How much does it cost to live in Singapore: A comprehensive guide

This article covers:

Singapore, often referred to as the Lion City, is a bustling metropolis known for its soaring skyscrapers, lush greenery, and vibrant blend of cultures. This island nation has consistently ranked as one of the most liveable cities globally, attracting expatriates, students, and professionals from around the world. But what does it cost to live in Singapore? In this comprehensive guide, we will delve into the intricacies of the cost of living in Singapore, covering everything from housing and transportation to healthcare, education, and prudent savings practices.

Understanding the cost of living in Singapore is crucial, whether you’re planning a move to this city, are already a resident, or have family members studying here. It’s not just about budgeting; it’s about making informed financial decisions that ensure your economic well-being aligns with the incredible opportunities Singapore has to offer.

Housing Costs

Singapore’s housing landscape is as diverse as its culture, offering an array of options to suit various budgets and preferences. The most common types of housing are public housing flats known as HDB flats and private condominiums. The cost of housing can vary dramatically based on factors like location, size, and amenities.

Public housing, represented by HDB flats, is the most affordable option and the choice for the majority of Singaporeans. These flats are typically found in well-developed residential areas and are known for their quality and amenities.

Rental costs for HDB flats vary based on size and location, with newer units or those closer to the city centre commanding higher prices.

On the other end of the spectrum are private condominiums, which offer luxurious living with facilities like swimming pools, gyms, and 24-hour security. Owning or renting a private condo in Singapore is a dream for many, but it comes at a premium. The prices or rental of private condos are considerably higher than HDB flats, making them an option for those with a more substantial budget.

Practical Tips for Finding Affordable Housing

- Location Matters: The proximity to public transport, schools, and amenities can significantly affect housing costs. Consider areas slightly away from the city centre for more affordable options.

- Consider HDB Flats: Don’t disregard HDB flats, especially if you’re on a budget. Some newer units come with modern amenities and are competitively priced.

- Room Sharing: If you’re comfortable, room sharing can significantly reduce rental costs. Many expatriates and students opt for this option, especially in private condominiums.

- Negotiate Your Lease: When renting, don’t hesitate to negotiate the lease terms, including rent and the inclusion of utilities or furnishings.

- Understand Additional Costs: If you are planning to own a property in Singapore, be aware of additional costs like maintenance fees, property taxes, and stamp duties, especially when purchasing private property.

The interplay between housing costs and transportation expenses forms a crucial facet of the Singaporean lifestyle. Your choice of residence not only affects your comfort and lifestyle but also significantly influences your daily commuting experience. Let’s explore transportation expenses in Singapore.

Transportation Expenses

Singapore boasts one of the world’s most efficient and well-connected public transportation systems. The backbone of this system is the Mass Rapid Transit (MRT) network, complemented by an extensive bus network. Owning a car is considered a luxury due to the high costs associated with it. Let’s break down the transportation expenses and the pros of each means:

Public Transport

- Ez-Link and Contactless Cards: In addition to the Singapore Tourist Pass, residents and long-term visitors often use Ez-Link cards or SimplyGo (contactless) cards for their daily commutes. These cards offer convenience as they can be topped up and used for MRT, buses, and even payments at some retail outlets and food stalls.

- Distance-Based Fares: Singapore’s public transport system operates on a distance-based fare structure. The further you travel, the more you pay. However, there is a cap on daily expenses to ensure that commuters don’t spend excessively on their daily commutes.

- Off-Peak Travel: To encourage off-peak travel and reduce congestion during rush hours, Singapore offers discounted fares for those who tap in during less crowded periods.

Owning a Car

Certificate of Entitlement (COE): The COE system in Singapore is a significant factor in car ownership costs. COEs are categorized into different vehicle types (e.g., cars, motorcycles) and are auctioned off in limited numbers each month. Bidders pay the prevailing COE price, which can fluctuate widely. The cost of a COE can sometimes exceed the actual price of the car.

- Additional Costs: In addition to the COE, car owners need to consider costs like road tax, insurance, and Electronic Road Pricing (ERP) fees. ERP fees are charges for using certain roads during peak hours.

- Limited Parking: Finding parking in densely populated areas can be challenging. Many residential areas have restricted parking, and public parking fees can be relatively high.

- Alternative Fuel Vehicles: The Singapore government promotes the use of eco-friendly vehicles, offering incentives such as rebates and tax exemptions for electric and hybrid cars.

Ridesharing

- Wide Availability: Ridesharing services like Grab and Gojek operate widely in Singapore. They provide an affordable and convenient means of transportation, especially for short trips or when you need a ride quickly.

