Wise (Formerly TransferWise) Review: Features, Pros & Cons

This article covers:

Transferring money abroad comes with its challenges. To name a few, are the high fees and amount of time you will have to wait until the money arrives at your recipient’s bank account. This is where money transfer providers like Wise become a better solution than banks or other traditional money transfer methods.

Pros | Cons |

Low fees | 48-hour limit on fixed exchange rate |

Fast transfers | Limited customer service |

Support 50+ currencies | Higher fees for card payments |

So, is Wise a suitable money transfer platform for you? Let’s take a look at our Wise review in this article.

Wise Rating

Wise is a money transfer platform that is not only popular but also trusted. Wise is rated 4.2 out of 200K+ reviews in Trustpilot.

Wise Review: The Main Features

Previously known as TransferWise, Wise is a popular cross-border money transfer platform, that provides fast and easy international money transfers as well as other services beyond transfers.

In this Wise review, we’ll go over the core feature – money transfers – and the innovative features that make it more than just a money transfer platform. Let’s take a look at the following:

Wise Money Transfer

Wise’s money transfer is the main feature that’s been around since it was still called TransferWise. This feature makes it easy for anyone to send money directly to 50+ currencies.

There are 50+ currencies that you can choose to send money using this feature. Apart from that, the transfer fees are also affordable compared to using bank transfers, as Wise prioritises affordable fees and mid-market exchange rates with zero markups.

Most importantly, transferring money using Wise is relatively quick and easy. You can set up the transfer and expect it to be received by the recipient’s bank account in a few hours to a maximum of 2 days, depending on the currency and country of the recipient.

Multi-Currency Account

Wise’s multi-currency account allows users to send, receive, or save money in 50+ currencies. This feature easily carries out transactions and manages expenses in certain foreign currencies you frequently use.

To start using this feature, you’ll first need to open a balance in the foreign currency you choose. Next, you can load it up using your local currency and pay it with your debit card, credit card, Apple Pay, or other payment method.

Let’s say you wish to deposit 1000 USD into your USD balance and pay in SGD. The amount due will be automatically adjusted based on the mid-market exchange rate, ensuring that you get a rate close to the real rate without any hidden markup.

Wise Debit Card

Wise debit card is an innovative feature from Wise that makes it beyond just a money transfer platform. To use this feature, you must first order your Wise card through your registered and verified Wise account and then follow the instructions provided.

Once you have obtained the Wise debit card, you can top up the currencies you want to have a balance in. It’s a perfect option to use when you’re travelling abroad, as it allows you to spend like a local and avoid unwanted fees (e.g., cash out and exchange rate fees).

The Wise debit card is currently available in 70+ countries. Make sure that it’s valid in your destination country before deciding to use it as a travelling partner.

Wise Digital Cards

Wise digital cards work similarly to the physical ones. You can use them to spend at the real exchange rate for both online and in-store transactions when you travel abroad.

However, by using Wise digital cards, you can manage expenses more easily as you can create up to 3 digital cards at one time. This functionality, in turn, simplifies the allocation of specific spending to each card, allowing better control of your spending.

Most importantly, using these digital cards for online transactions provides an extra layer of security. Each digital card you have has different details from the physical ones and can be deleted immediately once you’ve completed the transactions.

Wise Business

Wise business is a dedicated feature for enterprises. Generally, it has the same main features as personal account holders, such as transfers, cards, and multi-currency accounts, except for some additional capabilities made specifically for business account holders.

Wise business account holders can make batch payments for up to 1000 recipients, set team access to physical and digital cards, make invoice payments, integrate the Wise account with accounting software, and many more.

Wise business account holders can also obtain Wise business debit cards. They can enjoy the same benefits, such as avoiding additional ATM cash out and exchange rate fees when spending abroad.

Overall, Wise Business’s added capabilities make this feature ideal for enterprises running cross-border transactions. Enterprises can make or receive payments with lower fees and a more efficient process by using it.

Jars

Jars are a perfect feature to help you set aside money from your main balance, preventing you from careless spending. With this feature, it is easier to allocate your budget for several needs, such as bills, travel, emergency funds, and many more.

You can store your money in several jars with your preferred currencies, which you can choose from 50+ currencies. Simply click the + icon in the home bar, select your preferred currencies, customise your jars, and they’re all set.

Direct Debits

Paying the bills on time is now easier with the direct debits feature from Wise. This feature allows your service providers to directly withdraw an amount from your balance when the payments are due on a certain date in a month.

