This article covers:

Coming into 2022, we’re all about streamlining our finances and maximising benefit. So when it comes to credit cards, we want some pretty decent perks. Almost all cards provide a point scheme where you earn upon using the card. So which card should you pick? Well, we can help with these suggestions below!

Citi Rewards Credit Card

One of the attractive cards available in Singapore, Citi Rewards guarantees good returns on spending if you’re a shopaholic and it applies to local and international purchases, making it quite the versatile card to have.

What are the rewards available?

a. 10X Rewards Promotion

With the Citibank Rewards Card, you get to enjoy the following rewards:

- 10x rewards (4 miles) on online shopping

- 10x rewards (4 miles) on rides with Gojek, GrabCar, and more

- 10x rewards (4 miles) on online food orders and delivery

- 10x rewards (4 miles) on online grocery orders

- 1x reward on all other retail expenses

- Maximum flexibility while redeeming rewards through Citi ThankYou Rewards

- Complimentary travel insurance when the payment is done using the Citibank Rewards Card

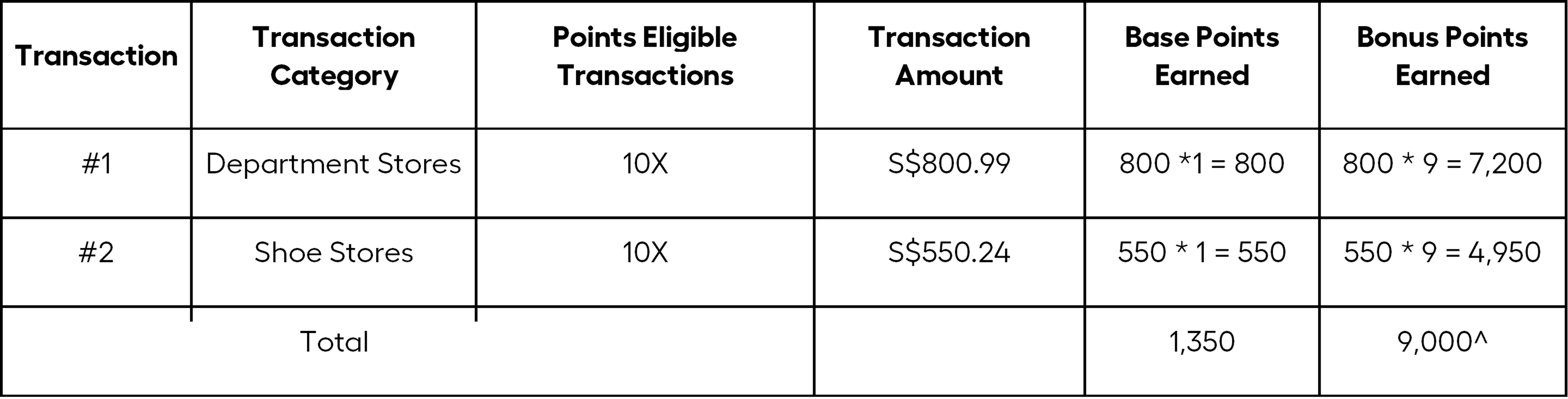

Every 10X Points Eligible Transaction charged to the eligible card will be awarded as follows:

- 1 Base Point for every S$1 of a 10X Points Eligible Transaction

- 9 Bonus Points for every S$1 of a 10X Points Eligible Transaction

– Each 10X Points Eligible Transaction will be calculated, rounded down to the nearest S$1.

– Bonus Points are subject to a cap of 9,000 Bonus Points per month whereas Base Points are not subjected to any cap.

Here is an illustration of how to earn the 10X Rewards per month:

^Even though Bonus Points exceeded 9,000 Bonus Points per month (12,150 Bonus

Points), eligible card holders will only be rewarded a maximum of 9,000 Bonus Points.

