This article covers:

Traditionally, people have been sending money abroad via banks or money transfer providers. While traditional methods offer familiarity and a sense of stability, a lot of time is often wasted on:

- waiting for good FX rates

- queuing up at a bank or money transfer outlet

- looking through and ensuring the transfer details are correct

- waiting for the transfer to happen

- ensuring your loved ones receive the money

What if you could avoid the all this hassle by using an easy to use, simple app?

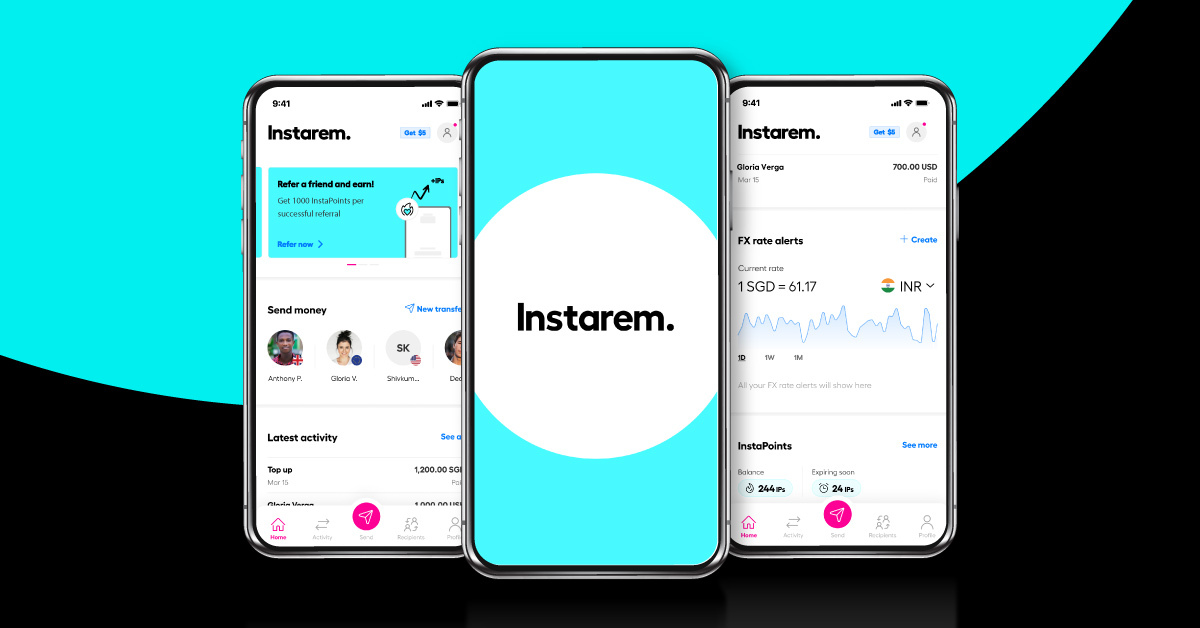

The Instarem app is designed to enable you to send money overseas effortlessly from the palm of your hand, and in just a few clicks. Here’s a quick guide on how to do just that.

- Download the Instarem app and set up a transfer

- Fund your transfer

- Special features of the Instarem app

Download the Instarem app and set up a transfer

- Download the Instarem app from Google Play Store or the App Store.

- Sign up using your Google, Facebook account or your email.

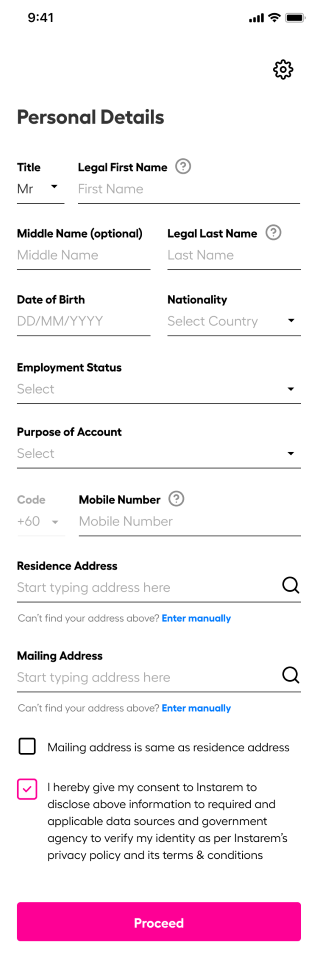

- Fill in your personal details and upload the required documentation to complete registration.

