.

- Rank & Growth Prospects: States ranking lower in tax burdens might be channelling their resources efficiently, possibly hinting at a thriving economy and better job opportunities.

2. Cost of housing

Here’s where the interplay of affordability rankings and tax structures becomes evident:

- No-Tax State & Real Estate Demand: States like Florida might lure with zero income tax, but cities like Miami are known for their high real estate prices. It’s essential to balance out tax savings against housing costs.

- Affordability & Housing Choices: A state with a favourable affordability index might offer better housing deals, ensuring your tax savings aren’t consumed by rent or mortgage.

3. Overall cost of living

Cost of living goes beyond housing:

- Total Tax Burden & Daily Expenses: A state with a lower tax burden like Alaska might seem financially attractive, but remember, daily expenses in Alaska, especially food and logistics due to its remote location, can be high.

- Best State to Live & Quality Services: The ranking of a state in terms of livability can offer insights into healthcare, education, and utility costs. A top-ranked state might ensure that even with higher expenses in certain areas, the overall quality of life remains unparalleled.

4. Lifestyle considerations

Marrying the qualitative with the quantitative:

- Cultural Alignments & State Rankings: A state’s ranking on the ‘Best State to Live’ scale can provide insights into cultural vibrancy, community structures, and recreational opportunities.

- Climate & Personal Preferences: No tax can compensate if you’re not a fan of Texas heat or Alaska’s prolonged winters. Personal comfort and preferences play a significant role.

In weaving your future, remember that the fabric is dense with various threads – fiscal, personal, professional, and socio-cultural. The absence of state income tax, while a significant factor, is embedded in this rich tapestry. To ensure your move is balanced, fulfilling, and financially sound, view the state not just as a taxpayer but as a future resident. Every data point, from tax burdens to livability rankings, is a beacon guiding your next big move.

Unraveling the tax-Free tapestry

Living in a tax-free state presents unique financial benefits and challenges. While the prospect of enhanced savings is tempting, the complete financial picture requires a more holistic view. One must look beyond immediate tax savings, touching upon lifestyle choices, long-term financial goals, and more.

Before taking the leap, weigh the pros and cons, consider all economic factors, and perhaps seek professional financial advice. Your financial well-being deserves a well-informed decision.

Before you go…

Moving to a tax-free state is no easy feat, but with the right tools and strategies in place, you can navigate this process smoothly.

