The impact of inflation on forex rates: Unveiling the 5 key causes

This article covers:

You might have noticed the items you’ve bought recently might have gone a little bit more expensive than usual.

The cause: Inflation

Inflation is a monetary phenomenon that has recently been the talk of the town yet again. U.S. Bureau of Labor Statistics has reported that inflation hit 8.6%, its highest level since 1981.

In this blog post, we will discuss what inflation is, the different causes of inflation, the impacts of inflation and how it affects forex rates. We will also provide some tips on how to protect yourself from the effects of inflation.

- What is inflation?

- What causes inflation?

- How to measure inflation?

- How does inflation affect the common man?

- What is the impact of inflation?

- Is inflation really bad?

What is inflation?

Inflation isn’t just a simple rise in the prices of goods and services.

IMF defined inflation as the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country.

To put it simply: prices are increased across the board for all goods and services and you get lesser with the same amount of money you have.

What causes inflation?

There is no one answer to what causes inflation but there are several different theories about what might cause it:

Demand-pull inflation

The demand for goods goes up when the economy is growing. This happens because there are more jobs and people make more money. And when this happens, the companies that make these goods will raise prices. This makes inflation happen.

Example: In India, traditional sweets are a trendy gift item for Diwali, so their demand rises just before the festival starts. To accommodate this demand, producers raise the prices, leading to demand-pull inflation (of sweets).

Also Read: 7 key factors that influence foreign exchange rates

Cost-push inflation

To put it simply, if the cost of something that a company needs to make a product goes up, the price of the finished product will also go up.

When companies have to pay more for things like labour, materials, or utilities, they’ll often raise prices to make up for it.

Example: Rising cost of Malaysia’s chicken. The cost of chicken increased because there are labour shortages, increased minimum wages, and the rising cost of imported chicken feed.

National debt

When a country’s debt grows, the government can ask people to pay more taxes or print more money.

If the government requires people to pay more taxes, businesses will raise their prices, and this will cause inflation.

But what happens if the government prints more money? Will that also cause inflation? We explain this in our next point.

Also Read: 9 things you must know about foreign exchange rates

Money supply

If the government prints more money, it will cause inflation.

That means that each unit of currency is worth less than before. And the amount of money available in the economy has increased. As a result, people can buy more things, which causes prices to go up.

Example: Venezuela’s 2018 hyperinflation. The government printed more money to pay its bills.

Exchange rates

When two countries trade with each other, the prices of things can go up and down because of how strong or weak the different currencies are.

If the value of the Indian rupee falls against the US dollar, it becomes weaker than the US dollar. This means that when Indians import things from America, they must pay more for them because the rupee is worth less.

Importers will then raise prices to cover their costs, which increases inflation in India.

The falling value of the Indian rupee makes Indian exports to the United States more competitive. Because Indian exporters are paid in US dollars, which is now more valuable, their profits increase. So, the exchange rate differential is a positive phenomenon for them.

Now that we know the different causes of inflation, let’s move on and discuss the inflation measurement.

How to measure inflation?

Two of the most common price indexes used by governments and policy-makers to measure inflation and design policies to control it are:

- The Consumer Price Index (CPI)

The CPI measures how prices for a bunch of different things have changed. It does this by looking at how much each individual thing has gone up or down in price. Then it averages all those numbers together to get a good understanding of inflation. The CPI is a good way to see how the cost of living is changing overall.

- Wholesale Price Index (WPI)

The WPI measures the average change in selling prices over time by domestic producers. The WPI basket takes into account commodity prices, but the products included vary from one country to another.

The WPI (Wholesale Price Index) and CPI (Consumer Price Index) measure inflation differently in the short term, but in the long term, they both show similar inflation rates.

Other indexes that are used to measure inflation are the Producer Price Index (PPI) and the Retail Prices Index (RPI).

How does inflation affect the common man?

Inflation means that prices are going up, and they’re going up faster than people’s incomes.

When this happens, the value of a country’s currency falls. This makes it harder for people to buy things because they need more money to buy the same things.

In the long run, high levels of inflation can make the economy slow down or stop growing. This happens because people can’t afford to buy things as much and businesses don’t want to invest in things either because they might not be worth anything in the future.

Also Read: What is the relationship between interest rates & exchange rates?

What is the impact of inflation?

Consumer prices, wages & growth

Translation: It erodes purchasing power.

Inflation makes it harder for people to afford things because prices are going up. When prices are high, people can’t afford as many things. This makes it harder for businesses to sell things and hurts the economy.

