- Home

- Send Money To India

4.4/5 – Excellent. From 8,000+ reviews

Send money to India from USA

We are regulated by Community Federal Savings Bank

Our rates

Our rates

Payment by

Fees Fees and exchange rates vary by sending amount, currency, payment method, and receiving country. Please change these parameters to view the applicable fees.

Transfer time Estimated transfer time may vary based on the currency selected, payment method, and bank timings.

First time transfer?

Get a special FX rate on your transfer! Send between USD 1 and USD 3,000 today.

Need to send over 25,000 USD? Enjoy special discounts. Learn more

Stay in control with our transparent pricing

Our transfer fee is transparent – never hidden, you’ll always see the exchange rate upfront, giving you total control to send money to India from USA at the best rates.

Better exchange rates

We provide you with competitive foreign exchange rates, every time.

Low transaction fees

Lower fees than banks and no additional charges.

No hidden fees

You will always see the total fees clearly displayed on our app.

How to send money to India from USA: 4 easy steps

Sign up for an account online or via our app. Upload proof of address in USA and your identification documents.

Fill in your recipient’s information.

Choose the type of currency you want to send, input the amount, and select your preferred transfer method.

Note: Refer to our international money transfer limits guide for more information on the maximum amount you can transfer in a single transaction to your choice location.

Key in the verification code that is sent to your registered phone number or email. This helps us keep your money safe.

Find the best rate for your money transfer

Compare Instarem’s rate for with banks and see the difference yourself.

*Rates available as on including any applicable fees.

Note: Rates may vary based on market fluctuations and transfer methods. Please check the updated rates and fees at the time of setting up your transaction.

