Crushing the Catch-22: 9 ways to build your credit score as an expat in the United States

This article covers:

- Obtain a Social Security Number (SSN)

- Apply for a Secured Credit Card

- Become an Authorized User

- Apply for a Credit Builder Loan

- Pay Bills on Time

- Apply for a Starter Credit Card

- Keep Credit Utilization Low

- Monitor Your Credit Report

- Apply for a Credit Card or Loan with Your Local Bank

- The reality is building credit takes time

- Before you go…

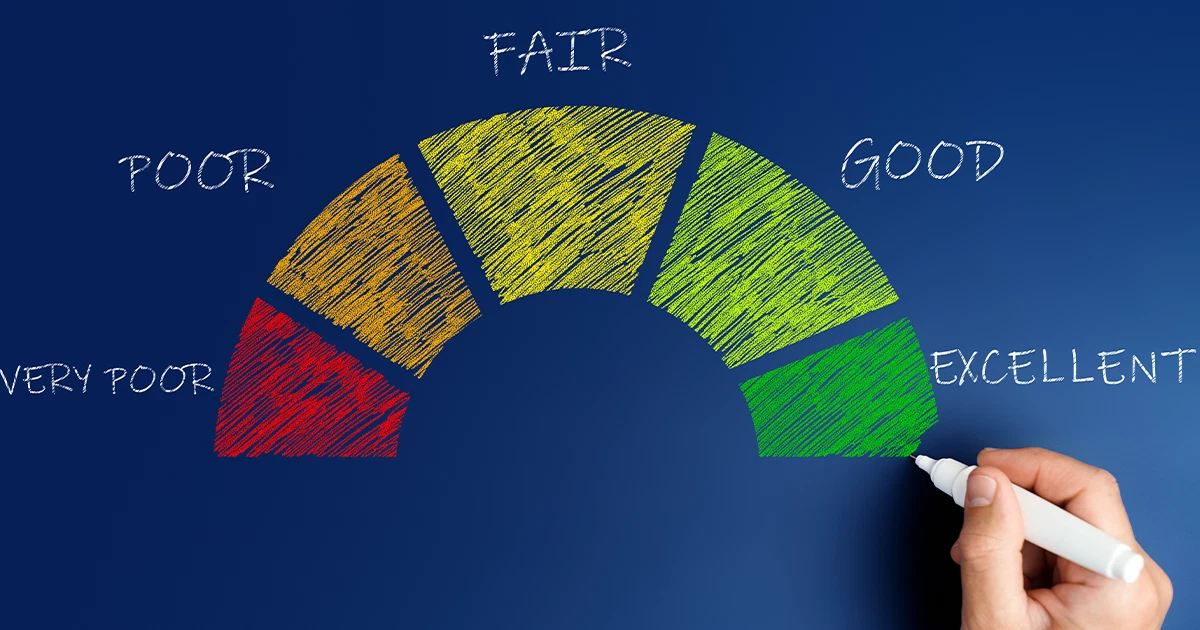

Building a credit score in the US as an expat can be incredibly frustrating. Everything, from securing a home loan to getting car insurance, seems to hinge on that elusive credit score. But how on earth are you supposed to have a good credit score when you have absolutely no credit history in the country?

And to top it off, getting a good credit card requires… you guessed it, a good credit score! It’s like a never-ending Catch-22 situation in Uncle Sam’s land!

However, don’t lose hope just yet. Despite the frustrations, there are ways to navigate this credit maze and establish a positive credit history. By maintaining consistent financial habits and handling credit responsibly, you can gradually build your credit score from scratch. It may take some time and effort, but with perseverance, you can conquer this credit conundrum and pave the way for a stronger financial future.

Here are some steps to help you get started on your credit-building journey.

Obtain a Social Security Number (SSN)

Oh, the never-ending hoops to jump through just to build credit in the US! One of the first hurdles you’ll encounter as an expat is obtaining a Social Security Number (SSN). Yep, you heard that right—without this elusive number, you can forget about building credit in this country. So, as soon as you become eligible, you better rush to apply for an SSN because it’s deemed as this all-important identifier for the credit reporting agencies.

Apply for a Secured Credit Card

When it comes to building credit, consider starting with a secured credit card. This type of card requires you to deposit a specific amount of money as collateral, which then becomes your credit limit. By using the secured card responsibly and making timely payments, you can effectively boost your credit score. It serves as a valuable stepping stone in your credit-building journey, allowing you to demonstrate financial responsibility and establish a positive credit history.

As you continue to manage your credit wisely, you’ll open the door to more credit opportunities and a stronger financial future.

Become an Authorized User

Consider becoming an authorized user on a credit card held by friends or family members in the US who have a solid credit history. By being added as an authorized user, their positive credit behaviour will be reflected on your credit report, thus aiding in the process of building your credit score. This approach allows you to benefit from their responsible credit management, which can have a positive impact on your creditworthiness.

