Tips for successful long term investing

This article covers:

- What is a long term investment?

- What are the benefits of long term investment, and why should you care about them?

- What are some of the best long term investments?

- How do you go about making a long term investment?

- What are the risks associated with long term investments?

- How can you minimize those risks?

- Before you go…

Your 20s and 30s are the perfect time to start saving for retirement. Though you may not feel like you have enough money to spare, even small contributions now will add up over time. In order to make the most of your savings, it’s important to invest them in a way that will provide the greatest return. One of the best ways to ensure a healthy retirement is to make smart long-term investments. Here are some tips for choosing the best long term investments for retirement.

What is a long term investment?

A long-term investment is an investment that is made with the intention of holding it for a period of more than one year. These investments are often made in stocks, real estate, or other types of securities. The goal of a long-term investment is to generate consistent returns over time by investing in solid companies or assets.

What are the benefits of long term investment, and why should you care about them?

Your health and your job prospects may not be in your control

By saving and investing early on, you can ensure a comfortable retirement no matter what life throws your way. Investing for the long term is one of the smartest things you can do to secure your financial future.

Your earnings may be reduced, but expenses only go up

It’s good to have a retirement plan. Retirement planning is important because it gives you a roadmap to follow to ensure that you will have enough money saved up to cover your costs in retirement. It also allows you to make adjustments along the way if your circumstances change.

Leaving a legacy for your loved ones

Another compelling reason to invest in the long run is to create a financial inheritance for your loved ones. Estate planning is a method of ensuring that your assets are distributed in accordance with your instructions after you pass away.

Plans change in different life phases

Your retirement plan will likely change as you move through different phases of life. For example, you may want to retire sooner if you have a health condition that makes it difficult to work. Or, you may need to adjust your plans if you have children who will require financial assistance with their education. By planning ahead and investing for the long term, you can make sure that your retirement plan is flexible enough to accommodate these changes.

Flexibility and liquidity for your wealth goals

One of the benefits of long-term investing is that it provides you with the flexibility to change your mind about when you want to retire. If you invest in stocks or other securities, you can typically sell them at any time and use the proceeds to fund your retirement. This is not the case with different types of investments, such as real estate or private equity, which can be more challenging to sell.

Another benefit of long-term investing is that it provides you with the liquidity to meet your other financial goals. For example, if you have an emergency fund to cover unexpected expenses, you can tap into it without having to sell your investments. This flexibility can help you stay on track with your retirement savings goals.

What are some of the best long term investments?

Risk-free returns investments

- T-bills, bonds, and other fixed-income securities offer a safe return on your investment. These investments are typically low-risk and provide a steady stream of income.

- Dividend-Paying Stocks: Dividend stocks are a great way to generate returns while reducing risk. These stocks tend to be less volatile than other types of stocks and often provide a consistent dividend payment.

- Real Estate: Real estate is one of the best long-term investments for building wealth. It offers the potential for high returns, while also providing a measure of security and stability.

- Mutual Funds: Mutual funds are a type of investment that allows you to pool your money with other investors. This allows you to diversify your portfolio and reduce risk.

Investments with greater risks

As you progress in your investing journey, you may understand that taking calculated risks over the long term can be financially lucrative.

- Stocks: Stocks offer the potential for high returns, but they also come with a higher degree of risk. When selecting stocks, it’s important to choose companies that are well-established and have a history of consistent growth.

- Commodities: Commodities are another type of investment that can offer high returns. These include items such as gold, silver, oil, and grain. Commodities are often more volatile than other types of investments, so it’s important to do your research before investing.

- Cryptocurrencies: Cryptocurrencies are a type of digital asset that has exploded in popularity in recent years. Bitcoin, Ethereum, and Litecoin are some of the most well-known cryptocurrencies. These investments can offer high returns, but they are also very volatile.

ETFs: ETFs are a type of investment that tracks an underlying index. They offer the benefits of diversification and often have low fees. - Foreign currency investment: The foreign currency market, also known as FOREX, is a decentralized market where currencies are traded. This market is open 24 hours a day, 5 days a week. FOREX offers the potential for high returns, but it is also very volatile.

