This article covers:

The Indian economy has grown leaps and bounds over the years. Many Indians have made an impressive mark globally across different industries, sectors, and segments. This has inspired numerous young Indians to fulfill their dreams regardless of geographical boundaries.

Living abroad is a dream many Indians aspire to. However, managing money in India has always been a challenge. Until a few years ago, Non-Resident Indians (NRIs) or Persons of Indian Origin (PIO) found transferring funds back to India difficult due to cumbersome processes and long transferring periods.

With modern NRI accounts and money transfer platforms, individuals living abroad can easily transfer, save or invest money in international currencies. NRI accounts serve various purposes, for example, making funds readily available for friends or family in India, saving money earned abroad, or even investing in various instruments.

In the article below, we shall discuss the two main types of NRI accounts, namely NRE and NRO, answer what NRE and NRO accounts are, and learn about the benefits and differences between NRE and NRO accounts.

Key Takeaways

- NRE account meaning: NRE stands for a Non-Resident External and is a rupee-denominated account an NRI can open. They can use the NRE account to deposit their foreign currency earnings.

- NRO account meaning: NRO stands for Non-Resident Ordinary and allows NRIs to receive funds in either Indian or foreign currency.

- Savings and investments with NRE vs NRO are permissible; however, one must choose the type of account depending on the nature of the investment.

- Various parameters highlight the NRI NRE NRO accounts difference, like taxation, repatriation, fund transfer limits, etc.

- The outstanding NRI deposits increased by $2.5 billion, from $138.77 billion in May 2023 to $141.28 billion at the end of June 2023, according to the Reserve Bank of India (RBI) Bulletin released in August 2023.

NRE and NRO Account Differences

The following table summarises the key differences between NRE and NRO.

|

Basis |

NRE Account |

NRO Account |

|

Full Form |

Non-Resident External Account |

Non-Resident Ordinary Account |

|

Meaning |

NRI account that allows only foreign credits from outside India into the account. |

NRI account that allows both foreign credits from outside the country as well as rupee credits within the country into the account. |

|

Purpose |

Allows you to transfer funds earned abroad to India and maintain them. |

Allows you to accumulate funds earned outside India and maintain the regular flow of income earned in India by way of rent, dividends, pension, etc. |

|

Taxation |

Interest earned and credit balances are tax-free |

Interest earned and credit balances are subject to respective income tax bracket |

|

Repatriation |

Free repatriation of funds outside India without limits |

Interest income is freely repatriable, whereas repatriation of the principal amount is up to specified limits. You may have to state the purpose and fulfil other requirements for repatriation. |

|

Joint Account |

Joint holding only if both the parties are NRIs |

Can open a joint account either with one Indian citizen or both NRIs. |

|

Deposits and Withdrawals |

Deposit: Foreign currency Withdrawal: Indian currency |

Deposit: Both foreign and Indian currency Withdrawal: Indian currency |

|

Currency |

Foreign currency to Indian currency |

Foreign or Indian currency to Indian currency |

|

Interest Rates |

High interest rates compared to NRO accounts |

Lower compared to an NRE account |

|

Permissible Transactions |

Inward remittance from outside India, interest income on account and investment, transfer from other NRE/ FCNR(B) accounts |

Inward remittances from abroad, legitimate dues in India like rent, dividend income, etc., and transfers from other NRO accounts. |

|

Source of Funds |

Foreign denomination |

Indian as well as foreign denomination |

|

Funds Transfer |

Funds can be transferred from an NRE account to another NRE account or NRO account. |

Funds from an NRO account are permitted to NRE account up to a ceiling of USD 1 million in a financial year. |

|

Common Reasons to Switch Between NRI accounts |

No taxes on transfer of funds from NRE to NRO account, and hassle-free fund transfer process. However, funds lying in NRO accounts are subject to tax. |

To transfer income earned in INR and withdraw in preferred currency for investments, to keep NRO account just for collection of income from India and manage investments through NRE account, tax benefits on NRE account. |

|

Suitability for NRIs |

Suitable for NRIs with no income source in India. |

Suitable for NRIs with income arising from both – foreign earnings and Indian locations |

|

Exchange Rate Risk |

Not subject to currency risk |

Subject to fluctuations of Indian rupee vis-à-vis foreign currency |

NRIs are eligible to open both, NRE as well as NRO account. Since, both the accounts serve different purposes, it is better to open both, wherein NRE account can be used to manage foreign earnings and NRO account can be used primarily for collection and accumulation of income in INR.

Must Read: Why Instarem is the best option for sending money safely to India from the USA

NRE and NRO Account Eligibility Criteria

|

Conditions |

NRE Account |

NRO Account |

|

Residential status |

NRI, PIO and OCI |

NRI, PIO and OCI |

|

Deposition currency |

Foreign currency |

Foreign and Indian currency |

|

Saving currency |

INR |

INR |

|

Power of Attorney |

Residential Indian |

Residential Indian |

When to Choose an NRE Account?

The selection between NRE and NRO accounts should mainly depend on the citizen’s requirements.

Situations where NRE account is the best option

- If an NRI wants to send funds to India to hold them in Indian currency.

- If an NRI’s income only includes earnings in foreign currency.

- If an NRI has no income or assets in India and intends to do only a few financial transactions in the country

- If an NRI wants to send foreign earnings to India and, if needed, repatriate the funds to the residential country without any restrictions.

- If an NRI wishes to invest in NRE deposits or link the NRE account for trading and investment

Must Read: International money transfer rules – Everything you need to know

Real-life scenarios and examples

Scenario 1: Prateeksha and Anupriya are two NRIs holding NRE accounts. While Prateeksha came to visit her parents in India for a short trip, Anupriya returned to Delhi for good.

