Best banks’ telegraphic transfer service in Singapore

This article covers:

While overseas money transfers often involve the tedious process of visiting international banks, the popularity of electronic media has significantly improved the scenario. Currently, telegraphic transfers through SWIFT (Society for Worldwide Interbank Financial Telecommunication) network are in frequent use and can be easily accessed when it comes to overseas fund transfers.

Telegraphic transfer is perhaps one of the more common and well established methods of transferring money overseas though not necessarily the cheapest or fastest option. Telegraphic transfers or TT can be relatively expensive compared to other means of international transfer due to the usage of the SWIFT network. SWIFT is a secure way to pass information between banks and allows several banks to process one payment, and because of this, the whole process takes longer time and can push up the costs.

What are the fees for an overseas telegraphic transfer by banks?

As a convenient and secure way of arranging funds and transferring money overseas, banks that provide telegraphic transfer services charge their users a fee. This fee is dependent on various factors that affect the transfer and can differ from one institution to another. Generally, an overseas transfer is levied with a higher charge than a domestic transfer, or a bank can charge higher when there is an exchange of currency or other intermediaries and agents involved.

Depending on the type of transfer, banks usually levy the following fees:

- Sender’s bank fees:

- The sender’s bank charges a fee in exchange for its overseas telegraphic transfer services.

- Exchange rates and their margins:

- Banks often charge an extra markup on overseas transfers as a way of earning profits.

- Recipient’s bank fees (also known as beneficiary fees):

- Every overseas transfer is charged with an undisclosed amount as the beneficiary fee or the recipient’s bank fee. The beneficiary fee is the most significant fee that is levied upon an overseas telegraphic transfer. Once the money is transferred, the recipient’s bank charges the beneficiary fees in accordance with the amount received.

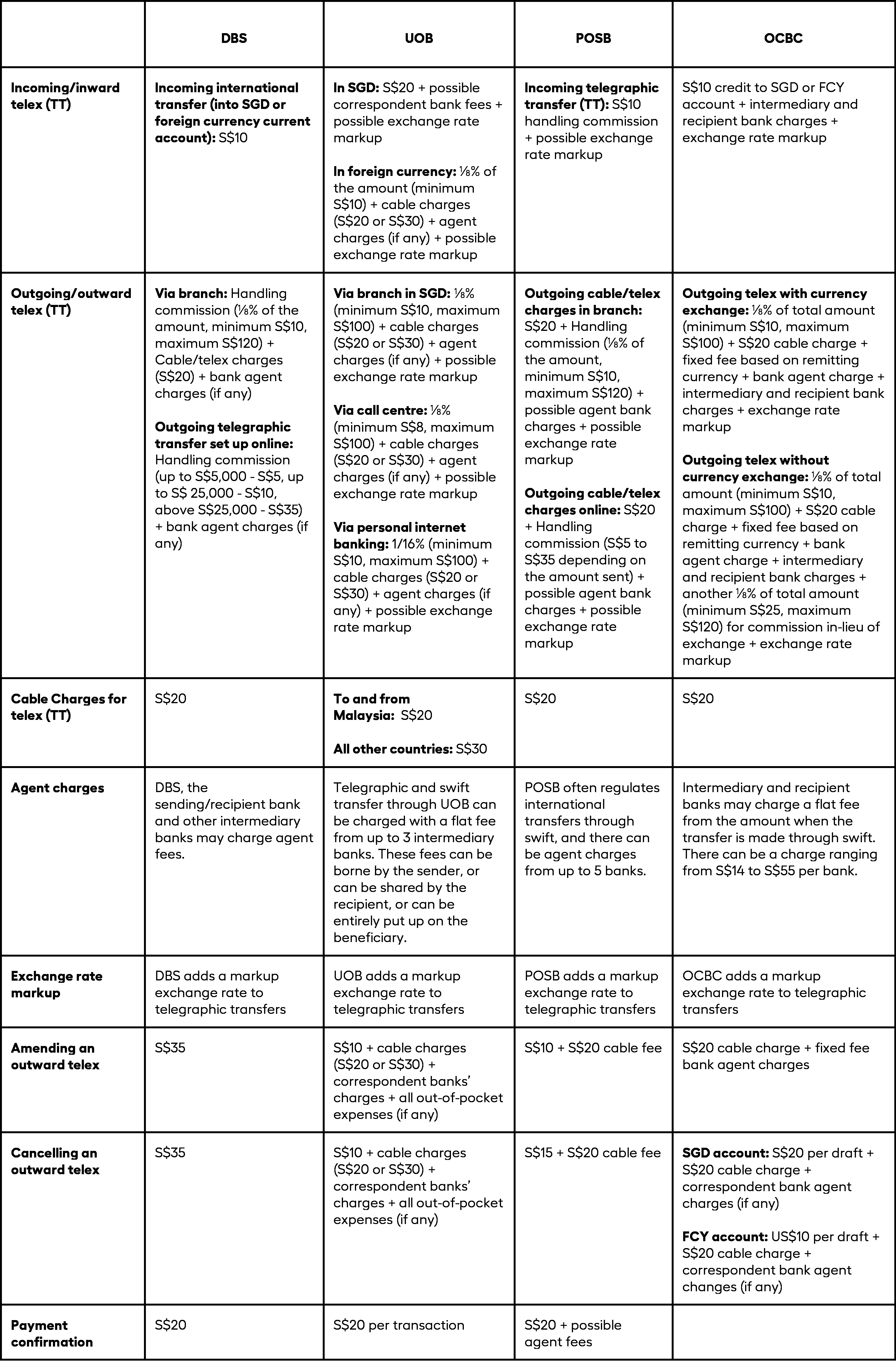

Comparing Singapore banks and their corresponding telegraphic transfer fees (as of Nov 2021)

An alternative way to sending money overseas: Instarem

As effective and convenient as telegraphic transfers are, the overseas transfer service in Singapore can be complex, opaque, expensive and slow. Payments made as swift transfers take into account intermediary fees, agent charges, and more. Furthermore, every transfer is charged a transfer fee and a markup in the exchange rate in the case of international transfers. All these charges imposed by banks can add up and set you back much more than the amount you wished to transfer initially.

Instarem, started out in 2014, is a Major Payment Institution based in SG with Payment Services Act license, offering an easy way of sending money overseas — at low rates and reasonable fees. Instarem provides the users with several added benefits that give it an edge over banks. For instance, unlike banks, Instarem has no hidden fees or charges on every international transfer and the transfers done by Instarem are typically prompt. Moreover, the massive remittance network also covers over 100 destination markets, with 65 markets in real-time!

Let’s look at a quick example of Instarem’s exchange rate vs DBS (e.g., 14th Nov 2021):

- Instarem = 1000 SGD will get you 24,009.85 THB (inclusive of fees)

- DBS Telegraphic Transfer = 1000 SGD will get you 23,821.93 THB (excluding fees)

That being said, you will gain more from the same amount you are trying to remit.

All these features make Instarem a popular choice for international money transfer or remittance over banks. Instarem is devoted to removing all complexities when it comes to fast international transfers and payments. You can now make smart overseas fund transfers easily by using Instarem!

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app