- Promotions and Discounts: These services often run promotions and offer discounts, making them more cost-effective than traditional taxis.

- Carpooling: Some ridesharing apps also offer carpooling options, allowing passengers heading in the same direction to share rides, reducing costs further.

Cycling

- Dedicated Cycling Paths: Singapore’s efforts to promote cycling include the development of dedicated cycling paths. These paths are often well-maintained and integrated into the public transportation system, making it easy for cyclists to combine cycling with other modes of transport.

- Bicycle Rentals: Many areas in Singapore offer bicycle rental services, allowing residents and tourists to explore the city on two wheels without the need for ownership.

- Bicycle-Friendly Facilities: Several locations in Singapore have bicycle-friendly facilities like parking racks and even showers for cyclists.

Singapore offers a vibrant blend of transportation choices, allowing you to craft a lifestyle that aligns with your budget and preferences. By carefully assessing the interplay between housing and commuting, you can create your own dedicated living experience in this dynamic city. Whether you choose the convenience of a centrally located HDB flat or the allure of a private condominium, your decision will profoundly shape your life in Singapore.

Healthcare

Singapore is renowned for its world-class healthcare system, offering exceptional quality medical services. However, it’s essential to be aware of the associated costs, particularly for expatriates and non-residents. Let’s delve into the healthcare landscape and financial considerations in the Lion City:

Health Insurance

- Types of Health Insurance: Expatriates and non-residents should consider different types of health insurance, such as international health insurance or local plans provided by insurers in Singapore.

These plans vary in coverage, including inpatient and outpatient services, maternity, dental, and more. Choosing the right type of insurance depends on your specific healthcare needs and budget. - Policy Customisation: One size doesn’t fit all when it comes to health insurance. It’s advisable to assess your coverage requirements and customize your insurance policy accordingly. Factors to consider include your family size, medical history, and specific healthcare needs.

Customising your policy ensures you pay for the coverage that matters most to you. - Cost Considerations: Health insurance premiums depend on several factors, including age, coverage level, and pre-existing medical conditions. Comparing policies from different providers can help you find the most cost-effective option.

Remember that while cost is important, the comprehensiveness of coverage matters as well. Striking a balance between affordability and the extent of coverage is key.

Medisave

A Singaporean Perk: Singaporeans and Permanent Residents (PRs) have a unique advantage through their Central Provident Fund (CPF) accounts, which include a Medisave component. Medisave is a national medical savings scheme that allows residents to set aside a portion of their income for healthcare expenses.

This component can be used for a wide range of medical services, from hospitalization to outpatient treatments. It significantly contributes to making healthcare more affordable for residents.

However, expatriates and non-residents do not have access to Medisave, underscoring the importance of having comprehensive health insurance coverage.

Practical Tips for Managing Healthcare and Education Expenses

- Routine Health Check-ups: Schedule regular health check-ups to detect and address potential health issues early, reducing long-term healthcare costs.

- Preventive Care: Focus on preventive healthcare by maintaining a healthy lifestyle. This can help avoid costly medical treatments later on.

- Utilize Employee Benefits: Take full advantage of health insurance and education benefits offered by your employer. These benefits can significantly reduce your healthcare and education expenses.

- Healthcare Subsidies: Some expatriates may qualify for healthcare subsidies if they meet specific criteria. Investigate whether you or your family members are eligible for any government subsidies.

- Financial Planning: Create a comprehensive financial plan that considers healthcare and education expenses. This plan can help you allocate resources efficiently and ensure you’re prepared for unexpected costs.

While Singapore’s healthcare system is celebrated for its excellence, it’s crucial to navigate the associated costs wisely. Comprehensive health insurance is a vital aspect of living in Singapore, offering financial security in times of medical need. By understanding the healthcare landscape and embracing preventive care, you can enjoy a healthy life in this vibrant city without compromising your financial well-being.

Education

Singapore’s education system is celebrated worldwide for its exceptional standards. Whether you’re a parent planning your child’s academic journey or a student pursuing higher education, understanding the various education options and their associated costs, all while considering the cost of living in Singapore, is crucial. Here’s a more detailed look at the educational landscape in Singapore:

International Schools

- Tuition Fees: Tuition fees for international schools in Singapore can vary widely based on factors like the reputation of the school, grade level, and facilities offered. On average, you can expect to pay between SGD 20,000 to SGD 40,000 annually, with some prestigious institutions charging even higher.

