Navigating the cost of living for expats in Germany

This article covers:

Germany is widely recognised as an appealing choice for expatriates across the globe among European countries due to its robust welfare system, ensuring a high quality of life for its residents. Within Germany, one can readily secure a well-paying job while maintaining a healthy work-life balance.

Apart from its economic allure, Germany’s allure lies in its capacity to serve as a welcoming home for people of diverse backgrounds, fostering a sense of belonging. This diversity enriches the cultural and social fabric, offering many attractions and recreational spaces to explore. Additionally, the nation boasts a clean and pristine environment, enhancing its appeal as a desirable destination.

Additionally, according to the Numbeo Cost of Living Index 2022, Germany ranks 18th in terms of living costs. This position implies a more affordable living experience in Germany compared to countries like the UK, Denmark, Norway, France, or the Netherlands.

The current cost of living in Germany

Germany’s cost of living is experiencing significant fluctuations, particularly in light of the recent economic events in Europe and the aftermath of the pandemic. As a consequence of the war in Ukraine, inflation rates have surged across the region. Notably, in October 2022, Germany faced a staggering inflation rate of 10.4%, primarily driven by soaring energy and food prices. Experts predict that this high inflationary trend is likely to persist until the end of 2024.

Given the current context of rapidly increasing prices, accurately estimating the cost of living in Germany for 2023 can be challenging. While certain expenses, such as taxes and insurance, remain relatively stable, others, such as food, drink, and utilities, are subject to considerable fluctuations.

Nevertheless, even amidst the ongoing inflation, Germany continues to be a relatively affordable place to reside, particularly when compared to other European countries. What makes Germany even more remarkable is its ability to maintain a high standard of living while providing world-leading education, healthcare, and transportation services.

Germany Tax Structure

Taxation in Germany is a multifaceted system, with taxes being imposed by different levels of government, including the federal government (Bundesregierung), federal states (Bundesländer), and municipalities (Gemeinden). The responsibility for tax administration is divided between two authorities: the Federal Central Tax Office (Bundeszentralamt für Steuern) and approximately 650 regional tax offices (Finanzämter).

The revenue generated from various sources, such as income tax, value-added tax (VAT), corporation tax, and other streams, is distributed among the federal government, states, and municipalities, enabling them to fund their respective operations and public services.

Withholding tax (Lohnsteuer)

Withholding or payroll tax is income tax and other contributions that your employer withholds from your salary. This will apply to the vast majority of expats in Germany and means your rate of income tax has already been worked out and paid for you. If this is your only source of income, you are not obliged to submit a tax declaration. The withholding tax is taken from your pay each month.

When discussing salary and employment contract terms for a new job, it is important to be aware of this deduction. There is a large difference between your gross salary and your net salary once taxes have been paid. The withholding tax levy includes taxes on your salary (Lohnsteuer), national insurance payments, taxes on non-monetary benefits, a solidarity surcharge, and a church tax.

Income tax

In Germany, any income earned is subject to taxation and expatriates have to pay income tax if they live in Germany for more than six months. The country utilises a progressive tax system, which means that as taxable income increases, so does the tax rate. For most individuals, income tax deductions are managed by their employers directly from their payroll. However, if you have multiple jobs, operate a business, or are self-employed in Germany, an annual tax return will be necessary to determine your income tax obligations.

For 2023, the tax rate ranges from 0% for those earning less than €10,908, to 45% for those earning more than €277,826 annually.

Income | Tax Rate |

Less than 10.908 euros | 0% |

10.909 – 62.809 euros | 14% to 42% |

62.810 – 277.825 euros | 42% |

More than 277.826 euros | 45% |

Social security payments

In Germany, all income from work must have social security contributions deducted. These contributions cover:

Health insurance (Krankenversicherung)

In Germany, the health insurance system (Krankenversicherung) is universal, which means that every individual is legally required to have health insurance coverage. The health insurance options in Germany consist of two types: statutory health insurance and private health insurance.