- You also have the option to be e-verified!

Once your account is verified, the next step is to set up a transfer!

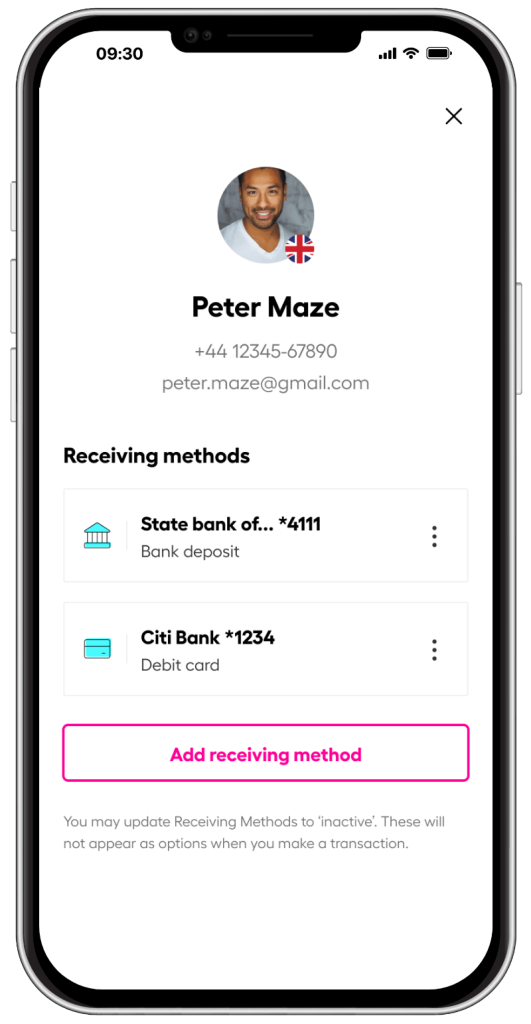

- Head to ‘ Send’ and add a recipient through your phone contacts or manually.

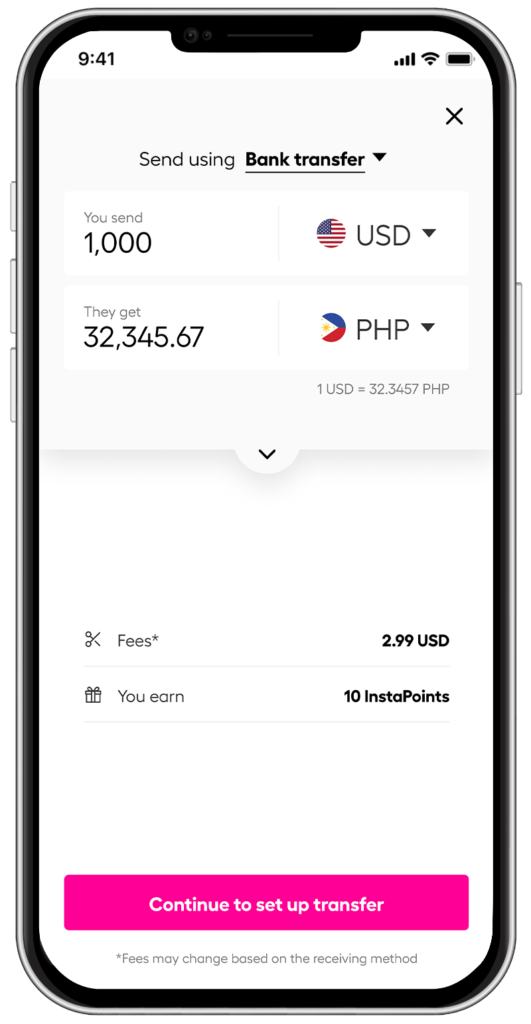

- Decide how you would like to fund your transfer by selecting your mode of payment*.

- Choose the currency you want to send and input the amount

- Select your recipient, receiving method and transfer details

- Key in your verification code that is sent to your phone number or email

Done! The app will then notify you once your payment is successful

Sounds easy right?

You Might Also Like To Read: Transfer money overseas with Instarem in a few easy steps

Not sure how to fund your transfer? Here’s how!