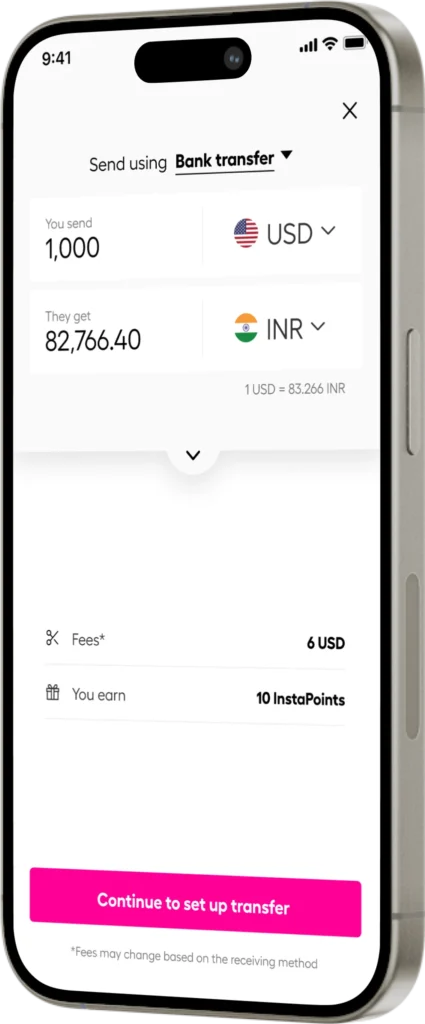

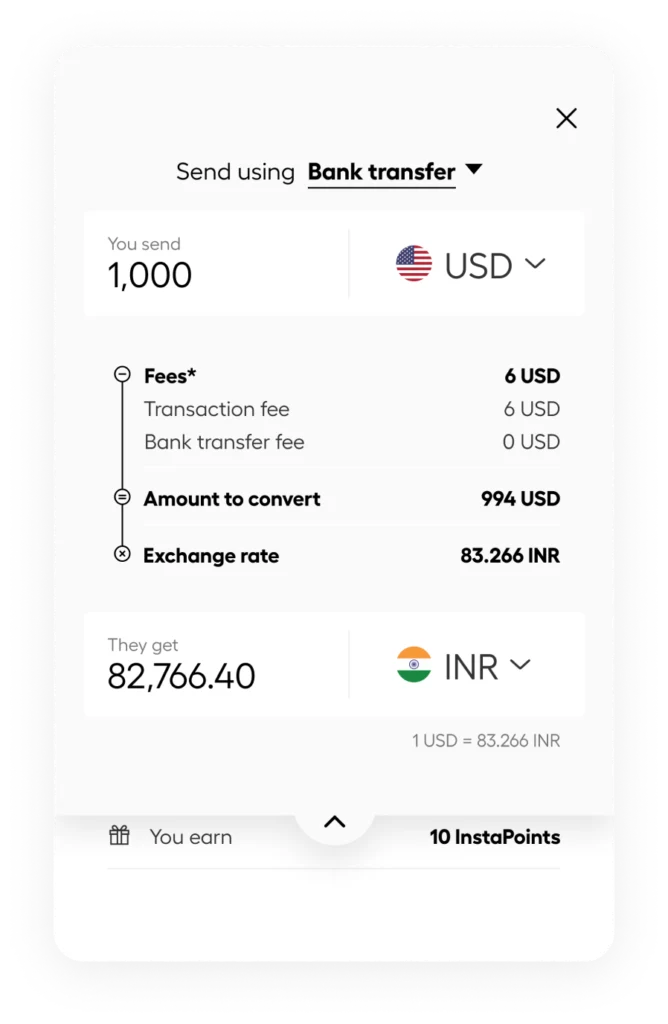

How much does it cost to transfer money to India?

The cost and speed of your transaction depends on the destination, your payment method, and how you want your funds to be received. We will always show you the cost upfront, before you proceed with the transfer so you can make the best choice for you to send money to United States of America.

For illustration purposes. Updated fees are shown to you at the time of setting up your transaction.

How long does it take to transfer money to India?

Sending money to India with Instarem is lightning-fast. Money transfer from USA to India will typically zip through in just a few minutes.

Sometimes, currency rules, bank processing, or holidays may cause a slight delay and it may take us a day or two. But no worries! Our top-notch technology and wide network of partners work together to get your money to India securely and quickly.

Ready to send money to India from USA?

Sign up now for fast, secure and low-cost transfers.

Best ways to send money to India from USA

At Instarem, sending money to India is as easy as it gets. Here are the payment methods Instarem offers you to fund your transfers.