- Additional Costs: In addition to tuition fees, consider additional expenses for uniforms, textbooks, extracurricular activities, and transportation.

Local Schools (Government Schools)

- Affordability: Singapore’s public schools, also known as government schools, offer quality education at a significantly lower cost than international schools. The fees for permanent residents (PRs) and citizens are highly subsidized, making them an economical choice.

- Admission for Expatriates: While local schools primarily serve PRs and citizens, expatriate children may be considered for admission under specific circumstances. The Ministry of Education (MOE) has guidelines for admitting foreign students, and availability may vary by school and grade level.

- Additional Costs: Similar to international schools, local schools may have expenses for uniforms, textbooks, and school-related activities.

International Baccalaureate (IB) Programs

- Cost of IB Programs: While IB programs are available in some local schools, they may also be offered by international schools. These programs follow a globally recognized curriculum. Tuition fees for IB programs can range from SGD 25,000 to SGD 35,000 annually.

- Considerations: When opting for IB programs, consider the school’s track record in IB examinations and the availability of extracurricular activities that complement the curriculum.

Practical Tips for Managing Education Expenses

- Explore Local School Options: Local schools are a cost-effective choice if you’re comfortable with your child attending a school that follows the Singaporean curriculum. Keep in mind that admission can be competitive for expatriate children.

- Scholarships and Financial Aid: Investigate whether the chosen school offers scholarships or financial aid programs. Some international schools provide these opportunities based on academic merit, talents, or other criteria.

Daily Expenses and Savings

In Singapore, daily living expenses can vary widely depending on your lifestyle and preferences. Here are some key aspects to consider:

Groceries

Singapore has a range of supermarkets, from budget-friendly to upscale. Buying local products and shopping at wet markets can be more economical. Meal planning can also help save on food costs.

Dining Out

Eating out is a common practice in Singapore due to its diverse culinary scene. Hawker centres offer affordable local dishes, while restaurants can be more expensive. Balancing dining out with home-cooked meals can help manage expenses.

Utilities

Utility bills, including electricity, water, and gas, can add up. Being mindful of energy consumption and choosing energy-efficient appliances can reduce costs.

Communication

Mobile phone and internet plans vary in price and data allowances. Consider your usage patterns and choose a plan that aligns with your needs.

Entertainment

Singapore provides an array of entertainment choices, catering to diverse tastes and budgets. From free outdoor events in scenic parks to high-end concerts and theatre productions, there’s something for everyone.

Engaging in affordable or cost-effective activities can ensure you savour Singapore’s vibrant entertainment scene without straining your budget. In Singapore where the cost of living can be high, making prudent choices about how you enjoy your leisure time is a valuable skill to cultivate.

Savings and Financial Management

In Singapore, prudent financial management plays a significant role in securing your financial well-being. Here’s a deeper insight into savings, investments, and the advantages of using online money transfer services:

Savings

- Importance of Savings: Building a robust savings fund is a fundamental step in achieving financial stability. A savings account in a Singaporean bank offers several advantages. These banks often provide higher interest rates on savings accounts compared to accounts in other countries.

- Regular Contributions: Consistency is key. Regular contributions to your savings account create a financial safety net for unexpected expenses or future financial goals. Automating these contributions can help you stay on track.

Investing

- Growing Your Wealth: Once you’ve established savings, the next financial milestone is to explore investment opportunities. Singapore offers a wide array of investment options, catering to different risk appetites and goals.

- Investment Options: Consider diversifying your portfolio by investing in stocks, bonds, mutual funds, real estate investment trusts (REITs), or exchange-traded funds (ETFs). Each investment vehicle carries its own set of risks and returns.

- Seek Expert Advice: Before venturing into investments, it’s advisable to seek advice from financial experts or advisors. They can provide personalized guidance based on your financial situation and goals, helping you make informed investment decisions.

By incorporating these financial management strategies, you can navigate the financial landscape in Singapore more effectively.

Whether your goal is to build a secure financial future or efficiently manage international transactions, these insights and practices will empower you to make sound financial decisions and maximize your financial well-being.

Navigating Singapore’s financial landscape with confidence

So, here’s to you—your financial growth, your aspirations, and your indomitable spirit in the Lion City. As the city-state continues to evolve, your financial acumen, shaped by your understanding of the cost of living in Singapore, will serve as the compass guiding you through every opportunity and challenge that comes your way. Welcome to a world of financial possibilities in Singapore!