You can transfer money to Instarem through Electronic Funds Transfer (EFT)/ Bank Transfer/ Wire Transfer in all countries.

You can also send money through these payment methods:

|

Country |

Currency |

Payment Method |

|

Australia |

AUD |

PayID, Bank Transfer, Debit Card, Credit Card |

|

Austria |

EUR |

Debit Card, Bank Transfer |

|

Belgium |

EUR |

Debit Card, Bank Transfer |

|

Bulgaria |

EUR |

Debit Card, Bank Transfer |

|

Croatia |

EUR |

Debit Card, Bank Transfer |

|

Cyprus |

EUR |

Debit Card, Bank Transfer |

|

Czech Republic |

EUR |

Debit Card, Bank Transfer |

|

Denmark |

EUR |

Debit Card, Bank Transfer |

|

Estonia |

EUR |

Debit Card, Bank Transfer |

|

Finland |

EUR |

Debit Card, Bank Transfer |

|

France |

EUR |

Debit Card, Bank Transfer |

|

Germany |

EUR |

Debit Card, Bank Transfer |

|

Greece |

EUR |

Debit Card, Bank Transfer |

|

Hungary |

EUR |

Debit Card, Bank Transfer |

|

Iceland |

EUR |

Debit Card, Bank Transfer |

|

Ireland |

EUR |

Debit Card, Bank Transfer |

|

Italy |

EUR |

Debit Card, Bank Transfer |

|

Latvia |

EUR |

Debit Card, Bank Transfer |

|

Liechtenstein |

EUR |

Debit Card, Bank Transfer |

|

Lithuania |

EUR |

Debit Card, Bank Transfer |

|

Luxembourg |

EUR |

Debit Card, Bank Transfer |

|

Malta |

EUR |

Debit Card, Bank Transfer |

|

Netherlands |

EUR |

Debit Card, Bank Transfer |

|

Norway |

EUR |

Debit Card, Bank Transfer |

|

Poland |

EUR |

Debit Card, Bank Transfer |

|

Portugal |

EUR |

Debit Card, Bank Transfer |

|

Romania |

EUR |

Debit Card, Bank Transfer |

|

Slovakia |

EUR |

Debit Card, Bank Transfer |

|

Slovenia |

EUR |

Debit Card, Bank Transfer |

|

Spain |

EUR |

Debit Card, Bank Transfer |

|

Sweden |

EUR |

Debit Card, Bank Transfer |

|

United Kingdom |

GBP |

Bank Transfer, Debit Card |

|

Hong Kong |

HKD, USD |

Bank Transfer, Debit Card |

|

India |

INR |

Bank Transfer |

|

Malaysia |

MYR |

FPX Transfer, Bank Transfer |

|

Malaysia |

USD |

Bank Transfer |

|

Singapore |

SGD |

PayNow, Bank Transfer, Credit/Debit Card Transfer |

|

Singapore |

USD |

Bank Transfer |

|

United States |

USD |

Credit/ Debit Card Transfer, ACH / direct debit, Set up Instarem as Payee, wire transfer |

Now that you are done with your first transfer, let’s explore some special features of the Instarem app.

You Might Also Like To Read: 4 reasons why you should send money with a credit card & how to do it

6 special features of the Instarem app

These great features will take your sending-money experience to the next level.

Quick Send

Are you sending to the same folks repeatedly? You are in for an even faster experience. Here’s how you can send money in just TWO steps!

Simply go to the Quick Send option on your dashboard and fill in the details.

