- Home

- Send Money To Austria

4.4/5 – Excellent. From 8,000+ reviews

Send money to Austria from Australia

We are regulated by Australian Transaction Reports and Analysis Centre (AUSTRAC)

Our rates

Our rates

Payment by

Fees Fees and exchange rates vary by sending amount, currency, payment method, and receiving country. Please change these parameters to view the applicable fees.

Transfer time Estimated transfer time may vary based on the currency selected, payment method, and bank timings.

Making your first transfer?

Get zero fees on your transfer! Send between AUD 1 and AUD 4,000 today.

Plus, enjoy AUD 5 off your first transfer of AUD 1,000 or more. Use code WELCOME.

Need to send over 30,000 AUD? Enjoy special discounts. Learn more

Stay in control with our transparent pricing

Our transfer fee is transparent – never hidden, you’ll always see the exchange rate upfront, giving you total control to send money to Austria from Australia at the best rates.

Better exchange rates

We provide you with competitive foreign exchange rates, every time.

Low transaction fees

Lower fees than banks and no additional charges.

No hidden fees

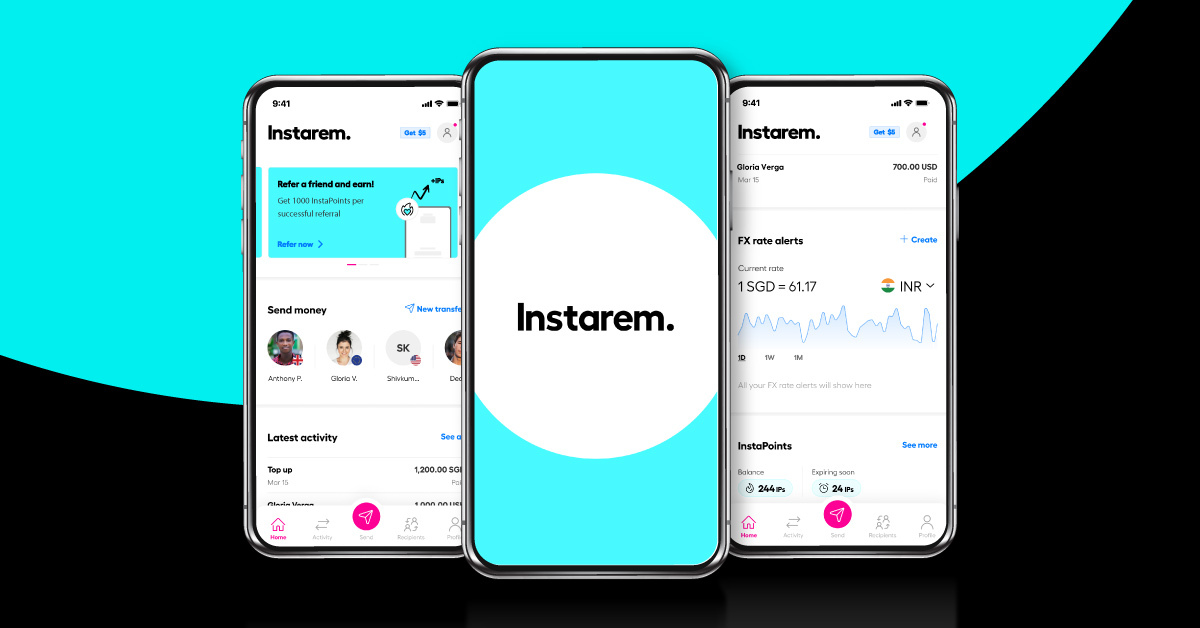

You will always see the total fees clearly displayed on our app.

How to send money to Austria from Australia: 4 easy steps

Sign up for an account online or via our app. Upload proof of address in Australia and your identification documents.

Fill in your recipient’s information.

Choose the type of currency you want to send, input the amount, and select your preferred transfer method.

Note: Refer to our international money transfer limits guide for more information on the maximum amount you can transfer in a single transaction to your choice location.

Key in the verification code that is sent to your registered phone number or email. This helps us keep your money safe.

Find the best rate for your money transfer

Compare Instarem’s rate for with banks and see the difference yourself.

*Rates available as on including any applicable fees.

Note: Rates may vary based on market fluctuations and transfer methods. Please check the updated rates and fees at the time of setting up your transaction.