- ETFs: ETFs are a type of investment that tracks an underlying index. They offer the benefits of diversification and often have low fees.

- Foreign currency investment: The foreign currency market, also known as FOREX, is a decentralized market where currencies are traded. This market is open 24 hours a day, 5 days a week. FOREX offers the potential for high returns, but it is also very volatile.

How do you go about making a long term investment?

When making an investment, it’s important to weigh the risks and rewards to make the best decision for your financial future. Some investments offer great potential for growth with relatively low risk, while others have the potential to bring in high returns, but also carry a higher risk of losing your principal investment.

It’s important to carefully consider all aspects of an investment before deciding whether or not to move forward. By understanding the risks and rewards associated with each investment, you can make informed decisions that will help you reach your financial goals.

What are the risks associated with long term investments?

There are a number of risks associated with long-term investments. These can include political and economic instability, changes in legislation, or natural disasters. Company or industry-specific risks may also be present, such as a company going bankrupt, or a new technology rendering an old one obsolete.

It is important to be aware of the risks involved before making any decisions about long-term investments. Investors should always do their own research, and consult with a financial advisor if necessary.

How can you minimize those risks?

There are a few things you can do to minimize risk when investing in long term:

- Consider your financial goals: What are you hoping to achieve with your investment? Are you looking to grow your wealth, generate income, or both?

- Do your research. Ensure you understand the industry you are investing in, and the specific financial product you are funding.

- Consider the risks and rewards: All investments come with some degree of risk, so it’s important to understand both the potential rewards and risks before making a decision.

- Diversify your portfolio. Don’t put all your eggs in one basket. Spread your investment across a few different investments, in different industries.

- Have a long-term outlook: When making a long-term investment, it’s important to have a timeline in mind and be patient. These types of investments can take time to generate returns, but they can also provide stability and growth over the long term.

The world of investing is a complex one, and it can be hard to know where to start.

One way to minimize risk is through foreign currency. You may convert cash into a different currency. The use of a foreign currency will act as a safeguard against market fluctuations, which can help to minimize the overall risk in your portfolio.

Dollar-cost averaging is also an investing technique in which you spread out your investment into equal amounts and invest at fixed intervals. This technique can help to reduce the risk of investing in foreign currency, as it helps to average out the price fluctuations over time.

Before you go…

Are you looking to grow your savings in foreign accounts to boost your investment funds? Well, besides keeping an eye on those foreign exchange rates, you should also be cautious of sneaky hidden fees. Trust us, transferring money between bank accounts can really hit you hard with those hefty transaction fees!