Interest rates

The interest rate and inflation are related. Just remember when the interest rate goes up, inflation also goes up. And it goes down when the inflation goes down.

In most countries, the central banks make decisions about the economy. They set a basic interest rate and decide how much inflation is acceptable each year.

This helps keep unemployment low, prices stable, and the economy growing.

When the basic interest rate is low, banks can offer cheaper loans to people who need them. This makes people spend more money – which encourages businesses to make more things and grow the economy. Sometimes when things get better, prices go up a little bit too.

It is the central bank’s responsibility to find the balance between too much deflation (a decrease in prices) and hyperinflation.

If the economy grows too quickly, it can cause hyperinflation.

To prevent this from happening, the central bank raises interest rates. This will slow down economic growth, but it will also help to control inflation.

Savings & investments

The bottom line is that lenders lose out when there is inflation.

Who are the lenders? People who invest in some form of stocks, bonds, or fixed deposits.

Inflation affects how much money you get back from investments. This makes it harder for your investment to grow in value over time. So, in reality, you will earn less money from your investment than if there was no inflation.

Plus, when there is an increase in inflation, it can also make it look like a company is doing better than it really is. The stockholder might think their investments are growing, but when you adjust for inflation, the growth isn’t really there.

This can be bad for investors because their earnings might go down and they could lose money.

Essentially, these people could have effectively made more money if they had just put their money under a mattress.

Foreign investments

Low inflation and interest rates don’t usually make a country attractive to foreign investors.

When interest rates are high, foreign investors tend to invest more money in a country, which makes the demand for the currency go up.

Exchange rates

A high inflation rate hurts a currency’s value and exchange rate.

When a currency loses value, it becomes more expensive to import things. If the country imports things from lots of different countries, rising prices can affect the whole country even if none of those other countries raises their prices.

Is inflation really bad?

Inflation is not always bad.

In fact, some inflation can be good for the economy as long as it does not grow too fast compared to the total value of all the goods and services produced in a country (Gross domestic product or GDP)

Moderate inflation is always considered good for the economy and is usually a sign that the economy is doing well. That is why governments and central banks use a policy of inflation targeting to keep inflation under control.

A healthy rate of inflation:

- Encourages consumption

- Stimulates the economy

- Increases wages

- Creates more jobs

- Increases corporate profitability

- Increases tax revenue

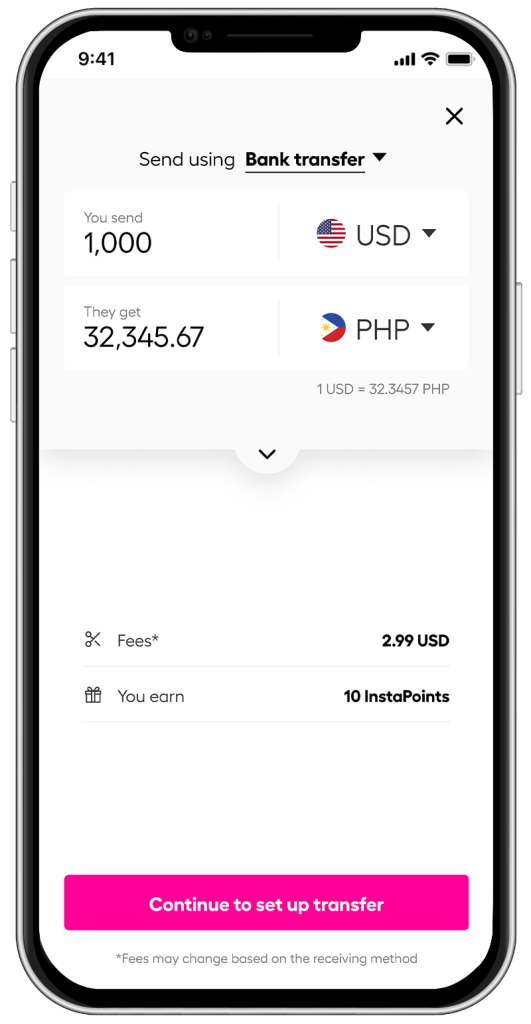

And if you are concerned about the recent inflation when you are sending money home, you can consider using Instarem to facilitate cost-effective money transfers.

*rates are for illustration purposes only.

Instarem helps you send money abroad to over 60 countries. If you’re looking for an easy and affordable way to send money to your family or friends or even for business, Instarem is the perfect solution.

With our simple platform, you can make a transfer in just a few clicks. Plus, we offer competitive rates and low fees so you can get the most out of your money.

Download the app, sign up on the web, or create a business account and see how easy it is to send money with Instarem.

**Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app