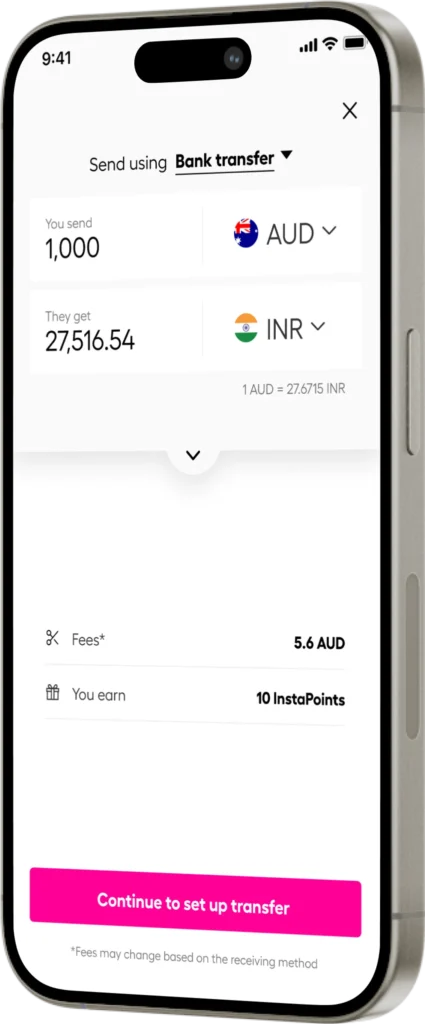

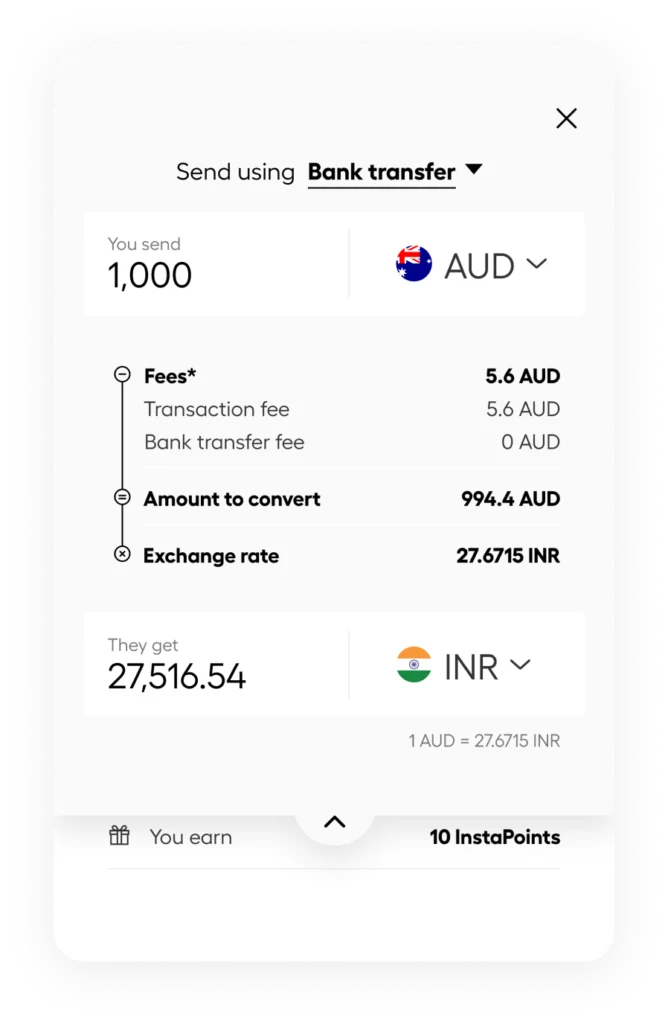

How much does it cost to transfer money to Austria?

The cost and speed of your transaction depends on the destination, your payment method, and how you want your funds to be received. We will always show you the cost upfront, before you proceed with the transfer so you can make the best choice for you to send money to Australia.

For illustration purposes. Updated fees are shown to you at the time of setting up your transaction.

How long does it take to transfer money to Austria?

Sending money to Austria with Instarem is lightning-fast. Money transfer from Australia to Austria will typically zip through in just a few minutes.

Sometimes, currency rules, bank processing, or holidays may cause a slight delay and it may take us a day or two. But no worries! Our top-notch technology and wide network of partners work together to get your money to Austria securely and quickly.

Ready to send money to Austria from Australia?

Sign up now for fast, secure and low-cost transfers.

Best ways to send money to Austria from Australia

At Instarem, sending money to Austria is as easy as it gets. Here are the payment methods Instarem offers you to fund your transfers.