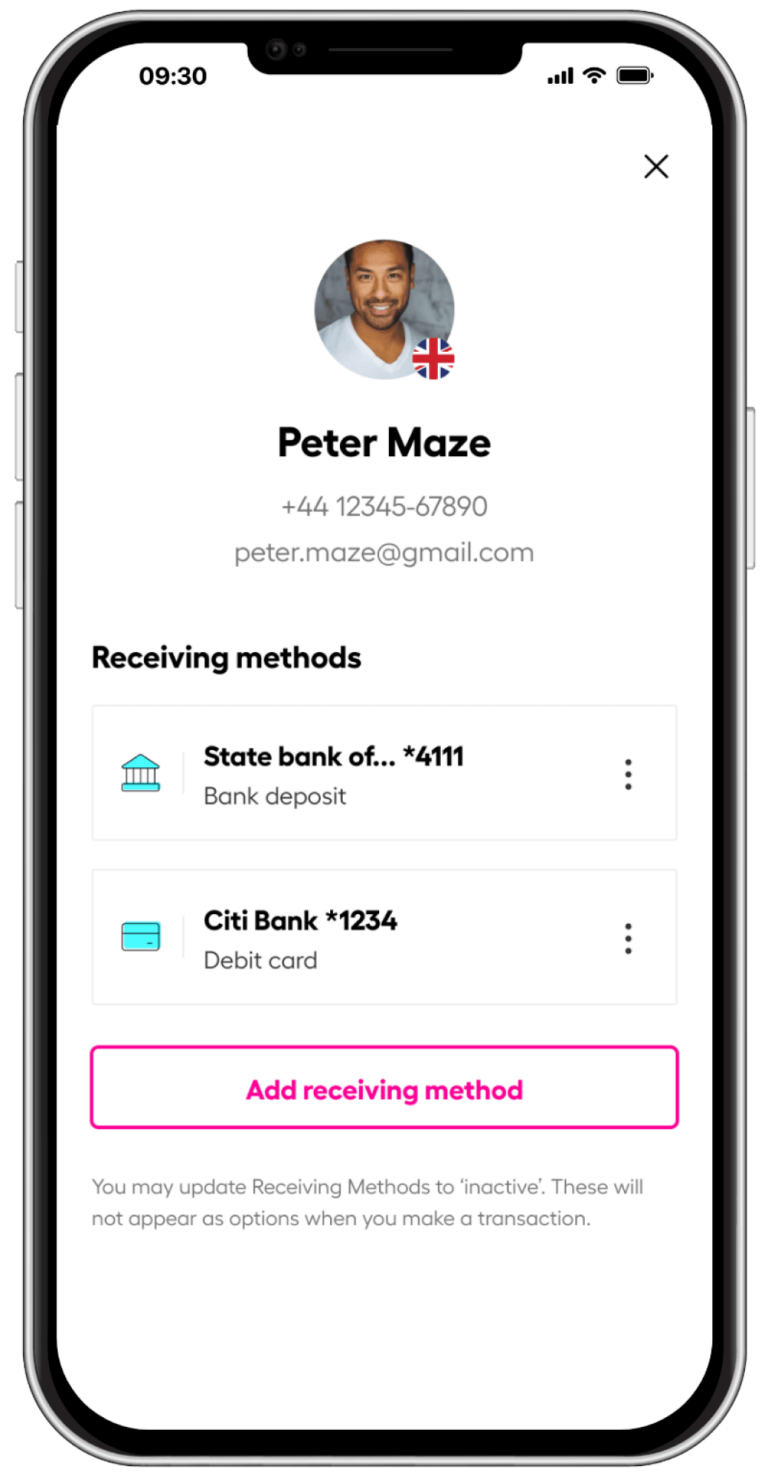

What information do I need to send money to India?

We will ask you for the following information:

- Your personal details. We may also need some documents for verification purposes.

- Your recipient’s personal details like full name, address, contact information and their bank details.

What our customers say

Send money from USA to 60+ countries

If you cannot find the location you would like to send to, it means we currently do not support transfers to that destination, but we are working on it! Do come back and check again as we are continuously updating our services.

More currency pairings for USD

If you cannot find your desired currency pair, it means that transfers to that specified currency are not supported by our services, but we are working on it! Do come back and check again as we are continuously updating our services.

Explore more

About us

From our humble beginnings to our biggest achievements, learn about what makes Instarem the best option for you to send money internationally.

Blog

Discover more about sending money overseas, tips for expats living abroad and more.

FAQs

At Instarem, we are dedicated to ensuring your financial security every step of the way. We employ cutting-edge encryption and secure payment methods to safeguard your information when you use our money transfer service to India. While we prioritise your security, it's also wise to exercise caution. Before initiating an online money transfer to India via Instarem, take the time to validate the recipient’s details and carefully review our comprehensive terms and conditions for better clarity.

Usually, international money transfers to India are speedy, often resulting in instant money transfer. However, occasionally, it might take one to two business days to complete. The exact timeframe depends on factors like your chosen payment method, verification processes, and any potential delays within the banking system. For the most accurate and current information on transfer duration, it's best to check our website directly.

Yes, you can track your money transfer from USA to United States of America via the Instarem app under "Activity" section. You will also be notified once your money transfer to United States of America has successfully reached your recipient.

Yes, you can send money to United States of America for Business too. Try our Business account, sign up with us today! For business related transactions, please open a business account with us

If you're thinking of sending money to India, it's important to choose the right method that fits your needs. Whether you prefer the reliability of bank transfers, the convenience of money transfer agents, or the efficiency of online platforms like Instarem, we've got all the details covered.

When sending money to India, there is generally no limit on the amount you can transfer, but money transfer service providers, banks, or other financial institutions may have daily transaction limits in place. If you are sending a substantial sum overseas, it's important to note that any transaction of 10,000 USD or more is typically reported to the Internal revenue Service (IRS) by the service provider or bank.

To remit money to India from the USA without tax implications, it's essential to understand the regulations from both the Internal Revenue Service (IRS) and India's taxation authorities.

IRS Gift Tax: Sending funds to India can be seen as a gift, potentially subject to gift tax by the IRS if there's no exchange of goods or services. Transfers over 10,000 USD must be reported to the IRS.