Eligible card holders will be awarded a total of 10,350 Points (1,350 Base Points + 9,000 Bonus Points) for the statement month. For more information, refer to the terms and conditions.

b. On-line Product-Led Acquisition Promotion

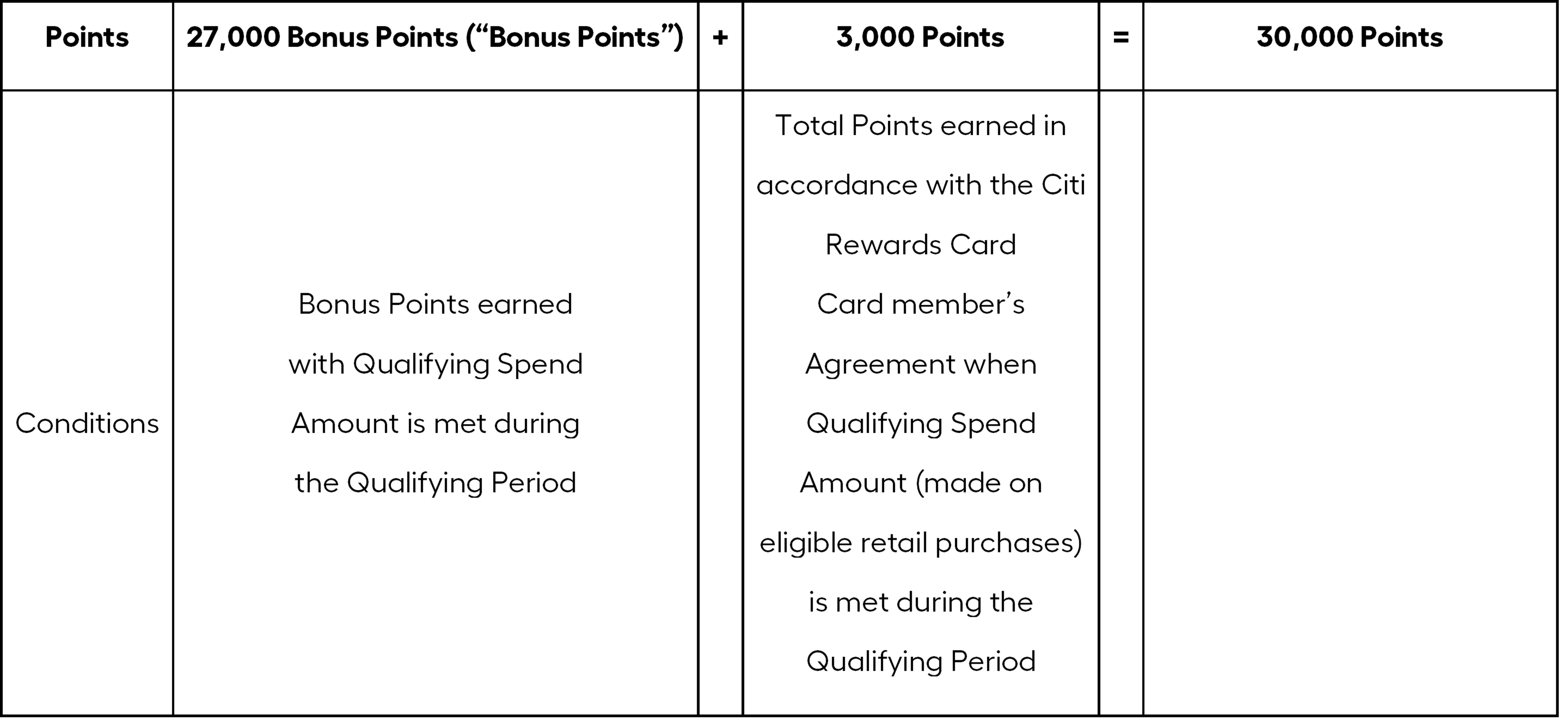

Receive 30,000 Citi ThankYou Points Welcome Offer when you spend S$3,000 with a Citi Rewards Credit Card in the first 3 months.

How to earn 30,000 Points?

An eligible card member is required to meet the following conditions to receive up to 30,000 Points:

- Apply for Citi Rewards Credit Card through an online acquisition channel within the Promotion Period.

- The application for the card must be approved and opened successfully within 30 days from the date of application.