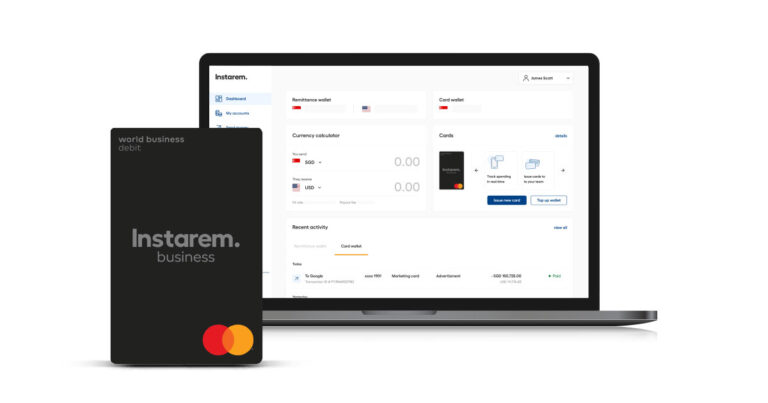

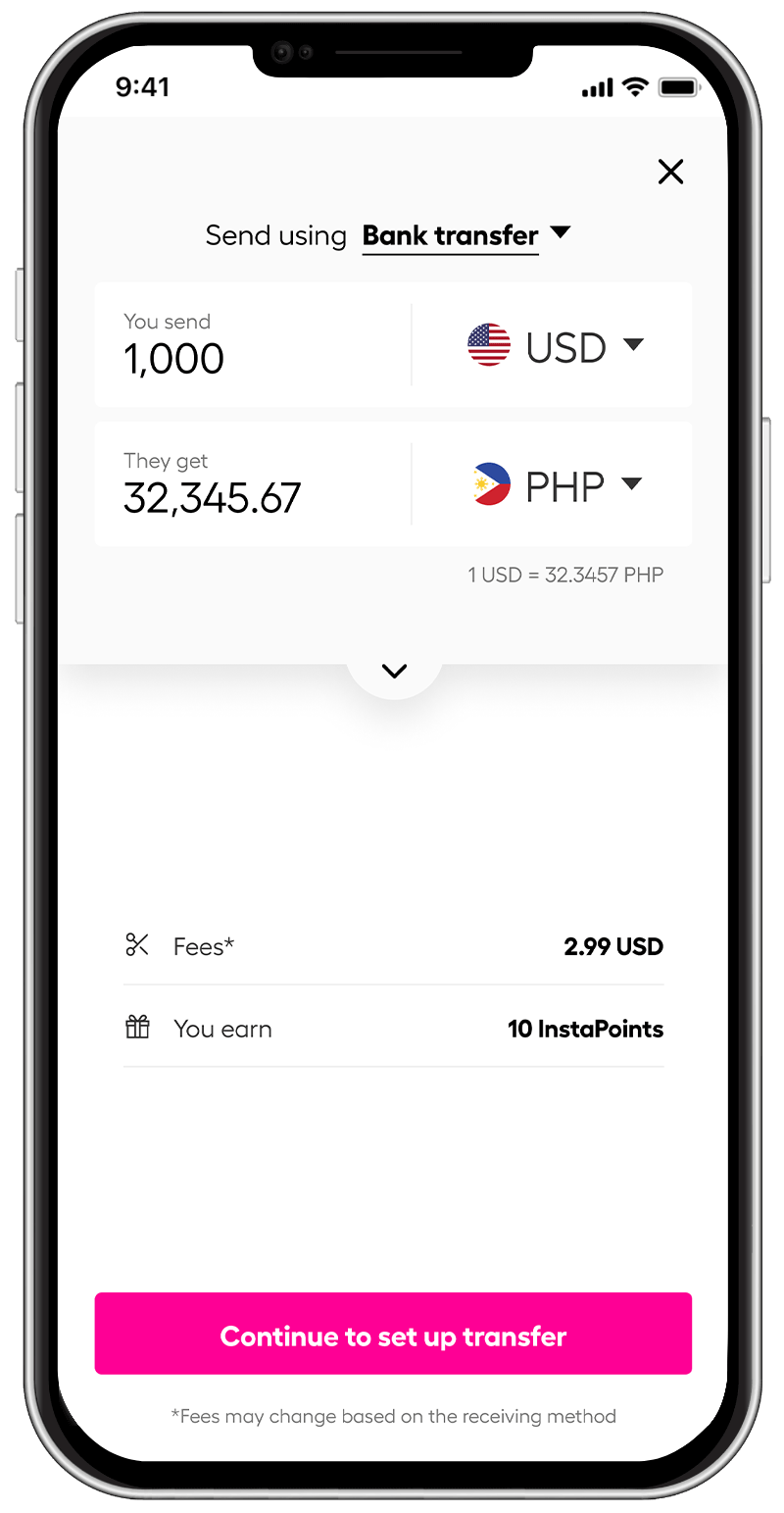

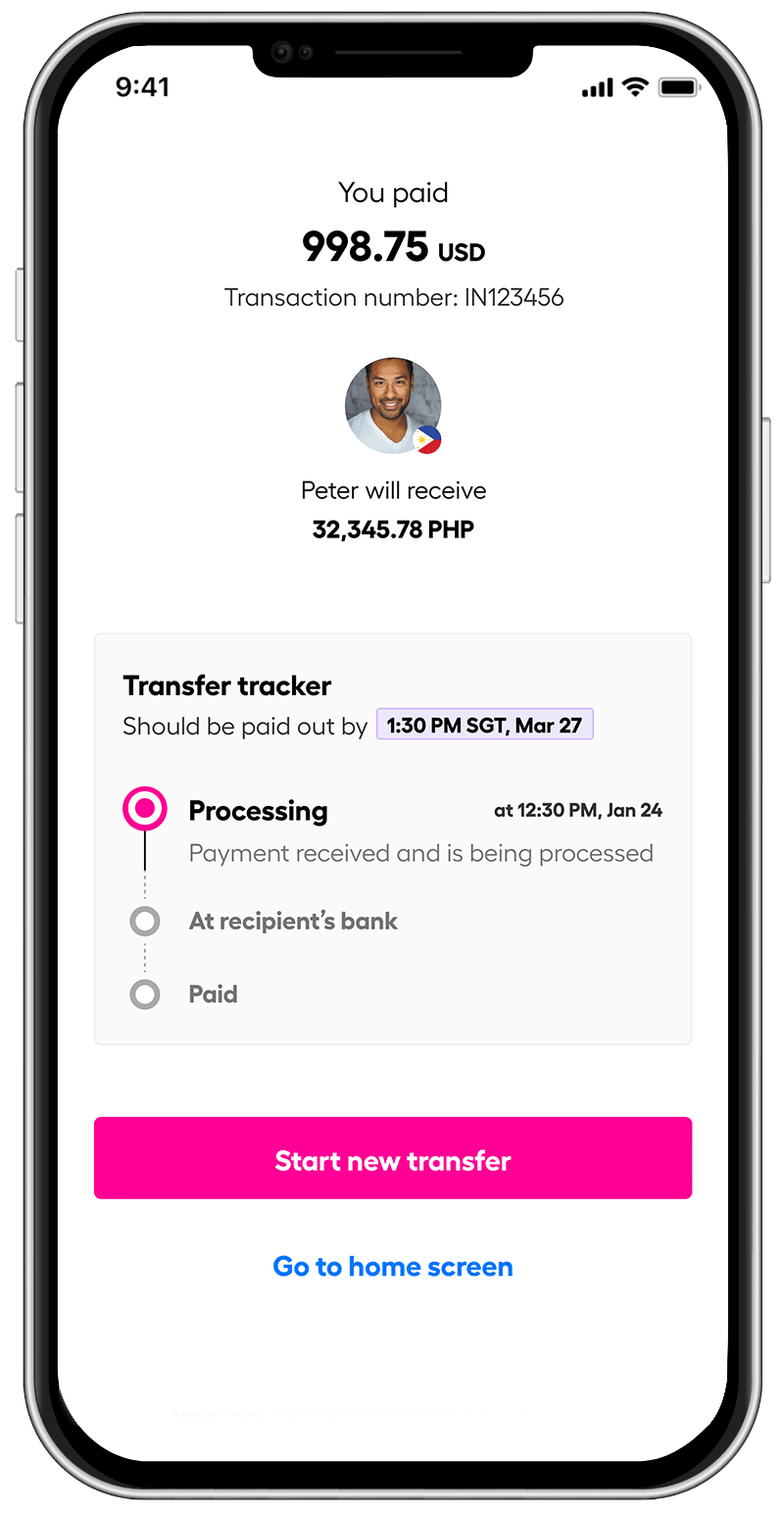

To make sure you don’t lose out when you send money overseas, it’s always a smart move to go for a money transfer service provider that lets you send money quickly and affordably, without any hidden costs. That’s where Instarem steps in.

*rates are for display purposes only.

They offer an exchange rate that’s super competitive, almost as good as the mid-market rate. Plus, each transfer comes with a small, transparent fee, which means you get the most bang for your buck on every transfer.

But wait, there’s more! When you sign up and start making transactions with Instarem, or if you successfully refer your friends to check them out, you’ll also earn InstaPoints. It’s a win-win situation for your savings and your social circle!

Download the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.