Indian Taxation: As an NRI, money transfer to India for family members (blood relations) typically have no tax implications. But for non-blood relatives, amounts over ₹50,000 in a year are taxable for the recipient.

Read more on how to transfer money to India without tax.

Transferring money to an Indian bank account through Instarem is a breeze. Whether you're on your desktop or using the app, simply log in to your Instarem account. From there, add or select your recipient and input the transfer details such as their legal name (as it appears on their bank account), their bank name, account number, and the IFSC code. Then, proceed to make the payment for the transfer.

With Instarem, enjoy top-notch rates and lightning-fast transfers, making it your go-to choice for international money transfers to India. Experience the convenience of quick and reliable fund transfers with Instarem today!

To transfer money to India smoothly, you'll need some key details about the recipient handy:

- Recipient's full name and address: Make sure it matches exactly as it appears on their bank statement.

- Recipient's bank details: This includes their bank name, branch name, IFSC/branch code, and their account number.

- Recipient's mobile number: This is important for any updates or notifications.

- Recipient's email address: Especially if you're doing an online transfer, so they can get an alert when the money arrives.

- Purpose of payment: Like whether it's for family support, services, or a property payment. Having this info helps streamline the process.

To convert USD to INR using Instarem, you need to:

- Log in or register for a free Instarem account

- Click ‘Send now’

- View the USD to INR exchange rate on the currency calculator

- Enter the amount you want to send

- Choose a payment method

- Enter the receiver's details and fund the transfer

To sign up for Instarem and start sending money to India, follow these steps:

- Create an account: You can sign up online or through our app. Provide your basic information and create your account.

- Verify your identity: Upload proof of your address in the US and your identification documents as part of the verification process.

- Add recipient details: Enter the information of the person in India you want to send money to, including their bank account details.

- Select transfer details: Choose the location or currency you want to send, input the amount you wish to transfer, and select your preferred transfer method.

- Verify your transaction: You'll receive a verification code via text or email. Enter this code to confirm and secure your transaction.

Once these steps are completed, your money will be on its way to your recipient in India.

Yes, an international student can send money to India via Instarem.

No, we do not support transfers to India using Google Pay.

Yes. With Instarem, you can conveniently use your credit card to make an instant money transfer to India.

Choosing the best app to send money to India depends on your specific needs and preferences. However, Instarem stands out as a reliable and convenient option for international money transfers to India.

With competitive exchange rates and low fees, Instarem is your go-to money transfer service to India. Our user-friendly app makes it easy to remit money to India securely and conveniently. Experience the ease and reliability of Instarem for your next transfer amount to India. Download our app from Play Store or Appstore.

Yes, you can send money to India from USA without an NRI (Non-Resident Indian) account. Instarem enables you to transfer funds directly to the recipient’s local bank account in India—no NRI account required.

The best rate for sending money from the USA to India depends on the current exchange rates and fees charged by different providers. With Instarem, you can enjoy competitive exchange rates and low fees, helping you get more value from your transfers. It’s always a good idea to check the live rates on Instarem to ensure you're getting the best deal.

When you send money to India from the USA using Instarem, a unique transaction number (also called a transaction ID or reference number) is generated for tracking your transfer. You’ll find this number on the transaction confirmation page and in the email we send you. It helps with the following:

- Tracking: Easily track the status of your transfer using the transaction number.

- Customer support: If you need any assistance, please have your transaction number ready when reaching out for support.

- Refunds: The transaction number also helps with smooth processing of refunds, if necessary.

Related blogs

How to transfer money from USA to India without tax?

Ever heard of the term ‘shrinking world’? Well, with each passing decade, our world is …

Steps to track your international money transfer

Track your international money transfer with ease! Here’s how you can easily track …

How long does a wire transfer take?

There are several options to send and receive money. Earlier, people commonly sent money through …

Instarem: Best Money Transfer Option for International Students

The life of an international student is exciting, challenging, adventurous, and everything but easy! Knowing …

NRE vs. NRO account: The ultimate A-Z guide

The Indian economy has grown leaps and bounds over the years. Many Indians have made …

10 highest paying part-time jobs for students in USA 2024

Studying abroad is a global phenomenon; it is not just limited to a particular country …