Apply for a Credit Builder Loan

Consider applying for a credit builder loan, a specialized offering by certain financial institutions that aims to assist individuals in establishing credit. With this type of loan, the bank holds the loan amount in a savings account, while you make consistent payments until the loan is fully repaid.

Once you have successfully paid off the loan, you receive the funds, and the positive payment history is reported to the credit bureaus. This method provides a structured and responsible approach to building credit, as it demonstrates your ability to manage loan payments effectively.

Pay Bills on Time

Ensuring prompt payment of bills, including rent, utilities, and insurance premiums, plays a crucial role in maintaining a strong financial standing. Although on-time bill payments may not have a direct impact on your credit score, it’s essential to be mindful of potential consequences. In certain cases, service providers may report late payments to credit bureaus if they become significantly overdue.

By consistently paying your bills on time, you demonstrate financial responsibility and positively reflect on your creditworthiness. This prudent approach sets a solid foundation for managing your financial obligations and fostering a positive credit history in the long run.

Apply for a Starter Credit Card

Consider applying for a starter credit card, which is specifically tailored for individuals with limited credit history. Certain credit card issuers offer these cards to provide newcomers with an opportunity to establish credit. Although starter credit cards may come with lower credit limits and higher interest rates, they serve as a valuable tool for building credit from scratch.

Keep Credit Utilization Low

A general guideline is to keep your credit card balance below 30% of your credit limit. High credit card utilization can have adverse effects on your credit score, potentially leading to a decrease in your creditworthiness.

Monitor Your Credit Report

Monitoring your credit report consistently to ensure its accuracy and to identify any potential issues or discrepancies.

Regularly checking your credit report from the three major credit bureaus—Equifax, Experian, and TransUnion—provides you with valuable insights into your credit standing.

By reviewing your credit report periodically, you can promptly address any errors or fraudulent activities, safeguarding your creditworthiness and financial well-being.

Apply for a Credit Card or Loan with Your Local Bank

Consider applying for a credit card or loan with your local bank if they have a presence both in your home country and the US. Having an existing relationship with such a bank may work in your favour, as they might take your international credit history into account.

This consideration can increase your chances of getting approved for a credit card or loan in the US, making the application process more accessible and potentially smoother.

The reality is building credit takes time

Building credit is indeed a gradual journey that requires patience and responsible credit habits. It’s essential to remember that time is on your side, and with consistent efforts, your credit score will improve over time.

Avoid the temptation of opening too many credit accounts simultaneously, as this can result in multiple credit inquiries, potentially lowering your credit score. Embrace the notion that building credit is a step-by-step process, and by practising responsible credit management, you pave the way for positive results.

Stay vigilant in avoiding any activities that could have a negative impact on your credit, such as defaulting on loans or missing payments. Instead, focus on establishing a positive credit history through timely and reliable payment practices.

As you maintain these good credit habits, you’ll gradually gain access to better credit options and improved financial opportunities in the United States. Remember, building credit may take time, but with dedication and prudence, your efforts will bear fruit, setting you on the path to a stronger and more promising financial future.

Before you go…

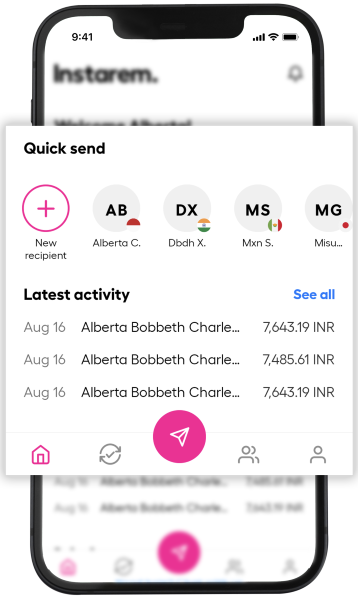

After settling into your life as an expat in the United States, you may find the need to explore remittance services, especially if you plan to send money back to your family in your home country.

Traditional remittance services often come with considerable costs due to currency fluctuations.

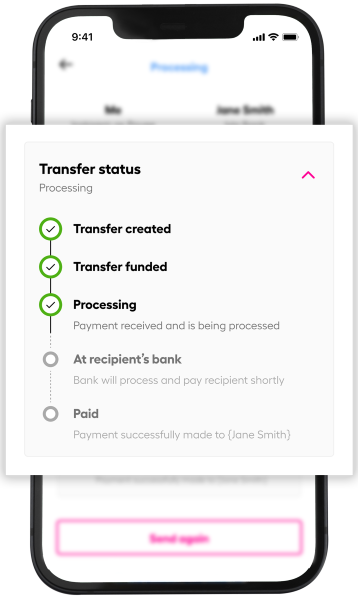

Fortunately, there’s a solution in the form of Instarem—an online and digital remittance service provider that offers competitive rates for remittance transactions.

Not only does Instarem provide the best rates, but it also ensures secure and fast transfers, giving you peace of mind that your family will receive the money promptly.

PS: If, like me, you’re planning to send money to India, Instarem offers a seamless way to handle cross-border financial responsibilities. It’s a dependable and effective choice for efficiently sending money to your dear ones.

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app