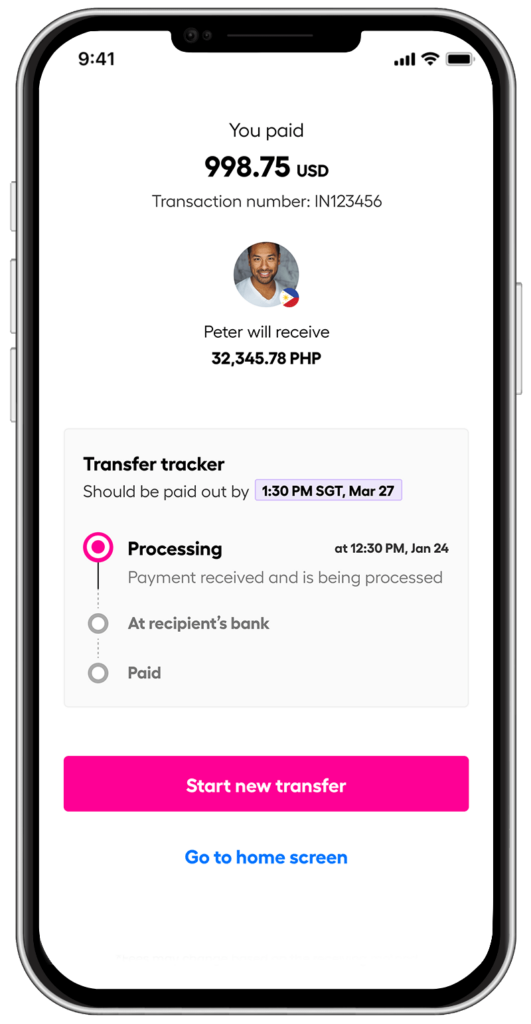

Transaction Timeline

Want to know if your money is on its way? You can check the timeline for your transfer status on the Instarem app. Get automatically alerted when it reaches your recipient, and when your transfer is complete.

Activity Listing

Don’t worry if you can’t remember if you’ve sent money to your mom. Access your transaction history on ‘Latest Activity’ situated below ‘Quick Send’ or by using the activity icon (on the bottom tab). The app keeps track of transactions in the last 365 days.

Fingerprint Login or Face ID

Finding it hard to remember your passwords? Don’t worry! Set up your fingerprint or Face ID login and you can safely access your app with biometric authentication.

Here are the steps to set up:

- Press the profile icon (last icon on the bottom right)

- Go to settings

- Enable Fingerprint login or Face ID

- Follow the set-up instructions

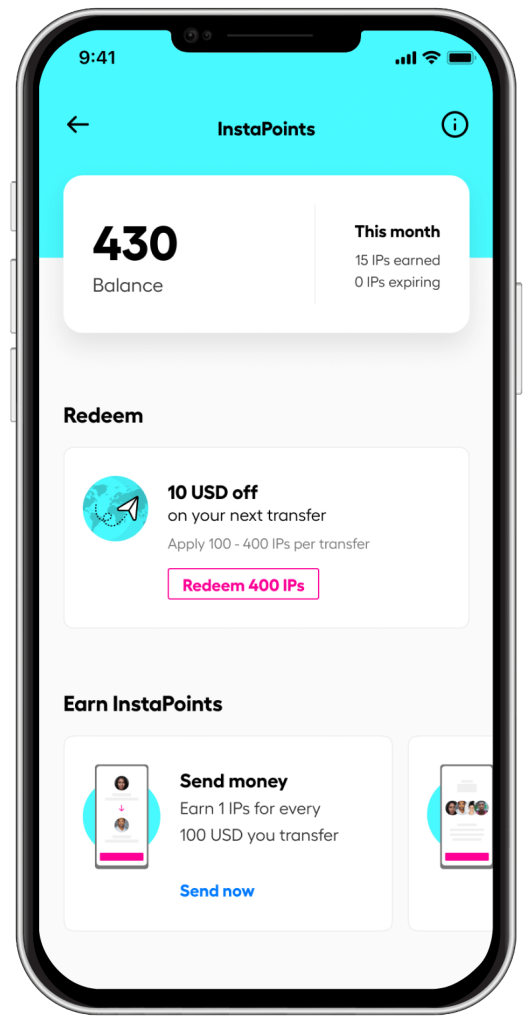

Earn Instapoints

Instapoint is a reward system created by Instarem where you earn points for every transfer you make.

The more you transfer, the more you earn.