Direct debits are perfect for monthly bills such as cloud software subscriptions, phone credits, or electricity bills. By using it, you no longer need to worry about forgetting to pay your monthly bills amid packed activities.

To start using this feature, navigate to the ‘direct debits’ section of your Wise account. Your service provider will ask you to submit some details. Once submitted, the direct debits will be activated within a few days, depending on the policies of the service providers.

Wise Direct Bank Transfers

Wise bank transfer is a reliable service for making direct transfers to overseas accounts. Its ease of use for wire transfers reduces the hassle of manual transfers, which require more paperwork and take longer to deliver.

Both Wise money transfers and multi-currency account features allow you to send money directly to overseas accounts. The latter, however, requires you to top up the balance first, whereas the former allows you to send money directly abroad.

The time it takes for the money to be received by the recipient from the time you set up the transfer. This depends on factors like the country you’re sending to and from, how you pay, what time you pay for your transfer, and security checks.

However, it usually doesn’t take long for the money you send to arrive in the recipient’s account. The funds will be transferred to the recipient’s account within a few hours to a day and, in rare cases, 2 days.

To find out the estimate, Wise gives you the information via email. The recipient will also receive the same email, allowing everyone to track and increase greater transparency.

Wise Transfer Fees

Wise ensures that they charge transparent transfer fees, no matter how much money you send using their service.

Wise transfer fees vary depending on the destination country and your chosen payment method. Fees for using low-cost methods such as bank transfers or multi-currency account transfers start at 0.4% of the total transfers.

On the other hand, when using debit and credit cards, the transfer fees are higher. The rates range from 3% to 4%, depending on the destination country and currency.

Wise will also give another discount the more you use it to transfer money. You’re eligible to get another discount when you’ve sent over 100,000 GBP (or equivalent in your currency) in a month using Wise.

Wise Foreign Exchange Rates

Wise charges a foreign exchange rate when converting your money to the destination currency. The rates fluctuate following the current market rate but tend to be affordable as Wise uses mid-market exchange rates with zero markups.