Before you go…

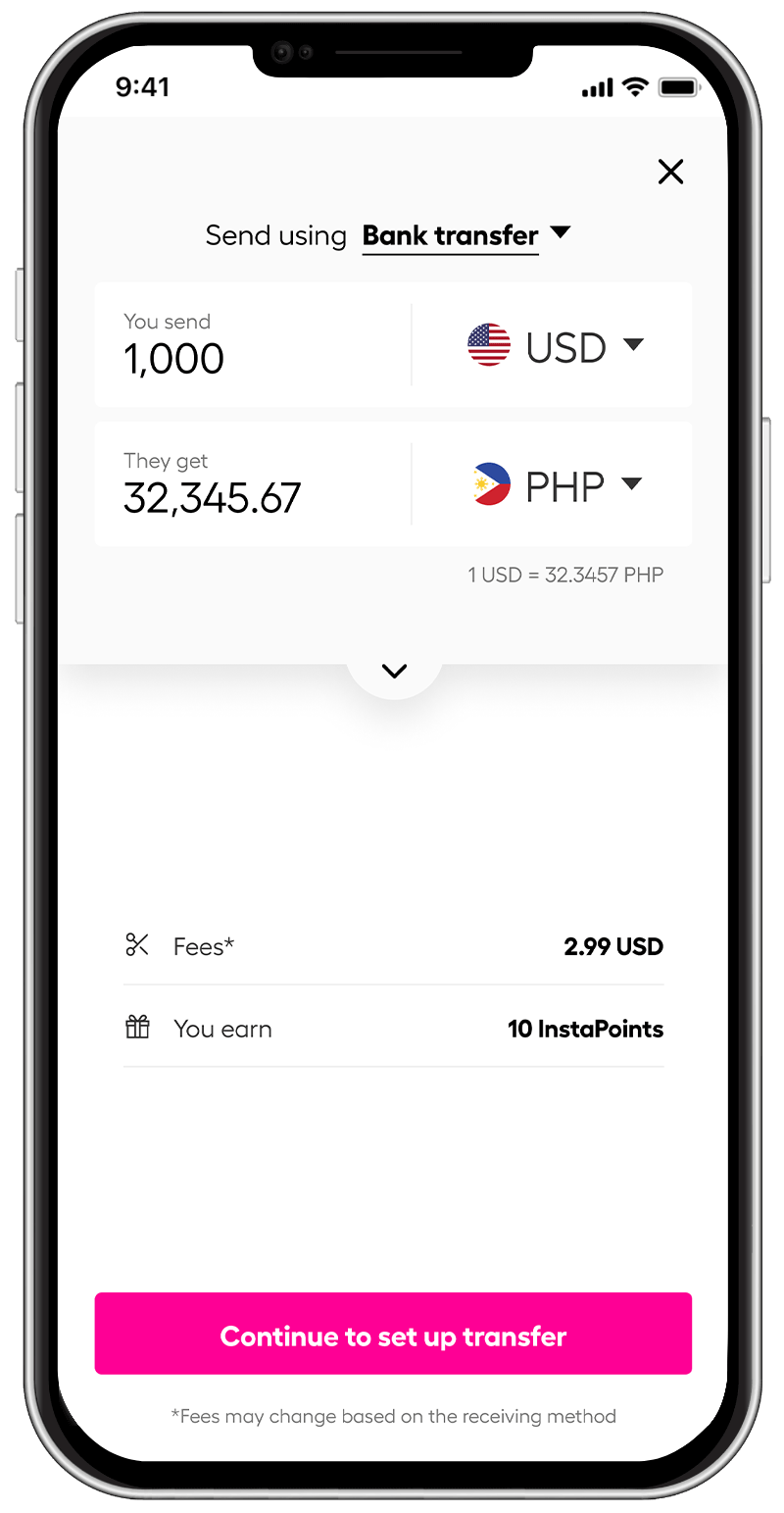

Managing expenses efficiently is integral to maintaining a healthy financial outlook. Online money transfer services like Instarem can be valuable in this regard.

*rates are for display purposes only.

- Competitive Exchange Rates: These platforms typically offer competitive exchange rates, ensuring that you get more value when converting currencies. Whether you’re sending money back to your home country or managing investments abroad, favourable exchange rates can make a significant difference.

- Low Fees: Online money transfer services often charge lower fees compared to traditional banks. This cost-effectiveness is especially beneficial when conducting frequent international transactions.

- Convenience: With user-friendly interfaces and mobile apps, these platforms provide convenience in managing your finances. You can initiate transfers, track transactions, and access your funds with ease.

Try Instarem for your next transfer.

Download the app or sign up here.

**Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.