- Spend S$3,000 or equivalent (“Qualifying Spend Amount”) using the Citi Rewards Credit Card successfully opened during the Qualifying Period.

Here is how the 30,000 Points will be credited:

For more information, refer to the terms and conditions.

What are the rewards promotions available?

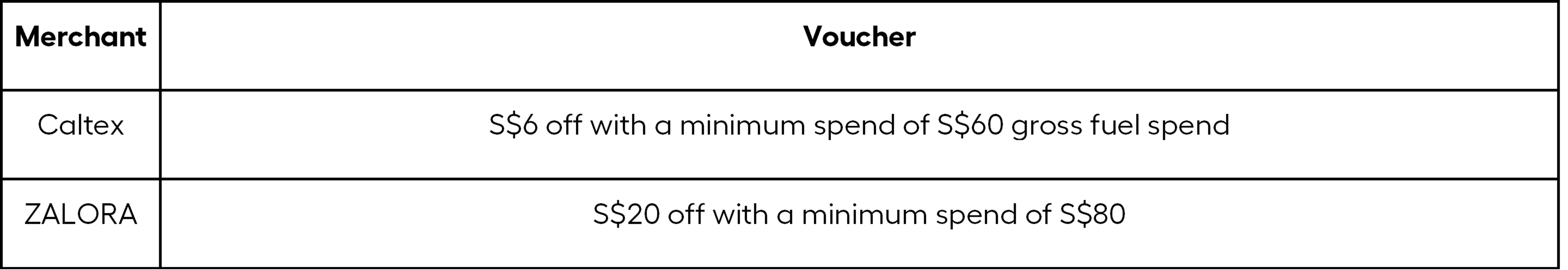

Zalora lovers are going to want to get this card, especially for the year end sale deal!

OCBC Titanium Rewards Credit Card

Newlyweds rejoice! The card for your needs is here; now with annual expenditure cap instead of monthly. Go get what you need for your dream home, or that baby room!

What are the rewards available?

- Stand a chance to be rewarded 50 OCBC$ (20 miles) up to 120,000 annually with every S$5 you spend on eligible online and retail purchases

- A chance to earn 5 OCBC$ for all other transactions

- An additional cash rebate of 2% when you spend at BEST Denki

- Using your OCBC$, you can also win e-vouchers from STACK marketplace and redeem them for:

- S$10 ZALORA voucher

- S$50 FairPrice Voucher

- 10X S$5 Multi-use Grab Voucher

- Redeem 10,000 Krisflyer Miles with 25,000 OCBC$ or cash rebates of S$50 Titanium Cash with 18,000 OCBC$

What are the promotions available?

New card holders can be rewarded with welcome gift vouchers worth up to S$300 via STACK, the digital loyalty platform.