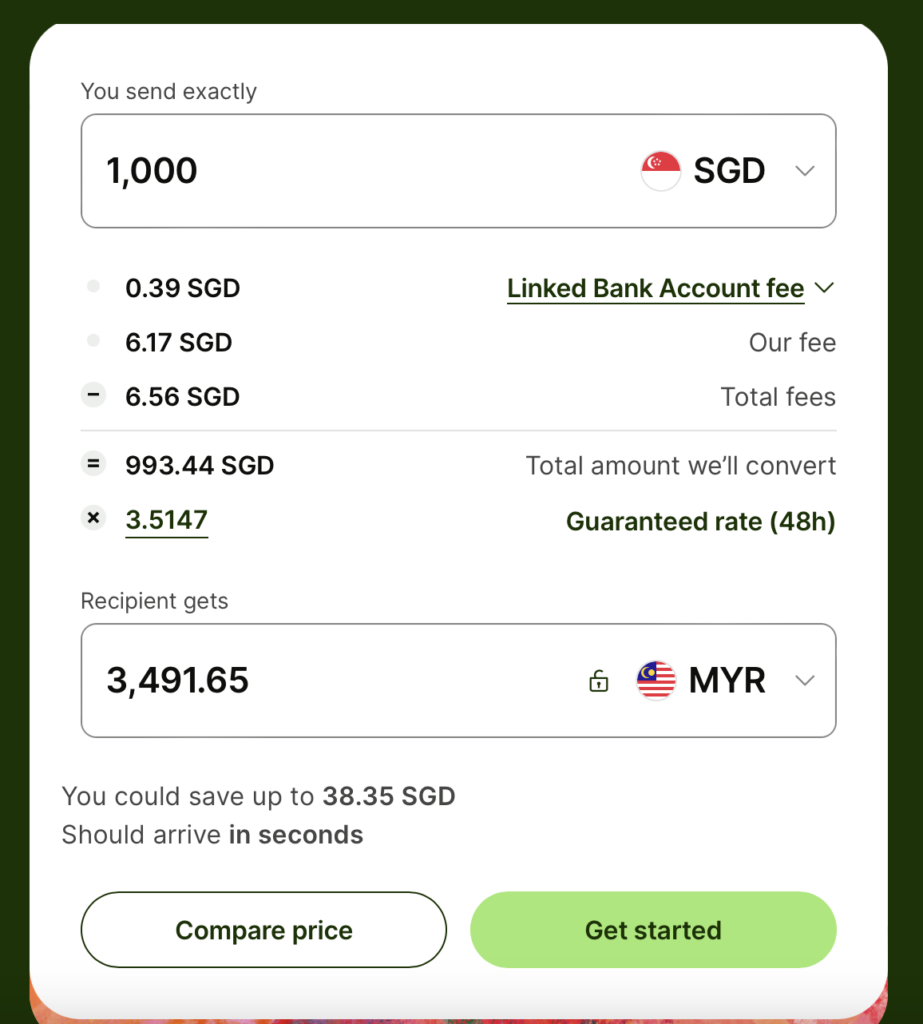

The amount left after deducting transfer fees is the amount you’ll convert to the destination currency. So, if you send 1,000 SGD to a MYR recipient, around 6.56 SGD will be deducted for transfer fees, and the remaining 993 SGD will be converted into MYR at the current exchange rate.

Rate taken April 22nd 2024, 1:40PM GMT+8

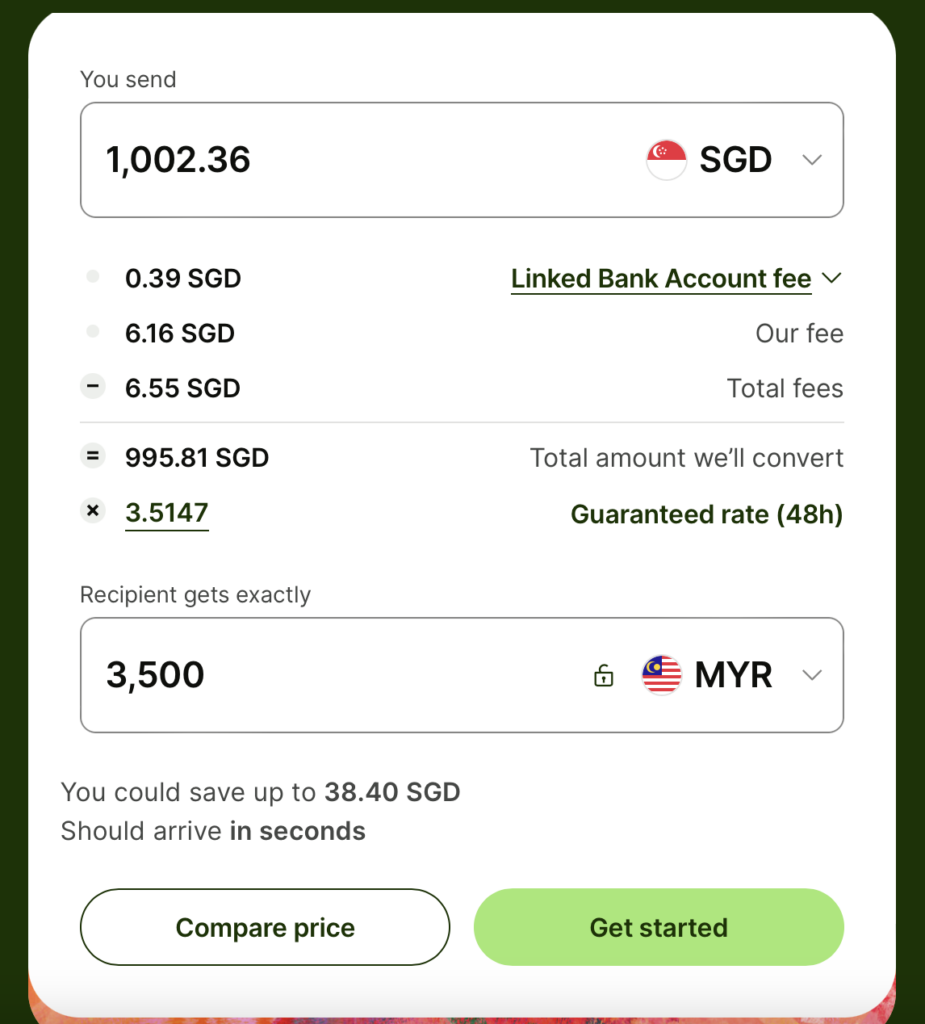

If you’d rather not worry about the exchange rate and would instead send a specific amount in the recipient’s currency, simply enter that amount in the ‘recipient gets’ section. As a result, the amount you must pay in your local currency will fluctuate from time to time.

