6 Questions You Should Ask Yourself Before Moving Abroad

This article covers:

As globalisation gathers pace, an increasing number of people are choosing to live and work abroad. Aspiring migrants from prosperous Western countries frequently opt to live in a foreign country in order to:

- Experience a new culture and improve their cultural know-how and awareness

- Meet new people from a different ethnic/cultural/social background

- Stretch their savings for travel or retirement

- Volunteer with a charity: Teaching English as a foreign/second language is a popular choice with people on a gap year

- Enjoy the advantages of lower living costs

- To explore the lifestyle of a ‘digital nomad’

- Explore new opportunities for financial investments, career advancement or personal fulfilment

And people from low or middle-income countries have been moving westward for decades, usually to:

- Improve their living standards

- Build a brighter future for themselves and their families

- Explore new career opportunities and improve their financial situation

Moving abroad without a solid plan or before doing proper research can quickly drag you into dire financial straits. However, irrespective of who you are, what your motivation is, or even which country you move to, there are several things you can do to stay financially healthy in a foreign country. In this article, we will tell you about a few such smart money moves you can make before you leave your current home country and after you move to your new home country.

We encourage you to first think about your own answers to the questions we pose, then review our answers and advice, and finally create a detailed financial plan suited to your particular goals and needs. By following this process, you will be better prepared to make the most of your new adventure.

PART 1: SAVE MONEY BEFORE YOU MOVE ABROAD

While there are several ways to save money once you are already living abroad, there are also things you can do before you leave, and that’s exactly what this first section is all about.

Q#1: When should I start saving my earnings

A#1: NOW!

Q#2: How much should I save?

A#2: Prepare a budget and you’ll know!

If you’re serious about moving abroad on your own, there’s no better time to start than now (although yesterday would have been even better!)

How much money you’ll need to start a new life abroad would depend upon factors such as where you’re moving to and from where, the exchange rate, how much income you expect to earn and what kind of lifestyle you plan to adopt. However, a good rule of thumb is to have between 6 to 12 months’ worth of living expenses before you actually move (12 to 18 months is even better).

If you are moving from a developed country like New Zealand to a developing country like Malaysia, some factors will likely work in your favour so you may find it easier to put aside a year’s worth or more of savings:

- The New Zealand dollar is stronger than the Malaysian Ringgit so it is easier for a New Zealander to save money for the move to Malaysia

- Cost of living expenses (food, housing, travel, utilities, entertainment) are comparatively lower in Malaysia so a New Zealander dollars will go a long way

However, a Malaysian moving to New Zealand will not enjoy the same advantages. Therefore he will have to work harder, make more sacrifices and save more money before his move.

That said, preparing a budget will give you a good idea of how much to save. Start by drawing up a list of your expected daily, weekly and monthly expenses. Research average figures for these expenses in your new country (average monthly rent in Thailand, the average daily cost of food in Jamaica, etc). Then calculate the total over a year. Add at least 10% of this sub-total to an ‘emergency living abroad’ fund. Convert this new total into your present currency so you’ll have a more complete picture of the minimum amount you must save before you move.

Make sure you have enough to meet housing and living expenses, emergency healthcare costs that may not be covered by your health insurance plus possible repatriation expenses if you plan to move back after a certain period.

Remember that you should not dip into this fund to finance your pre-departure expenses such as visas, medical checkups, immunisation, etc. This is the bare minimum you need to save before your move to stay financially comfortable abroad.

Q#3: Should I curtail my spending now? Will that help me save more?

A#3: Yes!

Remember this simple formula:

“Earn More + Spend Less = Save More”

Preparing a budget is great for understanding how much you need to save, but it does not necessarily tell you how to save. Obviously, you can save more for later if you can earn more now. However, this is often easier said than done. You may not have the time or resources to explore another income stream or maybe you’re not due for a salary raise for another 8 months. In such cases, the next best thing you can do to save more is to spend less.

A good way to figure out how you can reduce your spending is to first understand your overall spending patterns:

- What are your current expenses?

- How many are fixed and/or recurring?

- Can they be eliminated (Yes/No/Maybe) or at least reduced (Yes/No/Maybe)?

- How many expenses are variable? Identifying variable expenses is probably the most important step because this is where most of your savings can come from

Be as detailed (and honest!) as you can. Once you have these answers, you will be better able to devise a strategy to reduce your spending and save more for your move abroad.

Here are some examples of fixed and variable expenses to get you started with your own analysis:

This is a good strategy to use even after you move abroad. See the next section for ideas on how to limit your spending.

Q#4: Should I open a bank account before I go?

A#4: YES!

It is financially prudent to open a bank account before you arrive in your new country. All developed Western countries have strong banking systems. Also, many are moving towards ‘cashlessness’, so you will need a bank account for almost every transaction, from shopping to applying for a water connection and from buying a mobile phone to accessing your salary.

You Might Also Like To Read: Are We Soon Going To Be A Cashless Society?

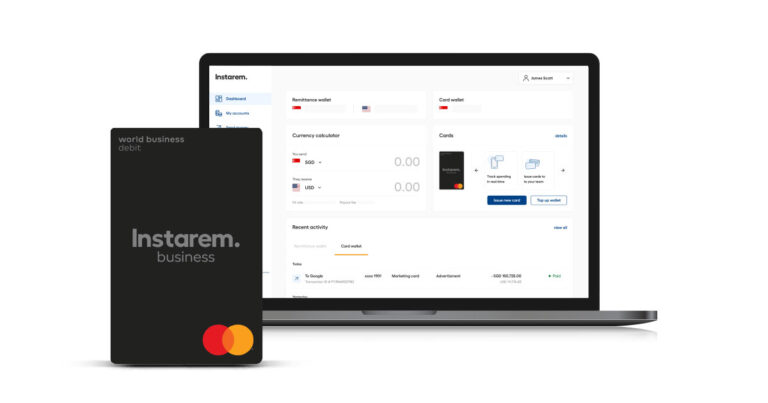

Also, placing some money into this account at regular intervals will force you to develop the habit of ‘saving more’. You can now avoid hefty transaction fees charged by banks and other service providers by using a reliable, low-cost money transfer service like InstaReM. InstaReM facilitates money transfers between a number of countries in Asia, Europe, North America and Oceania and gives the Best Transfer Amount Guarantee.