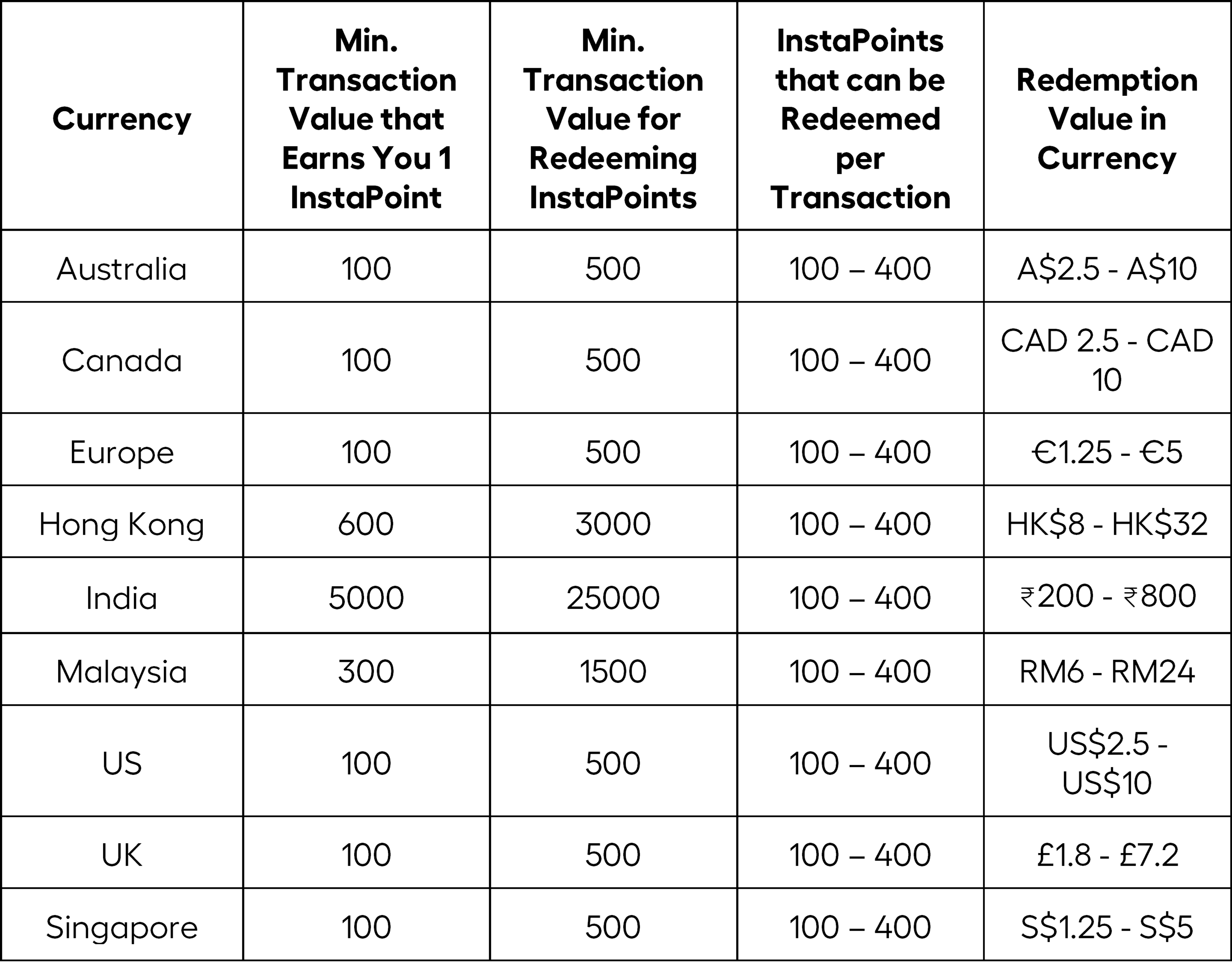

You can redeem between 100 and 400 InstaPoints per transaction. There is no maximum number of InstaPoints you can accumulate over time.

Below is the table of Instapoints and the redemption value you get per country:

Want more InstaPoints? Refer your friends.

Personalize your experience through your profile section

Don’t underestimate your profile section. Here’s where you have full control of your experience.

Set your payment options to allow the use of credit and debit card payments to make your money transfer experience simpler.

Want a full dark mode experience? Go to settings and personalize your experience under “Theme”

Have a query? Click on the support button to either drop an email or chat with our customer service team. FAQs are also available for you to browse through.

Simply access your profile section via the last icon at the bottom right of your dashboard.

Gain better foreign exchange rates when you pay with Instarem’s amaze card

If you’re in Singapore, you can also sign up for the Instarem’s amaze card via the app.

Pair up with any Mastercard bank cards or top up your amaze wallet and you get to:

- Fantastic FX rates with every global purchase.

- Earn InstaPoints on FX spends and redeem them as cashback or discounts on overseas money transfers.

Sign up via the Instarem app and get your virtual card instantly! It’s totally free.

Ready to send money?

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.