Common money mistakes to avoid when living abroad

This article covers:

Moving to a new country? It’s not just about throwing your stuff in a suitcase and catching a flight, right? It’s usually more complicated than that. There are emotional and financial challenges that can pop up along the way. And let’s be real, when you’ve got a million things on your plate, keeping track of your finances is not the easiest task. Before you know it, these challenges can snowball into something way bigger and tougher than you expect.

Instead of crossing your fingers and hoping for the best, wouldn’t it be better to be prepared? To understand what you need to watch out for and be ready to tackle any challenges that come your way?

Well, in this blog, we’ve got you covered. We’ll break down common financial slip-ups to watch out for, both before and after you start your new chapter abroad.

Forgetting about debts in your home country

Well, here’s the not-so-fun reality – just like your life problems, your debts also tag along wherever you go. Whether it’s that student loan, pesky taxes, or the mortgage giving you a side-eye, you’ve got to figure out the best game plan to handle those overseas debts and payments, no matter where you land. And trust me, you don’t want to play catch-up with the interest rates – they can sprint faster than your salary ever could.

Here’s a solid tip: why not make life easier? Set up those recurring payments using a global money transfer, so you can stay on top of things and not let those debts sneak up on you. It’s like putting your finances on autopilot and avoiding the headache of falling behind.

Failing to notice changing variable interest rates

If you’ve got some loans hanging around, keep an eye on those tricky variable interest rates. And get this, it’s not just where you’re from – your new home country is part of the game too.

Now, these interest rates aren’t just playing with the money in your piggy bank; they also decide how much you must give back for those loans.

We all want to be champions at paying back loans, right? But if there’s a chance to get even better rates, why not go for it? That’s what the cool kids call refinancing.

Not sure what refinancing means? Picture this: Imagine you have a jar of candy, and whenever you share some with your friend, they give you a little toy in return. But sometimes, the number of toys your friend gives you changes. If you notice they’re giving you more toys, you might want to trade in your candies for a different kind that gives you even more toys!

Well, refinancing is a bit like that. If you have a loan, and you find a better deal with lower interest rates, you can trade in your old loan for a new one. It’s like swapping your candies for a better toy deal, so you end up with more toys in the end!

And don’t forget, if there are cooler bank accounts out there that can make more money for your savings, why not give it a shot? It’s all about making those awesome money moves!

Failing to notify your bank of your plans

Sure, you might be all set to open a new bank account in a different country, but your old one back home won’t just chill out and gather dust, you know?

You might need to dip into that account every now and then. The last thing you want is your bank suspecting some shady business overseas and freezing or cancelling your account.

So, give them a heads up if you need to. Update your phone number or find a way to keep your hometown number alive so you can get those 2FAs when necessary.

Consider getting a virtual mailbox too, just to make sure you don’t miss any snail mail updates from the bank.

Oh, and don’t forget the VPN while you’re at it. Trying to access internet banking from overseas can be a real pain if the bank’s website decides to play redirect games to local sites only.

Waving goodbye to the basics, only paying the minimum

Hey, while you’re tackling those old debts back home, don’t let the new ones sneak up on you – we’re talking about the expenses that pop up when you first make the move abroad.

It’s a bit of a juggling act since you’re shelling out a bunch of money right from the get-go. And thinking a credit card is some kind of magic wand? Nope, not really.

Sure, with a credit card, you might get away with just making the minimum payments to dodge those pesky late fees. But here’s the kicker – the average interest rate? A whopping 24.25%. So, if you start with a grand and only throw in 50 bucks a month, you’re basically handing the bank a sweet $230.38 for free.

Now, we’re not saying you need to become a math whiz, but that $230 could find a better home than in the bank’s pocket, right? Think about it!

The smart move? Aim to pay off the whole balance, or at least chunk away as much as you can each month. Clearing the full balance means no interest costs, plus you get to enjoy interest-free days on future buys. Can’t wipe out the whole thing? No problem. Toss in whatever you can to shrink those interest costs.