Rate taken April 22nd 2024, 1:40PM GMT+8

List Of Countries Covered By Wise International Transfers

Planning to transfer money abroad using Wise? Wise supports wire transfers to a wide range of countries, including but not limited to the following:

Argentina | Australia | Bangladesh | Brazil | Bulgaria |

Botswana | Canada | Chile | China | Colombia |

Costa Rica | Croatia | Czech Republic | Denmark | Egypt |

Europe | Georgia | Ghana | Guatemala | Hong Kong |

Hungary | India | Indonesia | Israel | Japan |

Kenya | Malaysia | Mexico | Morocco | Nepal |

Netherlands | New Zealand | Nigeria | Norway | Pakistan |

Peru | Philippines | Poland | Romania | Russia |

Singapore | South Africa | South Korea | Sri Lanka | Sweden |

Switzerland and Liechtenstein | Tanzania | Thailand | Turkey | Uganda |

Ukraine | United Arab Emirates | United Kingdom | United States of America | Uruguay |

Vietnam | West Africa | Zambia |

Wise Pros And Cons

Despite being a popular choice for sending money overseas and having excellent features, Wise’s benefits and drawbacks are worth weighing to help you understand what to expect before using it. So, in this Wise money transfer review, we’ll list down the pros and cons.

Let’s check them out below:

Pros

- Low transfer fees: Wise transfer fees are low and transparent. You can seamlessly send money to overseas accounts without worrying about hidden costs.

- Mid-market exchange rates: When sending funds to foreign currencies with Wise, you’ll be charged based on the mid-market exchange rate. This ensures a fair fee structure and affordable cross-border transfers.

- Access to 50+ currencies: Wise gives you access to 50+ currencies for making payments, saving in multi-currency accounts, and receiving payments from abroad.

- Available in 70+ countries: Using Wise allows you to spend like a local in 70+ countries at affordable costs. You no longer need to convert cash at a money changer or pay high charges when using your cards abroad.

- Varying payment options: Wise has various payment options that you can use to send money overseas. This includes bank transfers, Wise accounts, and debit/credit cards.

Cons

- Higher transfer fees for some currencies: Albeit with the low transfer fees in most of the available currencies, Wise charges higher transfer fees for some currencies

- Uncertain transfer time: Wise promises to send money quickly – between a few hours to a day and, in rare cases, 2 days. However, you can only get to see the estimated delivery time, not the exact time your transfer will arrive at its destination.

- 48-hour limit on fixed exchange rates: Although Wise charges the currency conversion using mid-market exchange rates, they only guarantee that rate for 48 hours. The rate may fluctuate if any issues are causing delayed transfers.

- Limited customer support: Call customer support provided by Wise is limited. As a result, if you need immediate support outside office hours, you can only contact them via email.

- Higher fees for some payment options: Wise offers varying payment methods. However, for some options like debit and credit cards, you’ll be charged higher fees.

Who Is Wise Recommended For?

With all of Wise’s notable features, it makes it simple for anyone to make transactional transactions, and it’s especially recommended for:

- International businesses with cross-border talents, vendors, or clients need a solution for sending and receiving money overseas

- SMEs who do cross-border transactions, such as sending and receiving money to/from vendors or clients

- Students studying abroad who want to receive money from their home country faster

- Consumers who plan to shop online or abroad using digital and physical debit cards that can be pre-loaded in multiple currencies

Is There A Better Alternative to Wise?

Wise is an excellent platform that you can use to send money abroad. It also has added capabilities that make it beyond just a fund transfer platform.

However, it’s also essential to consider that Wise also has drawbacks despite its innovative features. Ensure that they won’t bother you that much so you can conveniently make cross-border transactions.

If you want to explore another wire transfer alternative to Wise, you can try Instarem. Similar to Wise, Instarem offers affordable transfer fees and exchange rates with no hidden costs.

Read more about Instarem through this Instarem reviews. Once you’re sure, now is the time to create your Instarem account and see how it works! Download the app or sign up here.

FAQs

Can I use Wise Business to send money to multiple accounts simultaneously?

Yes, you can send money to multiple accounts simultaneously using Wise Business. This feature allows up to 1,000 people in a single click.

How long does it take for Wise to deliver money?

The time it takes for Wise to deliver money varies. The estimated time ranges from a few hours to 1 day, and in rare cases, it can take up to 2 days.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.