Pension insurance (Rentenversicherung)

Germany’s pension system has earned consistently high rankings globally, a position that is continuously improving as the government undertakes reforms to streamline the system.

With an ageing population and mounting pension expenses, the German federal government has implemented several reforms since 2002 to ensure the long-term sustainability and affordability of the pension system. These measures include a gradual increase in the statutory retirement age and reductions in the maximum state pension payments.

Long-term care insurance (Plegeversicherung)

Germany’s social security system incorporated long-term care insurance (Pflegeversicherung) in 1995 with the aim of providing preparedness for individuals in the event they require long-term nursing care due to accidents, illnesses, or old age. This addition ensures that everyone has access to support and assistance when facing such circumstances.

Unemployment insurance (Arbeitlosenversicherung)

Unemployment insurance (“Arbeitslosenversicherung”) is automatically deducted from employees’ salaries when they are paid, relieving them of the responsibility for handling these contributions. Typically, the employer bears half of the unemployment insurance contribution, while the remaining half is covered by the employee.

These payments are usually shared between you and your employer, with your employer typically contributing 50%. Your share of contributions will be withheld from your salary and transferred to the relevant organisations. The total contribution for social security generally amounts to around 20 – 22% of your salary up to a specified maximum limit.

Benefits in kind (Geldwerter Vorteil)

You might also have a responsibility to settle taxes on items considered “benefits in kind,” which refers to perks or advantages provided by your employer, like the use of a company car. The taxation rate for company cars stands at 1% of the car’s list price, inclusive of VAT. Additionally, shares granted as perks or bonuses are also subject to taxation.

Solidarity surcharge (Solidaritätzuschlag)

Commonly referred to as “Soli,” the 5.5% tax supplement applies to income tax, capital gains, and corporation taxes. It was first introduced in 1991 to finance the expenses related to German reunification, including pensions and debts of the former East German government.

However, as of January 2021, significant changes have been made to the “Soli threshold” for income tax, leading to the virtual elimination of the surcharge for 90% of taxpayers. Only single individuals with a gross annual income of 62,603 euros or higher are now required to pay this tax supplement.

Church tax (Kirchensteuer)

Upon registration in Germany, individuals are required to declare their religion. If they identify as Protestant, Catholic, or Jewish, they become subject to the church tax, which is collected by the tax office on behalf of religious organizations in the country. The current church tax rate is 8% in Bavaria and Baden-Württemberg, and 9% in all other federal states. Those who have not declared any religion are exempt from paying the church tax.

Now that we know about taxes in Germany, let’s turn to the cost of living there.

Cost of Living in Germany

The cost of living in Germany differs from region to region and is heavily impacted by factors such as household sizes and lifestyles. For simplicity, we’ll look at the main costs people usually have while living in Germany.

Do note that these costs can rise substantially for families and larger households.

Housing Cost (Rent/Purchase)

As per Numbeo’s data from 2022, the average cost of a one-bedroom apartment in the city centre of Germany is approximately €750.

Below are the average rates for one-bedroom apartments in major German cities:

- Berlin: €1,087

- Cologne: €807

- Frankfurt: €1,060

- Hamburg: €993

- Leipzig: €592

- Munich: €1,346

- Stuttgart: €1,025

Buying a property is not as widespread in Germany compared to the US, France, or the UK. The average price for property in the city centre of a German town or city is approximately €5,430 per square meter. In Berlin, the cost rises to around €6,995 per square meter, and in Munich, it goes up significantly to about €11,759 per square meter.

In Germany, the average rental costs vary depending on the type of accommodation. For a room in shared accommodation, the monthly rent ranges from €300 to €800. On the other hand, for a one-bedroom flat, the monthly rent can be anywhere between €500 and €1,346. The overall average rental price for a one-bedroom apartment in the country is around €750 per month.