If you stick to a monthly budget, you’ll know exactly what you need to repay and can stash some cash aside specifically for that credit card bill. It’s all about keeping those finances in check!

Ignoring your mandated retirement funds

Ever thought about overlooking your required retirement savings? You might be wondering, what are these mandated retirement funds? They’re basically a government-introduced social security savings setup, where both employers and employees pitch in.

Just like the name suggests, it’s like a hands-off fund meant to cushion your retirement. Take Australia, for instance, they’ve got superannuation, and in Singapore, it’s the Central Provident Fund.

The cool part? Interest rates usually beat your local bank, and some might even throw in tax rebates if you decide to show your mandated retirement funds a little extra love.

So, if you’re part of this club, don’t forget to sprinkle in some contributions from time to time. Your future self will probably thank you for it!

Not taking advantage of specialist transfer providers

When you’re out and about in another country, don’t forget about those exchange rates, fees, and how easy it is to send money.

Because, really, who wants to end up with less bang for their buck?

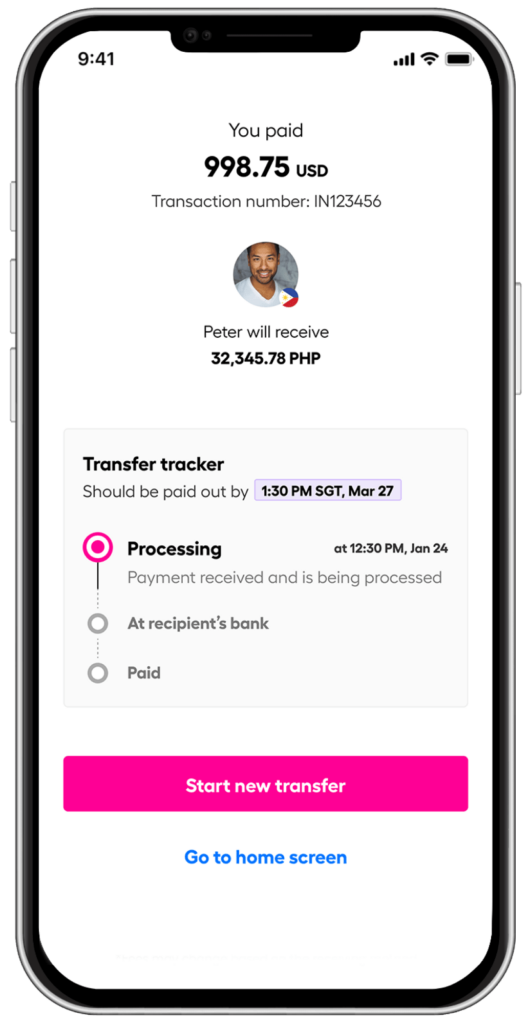

Enter Instarem – a smart way to send money abroad.

Enjoy lower transfer fees, better exchange rates, and speedier processing times. So, you’re getting the most out of your money, all while enjoying some peace of mind.

Check out rates and fees upfront and keep tabs on your money’s journey with our handy transaction timeline. Easy peasy!

Try Instarem for your next transfer!

Download the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products.

Instarem stands at the forefront of international money transfer services, facilitating fast and secure transactions for both individuals and businesses. Our platform offers competitive exchange rates for popular currency pairs like USD to INR, SGD to INR, and AUD to INR. If you're looking to send money to India or transfer funds to any of 60+ global destinations, Instarem makes it easy for you. We are dedicated to simplifying cross-border payments, providing cutting-edge technology that support individuals and businesses alike in overcoming traditional fiscal barriers normally associated with banks. As a trusted and regulated brand under the umbrella of the Fintech Unicorn Nium Pte. Ltd., and its international subsidiaries, Instarem is your go-to for reliable global financial exchanges. Learn more about Instarem.