When an NRI comes to the country for a short trip, they can continue to hold an NRE account. On the contrary, when they return permanently, they must convert their NRE account to a resident rupee account.

Hence, Prateeshka can continue with her NRE account, whereas Anupriya can convert it to a Resident Foreign Currency (RFC) Account.

Scenario 2: Danish holds an NRE account in India. The interest rates on NRE and NRO accounts vary, and the interest rate on NRE accounts is usually higher than the NRO account.

Danish earns an interest income of ₹3 lakh for the FY 2021-22 on his NRE account. As per the rules, the interest earned in the NRE account is exempt from tax in India. Danish will have no tax liability for the NRE account.

Now, assume that the balance in his NRE account (foreign earned income + interest income accrued from it) is ₹1 crore, and he wants to repatriate the entire fund to his resident country; he can freely do so without any limits. As per the NRE and NRO account RBI guidelines, the interest income and principal amount of the NRE account are freely repatriable.

On the contrary, interest income is freely repatriable, whereas the balance on the NRO account is remittable up to $1 million per financial year, including other eligible assets.

When to Choose an NRO Account?

Choosing between NRE and NRO accounts depends largely on the purpose of opening the account. Since both serve different purposes, an NRI can open both NRE and NRO accounts at the same time.

Situations where NRO account is the best option

- If an NRI has an income-generating asset in India, whether rental income, dividend income from the stock market, etc.

- If an NRI wants to do financial transactions in India apart from merely withdrawing or sending money to their families

- If an NRI wants to open a joint account with an Indian citizen

- If an NRI urgently needs funds in India or abroad, they can opt for loans against NRO fixed deposits.

- If an NRI wants to repatriate their Indian earnings of up to $1 million per financial year to their resident country

Real-life scenarios and examples

Scenario 1: Suppose Anand, an NRI who moved to the USA eight years ago, wants to transfer funds to his family in India. He plans to open a joint account in India with his mother (an Indian resident) for easy operation.

According to the Foreign Exchange Management Act (FEMA) guidelines, a NRI cannot open a regular savings bank account in India. They can either open an NRO or NRE account based on their requirement.

Since he wants his mother to be a joint account holder, Anand can open an NRO account.

Scenario 2: Maria, an NRI based in Australia, holds an NRE account with a bank. Recently, she started her handicraft business in her hometown in Chennai and earned decent profits, and has been wondering about using NRE vs NRO accounts for business purposes.

As per the rules for NRE vs NRO accounts, the deposit into the NRE account must be generated outside India and made in foreign currency only.

Thus, the income earned by Maria from her Indian handicraft business cannot be deposited in an NRE account, and she must open an NRO account to deposit this income generated within the country.

NRE vs NRO – Which is better?

There is no universal right or wrong NRI account, and deciding to select one should depend on your needs and income sources.

NRE accounts can be used to stock foreign currency and get it converted to Indian rupees. On the other hand, NRO accounts can be used to store income earned in India and funds from foreign countries.

Repatriation is an essential factor that must be considered, as NRO accounts have a limit for repatriation of up to $1 million per financial year. In contrast, NRE accounts are exempted from such limits.

The taxation on interest earned in NRE and NRO accounts also plays a decisive factor. Typically, an NRE account is a popular choice among NRIs. The interest earned and the credit balances both are tax-exempted in India. This means NRIs with NRE accounts need not pay any tax on the interest earned in India, thus increasing their overall returns.

Investing with NRE vs NRO accounts is also possible; however, you must choose the type of account depending on the nature of the investment. As an NRI, if you want to know which is better, using NRE vs NRO accounts for foreign income, consider various aspects like the source of income and your requirements.

Conclusion

Many NRIs these days opt for both NRE and NRO accounts. This helps them ease in operation of their assets and convenient free movement of funds across borders. Hence, it is imperative to learn about NRE vs NRO account features and use them wisely to manage funds in India from a resident country.

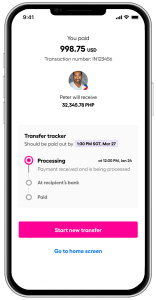

For reliable and hassle-free money transfer services, trust Instarem, a fast* and affordable# way to transfer funds.

*rates are for display purposes only.

Send money overseas with Instarem now. Simply download the app or sign up here.

Frequently Asked Questions

-

Is NRE or NRO tax-free?

The tax implications of NRE vs NRO accounts are as follows:

NRE Account: Tax exemption for interest income on NRE accounts and balances are exempt from wealth tax.

NRO Account: Interest income on NRO Accounts and deposits is subject to applicable tax rates. However, NRIs can benefit from Double Taxation Avoidance Agreements (DTAA).

-

Can I have both an NRE and NRO account?

Yes, NRIs can have both NRE and NRO accounts.

-

Can I transfer money from NRO to NRE?

Yes. According to the NRE and NRO account RBI guidelines, NRIs are now eligible to transfer funds from the NRO account to the NRE account up to USD 1 million per financial year, subject to tax payment.

-

What is the limit of NRO to NRE?

As per the rules for NRE vs NRO accounts, the limit to transfer funds from NRO to NRE is USD 1 million per financial year (April-March).

-

Can students have an NRE or NRO account?

Under the Foreign Exchange Management Act (FEMA), Indian students who go to foreign countries to study are considered NRIs and can avail of banking facilities similar to NRIs. Students can open both NRO and NRE accounts, wherein student NRE account is the most common one.

-

What are the documents required for an NRE account?

Common documents required to open an NRE account are:

- Duly filled-in application form

- NRI’s passport copy

- NRI’s residence permit or visa of the country of residence

- Salary slips

- 2-3 copies of recent passport-sized photographs

- Money remittance-related documents

Get the app

Get the app