Transportation Cost

When residing in cities, public transportation typically becomes the preferred mode of travel. Large cities boast highly efficient systems that incorporate tram, rail, and bus services. The underground train, also known as the subway or tube, is referred to as the U-Bahn, while overground trains within cities are called the S-Bahn.

For regional travel, people use either the RE (regional express) or RB (regional Bahn) trains. Intercity trains are denoted as IRE (interregional express) or ICE (intercity express).

In Germany, both bus and subway fares are reasonably priced and relatively comparable, meaning that taking the metro doesn’t cost more than taking a bus. A single trip on a bus, tram, or metro typically ranges from €1 to €2. For frequent travellers, monthly travel cards usually cost around €80 to €90.

However, high-speed trains connecting major cities can be expensive, especially if you book on the day of travel or opt for early morning departures. On the bright side, advance off-peak tickets can be purchased for as little as €20 between two major cities, making it a more budget-friendly option for train travel, such as from Berlin to Munich. Here are the travel fares for some of the major cities in Germany:

- Munich: €66

- Berlin: €81

- Frankfurt: €89

- Hamburg: €83

- Cologne: €91

German rail

In the majority of major cities, a citywide travel card will also cover bus travel, as the transportation systems are integrated. Occasionally, Bahn discount cards like BahnCard 50 or BahnCard 25 may offer discounts not only for trains but also for buses and coaches. However, it’s advisable to verify the specific terms with the respective transport provider beforehand.

Taxi service and fare in Germany

Local governments regulate taxis, and drivers are required to have licenses.

The rates for taxis in the city are determined by the local authorities, eliminating the need to compare prices or negotiate with drivers.

In each town or city, there is a primary taxi company, and you can easily call or book a taxi in advance, especially for trips like airport transfers. The contact numbers for these cab companies are readily available online.

Ordering a taxi in advance is advisable if you are not located in the city centre, planning to travel late at night, or if punctuality is crucial for your journey.

In major cities, you can usually find taxis readily available on the streets or at designated taxi ranks. The cities have a large number of taxis, with Berlin having around 400 official taxi ranks throughout the city.

However, during peak times like Friday or Saturday nights or significant city events, it may be a bit more challenging to find a taxi immediately. Look for taxis with a lit-up “Taxi” sign on top, indicating their availability for new fares.

In contrast to other living expenses like rent or dining out, taxi prices remain relatively consistent across Germany. Here are the approximate costs, including the base fare, for a 2.5-mile taxi ride in various major cities in the country:

- Leipzig: €8.75

- Cologne: €9.02

- Munich: €9.40

- Hamburg: €9.50

- Bonn: €9.75

- Berlin: €9.90

Healthcare

In Germany, health insurance is mandatory for all residents, including researchers and scientists arriving from abroad for both short and long-term work. To help incoming professionals, we have prepared the following overview of how the German health insurance system operates and how to acquire the necessary coverage.

Public Healthcare Cost

In Germany, all public health insurance providers apply a standard basic premium of 14.6% of gross income (2023) and an additional supplemental charge averaging 1.6% of gross income. These premiums are capped at a monthly income of €4,987.50.

Individuals earning above this threshold will not face higher insurance premiums. The basic premium is evenly divided between the employee and employer, with both contributing 7.3%. Since 2019, employers are also responsible for paying half of the supplemental charge.

Additionally, German residents and their dependents are required to join the country’s long-term nursing care scheme (Pflegepflichtversicherung). This scheme covers part of the expenses associated with personal nursing needs, such as bathing and feeding for those with substantial disabilities.

The cost of the nursing care scheme varies depending on the number of children an individual has. Generally, it ranges from 3.4% of gross salary for individuals with at least one child, to 4.0% (with a maximum of €199.50 per month) for those without children. The employer contributes a maximum of €84.79 towards this cost. These figures are slightly different in the state of Saxony, where costs start at 2.2% for individuals with one child and 2.8% for childless individuals. The employer contribution in Saxony is also lower, at 1.2%.