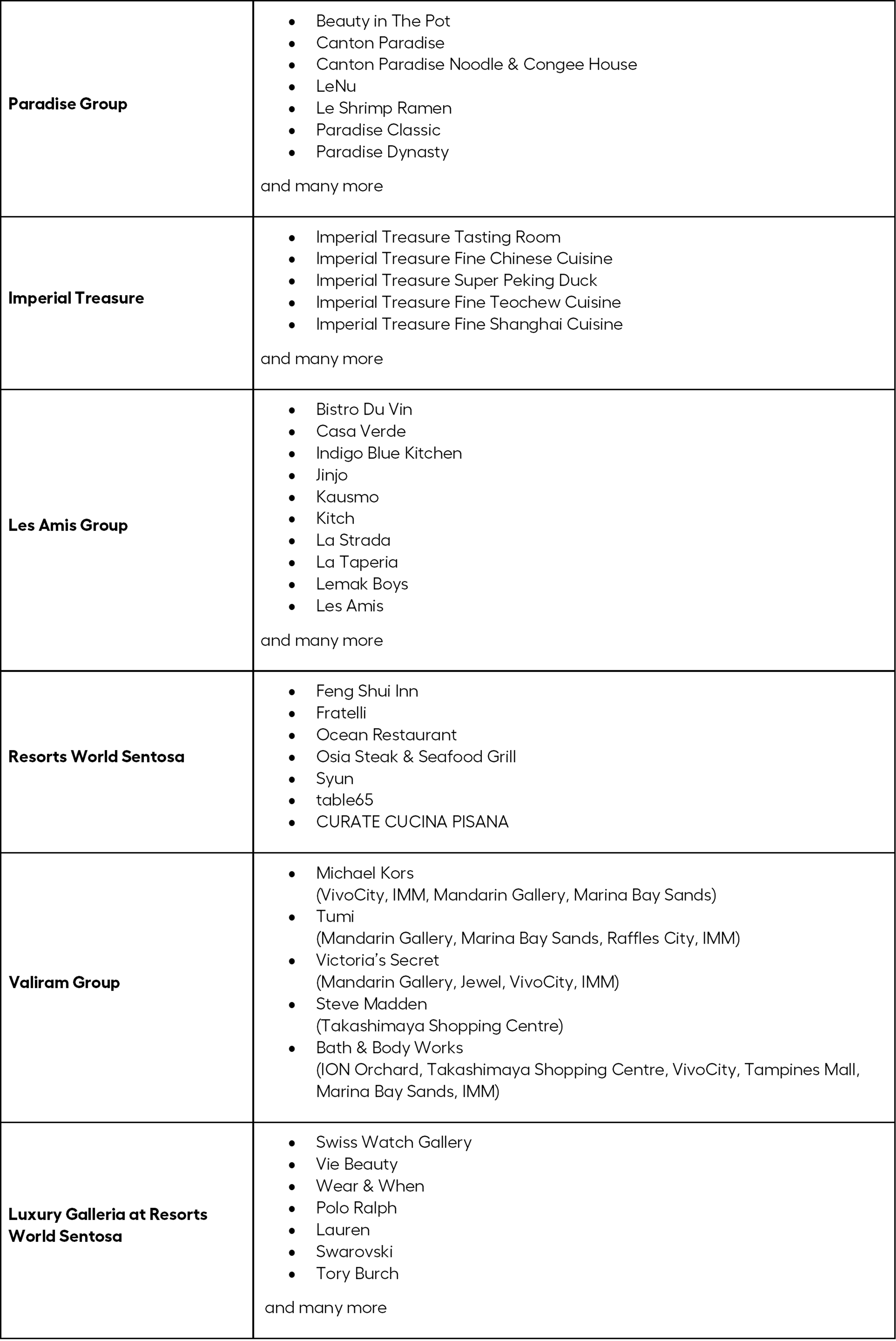

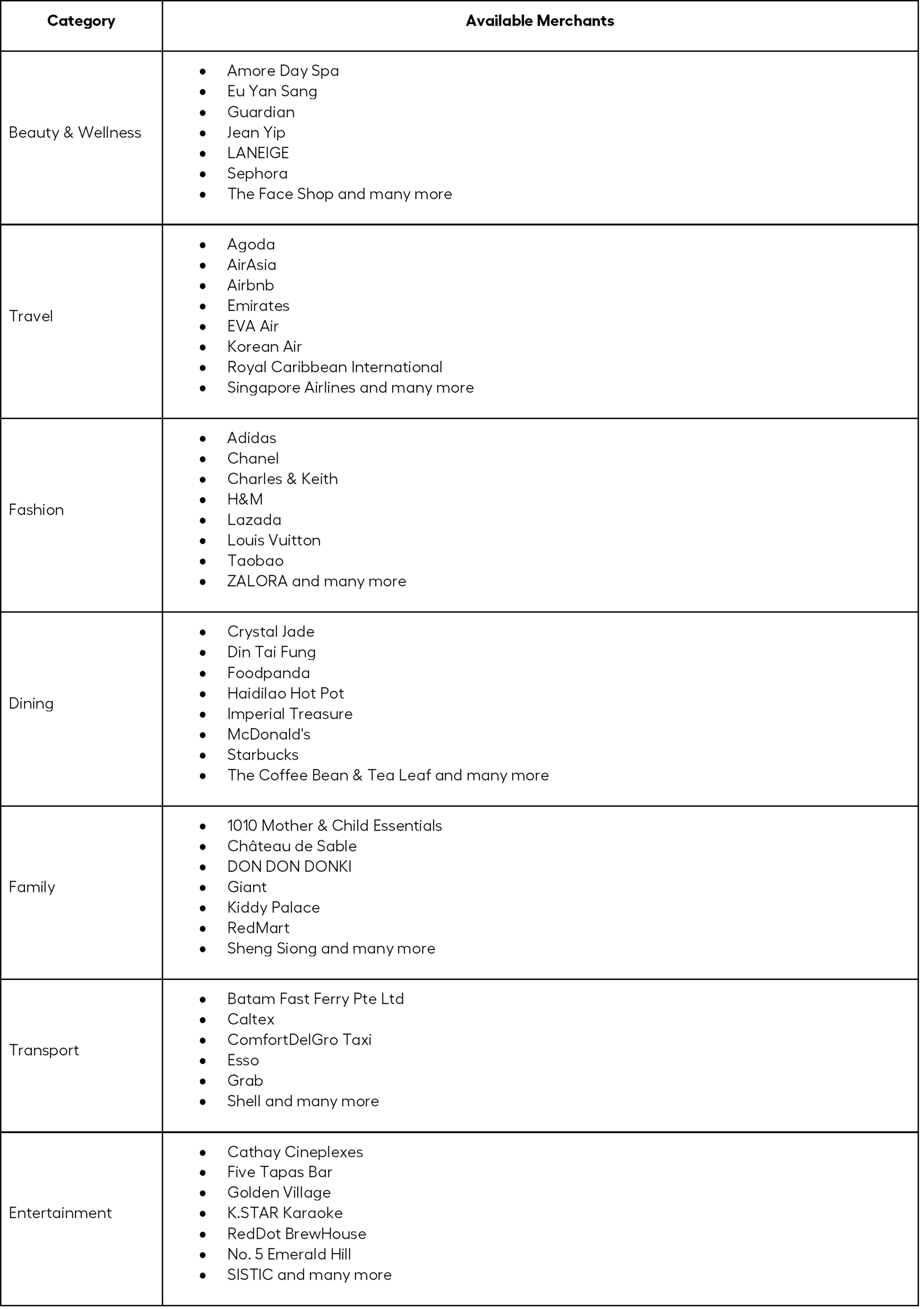

Below are the available merchants for you to redeem your vouchers.

All in all, it’s quite a decent card to have and the annual cap can be increased by upgrading to the blue or pink cards. Keep an eye out for the Krisflyer miles, your next getaway is around the corner!

Maybank World Mastercard Credit Card

Golfers, it’s time to up your handicap with this Maybank World credit card! Diners, be