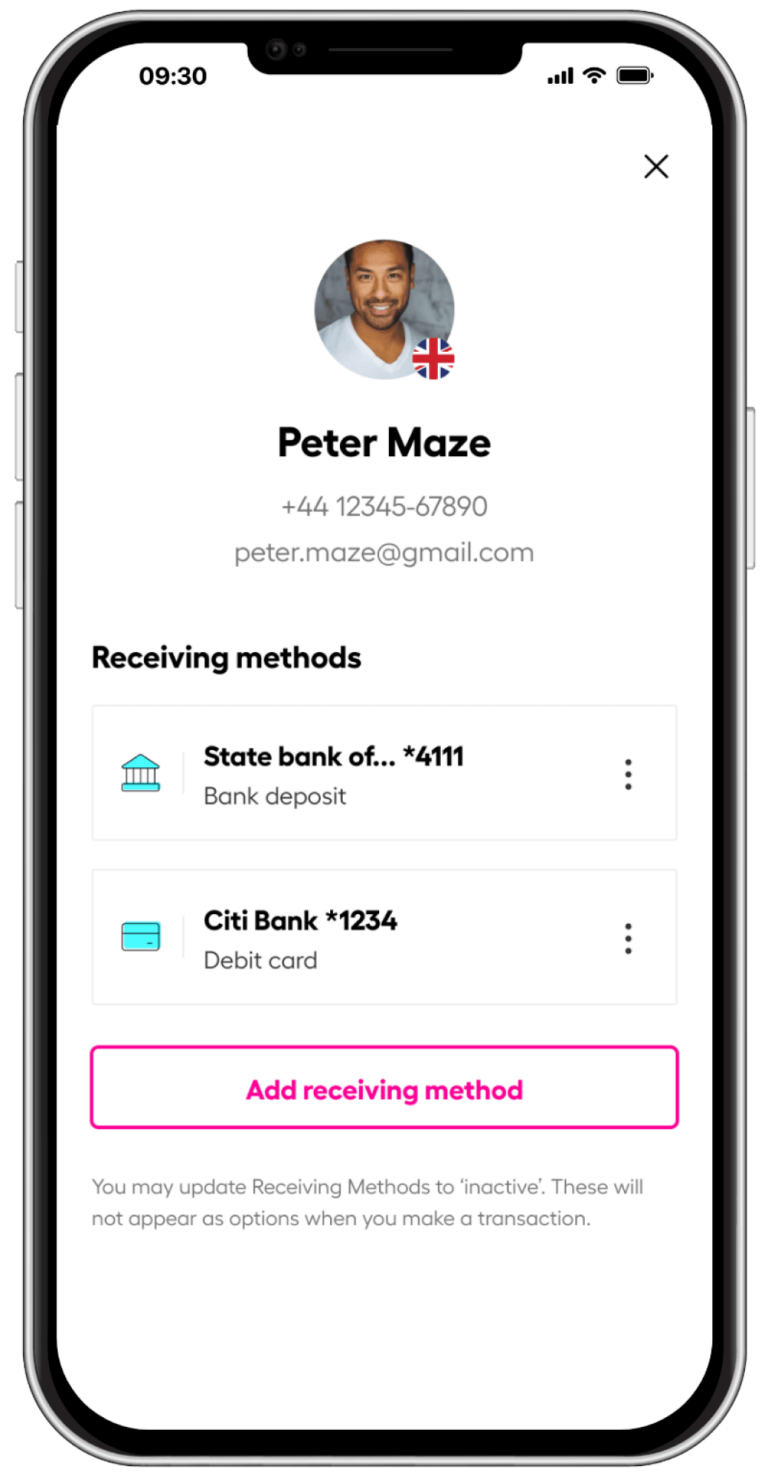

What information do I need to send money to Austria?

We will ask you for the following information:

- Your personal details. We may also need some documents for verification purposes.

- Your recipient’s personal details like full name, address, contact information and their bank details.

What our customers say

Send money from Australia to 60+ countries

If you cannot find the location you would like to send to, it means we currently do not support transfers to that destination, but we are working on it! Do come back and check again as we are continuously updating our services.

More currency pairings for AUD

If you cannot find your desired currency pair, it means that transfers to that specified currency are not supported by our services, but we are working on it! Do come back and check again as we are continuously updating our services.

Explore more

About us

From our humble beginnings to our biggest achievements, learn about what makes Instarem the best option for you to send money internationally.

Blog

Discover more about sending money overseas, tips for expats living abroad and more.

FAQs

Absolutely! When you choose Instarem to transfer money to Austria from Australia, you can be rest assured that your transaction is secure. We are regulated and licensed in 11 countries, and we specialize in international transfers, including sending money to Austria.

At Instarem, we take your financial security seriously. We use advanced encryption and secure payment methods to protect your information during the transfer process. However, it's always a good idea to be cautious. Before you proceed with any online money transfer to Austria, make sure to verify the recipient details and carefully review our terms and conditions.

Experience the convenience of online money transfers with Instarem, offering competitive exchange rates and affordable fees. Choose us for hassle-free transactions and exceptional customer support, making us the preferred option for sending money to Austria.

Related blogs

International money transfer rules – Everything you need to know

Are you planning to transfer money overseas, whether it’s for personal or business use…

Transfer money overseas with Instarem in a few easy steps

Whether you are sending money to support your family back home, paying for your child…

What makes sending money with Instarem, simple

Traditionally, people have been sending money abroad via banks or money transfer providers. While traditional…