Private Healthcare

In Germany, individuals have the option to select private health insurance (Private Krankenversicherung or PKV for short) under specific circumstances, including:

- Individuals who earn more than a predefined amount (€66,600 per year in 2023),

- Self-employed individuals, and

- University students who are still within the duration of their studies.

However, even if one meets any of these criteria, there is no obligation to opt for private health insurance. Anyone can still choose to have statutory health coverage.

Before deciding on private insurance, several crucial factors need consideration. One significant aspect is that once a person holds a private insurance policy, it can be exceedingly challenging to re-enter or return to the statutory healthcare system. Moreover, unlike statutory insurance, monthly premiums for private policies are not based on a person’s salary.

According to Stiftung Warentest, Germany’s leading consumer reports organization, individuals who initially sign up for private insurance in their mid-thirties can expect a significant increase in their premiums over time. By the time they retire, the premium is likely to be at least three times the original premium.

Education cost for schools

Schooling at the primary and secondary levels in Germany is generally free for all students, including expatriates. This applies to public schools, which are funded by the state. However, private and international schools typically charge tuition fees, which can vary widely depending on the institution.

At the tertiary level, Germany is known for its free university education policy. There are no tuition fees at public universities for both domestic and international undergraduate students. Some states may charge a small semester fee, which covers administrative costs and possibly public transportation tickets.

However, tuition fees might be charged for certain graduate and postgraduate programs, or for students who spend longer than the standard period of study to complete their degree, also known as “long-term fees”. It’s also important to note that private universities, which are not funded by the state, do charge tuition fees.

Lifestyle expenditure cost in Germany

On average, households in Germany spend around €387 per month on food, which includes drinks and tobacco. The actual amount may vary based on factors such as shopping preferences, whether one chooses discount stores or organic shops, regular drink deliveries, or smoking habits. However, it’s important to note that food prices are currently on the rise due to inflation and other factors, affecting every consumer.

For instance, the price of butter has nearly doubled, increasing by 47.9%, in just one year, while bread and cereals have become around 15% more expensive (as of July 2022). While these price increases are beyond individual control, there are still money-saving tips that can be utilised when grocery shopping.

Whether it’s for work or leisure, clothes are often considered to define a person’s appearance. On average, the cost of clothing in Germany amounts to €93 per month. Interestingly, you can also claim tax deductions for your work-related clothing and potentially receive a refund on some of the income tax you’ve paid!

Then there are vehicle maintenance and repair costs; your car may require repairs if the headlights aren’t functioning properly or if there’s an unsightly dent. On average, these repairs amount to €55 per month. Additionally, there are TÜV costs associated with vehicle inspections, which were approximately €120 in 2022. It’s important to note that the expenses for car inspections may vary depending on your region and the inspection company you choose.

However, the cost of living in Germany has been rising; since 2007, electricity prices have surged by approximately 63%, gasoline costs have gone up by 30% since 2010, and food and drink expenses have increased by 23% compared to 2017.

Cost comparison between some of the cities in Germany

The cost of living in cities across Germany varies considerably. Munich, Frankfurt and Hamburg rank as the most expensive cities. Conversely, cities like Leipzig and Dortmund are more affordable, offering a significantly lower cost of living.

Below is a table for the cost of living between cities in Germany. Hopefully, it helps to provide better insights into the cost of living in Germany.