prepared to wine and dine! This card is for you! Definitely a best option for low-maintenance miles & green perks!

What are the rewards promotions available?

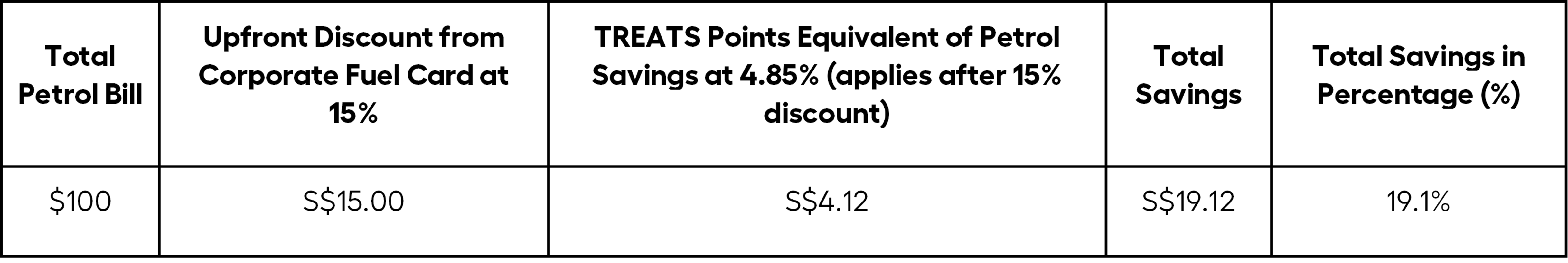

a. Exclusive Fuel Savings at 19.1%

Get a 15% discount with the Corporate Fuel Card8 and earn 10X TREATS Points when you fill up at petrol stations in Singapore. The Points collected can be redeemed for a further 4.85% savings with cash credits on your Corporate Fuel Card.