Firstly, find out if you are allowed to open an account in that country and what documents will be needed for the same. Then explore your account options – think if you should you open a checking account or savings account, fixed deposit or certificate of deposit. These terms vary with every country so you should educate yourself about them. You should also research important variables like interest rates, fees, terms and conditions, etc.

A majority of banks around the world offer free debit cards to account holders but check this with your bank anyway. Also, ask if you can apply for a credit card with low (ideally zero) transaction fees. The eligibility criteria for international credit cards may differ by card provider but the most important is your credit-worthiness. The higher your credit score, the more likely you are to have a successful application.

Check if the bank is part of a global network and if it has branches in multiple countries. The former will make it easier to withdraw cash from an ATM. And the presence in many countries is an indication of the bank’s reliability and trustworthiness.

Finally, if it is not possible to open an account in advance (banks in some countries may need you to do so from within that country), at least research your options, contact prospective banks for information and make sure you carry all the necessary paperwork when you do visit them in person.

PART 2: SAVE MONEY AFTER YOU MOVE ABROAD

Q#5: How should I manage my savings?

A#5: Try to bring in enough to save, invest in your future, track your finances and get a head start on retirement planning

The decision to move abroad is often motivated by financial considerations. So obviously, the work you do in your new country should bring in more money for you (higher in real terms not just in exchange-rate-adjusted terms). There is little point in making such a major life change otherwise.

If you plan to freelance or operate your own business, make sure that you choose both your work and clients carefully. Direct referrals from your network can bring in high-paying clients, freelancing sites often don’t. Build a reputation for high quality and reliability and you will be able to charge what you’re worth (and thus save more).

Save at least half of your total income and invest it wisely for emergencies. Research high-yield investment options that can bring in additional income and also help you save on tax. A certified financial planner can help you identify your risk/reward appetite and can design an investment plan tailored to meet your specific savings/investment/retirement needs. But, you must keep an eye on your own finances and not expect your advisor to do it for you:

- Be aware of inflation and its deleterious effects on your investment; adjust your strategy accordingly

- Consider investing in strong foreign currencies to diversify your investment portfolio and risk profile

- Get international insurance for protection from medical emergencies, natural disasters or political upheaval

Put at least 25% of your monthly income into a low-risk retirement fund. Abide by the ‘4% rule’ if you do withdraw funds from your retirement account. Adherence to this thumb rule will ensure that you have a steady income stream since your withdrawals will consist primarily of interest and dividends, not the principal. At the same time, it will help you maintain an account balance that keeps income flowing in even through retirement.

Q#6: How should I manage my spending?

A#6: Limit your discretionary expenses and opt for cheaper options.

Controlling your spending should be an essential part of your saving strategy when you move abroad. In the previous section, we have already explained how you can control your spending by separating your fixed and variable expenses.

Here are a few more ideas you can try:

- Prepare a detailed weekly or monthly budget and stick to it

- Eat at home rather than restaurants. Consider cutting down on your meat and alcohol intake. Instead of throwing parties at restaurants, banquet halls or clubs, invite your friends to your home and enjoy the double advantage of savings plus increased ‘social capital’

- Do your research before you rent. In general, rents tend to be lower on properties that are further away from the city centre. Look for information and verify facts before putting down a hefty deposit.

- If you have to drink out, take advantage of ‘happy hours’ at bars and pubs

- If you have to splurge, do it on experiences instead of things

- While travelling, take advantage of cheaper options: Budget flights, group tours and ride-sharing services, backpacker hostels instead of hotels, food courts instead of restaurants

- Shop for clothing, accessories and home décor items at thrift stores. Resist the lure of flash sales and avoid impulsive spending sprees

- Buy groceries on sale: All over the world, supermarkets and hypermarkets run specials sales throughout the year. Keep an eye out for such events and use discounts to your advantage

- Control your vehicular fuel consumption: Use public transport. Carpool. Invest in a fuel-efficient car and drive it only at certain times (such as weekends). Want to improve your fitness? Walk!

- Explore and enjoy low-cost entertainment options: Hiking, cycling, swimming, free film screenings, public performances and street festivals are all great alternatives to expensive musical gigs, plays and movies

- Buy insurance, especially for your health and your car. Medical expenses can quickly add up and play havoc with your savings and retirement goals

Final Thoughts

Moving abroad by oneself can be a daunting prospect for many. However, living and working in a foreign country can expand your horizons, make you more culturally aware, improve your self-confidence and open multiple doors, both personally and professionally. The key to survive is exercise restraint with regards to money in order to remain financially solvent.

In addition to the ideas we have already covered, the following tips can also help you in your quest to save money while living abroad by yourself:

- Talk to other expats living in the country you’re moving to. Learn from their experiences and mistakes!

- Commit to the goal of staying financially healthy. Make it a habit to be money-wise.

- Develop a network of trusted individuals you can turn to for help, support and advice.

As long as you are vigilant about managing your earning, spending and saving patterns, your life abroad will be a grand never-ending adventure!