Munich | Frankfurt | Hamburg | Leipzig | Dortmund | |

Meal, Inexpensive Restaurant | 15.00 euro | 15.00 euro | 12.00 euro | 11.00 euro | 15.00 euro |

Loaf of Fresh White Bread (500g) | 2.04 euro | 1.87 euro | 2.08 euro | 1.52 euro | 2.21 euro |

Rice (white, 1kg) | 2.44 euro | 2.37 euro | 2.45 euro | 1.88 euro | 2.66 euro |

Taxi Start (Normal Tariff) | 5.00 euro | 2.00 euro | 2.33 euro | 3.05 euro | 3.05 euro |

Gasoline (1 litre) | 1.84 euro | 1.96 euro | 1.92 euro | 1.95 euro | 2.07 euro |

Preschool (or Kindergarten), Full Day | 702.36 euro | 514.22 euro | 418.00 euro | 279.00 euro | 230.00 euro |

International Primary School, Yearly | 16,333.33 euro | 12,814.29 euro | 18,425.00 euro | 9,200.00 euro | *Unable to obtain exact data at the time of writing. |

Apartment Rental (1 bedroom) in City Centre | 1,329.26 euro | 1,155.00 euro | 1,000.61 euro | 622.08 euro | 605.00 euro |

Apartment (1 bedroom) Outside of Centre | 1,060.27 euro | 836 euro | 770.92 euro | 941.25 euro | 366.67 euro |

Apartment (3 bedrooms) in City Centre | 1,853.00 euro | 2,096.67 euro | 1,000.61 euro | 1,295.00 euro | 1,466.67 euro |

Apartment (3 bedrooms) Outside of Centre | 1,853.00 euro | 1,476.09 euro | 1,367.95 euro | 941.25 euro | 800.00 euro |

Apartment Purchase Price per Square Meter in City Centre | 11,708.71 euro | 8,583.75 euro | 8,029.17 euro | 5,500.00 euro | 3,400.00 euro |

Apartment Purchase Price per Square Meter to Buy Apartment Outside of Centre | 8,763.56 euro | 5,687.14 euro | 5,183.85 euro | 2,925.00 euro | 2,300.00 euro |

Average Monthly Net Salary | 3,418.36 euro | 3,434.26 euro | 3,066.66 euro | 2,294.31 euro | 2,201.62 euro |

Mortgage Interest Rate (Yearly, 20 Years) | 3.11% | 3.74% | 3.74% | 3.98% | 4.00% |

Managing your finances in Germany as an expat

One of the most significant aspects of being an expat is learning to manage your finances in your new home country. Germany, with its well-established banking system and numerous digital payment options, provides a solid financial infrastructure. However, the task of managing finances doesn’t stop at the German borders. Expats also need to transfer money between Germany and their home countries, whether for maintaining properties, supporting family, or managing investments back home.