Here is an illustration of how it works:

The promotion is valid until 31 December 2022. Terms and conditions apply.

b. 10X TREATS Points

Enjoy 10X TREATS Points (worth 4 air miles) when you spend at these merchants.

The merchants listed above are valid until 31 December 2022. Terms and conditions apply.

c. Garmin vívomove Style Promotion

You can also get a chance to win a Garmin vívomove Style worth S$469. To be qualified to participate in the promotion, eligible card holders need to meet the following requirements:

- Apply for at least one new Eligible Card as the principal cardholder and a CreditAble account as the main account holder

- After the application is approved, spend a minimum ofS$300 on Eligible Transactions Eligible Card and/or using the CreditAble account, each of the first 2 consecutive months

- Foreigners are also eligible for this promotion. Spend a minimum of S$350 with a Maybank World Mastercard Credit Card for each of the first two consecutive months upon approval to be qualified.

This promotion is limited to the first 2,000 qualifying applicants. Apply now and get rewarded with S$100 cash credit. For more information, refer to the terms and conditions.

d. Complimentary Airport Lounge Access

Enjoy one complimentary Plaza Premium Lounge Access by spending a minimum of S$1,000 in a single retail transaction with Maybank World Mastercard Credit Card within 3 months prior to the date of lounge access.

Card member’s guest(s) get to enjoy 20% off walk-in rates at Plaza Premium Lounge with Maybank World Mastercard Credit Card.

One thing to note, your TREATS points never expire if you’re automatically enrolled in the Rewards Infinite program, where you get to exchange your points for dining, shopping and entertainment gifts.

UOB Lady’s Card

Singapore’s first-ever dedicated card for ladies and the last entry in our list; it’s also one of the strongest rewards cards to date in Singapore. From 7 different categories to spend on, ladies are going to go gaga over this card!

What are the rewards available?

Earn 10X UNI$ (20 miles) for every S$5 that you spend on chosen category(ies) with no required minimum spend including:

Terms and conditions apply.

What are the rewards promotions available?

Lady’s Grand Lucky Draw Promotion

Customers with UOB Lady’s Card and UOB Lady’s Savings Account earn up to 10% instant cashback all year round for every transaction made in-stores at participating merchants.

Final note, UOB Lady’s Card does require its clients to be women. Tough luck, men!

Excited with the great rewards from credit cards?

Earn InstaPoints on FX spends and redeem them as cashback or discounts on overseas money transfers with Instarem’s amaze card!

This card is best for: Someone who wants the best of all worlds and to earn rewards on top of the existing rewards.

What makes this card unique?

One of the card’s unique features is that it can link up to 5 Mastercard bank cards into one, decluttering your wallet in the process. The amaze card also maximises dollar value for merchants and business-minded individuals by offering great FX rates while giving the user full control when selecting and linking which card to charge.

Is the amaze card worth it?

If you are looking for generous rewards to maximise eligible purchase categories and earn considerable cash back rewards, this card will be a game-changer.

Applying for the amaze card is also simple and convenient following a 5-step-guide.

- Download Instarem app. For fast and easy onboarding, use the Myinfo with Singpass option to sign up.

- After your Instarem account is approved, tap the card icon at the bottom of your app and tap at `Get Me Amaze`.

- After entering the name you want on your amaze card, check your delivery address details. Once that’s done, click the T&C checkbox and then confirm.

- Add your Mastercard details to link it to your virtual amaze card.

- You will see the successfully linked card on your amaze screen. You can start using your virtual amaze card for online transactions instantly, while your physical card will arrive in 7 to 14 working days.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.