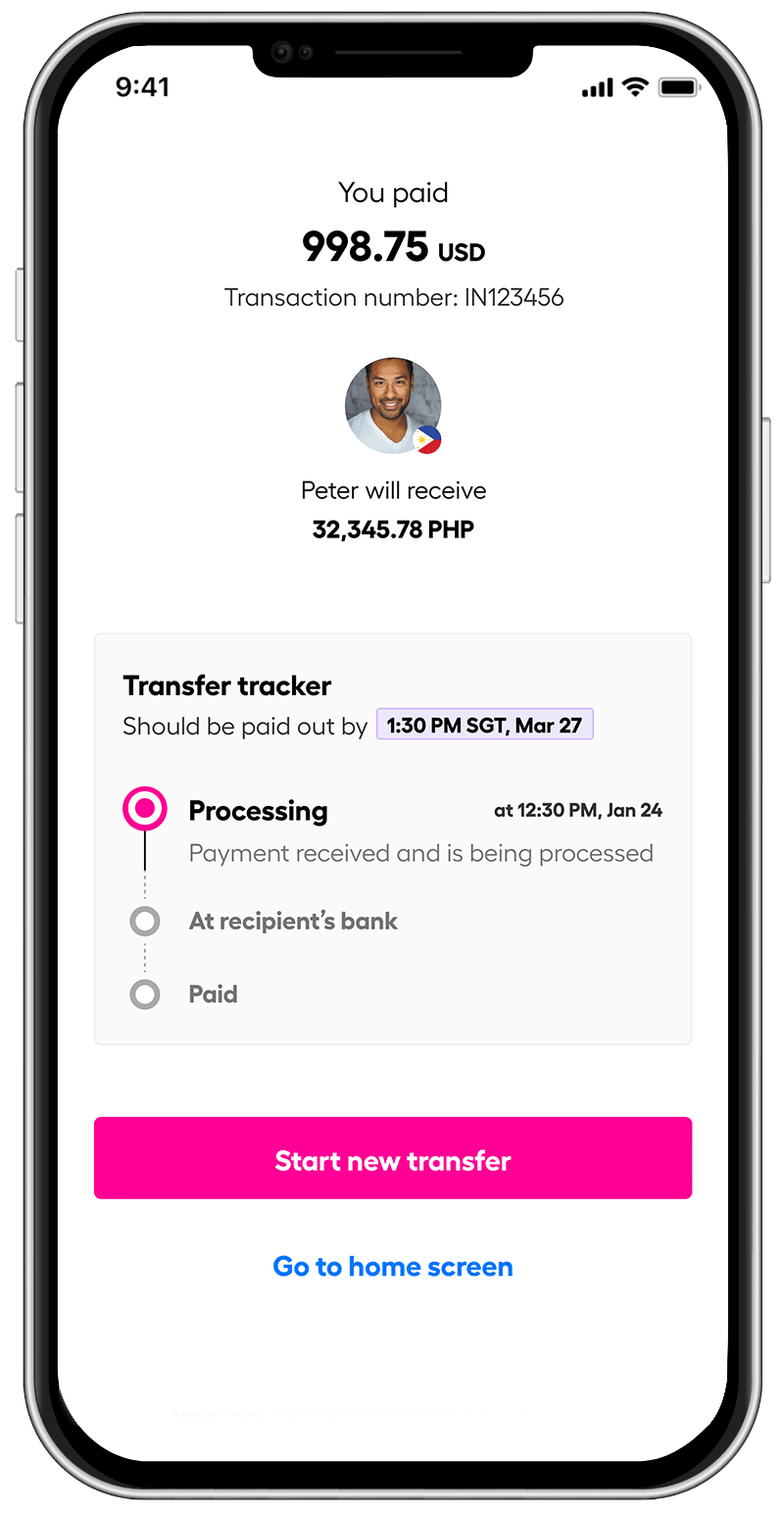

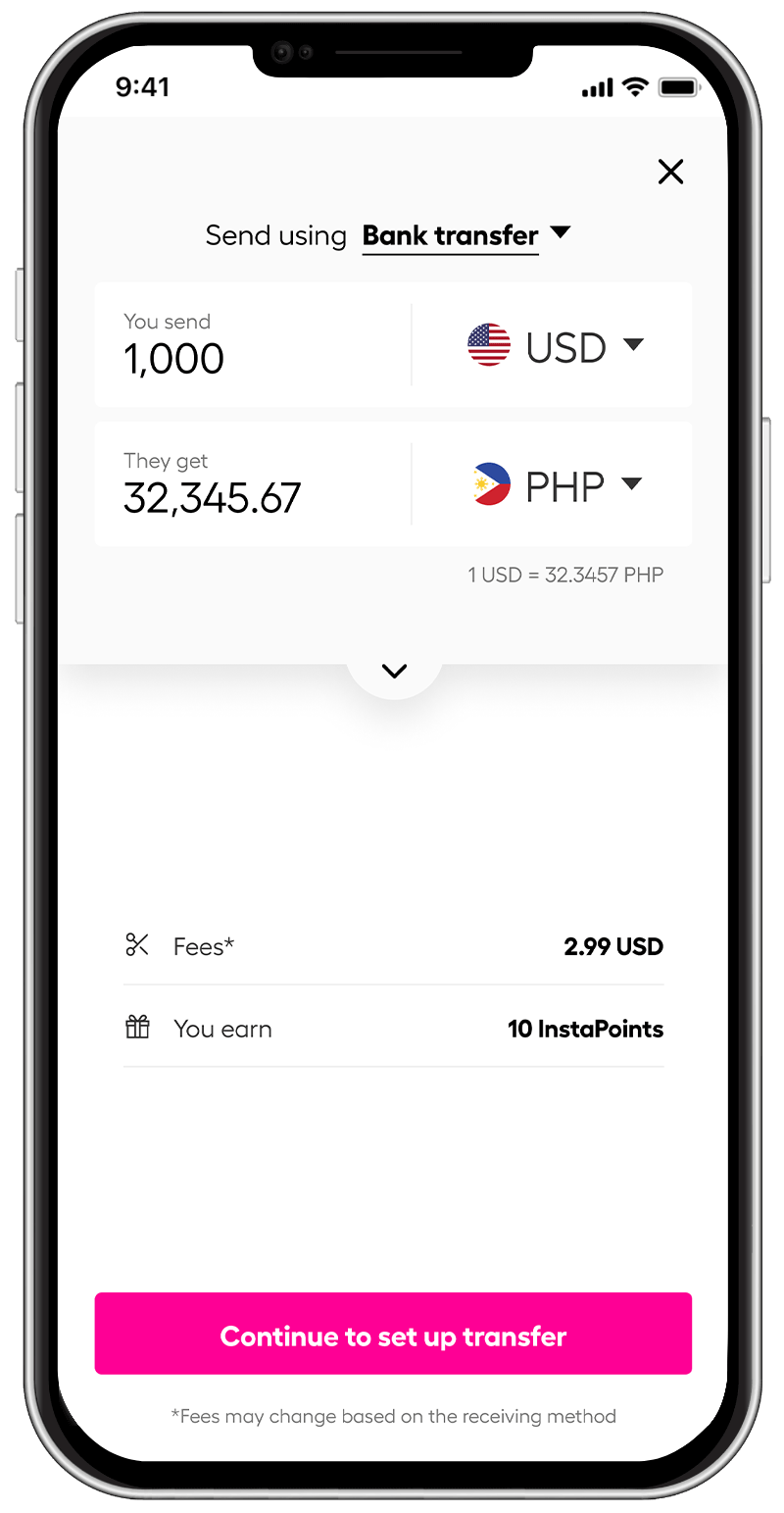

Instarem offers a secure and efficient overseas money transfer service that can help you manage your finances and prevent potential financial issues from arising due to complexity or unfamiliarity with regulations. If you need to send money to India, Instarem provides a reliable solution.

*rates are for display purposes only.

With competitive exchange rates and lower fees than most services, Instarem gives you a reliable way to handle the money matters of moving to a new country. Take charge of your financial affairs by utilizing Instarem measure when relocating interstate or internationally–it will help make sure you’re prepared for such an important transition.

Feel free to download the app or sign up here!

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.