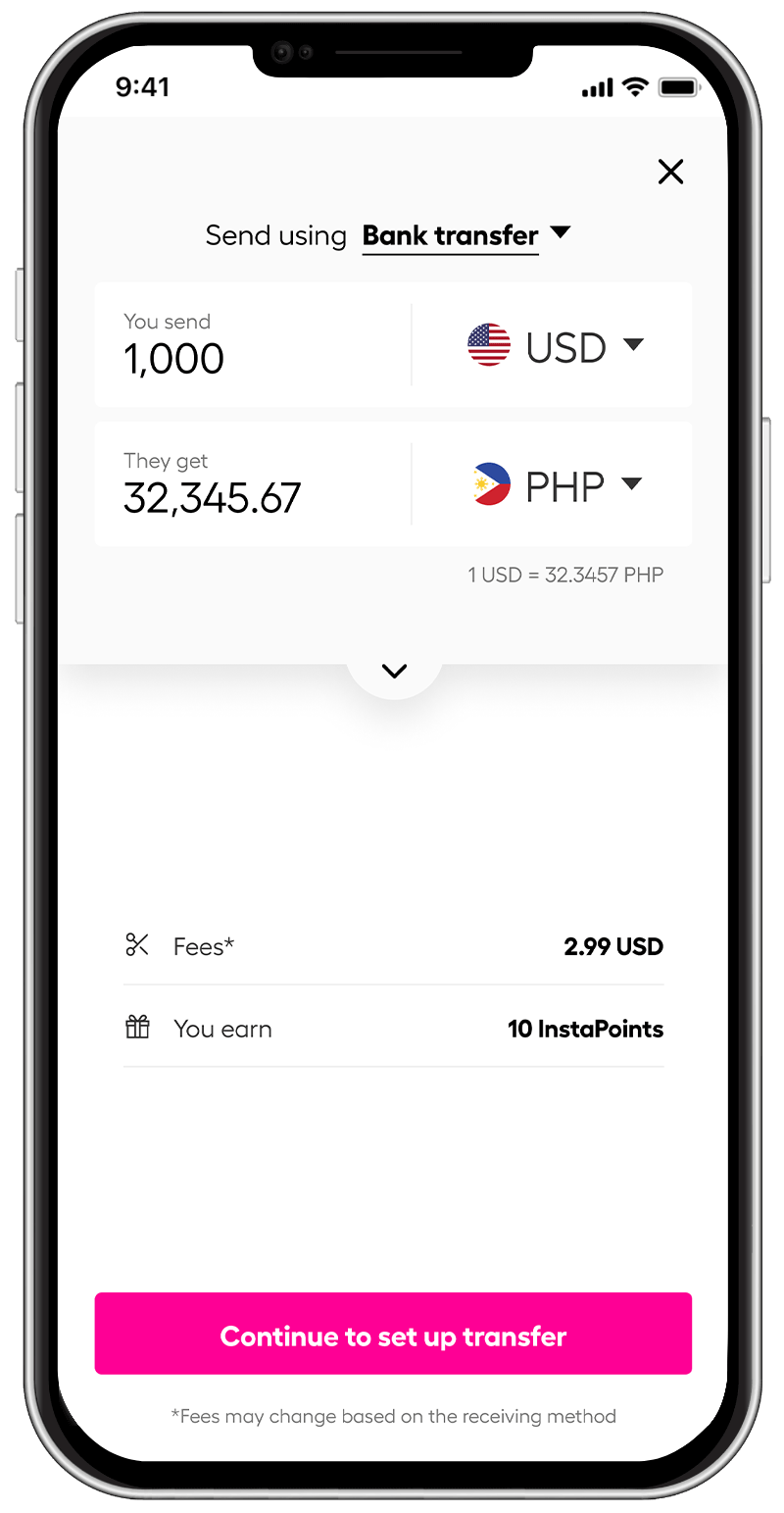

For these cross-border transactions, it’s important to use a reliable and cost-effective money remittance service. A platform like Instarem is highly recommended for this purpose. Known for its competitive exchange rates, transparency, and nominal fees, Instarem offers a stress-free solution for international money transfers.

*rates are for display purposes only.

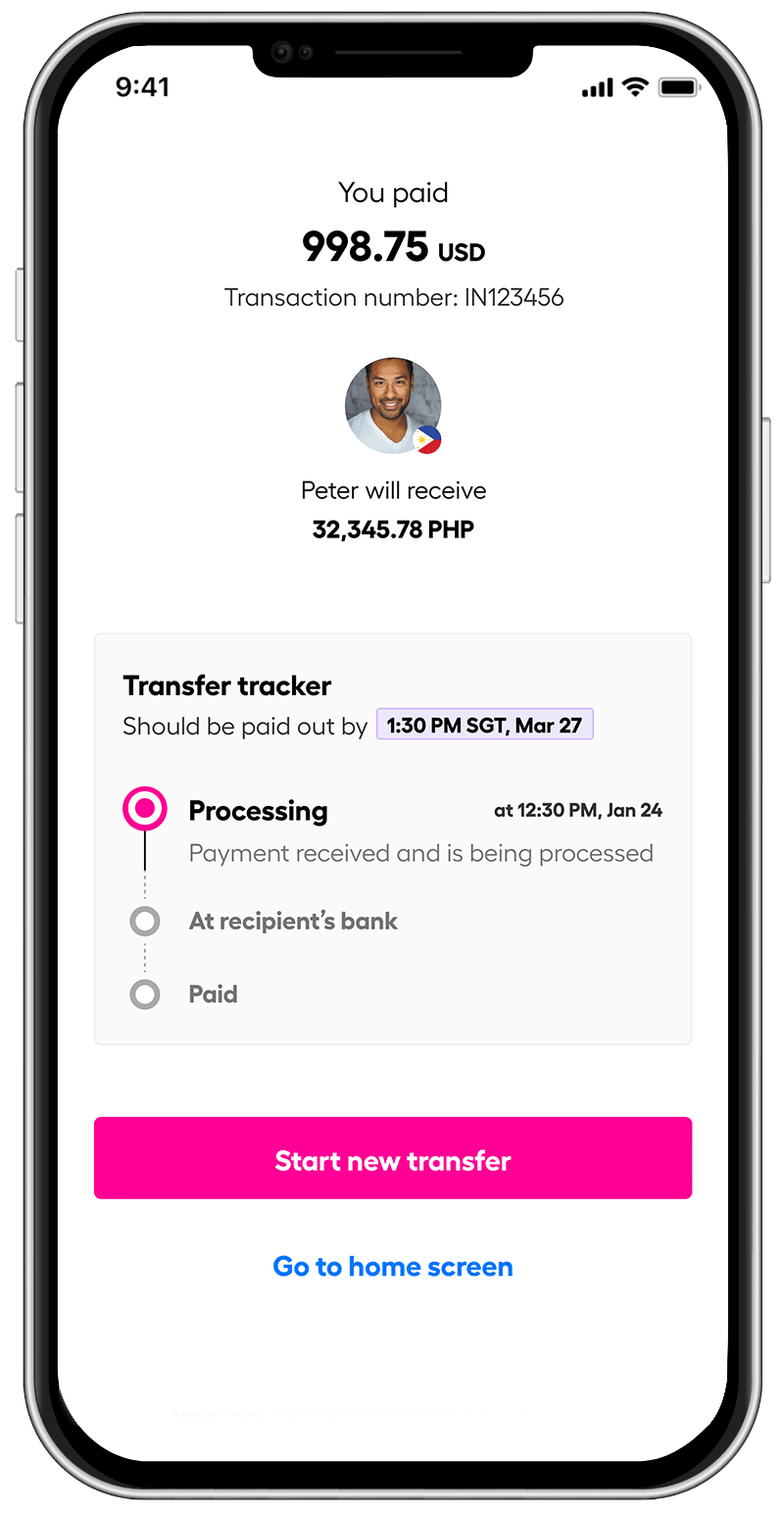

With Instarem, expats can easily send money to their home countries or fund their German accounts from overseas.

Expats are able to track their transactions in real time and receive notifications about their transfers. This simplifies the task of managing finances across borders, allowing expats to focus more on their lives in Germany.

By leveraging efficient tools like Instarem for international money transfers and maintaining a well-planned budget, expats can navigate the cost of living in Germany successfully and enjoy their new life abroad.

Download the app or sign up here.

Conclusion

Living in Germany offers expats a wide range of cultural experiences and opportunities for personal growth. The country’s rich history, diverse traditions, and vibrant arts and entertainment scene provide a stimulating environment for individuals looking to immerse themselves in a new culture. Moreover, Germany’s efficient public transportation, well-maintained infrastructure, and emphasis on sustainable living contribute to a convenient and environmentally conscious lifestyle.

Furthermore, Germany’s strong economy and numerous job opportunities make it an attractive destination for professionals seeking career advancement and international exposure. Expats can benefit from the country’s emphasis on work-life balance, which fosters a healthier and more fulfilling professional life. The welcoming and inclusive nature of German society encourages expats to integrate seamlessly into local communities, creating a sense of belonging and making the transition to living abroad smoother and more enjoyable.

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with the products or vendors mentioned.

Get the app

Get the app